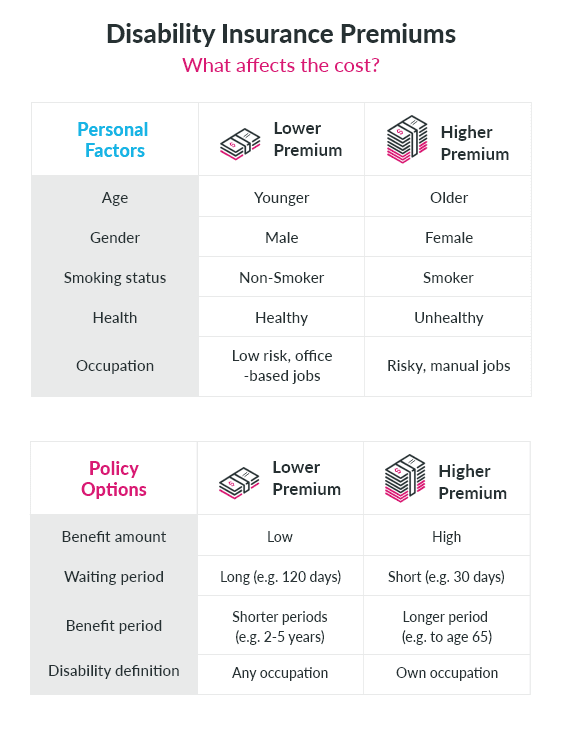

- The cost of disability insurance is influenced by age, gender, benefit length, and health

- Waiting periods (the time before benefits start) are also a major influencer of cost

- Women may pay more for disability insurance due to claims frequency

- Individual plans allow for flexibility to choose a product that fits your needs and budget

- What are the different types of disability insurance?

- How much of your income does disability insurance cover?

- How much does short-term disability insurance cost per month?

- How much does long-term disability insurance cost per month?

- How do insurance companies decide disability insurance premiums?

- Is a disability insurance benefit paid monthly?

- How much do you get paid out for disability insurance in Canada?

Disability insurance is an important part of your insurance portfolio, along with life and critical illness insurance. If you can no longer work due to an injury or illness, disability insurance provides you a living benefit—it’s income replacement for when you’re down and out.

So, what’s it going to cost you? There are different types of disability insurance, different cost influencers, and even employer benefits to consider. We’re here to demystify how much disability insurance can actually cost, looking at what the insurance covers, how much you can expect to pay in premiums, and why it’s worth it!

What are the different types of disability insurance?

Before we dive into the numbers, let’s define the types of disability insurance available to you. There are two main types of disability insurance you should know about: short-term disability and long-term disability coverage. The two are not mutually exclusive, as long-term disability insurance usually follows short-term coverage.

Short-term disability insurance (STD) is a policy that temporarily covers the loss of income due to accident or illness. Short-term disability…

- Provides coverage for short periods of time, typically 1-6 months

- Some policies may extend coverage for up to a year

- Usually offered by employers to their workers, with coverage extending from 70-100% of your income

Long-term disability (LTD) provides protection from loss of income for longer-lasting health problems. Long-term disability…

- Kicks in after the short-term coverage period has ended

- Has a variable coverage period depending on the policy in question

- Typically covers 2-10 years, or up until retirement age (65 years)

- Coverage usually from 50-70% of income

- Is most commonly claimed for longer duration mental health afflictions or physical health concerns (cancer treatment, musculoskeletal issues and injuries from accidents, etc to name a few)

Often, short-term disability insurance plans are integrated with long-term disability, providing coverage during the LTD waiting period. The waiting period (aka Elimination Period) is the period of time between the start of your disability and the start of the benefit payment period. During the waiting period, you are paying for your needs out-of-pocket. Most long-term disability policies will allow waiting periods of 30, 60, 90, 120, 180, and 365 days, although 90 or 120 days is the most commonly selected period.

The longer your waiting period the lower your premium. Why? Most disabilities are resolved within the first few months (such as broken bones, back issues, short-term illnesses); the longer the waiting period, the less likely an insurer will have to start paying out on a claim.

How much of your income does disability insurance cover?

If you lose the ability to work due to an illness or injury, short-term disability insurance will typically cover between 70% and 100% of your income, up to a maximum amount or until your coverage period expires. After your short-term coverage and waiting period are up, Long-term disability income typically covers between 50-70% of your gross income.

It is also helpful to know that supplementing the disability coverage you get through employee benefits with an individual policy will not double your coverage: you will still only be entitled to the coverage you are eligible for based on your income level. In other words, insurance providers will coordinate so that your disability insurance income does not exceed what you are eligible for (usually a maximum of 80% of your income).

