- Most critical illness insurance policies in Canada cover life-threatening cancers. However, coverage for early-stage or non-invasive cancers is typically limited or excluded

- The type, stage, and severity of cancer significantly influence coverage. For example, melanoma is often included if it meets certain criteria, whereas basal cell carcinoma is not

- Critical illness insurance provides a lump-sum payout to help cover treatment costs, living expenses, or other financial burdens associated with a serious diagnosis like cancer

- Policies often exclude pre-existing conditions, and there’s usually a waiting period before cancer coverage applies. Factors like remission status or family history of cancer can affect premiums and eligibility

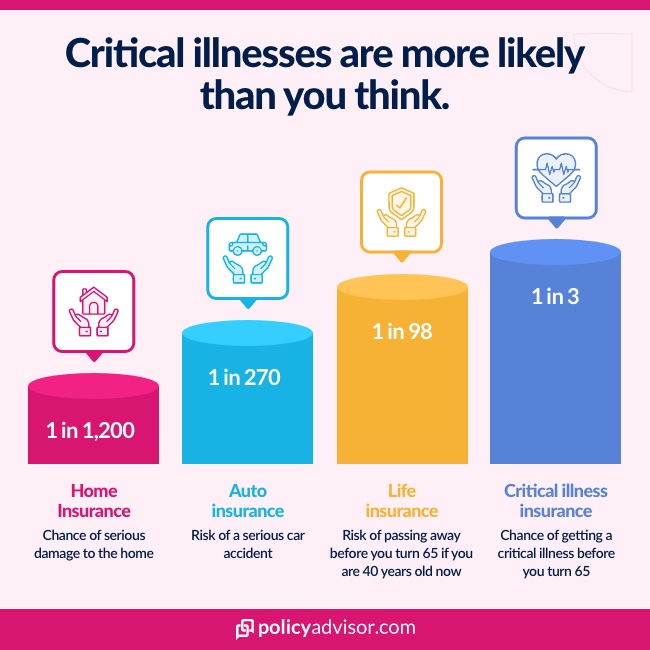

With one in two Canadians expected to be diagnosed with cancer in their lifetime, as reported by the Canadian Cancer Society, it is no surprise that critical illness insurance covers cancer.

Cancer, a disease caused by the uncontrolled growth of abnormal cells, can affect nearly any part of the body. The treatment costs for cancer can be astronomical, involving surgeries, chemotherapy, radiation, and sometimes experimental treatments.

In such cases, critical illness insurance provides a lump-sum benefit to help you focus on recovery without the added stress of finances. In this article, we’ll discuss how cancer is covered under critical illness insurance to ensure you’re always prepared for the unexpected.

What is critical illness insurance?

Critical illness insurance is a type of policy that provides a lump-sum payout if the insured person is diagnosed with a covered critical illness. It’s designed to help people financially when faced with a serious health condition.

Commonly covered illnesses include cancer, heart attack, stroke, and organ failure. This coverage can assist in managing medical costs, living expenses, or other financial burdens during a difficult time.

What cancers are not covered by critical illness insurance?

Typically, non-invasive or early-stage cancers (such as stage 0 or carcinoma in situ) and certain types of skin cancers, like basal cell carcinoma or squamous cell carcinoma, are not covered under most critical illness insurance policies in Canada. Coverage usually focuses on life-threatening and advanced-stage cancers.

However, melanoma, which is an aggressive form of skin cancer, is typically included if it meets the policy’s severity criteria (e.g., the cancer must have invaded deeper skin layers or spread). Other types of cancer that may be covered are:

- Blood cancers like leukemia may be covered if they reach a specific stage

- Thyroid cancers may only qualify if they exceed a specific tumor size or require aggressive treatment

Is breast cancer covered by critical illness insurance?

Yes, breast cancer is covered by most critical illness insurance providers in Canada as long as the policyholder meets their terms and conditions and is not diagnosed during the initial waiting period (typically 90 days).

Some policies, like RBC’s Critical Illness Insurance Plan, also provide you the full benefit amount if you’re diagnosed at an early stage.

Are genetic tests for cancer covered under critical illness insurance policies?

No, critical illness insurance policies typically do not cover genetic tests for cancer, as they are considered preventative or diagnostic rather than treatment-related.

Policies mostly cover the treatment of diagnosed conditions, rather than the cost of tests or screenings. However, some insurers may offer additional coverage or wellness benefits that could cover the cost of certain tests.

Can I submit a claim on a critical illness policy upon diagnosis of cancer?

Yes, you can submit a claim on a critical illness policy upon being diagnosed with cancer, but it depends on the type and severity of the diagnosis. Most policies cover life-threatening cancers as defined in the terms of the policy.

