Trusted by Canadians

The Gold Standard

They are the Gold Standard of Client Experience. The whole process was simple, hassle-free, uber transparent and all of this at no cost. Our advisor’s knowledge and attitude reeled us in from the first call. We felt as if we were premium clients.<...

Lipika

Knowledgeable and helpful

Very knowledgeable and helpful in determining the best plans for my son and I and he took the stress out of the process. Fully explained all of the options available to me, and answered all of my questions. I know that I made an informed decision ...

Franz T

Skeptical to believer

First I was skeptical about high reviews but anyways PolicyAdvisor. I could see that they are trying to give best details they have and guide us to choose policy rather than selling it. Rarely I type in reviews. I can say that PolicyAdvisor is wor...

Meenakshi N

Excellent service

Thank you for the excellent customer service. You’ve been very supportive in all our questions. After the video call, he didn’t really push to sell. We appreciate your time, and support in giving us updates and follow-ups and phone calls until we ...

Jessa Y

Genuinely Cared

My advisor genuinely cared about making sure I was comfortable and informed throughout the process, and patiently answered my many questions. He also always followed up to make sure I was up to date on my application process.

Jessica F

Simpler than expected

Answer all our questions in a timely manner, and the process was much more simple than I was expecting. We had our life insurance sorted and approved within a few days. I really like that they did the comparisons of policies for us.

Joanne V

Life Insurance made easy

Was looking for a life insurance policy and the search was exhausting by conventional means, until I found PolicyAdvisor. My representative was excellent, and explained all my options and preferred quotes. Life Insurance made easy, thank you all a...

Pedro

Unbiased advice

If you’re looking for best rate and an advisor, I would highly recommend PolicyAdvisor. They are expert in finding the best insurance provider. They are reliable and give unbiased advise. I’m glad I came across Policy Advisor online as they helped...

Zeny D

A walk in the park

I was able to derive a personalized quote within a minute. From there on it was as smooth as taking a walk in the park. I did not have to wait in long lines, could chart my progress, and had full control of my application.

Mayank

Super easy

I’d previously reached out to one of the big insurance companies directly but found them so unresponsive and uninterested. I’m glad we found PolicyAdvisor. They made comparing options easy so we found something that worked for our need...

Lindsay

What is private health & dental insurance?

Private health and dental insurance covers the cost of medication and medical treatments that universal health care in Canada does not. While provincial or territorial health plans typically cover essential medical services such as doctor visits, hospital stays, and surgery, extended health insurance expands the scope of coverage to include services like preventative care, follow-up treatments, and more.

What does private health insurance cover?

Personal health insurance plans often include benefits such as:

Prescription Drugs

Antibiotics, narcotics, creams, etc.

Paramedical Expenses

Mental health services, physiotherapy, registered massage therapy (RMT), chiropractic, etc.

Medical Equipment

Crutches, nebulizers, CPAP machines, etc.

Dental Treatment

Teeth cleaning, braces, crowns, etc.

Vision Care

Glasses, contact lenses, eye exams, etc.

Travel Medical

Emergency medical expenses

Extended health insurance provides comprehensive coverage for prescription drugs, dental coverage, vision care, travel medical coverage, and more. Some private health insurance coverage may even include semi-private or private hospital rooms or access to virtual healthcare providers. These additional benefits can vary depending on the specific insurance plan and provider.

There can be annual maximums placed on each coverage type in the form of dollar amounts as well as percentages of the cost covered. For example, a plan might cover.

- 80% cost of prescription cost up to $5000 per year

- 80% cost of dental care for the first $500 then 50% for the next $500

- $150/year cost of vision care (including eye exams)

- $5 million in emergency health coverage for first 9 days of each trip.

What are the types of personal health insurance plans in Canada?

Generally, Canadian insurance companies divide their health coverage into three tiers: basic, mid-tier, and enhanced. Higher tiers offer more comprehensive coverage, but cost more than basic plans.

The kind of coverage may vary between providers, but standard plans for each tier typically offer:

Basic Plan

- 60% of prescription costs, up to $5,000

- 60% of dental care, up to $500

- No vision care (including eye exams)

- No travel emergency medical coverage

Mid-Tier Plan

- 70% of prescription costs, up to $5,000

- 70% cost of dental care, up to $750 (preventative only)

- $250 every 2 years for vision care (including $50 per eye exam)

- $5 million in emergency health coverage for the first 60 days of each trip

Enhanced Plan

- 80% of prescription costs, up to $5,000

- 80% of preventative dental care, up to $750; 50% of restorative care, up to $500; 60% of orthodontic, up to $1,500

- $300 every 2 years for vision care (including $50 per eye exam)

- $5 million in emergency health coverage for the first 60 days of each trip

Some providers offer direct billing, meaning that the medical services provider bills them directly for their portion of the cost. Other providers may require you to pay the entire bill upfront and they will reimburse you after you submit your claim.

Need insurance answers now?

Call 1-888-601-9980 to speak to our licensed advisors right away, or book some time with them.

How much does private medical insurance cost?