That being said, if your employee disability insurance does not provide sufficient coverage, it may still be worthwhile to top up with a private policy or opt strictly for an individual policy where you get to determine coverage and premium plans.

How much does short-term disability insurance cost per month?

Like life insurance, where cost is partially related to the size of the benefit you buy, disability insurance coverage is also determined by other factors, like age, health status, and gender. However, the cost calculations differ in that the disability insurance benefits you receive every month is relative to your original income.

Additionally, what is more likely to be influenced by the policy cost is how long your disability coverage lasts and how broad-reaching the definition of “disability” is. We’ll touch on this more below.

Many short-term disability policies are offered through employer benefits, meaning that employees pay little to nothing in premiums. Instead, the premiums are usually deducted directly from their paycheques, if any.

Generally, the cost of an STD insurance policy is highly dependent on your salary. Because disability insurance pays out a portion (between 50% and 100%) of your income, premiums costs vary significantly. Among the cheapest options for short-term disability insurance are injury-only policies (which exclude illnesses) that can start around $10/month. However, it will truly depend on what your employer offers—your work may have set up a specific group rate with the insurance provider. For private policies, it’s best to get an individual quote based on your income replacement needs.

How much does long-term disability insurance cost per month?

Long-term disability premiums tend to range between 1% and 3% of your income, making it one of the most affordable and effective insurance products for income protection.

Thus, a person making $40,000 (before taxes) can buy a long-term disability insurance policy for a monthly benefit of $2,500 per month for as little as $24/month (2 year benefit period) or $43 per month (coverage to age 65). At $100,000, premiums will be upwards of $80/month. In short, the higher the monthly benefit, the higher will be the premiums. However, there are of course other factors that contribute to the price as well (see the below chart).

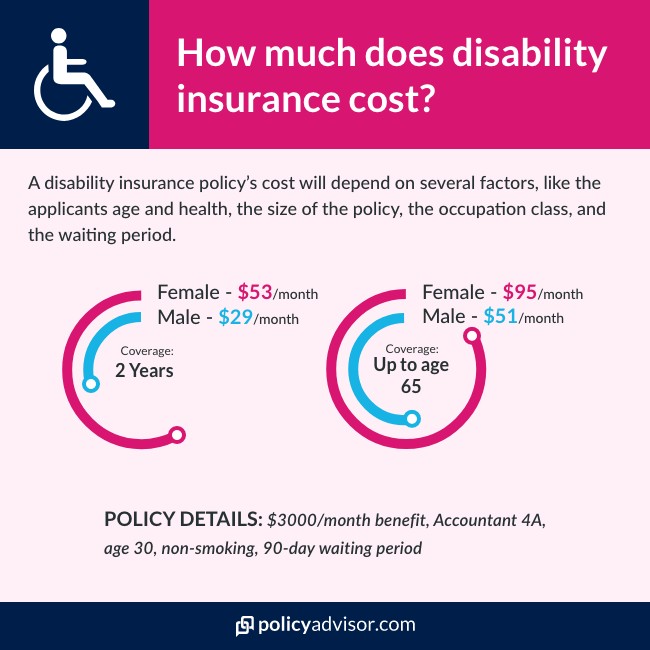

For individual plans, the cost will vary depending on policy length, coverage, and your insurance needs. Here is one example of what individual long-term disability insurance may cost.

Policy details

- Benefit Amount: $3000/month

- Occupation Class: Accountant – 4A

- Age: 30

- Status: Non-smoking

- Waiting Period: 90 Days

| Coverage Length | Male | Female |

|---|---|---|

| 2 Years | $29/month | $53/month |

| Up to age 65 | $51/month | $95/month |

If you have a long-term disability insurance policy through an employer, you will pay substantially less in monthly premiums. In the Government of Canada disability insurance plan, for example, the government covers 85% of the premium costs, while the insured employee pays the remaining 15%. For an employee earning $45,000, the employee’s monthly contribution is $15.75 per month.

Some employers may offer long-term coverage in addition to short-term packages. However, it’s important to keep in mind some employer benefits have very strict definitions of disability, choosing to opt for the cheapest insurance plan to save them money.

For example, many work plans choose an “any-occupation” definition of disability. This is the most stringent definition of disability that can be covered in a disability insurance policy. Under this type of policy, you may be ineligible to receive benefits if you can work in any other job. You may not even be working, but if you are deemed to be able to work, you will not be eligible for benefits under a policy with this definition.

How do insurance companies decide disability insurance premiums?

