- Critical illness insurance provides a one-time, tax-free lump-sum payment if you are diagnosed with a covered condition, such as a heart attack, cancer, or stroke

- The tax-free one time payment can be used in different ways, such as to replace lost income, pay outstanding mortgages, and support family needs

- Critical illness insurance is beneficial if you need financial support beyond hospital treatment, for example: a long-term recovery or specialized treatment outside of Canada

Understanding what conditions are covered by critical illness insurance is crucial before purchasing a policy. While it provides a tax-free lump sum payment for serious health conditions like heart attack, cancer, and stroke, not all conditions qualify for a claim.

In this post, we’ll examine what critical illness insurance covers in Canada and what constitutes a valid claim.

But first, let’s take a closer look at how it works.

How does critical illness insurance work?

Critical illness insurance is a type of coverage that provides a tax-free lump sum payment if you are diagnosed with a covered health condition. Most critical illness insurance policies cover major illnesses like:

- Cancer

- Heart attack

- Stroke

- Multiple sclerosis

- Parkinson’s disease

To claim critical illness insurance benefits, you must:

- Be diagnosed with a specific illness listed in your plan

- Submit the required medical documentation to verify your diagnosis

- Meet the waiting period requirements (if applicable)

The payout can be used for any purpose, including medical expenses, income replacement, or lifestyle adjustments during recovery.

What is covered under critical illness insurance?

Most critical illness insurance plans cover 26 common illnesses defined by the Canadian Life and Health Insurance Association (CLHIA).

Coverage for these health conditions may vary depending on the insurance company. Some insurers may also offer coverage for conditions other than the ones listed in the CLHIA guidelines.

The 26 conditions that most common carriers cover are:

Cancers and Tumours:

Cardiovascular:

- 3. Aortic Surgery

- 4. Coronary Artery Bypass Surgery

- 5. Heart Attack

- 6. Heart Valve Replacement or Repair

- 7. Stroke (Cerebrovascular accident)

Neurological:

- 8. Bacterial Meningitis

- 9. Dementia, including Alzheimer’s Disease

- 10. Motor Neuron Disease

- 11. Multiple Sclerosis

- 12. Parkinson’s Disease and Specified Atypical Parkinsonian Disorders

Vital Organs:

Accident and Functional Loss:

- 16. Acquired Brain Injury*

- 17. Blindness

- 18. Coma

- 19. Deafness

- 20. Loss of Independent Existence

- 21. Loss of Limbs

- 22. Loss of Speech

- 23. Paralysis

- 24. Severe Burns

Other

Please note that not all of these are included in every insurance policy, unless explicitly stated. If you have an existing policy or intend to buy one, please refer to the policy documents for full terms, conditions, and definitions.

What critical illness insurance plans do Canada’s largest insurers offer?

Some critical illness insurance plans cover just one condition, such as cancer (including its various forms), while others provide coverage for 26 or more illnesses. Most insurers include the “big three”—cancer, heart attack, and stroke—as standard, but the number of covered conditions varies by provider.

Here’s a look at some critical illness insurance plans from Canada’s top insurers:

| Insurance company | Plans | Key features |

|---|---|---|

| Canada Life |

|

|

| Sun Life |

|

|

| RBC Insurance |

|

|

| Manulife |

|

|

| Desjardins |

|

|

Putting cost aside, a quick glance at the offerings from most providers shows that critical illness products are often offered in a similar fashion no matter the company, with the biggest differentiator being the number of illnesses covered. However, there are some additional features and benefits you can look for when deciding which policy is best for you.

Partial payouts and non-life-threatening illnesses

An interesting feature included in some policies is the partial payout option or—as some companies may call it—“an early discovery benefit”. What this means is that you can receive a small amount of money if you contract a non-life threatening or less-critical illness/condition while insured.

An example of this would be if you develop treatable skin cancer. To the average person this definitely still means the big “C” cancer, however you will not qualify for full payment of the policy benefit amount as most policies do not consider it a “critical illness”. However, if you had a partial payout clause, you’d still receive some money as you did contract a form of cancer listed as eligible, and your policy would carry on through the length of your term.

These partial payout clauses typically payout between 10 to 25 percent of your policy’s value (though generally there is a maximum payout) and most importantly it doesn’t void your policy or reduce your final payout if you do end up subsequently contracting a defined life-threatening critical illness.

