- Disability insurance offers you protection against loss of income. It replaces a substantial amount of your paycheque in the event you become injured or disabled and are unable to work.

- You can purchase disability insurance through your employer’s benefits plan, through being a member of a group association, or through individual coverage provided by insurance companies

- Deciding if you need individual disability insurance coverage is determined by if your current coverage and whether you want the maximum amount of protection available to you

Disability insurance – it’s not the first thing anyone wants to talk about. While most Canadians are a teensy bit more comfortable talking about death or major illnesses which accompany ageing, we like to pretend we’re invincible in our prime earning years.

Unfortunately, that’s just not true. 1 in 7 Canadians identifies as having a disability and 33 percent of workers between ages 30-64 will experience a disability greater than 90 days. What’s more, less than 10 percent of disability claims are due to accidents; most are due to illnesses.

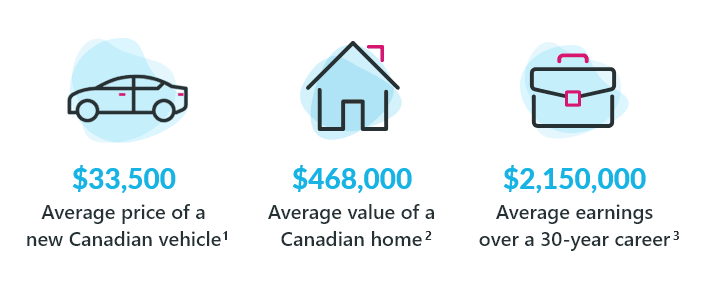

Now that we’ve burst the invincibility bubble, it’s time to matter-of-factly dispel some other myths around disability insurance. We take our ability to earn an income for granted. If you get insurance for other assets in your life, why wouldn’t you wish to protect the most valuable asset of your life?

The quality of life you’ve built for yourself and your loved ones may be hard to maintain if you find yourself without your regular paycheque. Don’t bury your head in the sand on this one. Read this guide for straight answers around a difficult subject.

What is disability insurance?

Disability insurance, sometimes also referred to as income protection insurance, is an insurance product which offers you protection against loss of income by replacing a substantial portion of your paycheque if you become disabled. The insurance company that offers you the coverage typically agrees to replace 60 to 85 percent of your regular income, regardless of whether the loss of your earning ability was due to a sudden accident or a degenerative illness. This ‘benefit’ payment is made to you until you return to good health (i.e. resume working) or until the end of your disability coverage period – whichever comes earlier of course! The monthly or weekly benefit payment is potentially tax-free, but more on that later.

Do I need disability insurance?

TBH that’s a personal question only you can answer.

But!… As your honest advisor, let’s help you think this through. No crazy math calculations are needed for this one. Disability insurance is a must-have for anyone depending on their regular income to pay for rent or mortgage costs, those who need a paycheque to support their family or provide for other daily living expenses, those who have limited access to savings or investments to maintain their current lifestyle for an extended period of time, or any other financial obligations. If you’re one of the rare people who could live the rest of your life in comfort off of your current savings, then maybe this product isn’t for you.

What conditions qualify for disability insurance?

Canadians are susceptible to injuries and conditions that prevent them from working. No wonder 12 million Canadians have disability insurance coverage (CLHIA, 2016, PDF). Though, this doesn’t mean they fully understand the main causes for disability claims. While – as we said – the first thing many people think of when they hear disability insurance is physical ailments and accidents that may bar them from working, the top 4 reasons for disability claims in Canada are mental illness, musculoskeletal issues, and injury or poisoning.

What are the different types of disability insurance?

Broadly speaking, there are two types of disability insurance. The categories work exactly as their names claim to — no complex mnemonic needed.

Short-term disability insurance is usually offered to cover the loss of income from short-term or temporary health issues arising from a less-serious illness or accident. The benefit payments can begin as soon as you use up your sick leave, sometimes as early as 1-14 days after a claim is submitted, with coverage lasting typically between 6-26 weeks – although coverage can also go as long as 52 weeks. It’s commonly used for temporary health issues, like minor accidents, sports injuries and back problems that may prevent you from working for a few weeks or months. Short-term disability insurance also takes precedence. It is frequently applied to cover some or all of the period prior to the start of payments under a long-term disability coverage (See elimination period below).

Short-term plans are generally offered by your employer as they seek to attract and retain talent and typically cover 50 to 70 percent of your income. Some employers may not offer short-term coverage in which case employees that are eligible rely on federal Employment Insurance (EI) disability benefits.

