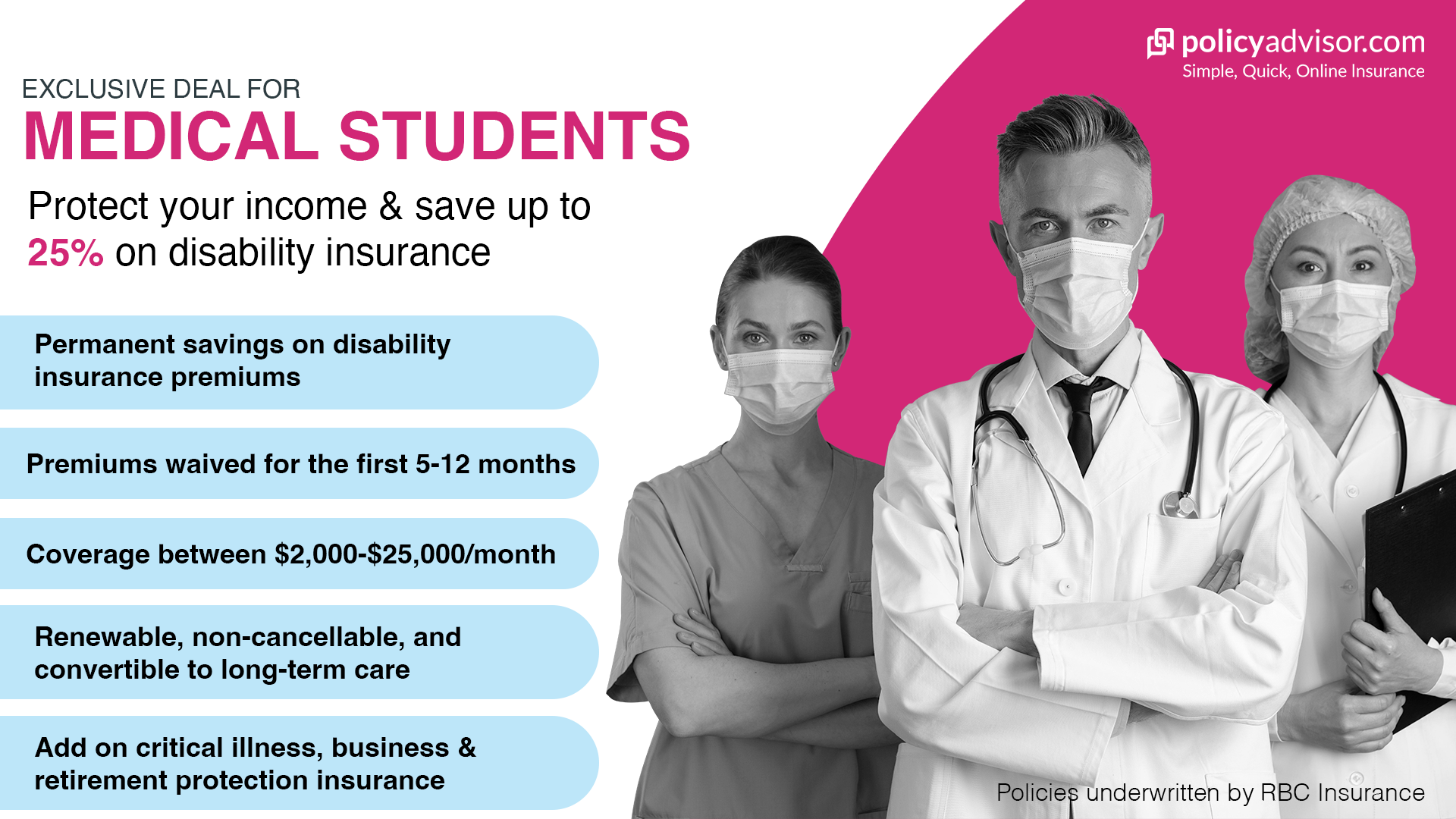

- The Medical Student Offer gives med students disability insurance at much lower rates

- It also gives them access to other types of coverage at lower rates and with a simplified application process

- MSO policies are underwritten by RBC

Medical students work hard to pursue one of the most noble careers there is, and they can protect the future they’ve worked so hard to build with a unique Medical Students Offer on disability insurance that can keep them covered for years to come.

Keep reading to find out what the Medical Students Offer is, how it can safeguard medical students, and how you can get it.

What is the Medical Student offer?

The Medical Student Offer (MSO) is a special deal that lets medical students buy disability insurance at a lower cost than normal and even get up to 12 months free. The application process is simple (just 1 page) and you may not even have to do a medical exam.