So, what illnesses qualify for partial payout?

These vary between provider and policy, but partial payouts often cover forms of non-life-threatening cancer and coronary angioplasty. The number of covered conditions will typically range between 4 and 16. Some companies will allow for one partial payout while others may allow for multiple partial payouts.

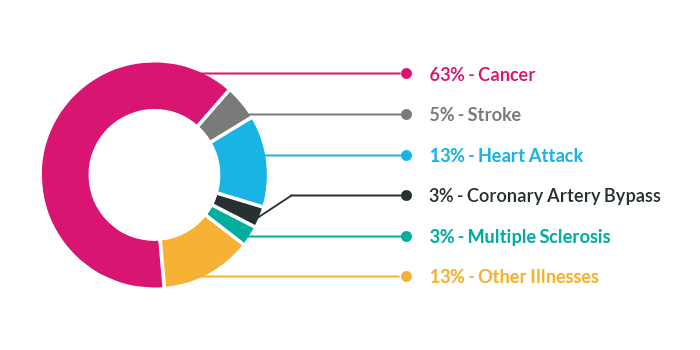

What are the most common claims for critical illness insurance?

In Canada, cancer, heart attack, and stroke account for the majority of critical illness insurance claims. According to the Canadian Institute of Actuaries, cancer represents the largest share of claims (67%), followed by heart attack and stroke.

Other commonly claimed conditions include:

- Coronary artery bypass surgery

- Multiple sclerosis

How to get critical illness insurance?

There are several ways to obtain critical illness insurance, depending on your requirements. Here are the most common options:

- Individual policy: Can be purchased through an agent or online, and usually requires medical underwriting to determine your eligibility and premium costs

- Group plan: Available through your employer or association you’re enrolled with. These plans are either partially or fully paid for by the entity providing them (as they’re considered the policyholders). Coverage usually ends when you leave the employer or association

- Special purpose plan: This type of critical illness insurance covers your loan payments for a specific period, if you’re diagnosed with a critical illness. You can apply for a special purpose policy by checking a box on your loan application or submitting an insurance application after your loan’s approval

Note that you can have multiple types of critical illness insurance simultaneously. To determine the right coverage for your needs, schedule a free consultation with our licensed advisors.

How to claim critical illness insurance?

To file a critical illness insurance claim, you must submit a claim form to your insurance provider within the timeframe specified in your policy. Most insurers require you to submit a completed form and medical proof within 30 to 90 days of your diagnosis date or surgery.

Critical illness insurance vs. other health insurance products

While it provides coverage for specific medical conditions, critical illness insurance shouldn’t be confused with health insurance, which reimburses certain medical expenses, or disability insurance, which replaces your income if you become disabled. Each of these products serves a distinct purpose, as explained below:

| Category | Critical illness insurance | Health insurance | Disability insurance |

| Definition | Provides a one-time lump-sum payment if you’re diagnosed with a covered condition | Covers medical expenses not covered by provincial healthcare | Replaces 60 to 85 percent of your income if you become disabled |

| Payout type | One-time tax-free benefit | Reimburses covered medical expenses (upon submission of required documents) | Pays monthly or weekly benefit until you return to work |

| Coverage duration | Limited period (10 or 20 years) or lifetime (up to age 100) | As long as premiums are paid | Until the age of 65 |

| What is covered? |

|

|

Illness or injury that leads

to a loss of income |

| Maximum coverage limit | $2-$3 million | No maximum coverage limit | Depends on age, occupation, income, and other limitations |

| Triggered by | Diagnosis of a covered condition | Medical treatment or hospitalization | Illness or injury that keeps you from working |

Definitions of critical illnesses in Canada

In 2018, the CLHIA updated its Critical Illness Benchmark Definitions in order to help standardize the language around common conditions and afflictions across the industry.

While the CLHIA listed and defined 26 common illnesses, conditions, or health events in their publication, insurers may offer coverage for other health conditions as well. Some insurers may offer coverage for illnesses not defined by the CLHIA and some may even use their own qualifying language.

Having said that, these definitions are commonly used and adhered to by many insurers, so you should familiarize yourself with them before choosing a provider.

