- Critical illness insurance widely covers many illnesses and circumstances for Canadians that provincial health plans or employee medical benefits may not.

- Critical illness insurance is worth it as such illnesses are quite common in Canada

- The coverage can soften the financial blow that accompanies a major medical event

Imagine receiving a life-changing diagnosis like cancer, a heart attack, or a stroke—not only would you face emotional and physical challenges, but the financial strain could be overwhelming.

Critical illness insurance promises a financial safety net during these difficult times, providing a lump sum payout to cover medical costs, replace lost income, or help with daily living expenses. But is it truly worth the investment? Let’s unpack the details together.

Is critical illness insurance worth it in Canada?

Yes, having critical illness insurance is worth it in Canada! It helps insured individuals during difficult times by paying them a lump sum benefit amount that is non-taxable. Canadians who have a critical illness insurance policy can utilize this payout for their treatment or other expenses and focus on complete recovery.

What is critical illness insurance?

Critical illness insurance is an agreement you make with an insurance provider that they will pay you a lump-sum benefit if you develop a life-threatening illness. Critical illnesses usually require a long and expensive treatment plan.

The payout can help individuals receive the best healthcare facility to proceed with their treatment. Additionally, it may also serve as an income backup in case the individual needs to take some time off work.

Here are some of the key features of critical illness insurance:

- A one-time payment that is given regardless of any other health insurance policy

- Coverage against 26 critical ailments, including heart attack, cancer, stroke, kidney failure, organ transplants, and more

- Provision of additional coverage for diseases such as Alzheimer’s disease, severe burns, multiple sclerosis, etc

- Critical illness insurance usually has a waiting period—a predefined duration during which you can’t make any claims

- Critical illness insurance is a living benefit—you will get the payout while you are alive and undergoing treatment

Why is critical illness insurance coverage worth it?

Critical illness insurance is worth the cost of monthly premiums because it’s very likely that you will be payed out for your policy. In fact, over 80% of critical illness insurance policies are paid out, and that number is growing. Because this type of insurance coverage can include a variety of illnesses, chances are, you’ll have to make a claim. That means it’s worth your money.

Let’s take a look at some stats.

Critical illness insurance statistics in Canada

- More than 80 percent of working Canadians have either suffered from a critical illness themselves or know someone who has a critical illness.

- More than 400,000 Canadians are still living with the after-effects of stroke.

- The average out-of-pocket expenses for cancer in Canada is around $400 a month.

What does critical illness insurance cover?

Critical illness insurance in Canada covers close to 26 diseases that require immediate medical intervention and management, including cancer, heart attack, strokes, kidney failure, brain tumor, and more.

Here are a few prominent diseases covered by critical illness insurance:

- Heart attack

- Stroke

- Cancers

- Aortic surgery

- Coronary artery bypass surgery

- Major organ transplant

- Major organ failure on a waiting list

- Occupational HIV infection

- Kidney failure

- Aplastic anemia

- Acquired brain injury

- Benign brain tumor

- Dementia (including Alzheimer’s disease)

- Bacterial meningitis

- Motor neuron disease

- Multiple sclerosis

- Parkinson’s disease

- Loss of limbs

- Paralysis

- Severe burns

Advantages of critical illness insurance coverage

Critical illness insurance comes with many advantages as an insurance product beyond the high rate of payout, including flexibility, return of premium rider, easy conversion to permanent coverage, and more.

- Flexibility in how benefit is used

- Premiums can be returned if there are no claims (return of premium rider)

- Ability to get coverage as a rider or separate policy

- Ability to convert to permanent coverage

Disadvantages of critical illness insurance coverage

While critical illness insurance is a great product, there are some aspects that some may find negative in terms of pricing, underwriting guidelines, and claims processing process.

- More expensive than life insurance

- More stringent underwriting guidelines

- Strict claims process (you must have an official diagnosis, which may take time)

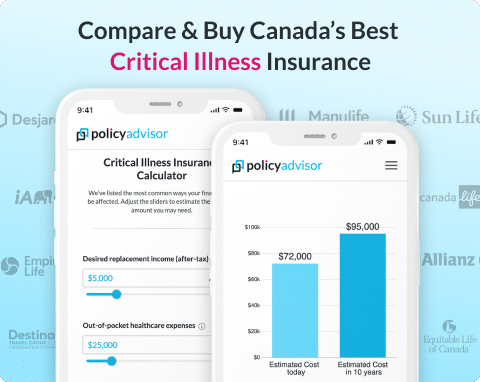

How much does critical illness insurance cost?