Plus, the MSO gives students access to other types of insurance at a lower cost and with package deals. It’s a special deal that lets Canada’s future doctors build comprehensive coverage that meets their needs and gives them peace of mind for tomorrow.

It’s underwritten by RBC Insurance and sold through brokerages like PolicyAdvisor.

What is disability insurance?

Disability insurance is a type of insurance policy that helps to protect you against loss of income. It replaces a portion of your regular monthly income if you become injured or ill and cannot work. A disability insurance plan:

- Pays 60-80% of your income

- Continues every month until:

- You recover and return to work

- Your policy ends (usually at age 65 or retirement)

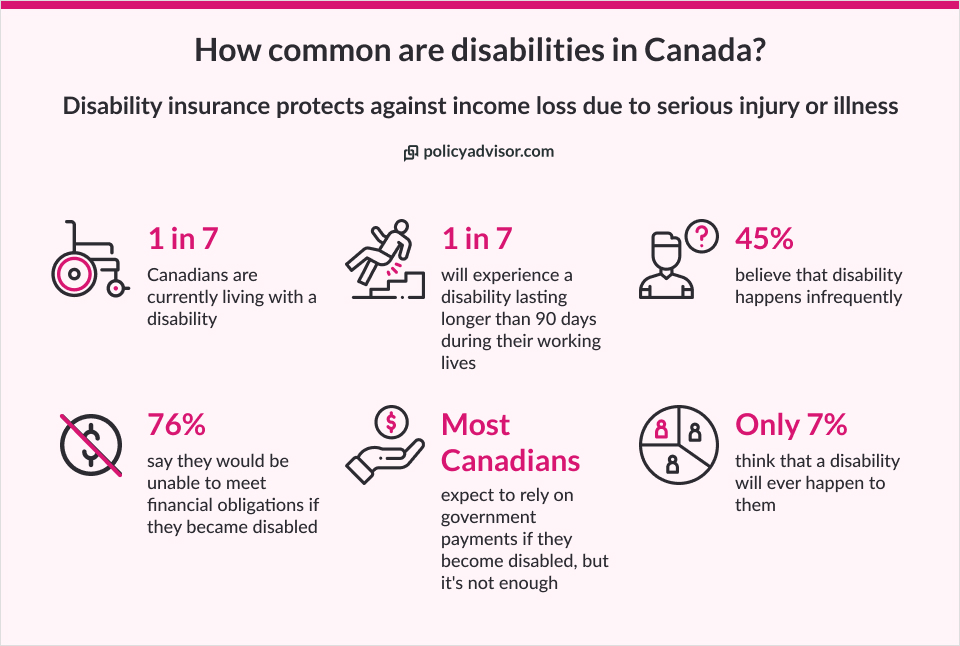

Do Canadian med students need disability coverage?

Yes, students in med school need disability insurance to protect the income they work so hard to secure. It will cover you if you become so badly injured or ill that you can’t:

- Attend training or classes

- Continue your education

- Work

- Practice as a fully-licensed doctor

- And more

Disability insurance will help cover your bills or expenses, so you can focus on getting better in peace.

Are medical students covered by Canadian Medical Association (CMA) insurance plans?

Yes, medical students can get some coverage from groups like the Canadian Medical Association. But, it might not cover everything they need.

We suggest they buy their own insurance coverage that fits their exact needs — now and in the future. And the Medical Student Offer is a fantastic way to do that at the lowest cost and with the best coverage options.

What are the benefits of the Medical Student Offer?

This offer is extremely rare, and gives med students a ton of benefits.

- Significantly lower premium rate — savings of up to 25% on disability insurance remain for the duration of the policy

- Guaranteed level premiums — the amount you pay will stay the same for the entire duration of your policy

- Easy application process — only answer a few questions, with simple approval and option to skip the usual insurance medical exam

- Simple eligibility criteria — you can qualify even if you’re still a student with no job lined up yet

- Policy is non-cancellable — as long as you keep paying premiums, the insurance company cannot cancel your policy

- Policy is renewable — you can renew your policy after age 65, which is rare in the industry

- Riders and optional coverage available — options to add coverage for critical illness, retirement protection, and business coverage at additional low cost and without additional underwriting

- Premiums waived — between 5 to 12 months of coverage are offered at no cost

- Designed to grow with you — as you advance in your career, this policy is meant to give you the flexibility to adjust coverage based on your needs

- Backed by a strong brand name — policies are underwritten by RBC, one of the country’s biggest banks and a financially strong and secure provider

What are the other types of insurance coverage offered through the MSO?