Let’s look at 26 critical illness definitions used widely by Canadian insurance companies:

Cancers and Tumours

Benign Brain Tumour

Benign Brain Tumor is a definite diagnosis of a non-malignant tumor located in the cranial vault and limited to the brain, meninges, cranial nerves, or pituitary gland. The tumor must require surgical or radiation treatment or cause Irreversible objective neurological deficit(s).

Exclusions: No benefit will be payable under this condition for:

- Pituitary adenomas less than 10 mm;

- Vascular malformations;

- Cholesteatomas; or

- Infectious or inflammatory tumors

Cancer (life-threatening)

Cancer (life-threatening) means the definite diagnosis of a malignant tumor. This tumor must be characterized by the uncontrolled growth and spread of malignant cells and the invasion of tissue. Types of cancer include carcinoma, melanoma, leukemia, lymphoma, and sarcoma.

Exclusions: No benefit will be payable under this Covered Condition for the following:

- Lesions described as benign, non-invasive, pre-malignant, of low and/or uncertain malignant potential, borderline, carcinoma in situ, or tumors classified as Tis or Ta

- Malignant melanoma of skin that is less than or equal to 1.0mm in thickness, unless it is ulcerated or is accompanied by lymph node or distant metastasis

- Any non-melanoma skin cancer, without lymph node or distant metastasis. This includes but is not limited to, cutaneous T cell lymphoma, basal cell carcinoma, squamous cell carcinoma, or Merkel cell carcinoma

- Prostate cancer classified as T1a or T1b, without lymph node or distant metastasis

- Papillary thyroid cancer or follicular thyroid cancer, or both, that is less than or equal to 2.0cm in greatest dimension and classified as T1, without lymph node or distant metastasis

- Chronic lymphocytic leukemia classified as Rai stage 0 without enlargement of lymph nodes, spleen, or liver and with normal red blood cell and platelet counts;

- Gastro-intestinal stromal tumors classified as AJCC Stage 1

- Grade 1 neuroendocrine tumors (carcinoid) confined to the affected organ, treated with surgery alone, and requiring no additional treatment, other than perioperative medication to oppose effects from hormonal oversecretion by the tumor

- Thymomas (stage 1) confined to the thymus, without evidence of invasion into the capsule or spread beyond the thymus

Cardiovascular

Aortic Surgery

Aortic Surgery means the undergoing of surgery for disease of the aorta requiring excision and surgical replacement of any part of the diseased aorta with a graft. Aorta means the thoracic and abdominal aorta but not its branches.

Exclusions: No benefit will be payable under this condition for:

- Angioplasty

- Intra-arterial procedures

- Percutaneous trans-catheter procedures

- Non-surgical procedures

Coronary Artery Bypass Surgery

Coronary Artery Bypass Surgery means the undergoing of heart surgery to correct narrowing or blockage of one or more coronary arteries with bypass graft(s).

Exclusions: No benefit will be payable under this Covered Condition for:

- Angioplasty

- Intra-arterial procedures

- Percutaneous trans-catheter procedures

- Non-surgical procedures

Heart Attack

Heart Attack means a definite diagnosis of the death of heart muscle due to obstruction of blood flow, that results in a rise and fall of biochemical cardiac markers to levels considered diagnostic of myocardial infarction, with at least one of the following:

- Heart attack symptoms

- New electrocardiogram (ECG) changes consistent with a heart attack

- Development of new Q waves during or immediately following an intra-arterial cardiac procedure including, but not limited to, coronary angiography and coronary angioplasty

Exclusions: No benefit will be payable under this covered condition for:

- ECG changes suggestive of a prior myocardial infarction

- Other acute coronary syndromes, including angina pectoris and unstable angina

- Elevated cardiac biomarkers and/or symptoms that are due to medical procedures or diagnoses other than heart attack

Heart Valve Replacement or Repair

Heart Valve Replacement or repair means the undergoing of surgery to replace any heart valve with either a natural or mechanical valve or to repair heart valve defects or abnormalities.