Long-term disability insurance is used to protect against loss of income from more persistent, ongoing health issues. Its coverage usually begins right after the short-term disability period is over and the coverage time can be for 2 or 5 years, although most coverages last until the age of 65 (standard retirement age). It’s usually purchased by individuals to supplement their employer-provided disability insurance. It’s commonly used for mental health problems, musculoskeletal problems, accidents, and more.

How do I buy disability insurance?

You can potentially buy disability insurance through your employer, through a professional association or groups of which you are a member, or individually. Generally speaking, most disability products arranged through groups – be it your employer or an association – are cheaper and are guaranteed at issue; you could elect to get coverage just by becoming an employee or a member of the group. No individual underwriting needed. Some employers even pay a share of up to 100 percent of the disability premiums. Count yourself fortunate if you find yourself in that situation, as employer-provided disability coverages continue to shrink. Lastly, if your employer or association pays for any or all of your premiums, the disability benefits that you may receive are taxable.

I have employer-provided disability coverage, why do I need individual disability insurance?

Well as they say, if the deal sounds too good to be true, then it usually is. Employer disability or for that matter most group-arranged disability policies have limitations, such as a limited coverage amount that is likely inadequate to cover your income replacement needs, nor do they have any flexibility to customize coverage. By definition, when it rains it pours – your enrolment in the group plan is also predicated on your continued employment or continued participation in the group or your plan sponsor’s continuation in their program. Should you change employers or leave the group, you risk losing the coverage and most certainly the temporary benefit of lower pricing. Individual disability insurance plans, that you apply for directly, are something you can truly call your own. Ask the 1 million Canadians that have chosen to buy their own disability policies.

What are the benefits of an individual disability insurance policy?

With an individual disability insurance policy, you own your coverage. You can seek the maximum coverage amount your individual circumstances allow and add additional top-ups to make it perfectly sized for you. The coverage is portable: it goes wherever you go, regardless of whether you change employers or make new friends with new group memberships. Your cost of insurance will not change unless you increase the coverage amount. And if you pay your own premiums using after-tax income, you will receive the benefits tax-free.

What can disability insurance payments be used for?

Whatever you choose! The monthly benefit you receive from an individual disability insurance policy can cover your everyday expenses as well help you pay any long-term debt repayments and medical bills. Additionally, many policies also provide non-monetary benefits such as rehabilitation, financial planning, job training, and more to help you regain your physical, emotional, and financial well-being.

When should I buy disability insurance?

If you need disability insurance, then purchase it right now! The cost of disability insurance will never be lower for you than it is currently; the costs only increase with age. If you’re in relatively good health, you should easily qualify for a disability policy – and can lock in lower rates at this age. Alternatively, if your health declines or occupation changes, you may no longer be insurable at an affordable premium in the future that you could easily obtain today.

How much does disability insurance cost?

As a rule of thumb, disability insurance can cost between 1 – 3% of your annual income. The payments (aka premiums) can be made monthly, quarterly or annually.

What factors affect the cost of disability insurance?

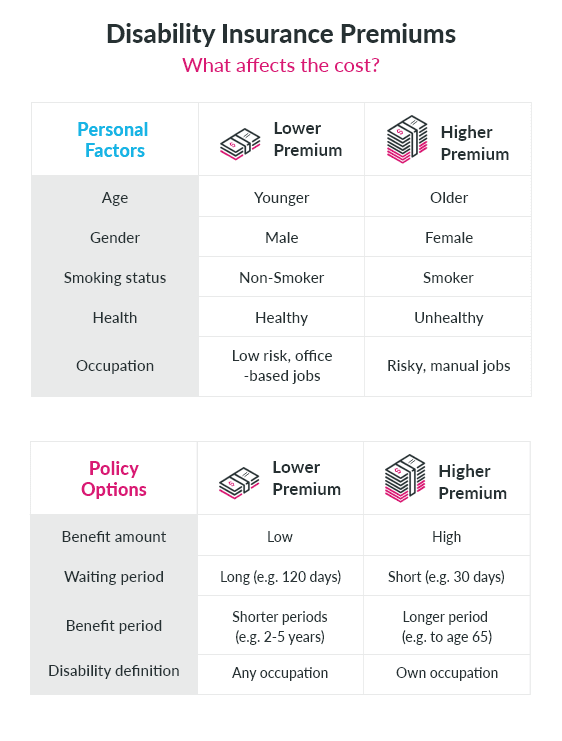

The actual cost of disability insurance depends on a few factors:

Age. Like most other life and illness insurance products, age matters. The younger you are, the lower the risk of experiencing a disability and therefore the lower the cost of protecting you against it.