The cost of personal health insurance in Canada depends on your personal health history and your plan’s coverage details. For example, if you have pre-existing medical conditions and have complex medical needs that require coverage, your plan will be more expensive. To get an accurate price for your individual health insurance plan, at the time of application, the insurer will want to know…

About you…

About your plan…

The price you pay will differ from the price your neighbor pays—the plan and the cost are unique to you. But let’s give you an example quote as a baseline.

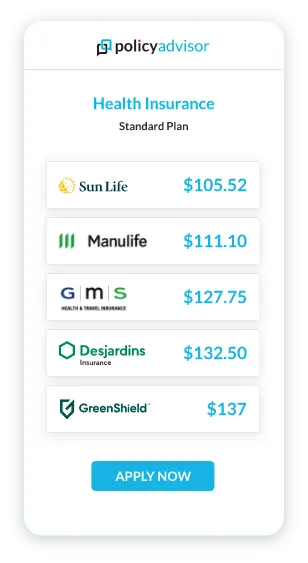

Health insurance quote for a single person in Canada

Basic Plan

$80/month

Standard Plan

$100/month

Enhanced Plan

$120/month

*Quote for a 35-year-old male, non-smoker, with no health risk or pre-existing conditions, who lives in Ontario.

Is private health insurance worth it in Canada?

Yes! Even with your government health plan, your medical costs can start to rack up — especially for routine checkups like dental cleaning or eye exams (not to mention if you have kids)! On top of covering the immediate expenses that come after a health event, like medication or rehabilitation, extended medical insurance can also cover preventive care and maintenance health care services like:

|

Physiotherapy |

$75-$100/hour |

|

Registered massage therapy |

$80-$150 |

|

Braces |

$5,000-$6,000 |

|

Prescription Glasses |

$40-$1,000 |

With private health insurance, you can rest assured that your family can afford care without dipping into your savings if something happens.

Recognized as a leader in the industry

Who needs personal health & dental insurance?

Anyone who wants a portion of their medical costs taken care of in a way that lets them balance their budget needs personal medical insurance. Provincial plans will cover some eligible expenses, but extended health insurance will cover the rest.

Sometimes you have health care coverage through your work or group plan. But that’s not always the case. You need extended health and dental if you are…

Business owners/Self-employed

If you own a business, or you’re self-employed or a side hustler, you should get individual or group health insurance to keep yourself and your employees in peak condition.

Retired

Your employee benefits plan may have covered you in your working years, but now that you’re retired and off the payroll, you will need your own extended health plan.

Families

Medical costs for a family with dependents can add up quickly (like when one kid needs braces and the other needs glasses). Health insurance can help families afford those costs.

Isn’t medical care free in Canada?

Universal health care in Canada provides coverage for basic medical care like doctor’s visits, hospital stays, and surgery. It may also cover some medications/treatments administered in the hospital. However, thousands of other out-of-pocket expenses come with medical, dental, and vision care that are not covered by the government health insurance plan.

| Universal Health Care | Private Health Care | |

|---|---|---|

| Doctor’s Visits | ||

| Surgery costs | ||

| Hospital stays | ||

| Prescription drugs | ||

| Mobility equipment | ||

| Dental care | ||

| Vision Care | ||

| Emergency travel medical | ||

| Therapy | ||

| Chiropractor | ||

| Physiotherapy | ||

| Massage |

Who provides extended health insurance

We work with Canada’s best health and dental insurance providers. Each provider has different plans and different prices–our expert advisors at PolicyAdvisor can find the best health plan option for you!

How do I apply for health & dental insurance?

To apply for health and dental insurance, start with our online quoting tool — it takes just a few minutes to find a great plan!

Answer a few simple questions about your health and what coverage you’re looking for. We’ll shop the health insurance market to find the best prices for your health and dental insurance!

Frequently asked questions

Medical insurance covers out-of-pocket expenses for standard injuries and illnesses that are not covered by your provincial health plan. It will pay a portion of these expenses (usually 70% to 90%).

Critical illness insurance, on the other hand, is a one-time payment to you if you are diagnosed with a critical or terminal illness. For example, if you are diagnosed with cancer, critical illness insurance will give you a one-time payment that you can use however you wish. It can cover things like travel costs to specialized treatment facilities or an extra special family vacation. Extended medical would cover your cancer surgery and a portion of your cancer treatment in this scenario.

Yes. Health insurance commonly includes dental coverage in their mid-tier and enhanced plans. Some companies also offer dental benefits as an add-on coverage.

Read more about private dental insurance.

In many provinces, vehicle insurance has accident benefits that cover the cost of therapies and medical treatments associated with the accident. However, that coverage is very limited.

For example, the accident benefits may only provide 3 sessions of physiotherapy, but the whiplash sustained in the accident requires you to have more sessions to regain mobility. This is where your extended health benefits would come in; they could help cover the cost for the remaining sessions (up to policy maximums).

Health insurance claims are filed directly with your provider. Most insurance providers have online submission forms you can fill out on their website, or printable forms you send them by mail. You will need the receipt as proof of the medical bills you paid, although some companies only require you to hold onto the receipt in case there is any claim dispute..

Some providers also do direct billing, meaning that you don't have to pay upfront. The insurance company is directly billed at the point of the transaction.

Learn more about the process of submitting a health claim.