Exclusions: No benefit will be payable under this condition for:

- Angioplasty

- Intra-arterial procedures

- Percutaneous trans-catheter procedures

- Non-surgical procedures

Stroke

Stroke (cerebrovascular accident) means a definite diagnosis of an acute cerebrovascular event caused by intra-cranial thrombosis, hemorrhage, or embolism from an extra-cranial source, with:

- Acute onset of new neurological symptoms, and

- New objective neurological deficits on clinical examination,

- Persisting for more than 30 days following the date of diagnosis. These new symptoms and deficits must be corroborated by diagnostic imaging testing. The diagnosis of stroke must be made by a Specialist

Exclusion: No benefit will be payable under this covered condition for:

- Transient Ischaemic Attacks

- Intracerebral vascular events due to trauma

- Lacunar infarcts that do not meet the definition of stroke as described above

Neurological

Bacterial Meningitis

Bacterial Meningitis means a definite diagnosis of meningitis, confirmed by cerebrospinal fluid showing the presence of pathogenic bacteria. The presence of pathogenic bacteria must be confirmed by culture or other generally medically accepted microbiological testing. The Bacterial Meningitis must result in neurological deficits persisting for at least 90 days from the date of diagnosis.

Exclusion: No benefit will be payable under this condition for viral meningitis.

Dementia, including Alzheimer’s Disease

Dementia, including Alzheimer’s Disease, means a definite diagnosis of dementia, which must be characterized by a progressive deterioration of memory and at least one of the following areas of cognitive function:

- Aphasia (a disorder of speech)

- Apraxia (difficulty performing familiar tasks)

- Agnosia (difficulty recognizing objects)

- Disturbance in executive functioning (e.g. inability to think abstractly and to plan, initiate, sequence, monitor, and stop complex behavior), which is affecting daily life

Exclusion: No benefit will be payable under this covered condition for affective or schizophrenic disorders, or delirium.

Motor Neuron Disease

Motor Neuron Disease means a definite diagnosis of one of the following: amyotrophic lateral sclerosis (ALS or Lou Gehrig’s disease), primary lateral sclerosis, progressive spinal muscular atrophy, progressive bulbar palsy, or pseudo bulbar palsy, and limited to these conditions.

Multiple Sclerosis

Multiple Sclerosis means a definite diagnosis of one of the following occurring after the later of the issue date of an insured person’s coverage, or the last reinstatement date of an insured person’s coverage:

- Two or more separate clinical attacks, confirmed by magnetic resonance imaging (MRI) of the nervous system, showing multiple lesions of demyelination

- A single attack, with objective neurological deficits lasting more than 6 months, confirmed by MRI of the nervous system, showing multiple lesions of demyelination

- A single attack, confirmed by repeated MRI of the nervous system, which shows multiple lesions of demyelination that have developed at intervals at least one month apart

Exclusion: No benefit will be payable for the following:

- Solitary sclerosis

- Clinically isolated syndrome

- Radiologically isolated syndrome

- Neuromyelitis optica spectrum disorders

- Suspected multiple sclerosis or probable multiple sclerosis

Parkinson’s Disease and Specified Atypical Parkinsonian Disorders

Parkinson’s Disease and Specified Atypical Parkinsonian Disorders means a definite diagnosis of either A) Parkinson’s Disease or B) Specified Atypical Parkinsonian Disorders, as defined below.

- Parkinson’s Disease means a definite diagnosis of primary Parkinson’s Disease, a permanent neurological condition that must be characterized by bradykinesia (slowness of movement) and at least one of the following: muscular rigidity or rest tremor. The insured person must exhibit objective signs of progressive deterioration in function for at least one year, for which the treating neurologist has recommended dopaminergic medication or other generally medically accepted equivalent treatment for Parkinson’s Disease

- Specified Atypical Parkinson’s Disorders means a definite diagnosis of progressive supranuclear palsy, corticobasal degeneration, or multiple system atrophy

Exclusions: No benefit will be payable for Parkinson’s Disease or Specified Atypical Parkinsonian Disorders if, within the first year following the later of the issue date or the latest reinstatement date of an insured person’s coverage, such insured person has any of the following:

- Signs, symptoms, or investigations that lead to a diagnosis of Parkinson’s Disease, a Specified Atypical Parkinsonian Disorder, or any other type of Parkinsonism, regardless of when the diagnosis is made

- A diagnosis of Parkinson’s Disease, a Specified Atypical Parkinsonian Disorder, or any other type of Parkinsonism

Vital Organs

Kidney Failure

Kidney Failure means a definite diagnosis of chronic irreversible failure of both kidneys to function, as a result of which regular hemodialysis, peritoneal dialysis, or renal transplantation is initiated.