Early-stage or non-invasive cancers may not qualify for a claim or might require additional criteria to be met. You must always consult your insurer to understand the claims process and required documentation, such as medical reports.

Is prostate cancer covered by critical illness insurance?

Yes, prostate cancer is generally covered by critical illness insurance in Canada, provided it meets the severity and life-threatening criteria set out in the policy.

Early-stage prostate cancer may not qualify for a claim, but if the cancer progresses to a more serious stage and meets the policy’s definition, a claim can typically be made.

For instance, Manulife’s Lifecheque® and Sun Life’s Critical Illness plans cover Stage A (T1a or T1b) prostate cancer, provided the diagnosis is made by a specialist and confirmed through a pathological examination of the tissue.

Can I get critical illness insurance if I am in remission?

Yes, you may be able to get critical illness insurance if you are in remission, but approval will depend on several factors, including how long you’ve been cancer-free and the specific policy guidelines.

Insurers often impose waiting periods or exclusions for pre-existing conditions. However, you should remain prepared for higher premiums or limited coverage, as a history of cancer increases the perceived risk.

Can I get critical illness insurance if I have a family history of cancer?

Yes, having a family history of cancer does not automatically disqualify you from getting critical illness insurance. However, insurers may consider it during the underwriting process.

This could lead to higher premiums or additional exclusions, depending on the policy and how closely related the family members with cancer are. It’s important to disclose your family medical history accurately to avoid issues during claims.

How to buy critical illness insurance?

There are different ways to buy critical illness insurance, depending on your requirements, such as individual, group and special purpose policies. Here are the most common options:

- Individual policy: Can be purchased through an agent or online, and usually requires medical underwriting to determine your eligibility and premium costs

- Group plan: Available through your employer or association you’re enrolled with. These plans are either partially or fully paid for by the entity providing them (as they’re considered the policyholders). Coverage usually ends when you leave the employer or association

- Special purpose plan: This type of critical illness insurance covers your loan payments for a specific period, if you’re diagnosed with a critical illness. You can apply for a special purpose policy by checking a box on your loan application or submitting an insurance application after your loan’s approval

You can have multiple types of critical illness insurance simultaneously. To determine the right coverage for your needs, schedule a free consultation with our licensed advisors.

Frequently asked questions

Is there a waiting period for cancer coverage under critical illness insurance?

Yes, most critical illness insurance policies in Canada have a waiting period before cancer coverage applies. This waiting period can range from 30 days to several months, depending on the insurer.

The waiting period typically ensures that the cancer diagnosis occurred after the policy was active and helps prevent claims for pre-existing conditions.

Does critical illness insurance provide a lump sum payout for all types of cancer?

Critical illness insurance usually provides a lump sum payout for a range of life-threatening cancers, but not all types of cancer are covered equally. For example, invasive cancers that meet the severity criteria of the policy are typically eligible for a lump sum payout.

However, early-stage or non-invasive cancers, like certain forms of skin cancer or Stage 0 cancers, may not qualify. It’s essential to understand the specifics of the policy, including the types of cancer covered and any exclusions or limitations.

Can cancer survivors increase their coverage amount after a policy is in place?

In most cases, cancer survivors cannot increase their critical illness insurance coverage amount once a diagnosis has been made. This is due to the fact that insurance companies typically do not allow coverage increases for pre-existing conditions.

If you are a cancer survivor, any changes to your policy, such as increasing coverage, may be subject to additional underwriting or exclusions.

How does a critical illness policy differ from a terminal illness benefit?

A critical illness policy and a terminal illness benefit both provide financial support in the event of a serious illness, but they differ in coverage and purpose.

Critical illness insurance provides a lump sum payout for a range of serious illnesses, such as cancer, heart attack, or stroke, provided the condition meets the policy’s severity criteria.

On the other hand, a terminal illness benefit is specifically for situations where the illness is expected to result in death within a defined period, usually 12 months.

Some critical illness policies may include a terminal illness benefit as part of the coverage, allowing for an early payout if the policyholder is diagnosed with a terminal condition.

Critical illness insurance protects Canadians diagnosed with serious health conditions like cancer. While most policies cover life-threatening cancers, early-stage or non-invasive cancers are often excluded or require additional criteria. The Canadian Life and Health Insurance Association (CLHIA) defines cancer as the uncontrolled growth of malignant cells, typically focusing on life-threatening stages for coverage. With nearly half of Canadians expected to face cancer in their lifetime, reviewing policy terms, exclusions, and eligibility criteria is essential. Factors like remission, family history, and waiting periods also play a role in determining coverage and premiums.