Gender. Actuaries have determined women file more disability claims and are likely to have more expensive claims (from an insurer’s point of view) as they may be out of employment for longer periods of time. As per Stats Canada, 15% of women – compared to 12% of men – aged 15 or older reported having one or more disabilities that limited them in their daily activities in 2012. For the same age, 61% of women with disabilities participated in the labour force while 63% of men with disabilities were working. All other factors being equal, women may pay almost 40% higher disability insurance rates than men. This is quite a contrast to life or auto insurance rates, where the pricing advantage is firmly with women.

Smoking Status. Smoking (or tobacco use) is the leading risk for disability and premature death in Canada, causing 45,000 deaths annually. A tobacco-free lifestyle has huge health benefits and even bigger insurance premium benefits. If you are willing to butt out, you may save yourself from some premium-sized holes in your pocket.

Health. Similar to other life and illness insurance policies, insurance companies look at your recent and past health history to establish whether they can offer disability insurance and the price at which they should offer. Therefore you should apply for disability insurance when you are in good health and free of any disabilities.

Occupation. Premiums are usually based on the type of occupation a person has and the perceived level of risk. A high-income earning professional doing the majority of their work inside an office has a lower premium compared to a manual labourer or skilled tradesman.

Can the type of insurance policy affect my premium rates?

Of course! The cost of disability insurance also depends on certain variable factors you choose when you start the policy: the benefit amount, the waiting period, the benefit period, and the classes of disability we mention later in this guide (own, regular, and any).

Benefit Amount. The amount of cash you receive as your monthly benefit. It depends on your current income and occupation class but is generally offered between 60-80 percent of your monthly take-home pay, up to a pre-defined maximum. If you buy your own policy and pay for premiums with your after-tax dollars, your benefits will not be taxed, so a 60-80 percent coverage benefit could help replace most of your current monthly take-home pay. The higher your benefit amount selection, the higher the premiums.

Waiting Period (aka Elimination Period). This is the period of time between the start of your disability and the start of the benefit payment period. During the waiting period, you are paying for your needs out-of-pocket. Most long-term disability policies will allow waiting periods of 30, 60, 90, 120, 180 and 365 days, although 120 days is the most commonly selected period. The longer your waiting period the lower you will pay in premium. Why? Most disabilities are resolved within the first few months ( such as broken bones, back issues, short term illnesses); the longer the waiting period, the less likely an insurer will have to start paying out on a claim.

Benefit Period. This is the length of term of your benefit, or how long you will receive the benefit payment. Common term lengths are 2 years, 5 years, or until age 65. The longer your chosen benefit period, the higher your premium.

Disability Definition. This is the most important criteria for defining the cost of your disability insurance and can even determine whether or not you will be considered eligible to receive benefits.

To get an idea of how these factors influence the price of a policy, play around with the sliders on our disability insurance calculator.

Different definitions? What are the different disability definitions?

There are three different kinds of disability insurance you can purchase. Own, Regular, and Any. Despite their sounding like different kinds of petrol, choosing disability insurance is not like going to the gas station.

Own-Occupation. A policy with an own-occupation definition protects your ability to work in your specific profession. You will be eligible for benefits if a disability prevents or limits you from performing the duties of your pre-injury occupation. There are no restrictions: for instance, you can continue to receive benefit payments even if you’re able to work in another occupation or in any other capacity. This definition is usually offered to professionals that have made a significant investment in their occupation, including years of training and acquired experience e.g. surgeons, lawyers, accountants, senior corporate professionals, etc. Given the generous occupation definition, this type of policy is associated with the highest premiums and typically only available for specialized professions.

Regular-Occupation. A policy with a “Regular Occupation” definition also protects your ability to work in your pre-injury occupation or one fitting your experience and level of education. Though it sounds similar to own-occupation there is one critical caveat. If you choose to work in a different occupation, your benefits will be reduced, or fully withdrawn. To put it differently, to claim under this policy, you can collect full benefits for as long as you are disabled and unable to perform essential duties of your pre-injury occupation, but you can’t choose to take up any other comparable job.

Any-Occupation. This is the most stringent definition of disability that can be covered in a disability insurance policy. Under this type of policy, you may be ineligible to receive benefits if you can work in any other job. You may not even be working, but if you are deemed to be able to work, you will not be eligible for benefits under a policy with this definition. Therefore, any-occupation policies typically have the lowest premiums.