Major Organ Failure on Waiting List

Major Organ Failure on Waiting List means a definite diagnosis of Irreversible failure of the heart, both lungs, liver, both kidneys, or bone marrow, and transplantation must be medically necessary.

Major Organ Transplant

Major Organ Transplant means a definite diagnosis of the irreversible failure of the heart, both lungs, liver, both kidneys, or bone marrow, and transplantation must be medically necessary. To qualify under Major Organ Transplant, the insured person must undergo a transplantation procedure as the recipient of a heart, lung, liver, kidney, or bone marrow, and limited to these entities.

Accident and Functional Loss

Acquired Brain Injury

Acquired brain injury means a definite diagnosis of new damage to brain tissue caused by traumatic injury, anoxia, or encephalitis, resulting in signs and symptoms of neurological impairment that:

- Are present and verifiable on clinical examination or neuropsychological testing,

- Are corroborated by imaging studies of the brain such as Magnetic Resonance Imaging (MRI) or Computerized Tomography (CT) showing changes that are consistent in character, location, and timing with the new damage, and

- Persist for more than 180 days following the date of diagnosis

Exclusion: No benefit will be payable under this condition for:

- An abnormality seen on brain or other scans without definite related clinical impairment

- Neurological signs occurring without symptoms of abnormality.

Blindness

Blindness means a definite diagnosis of the total and irreversible loss of vision in both eyes, evidenced by:

- The corrected visual acuity being 20/200 or less in both eyes

- The field of vision being less than 20 degrees in both eyes

Coma

Coma means a definite diagnosis of a state of unconsciousness with no reaction to external stimuli or response to internal needs for a continuous period of at least 96 hours, and for which period the Glasgow coma score must be 4 or less.

Exclusion: No benefit will be payable under this covered condition for:

- A medically induced coma

- A coma which results directly from alcohol or drug use

- A diagnosis of brain death

Deafness

Deafness means a definite diagnosis of the total and irreversible loss of hearing in both ears, with an auditory threshold of 90 decibels or greater within the speech threshold of 500 to 3,000 hertz.

Loss of Independent Existence

Loss of Independent Existence means a definite Diagnosis of the total inability, due to disease or injury, to perform independently, with or without the aid of assistive devices, at least 2 of 6 Activities of Daily Living listed below for a continuous period of at least 90 days with no reasonable chance of recovery.

Activities of Daily Living are as follows:

- Bathing: washing oneself in a bathtub, shower, or by sponge bath

- Dressing: putting on and removing necessary clothing, braces, artificial limbs, or other surgical appliances

- Toileting: getting on and off the toilet and maintaining personal hygiene

- Bladder and bowel continence: managing one’s bladder and bowel function with or without protective undergarments or surgical appliances so that hygiene is maintained

- Transferring: moving in and out of a bed, chair, or wheelchair

- Feeding: consuming food or drink that already has been prepared and made available

Loss of Limbs

Loss of Limbs means a definite diagnosis of the complete severance of two or more limbs at or above the wrist or ankle joint as the result of an accident or medically required amputation.

Loss of Speech

Loss of Speech means a definite diagnosis of the total and Irreversible loss of the ability to speak as a result of physical injury or disease, for a period of at least 180 days.

Exclusion: No benefit will be payable under this Covered Condition for all psychiatric-related causes.

Paralysis

Paralysis means a definite diagnosis of the total loss of muscle function of two or more limbs as a result of injury or disease to the nerve supply of those limbs, for a period of at least 90 days following the precipitating event.

Severe Burns

Severe Burns means a definite diagnosis of third-degree burns over at least 20% of the body surface.

Other

Aplastic Anemia

Aplastic Anemia means a definite diagnosis of a chronic persistent bone marrow failure, confirmed by biopsy, which results in anemia, neutropenia, and thrombocytopenia requiring blood product transfusion, and treatment with at least one of the following:

- Marrow stimulating agents

- Immunosuppressive agents

- Bone marrow transplantation

Occupational HIV Infection

Occupational HIV Infection means a definite diagnosis of infection with Human Immunodeficiency Virus (HIV) resulting from accidental injury during the course of the insured person’s normal occupation, which exposed the person to HIV-contaminated body fluids.