Aside from disability insurance, the MSO also gives access to:

- Critical illness insurance

- Business overhead expense insurance

- Business loan protection insurance

- Retirement protection insurance

- Future increase option (FIO) insurance rider

Med students can apply for these other types of plans at any time during the eligibility period, and they don’t have to go through more underwriting to get it. Plus, they can get lower prices on most of these plans.

How much does coverage cost through the MSO?

The cost of disability insurance is different for everyone. It depends on your personal information like age and health, and on your policy’s details. The best way to find out how much it would cost you is to let our licensed insurance advisors check it out for you. We offer consultations free of charge and at no-obligation — it won’t cost you anything to chat with us and get your Medical Student Offer quote for a disability insurance policy.

How can med students apply for the RBC disability insurance offer?

Medical students in Canada can apply for the Medical Student Offer by contacting our licensed insurance advisors. We can give you a personalized quote and help walk you through the process.

Who is eligible for the medical students disability coverage offer?

To be eligible for the RBC MSO, you must meet the following criteria:

Can I get the Medical Student Offer if I have health issues?

Yes, you can still get disability coverage through the MSO even if you have pre-existing medical conditions or health issues. The application process is a type of underwriting called guaranteed – it only asks a few health-related questions and does not make you do a medical test. This means you can still get approved even if you have health concerns.

However, this policy comes with an exclusion that you will not be covered for that pre-existing health condition for the first 2 years of your policy.

When can I apply for the Medical Student Offer?

The MSO has a specific period when you are eligible to apply. You can only apply:

- When you’re a student

- Until you complete your residency or fellowship

- Up to 90 days after completing your residency or fellowship, but no later than September 30th of that year

However, you can also apply for additional coverage at the following times:

When can I apply for optional MSO coverage?

| Coverage | Eligibility period |

|---|---|

| Critical illness insurance | Normal MSO eligibility period + up to your 1st year of practice |

| Business protection plans | Within 6 months before or after your 1st year of practice |

| Retirement protection coverage | Up to 6 months before and 6 months after your residency ends |

| Future increase option rider | Up to 6 months before and 6 months after your residency ends |

Why PolicyAdvisor?

There are tons of reasons why you should choose to get coverage with us, as Canada’s leading brokerage. We have years of experience in the industry, and when you choose us as your advisors, you’re signing up to:

Frequently asked questions about RBC’s Medical Student Offer

No, RBC’s Medical Student Offer and Student Offer are not the same thing. RBC actually has two separate offers that medical students in Canada can take advantage of:

- Medical Student Offer — 25% savings on disability insurance + access to other types of coverage, with more savings and bundle deals available

- Student Offer — 10% savings on disability insurance + other benefits

The offer available through PolicyAdvisor is the Medical Student Offer with 25% savings on disability insurance.

Yes, you can apply for the Med Student Offer even if you’re still in school and don’t have a job yet. That’s one of the many benefits of this offer — it’s designed to make things easy for Canada’s future doctors to get the income protection insurance they need to live successful and financially secured lives with peace of mind.

No, international students are not eligible for the MSO at this time. If you are an international student who wants to buy insurance like disability or something else, contact us. Our advisors would be happy to help look at your options.

What counts as a disability can vary based on the type of policy, the insurance provider, and more. The Medical Student Offer is:

- Own-Occupation — this is a policy where you receive benefits for any injury or illness that stops you from being able to do your specific job, even if you can still do other jobs

- Ex: A surgeon with a hand injury who cannot still do surgeries, but could still lecture or do consulting work while recovering would be covered

This may sound obvious, but disability insurance policies can also be:

- Regular Occupation — only pays out if you cannot do your specific job OR any related job in your field

- Ex: A surgeon with a hand injury who cannot do surgeries but could still lecture would NOT be covered

- Any Occupation — only pays out for an injury or illness that stops you from doing ANY job at all, even if it’s not in your normal line of work

- Ex: A surgeon with a hand injury who cannot do surgeries but could still lecture, do telemarketing, become a social media influencer — anything!

Disability insurance and critical illness insurance are both types of “living benefits”. This means they give you financial protection while you are alive. But, they work differently and cover different things:

It’s usually best if you have insurance for both disability and critical illness. But it also depends on your own circumstances. You may not necessarily need both if you have good coverage through a group plan or a spouse’s plan, for example.

If you’re unsure about which you need, book some time with one of our licensed insurance advisors. We’re happy to give you a free consultation so you can assess your needs and figure out what would work best.

The Medical Student Offer gives medical students disability insurance with 25% savings. Plus, it lets them get other types of insurance at lower rates and with an easy application process. It’s a very attractive offer that helps Canada’s future doctors protect the income they’ve worked so hard to earn.