The cost of critical illness insurance can vary based on the type of coverage you want, your age, general health condition, etc. Usually, the price will range between $22 to $640 for non-smokers and $36 to $880 for smokers. The following tables show the estimated costs of critical insurance coverage based on the coverage period, and the age and gender of the insured:

10-year coverage for male non-smokers

| 10-year coverage | 100K | 250K | 500K |

| Age 25 | $22.49 | $48.09 | $90.21 |

| Age 35 | $30.87 | $68.40 | $130.81 |

| Age 45 | $63.18 | $136.35 | $267.30 |

| Age 55 | $153.81 | $321.75 | $638.10 |

10-year coverage for male smokers

| 10-year coverage | 100K | 250K | 500K |

| Age 25 | $36.49 | $67.09 | $102.21 |

| Age 35 | $58.87 | $84.40 | $165.81 |

| Age 45 | $95.18 | $156.35 | $321.30 |

| Age 55 | $198.81 | $359.75 | $879.10 |

10-year coverage for female non-smokers

| 10-year coverage | 100K | 250K | 500K |

| Age 25 | $24.20 | $47.88 | $91.49 |

| Age 35 | $32.07 | $69.47 | $132.95 |

| Age 45 | $62.01 | $135.45 | $266.40 |

| Age 55 | $127.06 | $285.98 | $567.45 |

10-year coverage for female smokers

| 10-year coverage | 100K | 250K | 500K |

| Age 25 | $29.20 | $58.88 | $98.49 |

| Age 35 | $43.07 | $78.47 | $154.95 |

| Age 45 | $85.01 | $153.45 | $287.40 |

| Age 55 | $147.06 | $297.98 | $590.45 |

Factors influencing the cost of critical illness in Canada

Several factors influence the cost of critical illness insurance in Canada, including age, health status, coverage amount and smoking status of the individual. Take a look at some of the most prominent ones:

- Age: Premiums increase with age as the risk of developing a critical illness rises

- Health status: Pre-existing conditions or a history of illness can lead to higher premiums or coverage denial

- Coverage amount: Higher coverage amounts lead to more expensive premiums

- Policy term: Longer policy terms often result in higher costs

- Smoking status: Smokers typically face higher premiums due to increased health risks

- Occupation and lifestyle: High-risk occupations or unhealthy lifestyle choices can elevate premiums

- Family medical history: A family history of critical illnesses can also raise premium costs

What are the top 3 critical illnesses?

In Canada, the top three critical illnesses leading to insurance claims are cancer, heart attack, and stroke. These conditions are highly prevalent and are included in nearly all critical illness insurance policies, often accounting for the majority of claims due to their frequency and impact on individuals’ health and finances.

According to the Canadian Cancer Society, cancer is the leading cause of death in Canada, responsible for 30% of all deaths. Approximately 2 in 5 Canadians (44% of men and 43% of women) are expected to develop cancer during their lifetime.

Between 2015 and 2030, the number of new cancer cases diagnosed is expected to increase by about 40%. Lung, breast, colorectal, and prostate cancers are the top four types, accounting for 46% of diagnosed cases.

Do you need critical illness insurance cover?

Regardless of any disadvantages of the product, the rate at which you are likely to get paid out for this policy makes this policy worth it—it’s a very low-risk gamble compared to other insurance products. Critical illness insurance provides a different type of peace-of-mind than other insurance categories like term life or whole life insurance.

If you worry about your quality of life after a health scare, how a sickness could affect your family’s financial well-being, or having to work through an illness thus delaying or hampering your recovery, then critical illness can definitely be considered worth it.

Which is better life insurance or critical illness?

Life insurance and critical illness insurance are completely different insurance products that serve different purposes.