This can get a little confusing so let’s use an example. Let’s say you’re a surgeon and have gone through the years of education and training required. Through some unfortunate turn of events, you lose your pinky finger after a random shark attack. Bad luck; we know.

If you have own-occupation disability insurance, you are now entitled to your full benefit. Though you can still perform many other duties in the medical field, a surgeon needs their pinky for those tricky sutures and scalpel work.

If you have regular-occupation disability insurance you do not receive your full benefit or in most cases any at all. You can still perform many roles in the medical field, change your specialty, or teach without the full use of your hand.

If you had any-occupation disability insurance, a shark could have chomped off your whole arm or any other number of appendages. But, if you are still able to perform the duties of any occupation, you are not entitled to your benefit. It only pays out for a completely debilitating condition.

How much disability insurance coverage can I get?

For most Canadians, the maximum coverage amount for disability insurance is based on your age, occupation class, income and any limitations of the underlying product. But, specialized pricing and policies are available for the ballers out there…

Disability policies from employers, groups, or even one you purchase personally all coordinate – unlike other insurances – so buying more will not get you more coverage than you are eligible for overall. Insurance companies coordinate benefits with each other to make sure you are only paid out your maximum eligibility, so if you buy more than your income can justify you may be overpaying.

For qualified professionals seeking coverage, the monthly benefit can range from $500 to as high as $25,000 a month depending on your specific occupation and current income levels, or even more for highly specialized cases.

How do I apply for individual disability insurance?

The application process for individual disability insurance is very similar to applying for life insurance. The underwriting process, similar to when you apply for the best life insurance, evaluates whether you are insurable. Insurance companies will pay particular attention to whether you have any preexisting conditions that could later prevent you from working. There is also an extra step to verify your income level and work credentials since your coverage amount is generally established based on your current income. In some cases, companies may also benchmark coverage off the average income levels from previous years. PolicyAdvisor’s disability insurance tool lets you learn about disability insurance, play around with the numbers, and apply online.

What would disqualify me from getting disability insurance?

Because disability income is based on income replacement, you must be working and earning an income to apply for disability insurance.

Will disability insurance cover me if I’m self-employed?

If you are amongst the rising number of entrepreneurial Canadians choosing to be their own boss, you should plan for a safety net for you and your family through disability insurance. Disability insurance plans are designed to cover self-employed individuals’ needs for protecting their income and some can also help cover business expenses. You’ll need to provide proof of income for a substantial period of time and the status may also affect the price of premiums.

Does disability insurance cover pre-existing conditions?

Pre-existing conditions don’t necessarily disqualify you from obtaining disability insurance. Insurance companies will typically carve out an exclusion for certain pre-existing conditions. These exclusions may be permanent, or in some cases may be removed if there is no recurrence or degeneration of the condition within a pre-designated period of time. If you currently deal with a condition or disability but can still perform the duties of your occupation, it’s possible to obtain disability insurance for conditions or illnesses unrelated to your current disability. You can be covered for new, unrelated disabilities, but not further complications from the pre-existing ones you had.

How does pregnancy affect individual disability insurance?

It’s complicated and really depends on your policy. While most policies won’t pay disability benefits for a normal pregnancy or childbirth, some will approve claims for disabilities arising from complications during pregnancy or childbirth. When in doubt, speak to our friendly licensed advisors.

Do I need disability if I have critical illness insurance? What about if I have life insurance?

Life insurance and critical illness insurance are important protection products, however, they serve very different needs. Life insurance covers your death; an insurance company will pay your designated beneficiary a lump-sum tax-free amount when you die. Critical illness insurance covers if you develop a specified illness, have a health event or undergo treatment. You receive a tax-free lump-sum payment once proof of the illness or health incident is established.

Similar to critical illness insurance and unlike life insurance, disability insurance is a living benefit to you. This means you can avail of the benefit while you are alive. However, the disability is specifically designed to replace your ongoing income when you are unable to work due to disabilities that may not qualify as life-threatening and therefore not trigger a payment under critical illness policies.

Is mortgage disability insurance worth getting?

Our view on mortgage disability insurance is very similar to our view on bank-provided mortgage insurance. You are much better served by insurance products that serve you and your financial situation and security; not one that can only be applied to safeguard your lender. So repeat after us: Mortgage disability insurance covers the lender, not you! And individual disability insurance will typically be a better product for protecting you and your family.

Wouldn’t public healthcare or Canada Pension Plan (CPP) would cover me instead?