The accidental injury leading to the infection must have occurred after the later of the issue date or the latest reinstatement date of such insured person’s coverage.

Exclusion: No benefit will be payable under this covered condition if:

- The Insured Person has elected not to take any available licensed vaccine offering protection against HIV

- A licensed cure for HIV infection has become available prior to the accidental injury

- HIV infection has occurred as a result of non-accidental injury including, but not limited to, sexual transmission and intravenous (IV) drug use

Get a critical illness insurance quote

Ready to buy critical illness insurance? Book a free consultation with our licensed advisors, who’ll help you compare different providers, understand their offerings, and clarify any doubts about a policy’s financial and medical requirements. Call now to get tailor-made plans for your specific needs!

Frequently asked questions

How quickly can I receive a payout after being diagnosed with a critical illness?

The speed at which you would receive your critical illness payout depends on your provider and policy terms. However, most providers, like RBC Insurance, will pay your benefit within 60 days of receiving completed claim forms and all the documents requested from your medical specialist.

Can I purchase critical illness insurance if I have a pre-existing condition?

Yes, you can purchase critical illness insurance in Canada if you have a pre-existing condition. However, you must disclose your condition details, ongoing treatments, and recent diagnoses during your application. Depending on the severity of your condition, the insurer may respond in one of these ways:

- Decline: The insurer may automatically decline your application, particularly for serious conditions like advanced cancer, cystic fibrosis, and multiple sclerosis

- Rated Policy: If your condition presents a higher risk, you may be offered a “rated” policy with higher premiums

- Standard Approval: If your condition isn’t considered high-risk, your application may be approved with standard terms

Is critical illness insurance worth it for individuals with a family history of covered illnesses?

Yes, individuals with a family history of critical illnesses, such as cancer, heart attack, and stroke, should strongly consider critical illness insurance, as they have a higher susceptibility to these conditions.

How does critical illness insurance coverage change as I age?

As you age, critical illness insurance coverage becomes more expensive, since premiums tend to increase with age. Coverage availability also becomes limited, particularly for individuals over the age of 60.

Additionally, you may become more susceptible to pre-existing conditions such as arthritis, osteoporosis, and diabetes, or may already have them, which can make obtaining coverage more difficult.

Can I renew my critical illness insurance policy, and are there any changes on renewal?

Yes, you can renew your critical illness insurance policy at the end of its term. Some companies, like Sun Life, automatically renew 10-year term policies at guaranteed renewal premiums. You may also have the option to increase your coverage; however, this might require additional medical underwriting.

What is the difference between critical illness insurance and terminal illness benefit in life insurance?

Critical illness insurance covers serious health conditions like cancer, heart attack, and stroke, and provides a tax-free lump sum payment upon diagnosis. A terminal illness benefit, typically included in permanent life insurance plans, pays 50-75% of the insurance amount if you’re diagnosed with a terminal illness and have two years or less to live.

Are children covered under my critical illness insurance plan?

No, you can’t add children to your own critical illness insurance. However, you can buy a separate children’s critical illness policy that covers over 30+ health conditions and provides a lump sum payment if your child is diagnosed with a covered condition. Children’s critical illness insurance can be purchased anytime from birth until age 25.

What happens if I move out of Canada? Does my critical illness insurance still cover me?

Yes, your critical illness insurance remains in effect if you relocate from Canada, as long as you continue paying your premiums. However, there may be additional requirements when filing a claim. For instance, your insurer might need to verify that your diagnosis and treatment meet Canadian standards.

Is COPD covered by critical illness insurance?

No, critical illness insurance is specifically designed for severe health conditions, such as cancer, heart attack, and stroke, and usually doesn’t cover COPD, or chronic respiratory illnesses.

Critical illness insurance provides a one-time lump-sum payment if the insured contracts a serious illness covered by the policy. It typically covers cancer, heart attack, stroke, kidney failure, and other life-threatening conditions. You can use your critical illness payout in different ways such as to replace lost income, fulfill personal and familial obligations, and pay outstanding mortgages and other loan payments.