- Life insurance: pays out a death benefit to your beneficiaries when you pass away

- Critical illness insurance: pays out a benefit to you (the policyholder) if you are diagnosed with a critical illness

In the context of permanent (or whole life) coverage, permanent life insurance is more of a guaranteed product than critical illness, because one day you will pass away, but you may not necessarily be diagnosed with a critical illness. But that doesn’t make it a better product than critical illness insurance.

Both policies are important to have when considering the financial future of your family. Critical illness insurance will financially support your family if you are recovering where as life insurance will take care of your family if you have passed away.

What cancers are not covered by critical illness insurance?

Typically, non-invasive or early-stage cancers (such as stage 0 or carcinoma in situ) and certain types of skin cancers, like basal cell carcinoma or squamous cell carcinoma, are not covered under most critical illness insurance policies in Canada. Coverage usually focuses on life-threatening and advanced-stage cancers.

However, melanoma, which is an aggressive form of skin cancer, is typically included if it meets the policy’s severity criteria (e.g., the cancer must have invaded deeper skin layers or spread). Other types of cancer that may be covered are:

- Blood cancers like leukemia may be covered if they reach a specific stage

- Prostate cancer might require a diagnosis above a certain grade on the Gleason scale to qualify for a claim

- Thyroid cancers may only qualify if they exceed a specific tumor size or require aggressive treatment

Do I need both income protection and critical illness cover?

Yes, you may need both income protection and critical illness cover. Income protection and critical illness insurance coverage are different insurance products with different purposes.

- Income loss protection or job loss insurance: pays out a benefit if you lose your job

- Critical illness insurance: pays out a benefit to you (the policyholder) if you are diagnosed with a critical illness

- Disability insurance: replaces a portion of your income if you are sick or injured and cannot work for a short or long period of time (depending on the policy). This is different from job loss insurance as you are only temporarily off work.

Disability insurance will replace your income while you’re off work due to a critical illness, whereas critical illness insurance will pay you a one-time lump sum payment when you are diagnosed with that illness. We recommend both products to ensure your full financial security during your recovery period.

Does critical illness pay out on diagnosis?

Yes, critical illness insurance in Canada typically pays out after a diagnosis of a covered illness, provided you meet the conditions outlined in the policy. This often includes meeting a minimum survival period (typically 30 days) and providing the necessary documentation, such as medical reports with proof of diagnosis within 30 to 90 days of the diagnosis date or surgery

Once the policy requirements are met, you receive the payout as a tax-free lump sum. The money can be used at your discretion, whether for medical costs, living expenses, home care, or paying off debts.

What to look for in a critical illness insurance policy?

When selecting a critical illness policy and deciding if it’s worth it for your family, you should consider looking for simplified issue options, flexibility, eligible illnesses, coverage amounts, and survival periods for a well-rounded coverage.

To give you a better idea of how to select the best critical illness insurance policy, here’s a breakdown of policy benefits you should look for:

- Simplified issue options: Many insurance providers offer online options to purchase policies with quick, easy, and instant approval.

- Flexibility in premiums: Options such as limited pay and return of premium change the way pay for premiums or lessen the financial impact of those premiums.

- Eligible illnesses: Many of the providers in Canada offer enhanced coverage for 25+ illnesses. However, there are a few companies that offer basic coverage only (16 or even sometimes 4 illnesses). Some even have policies that cover only 1 type of illness, like heart-related events or cancer.

- Coverage amounts: Canadian insurance companies offer critical illness insurance coverage from $10,000 to millions of dollars, but each provider has different minimum and maximum coverage amounts.

- Survival period: As we have already discussed, insurance providers in Canada generally instill a 30-day survival period (which is also known as a waiting period).

- Coverage for children: Many policies offer optional riders for coverage for children.

- Partial payouts: Some policies have options that cover partial conditions and thus disburse partial benefit payouts.

Several Canadian insurance providers offer different types of critical insurance policies. Each of these policies has its own merits and drawbacks. PolicyAdvisor has reviewed all the major critical illness insurance offerings in Canada. In doing so, we come up with a list of features, details, and options Canadians should look for when shopping for their own critical illness coverage.

It may be the case that every feature is available in one policy, but with the help of an experienced insurance broker, you can find the coverage that is best for you.

Critical illness insurance vs. disability insurance

Critical illness insurance and disability insurance serve different purposes in financial protection.