For an individual disability insurance policy, the cost of premiums varies depending on several factors, such as age, gender, health, smoking status, and occupation. Like most insurance policies, the risk to insurers increases the older a person is, as the possibility of getting a disability is higher and so premiums increase with age.

Where disability insurance premiums diverge from life insurance is when it comes to gender. While men tend to pay more in life insurance premiums, women can be subject to higher disability insurance premiums, due to a higher statistical filing rate and more expensive claims.

According to insurer stats, women are more likely to take time off work due to disability. Health and occupation also factor in: medical history can influence private disability insurance rates as can having a higher risk job. For example, an office worker may have access to lower premiums than someone working with heavy machinery.

Of course, the type of policy also comes into play. Disability insurance policies with lower benefits and shorter coverage periods will have lower premiums than policies with higher benefits and longer coverage periods.

The nature of the coverage is also important. For example, disability insurance coverage has three definitions of disability: “any occupation,” “regular occupation,” and “own occupation”. Any occupation coverage—the cheaper option—only pays out if the policyholder is unable to work at any job. A policy with a “regular occupation” definition also protects your ability to work in your pre-injury occupation or one fitting your experience and level of education. Own occupation, by contrast, provides coverage if the policyholder is unable to work the job they have. This type of coverage, which pays out more frequently, is thus more expensive.

The last important cost influencer for long-term disability insurance premiums is the waiting period. Also known as the elimination period, the waiting period is the time between when you stop working and when the disability benefits kick in. During this period, you will either be covered by short-term disability insurance (which has short wait periods) or you will pay out of pocket. For an LTD policy, the length of a waiting period has an impact on the premiums you pay: a short waiting period (30-60 days) will have much costlier premiums than a longer waiting period (120-365 days).

Is a disability insurance benefit paid monthly?

Yes, unlike critical illness insurance which pays out a one-time lump sum, disability insurance issues monthly or bi-weekly payments. The reasoning is that the benefit payments mimic regular income earnings even if you are not able to work. The idea is that monthly disability payments will ensure stability and enable you and your family to maintain your cost of living prior to losing the ability to work.

Depending on where your disability benefits are coming from (either individual or employer), they may or may not be considered taxable income. If you are receiving benefits through an employer who pays the policy premiums, your monthly disability benefit income will likely be taxable.

With an individual disability insurance policy—which are becoming more popular as employers cut back on benefits and people are increasingly self-employed—you are responsible for paying premiums to keep the policy active. One of the greatest advantages of individually-owned coverage is that the monthly benefits you receive are tax-free.

How much do you get paid out for disability insurance in Canada?

With short and long-term disability insurance, it is common to get paid out 50-100% of your income each month, depending on the type policy.

In Canada, it is possible you will receive some income replacement if you become unable to work even without employer benefits or an individual disability insurance policy. For example, if you are eligible for employment insurance (EI), you may receive sickness benefits. These provide up to 15 weeks of coverage if you become unable to work for medical reasons. With EI sickness benefits the coverage is limited: it pays out up to 55% of your monthly income up to a maximum of $595/week or $2,380/month. For people making less than $30,000/year, this could be suitable for short-term disability coverage. Anything more, however, and it is probably a good idea to buy supplemental disability insurance.

While EI sickness benefits are intended for short-term financial support, the Canadian government also offers a safety net for long-term disability through the Canadian Pension Plan (CPP) disability benefit. People with a long-term disability who are under the age of 65 and who have contributed enough to the CPP qualify for this benefit. However, this coverage is even more limited than EI with an average monthly amount of $1,031 up to a maximum of $1,413/month. If you qualify for this benefit and have private disability insurance, your private benefit will be adjusted to account for the CPP payment.

Ultimately, it is a good idea to look into protecting yourself and your family financially should you lose the ability to earn an income. While it is unfortunate to think about, an accident or sudden diagnosis can upturn your life, not only affecting your health but also your ability to work and earn a living. Disability insurance provides a safety net in these cases, ensuring that you can focus on yourself and your loved ones during this time, rather than worry about how to make ends meet. In some cases, government benefits or employer benefits will be enough, but if you don’t qualify for these or have additional coverage needs, it is worthwhile to think about a private disability policy.

Who sells disability insurance?

Many insurance companies also sell disability insurance products, and there’s one quick, simple marketplace that lets you compare them all.

The cost of disability insurance depends on the type of policy you are selecting—either short or long term. Other factors such as age, length of benefit, health, and coverage amount will affect premium cost. Employer-provided short-term coverage is usually the most cost-effective but long-term disability coverage is best to purchase individually.

1-888-601-9980

1-888-601-9980