If you are contributing to Employment Insurance and CPP/QPP, you are indeed eligible for EI Sickness Benefits and CPP Disability Benefits respectively. However, the criteria for offering coverage or disbursing benefits is very stringent, and payout through these programs may be much lower than your current monthly wages.

EI Sickness Benefits provide for Canadians unable to work because of sickness, injury, or other issues. The benefits, subject to eligibility conditions of work history and EI contributions, are paid out for a maximum of 15 weeks after a 1 week waiting period. You may receive up to 55 percent of your maximum insurable earnings with a maximum benefit amount of $562 per week. You may be able to receive an additional family supplement depending on your net family income, your spousal situation, and whether you have children. The EI sickness benefit amount is however always taxable. So yes – you are potentially covered by this public safety net – but it’s a pretty small net and not considered adequate by a large number of claimants.

CPP Disability Benefits provide for those who have made contributions to CPP and are disabled and cannot work at any job on a regular basis. The disability must be both severe and prolonged. Severe disabilities are those that stop you from doing any type of substantial, gainful work at all. Prolonged disabilities are long-term where the duration is either unknown or likely to result in death. The average payout for CPP Disability benefits in Canada is just under $1,000 per month; the maximum monthly payment as of 2019 is just over $1,300. CPP benefits are also taxed, just like income. Most individuals would find the $16,000 in pre-tax benefits less than adequate to pay their bills and maintain their lifestyles. And remember, CPP benefits only pay out if you are completely unable to obtain gainful employment whatsoever.

Private disability insurance plans exist to cover the gap for those who need protection beyond the critical but small social safety net that covers the basic needs of Canadians.

I have insurance through WSIB, why would I need private disability insurance?

The Workplace Safety and Insurance Board (WSIB) is an Ontario-specific workers’ compensation board. Each province, territory, and Canada itself (for Federal employees) has its own. These boards exist to protect employees from the financial hardships associated with work-related permanent injuries and conditions and are solely funded through employer premiums. They operate at arm’s length to make sure employee claims for workplace accidents are administered correctly. WSIB and similar coverages are mandatory for certain categories of employers such as those operating in the construction industry but are purely optional for many other categories of employers.

In cases where you have WSIB coverage through your employer, remember it may not be what you think it is. Disability insurance offered through WSIB is generally tailored specifically around covering accidents that happen on the job. If you are injured outside of the workplace, this insurance won’t cover you, and mostly involves lump sum tax-free payments for loss of appendages or senses like sight and hearing due to a workplace accident.

Are disability insurance payments taxable?

There’s some debate on who said it, but the quote still rings true: Nothing is certain except for death and taxes. The government will get its share of your earnings one way or another. Depending on the disability insurance policy you paid into in the first place, your benefit will be taxable.

Disability income may or may not be subject to income tax, depending on whether the policy premium was funded with pre-tax or after-tax dollars, among other considerations. If you are paid out by a policy that was fully or partly paid by your employer or another association or entity, generally using pre-tax premium dollars, you will be taxed when you receive the payment.

However, for a policy you pay entirely, the story will be different. If you are paying the full price for premiums throughout your coverage period, and do not claim them as tax-deductible business expenses, you will not be taxed on the benefit you may one day receive. Why? Because the money you are using to pay those premiums has already been taxed. There’s no double jeopardy in taxes.

What happens at the end of the coverage period?

Some disability insurance policies have options to convert them to long-term care coverage at the end of the coverage period. You would typically need to be between the ages of 55-65 when your coverage period ends to take advantage of this option. It activates in your twilight years if you need assisted-living options, whether in your own home or in a group setting.

What happens to my disability insurance payout if I die?

In most cases, your benefit ends with your death, the same as your wages would with a job. However many disability policies will also include a survivor benefit whereby your family or any designated beneficiary may receive a lump sum payment of up to 3 times the maximum monthly benefit, should you pass away while receiving disability benefits.

Do I pay more if I purchase a disability policy through a broker?

Of course not! On the flip side, you may be able to save money on a disability policy if you use an independent broker. At PolicyAdvisor, we compare a broad selection of policies from the market, evaluate them across features and prices and recommend to you the best disability coverage at the lowest price possible. Given our extensive relationships, we also know how to advocate for you with our partners. When you are ready, give the tool a spin!

Who sells disability insurance?

Many insurance companies also sell disability insurance products, and there’s one quick, simple marketplace that lets you compare them all.

Disability insurance offers you protection against loss of income. It replaces a substantial amount of your paycheque in the event you become injured or disabled and are unable to work.