One one hand, critical illness insurance provides a lump-sum payment if you’re diagnosed with a specified serious illness. Disability insurance, on the other hand, provides regular income replacement if you’re unable to work due to an injury or illness. Both types of insurance offer vital protection, but they address different financial needs.

Here is a detailed comparison of the two insurance plans. Check out to know more:

Difference between critical illness insurance and disability insurance

| Comparison features | Critical illness insurance (CI) | Disability insurance (DI) |

| Claim event(s) | Diagnosis of a covered life-

threatening illness or condition |

Any illness or injury that leads to a loss of income |

| Covered conditions | 26+ common conditions including:

|

Any medical condition that would prevent you from working, including:

|

| Benefit amount | $25K – $2.5M+ depending on

your policy |

Replaces a part of your monthly income |

| Benefit duration | One or more lump-sum

payment(s) |

Monthly payments Until you

recover or your policy lapses (can last until you reach 65 or older) |

| Coverage term | You can get coverage up to age 100 | Most policies end when you turn 65 |

| Period before benefits begin | Survival period of 30 days | Waiting period (or elimination

period) of 30 days to 1 year |

When combined, these two types of insurance provide both immediate financial relief and ongoing income support, ensuring that you’re financially protected from both the short-term and long-term impacts of a serious health issue.

Is it worth paying for critical illness insurance?

Yes, critical illness insurance can be a worthwhile investment in Canada, particularly if you:

- Don’t have employer-provided insurance or benefits

- Have a family history of serious illnesses

- Want to ensure your mortgage or other financial obligations are covered if you lose income due to illness

When it comes to affordability, critical illness insurance is relatively accessible, with premiums starting as low as $24 per month. However, costs may vary based on your age, health, smoking status, and the level of coverage you choose.

If you’re worried about critical illness insurance not being worthwhile, you can add a return of premium rider to your plan. This option will return all your paid premiums if:

- You pass away without making a claim

- Your policy expires without a claim

- You cancel your policy after a set period without a claim

Find out if critical illness insurance is worth it for your family

Those seeking coverage should consider this carefully and choose the policy (or critical illness insurance rider) that suits them best, considering both their coverage requirements and their budget. Better yet, get in touch with one of our experienced advisors to help educate you on your options.

Frequently asked questions (FAQs)

What is the difference between critical illness insurance and health insurance?

Critical illness insurance in Canada provides a lump-sum payment if you’re diagnosed with a life-threatening illness. This payment can help pay for any purpose, like covering treatment costs, paying off debts, or adapting your lifestyle.

Health insurance covers routine medical expenses that provincial health coverage may not offer. This may include doctor visits, prescription drugs, and hospital stays. It may also include extended benefits like dental and vision care.

Can I purchase critical illness insurance if I have a pre-existing condition?

Yes, you can purchase critical illness insurance if you have a pre-existing condition, but it may be more challenging.

Insurers often assess the risk associated with your pre-existing condition. This could lead to higher premiums, exclusions, or denial of coverage for illnesses related to that condition.

Can I customize my critical illness insurance policy?

Yes, you can often customize your critical illness insurance policy to fit your specific needs. Insurers typically offer various options that allow you to tailor your coverage. They are as follows:

- You can select from a range of critical illnesses to include in your policy

- You can determine the lump-sum payout amount

- You can add optional riders, like the return of premium or disability income, for additional benefit

- You can choose the length of coverage, whether it’s a set number of years or until a certain age

What are the exclusions typically found in critical illness insurance policies?

Critical illness insurance policies often include several common exclusions. These exclusions may vary from one insurer to another, but they generally include:

- Self-inflicted injuries: Conditions resulting from intentional self-harm are usually not covered

- Substance abuse: Illnesses arising from alcohol or drug abuse are commonly excluded

- Non-disclosure: Failure to fully disclose your medical history can lead to denial of claims

- Less severe conditions: Early-stage or less severe forms of certain illnesses, like some cancers, may be excluded

Critical illness insurance is worth your money. It provides a one-time tax-free lump sum if you are diagnosed with a critical illness. It’s worth it to cover medical expenses and support your quality of life and recovery if you are ever diagnosed with a critical illness. It can provide financial support by covering your family’s financial needs or preventing you from having to work while ill.