- The cost of employee benefits typically ranges from $80 to $350 per employee per month, depending on the coverage level

- Canada Life provides flexible benefits and savings plans tailored for companies with up to 75 employees

- Canada Life offers life insurance up to 300% of salary (max $1.25 million) and accidental death coverage up to $500,000

- Their retirement plans include RRSPs, DPSPs, and optional TFSAs to enhance employee savings and retirement readiness

- The virtual healthcare Consult+ provides 24/7 access to healthcare professionals for consultations, prescriptions, and referrals

- Provides faster claims processing where simpler claims are processed within 24-48 hours

- What are the key features of Canada Life small business benefits for employees?

- What does Canada Life’s small business benefits for employees cover?

- What are Canada Life’s Consult+ virtual healthcare services?

- What we like about Canada Life’s employee benefits for small businesses plan?

- Frequently asked questions

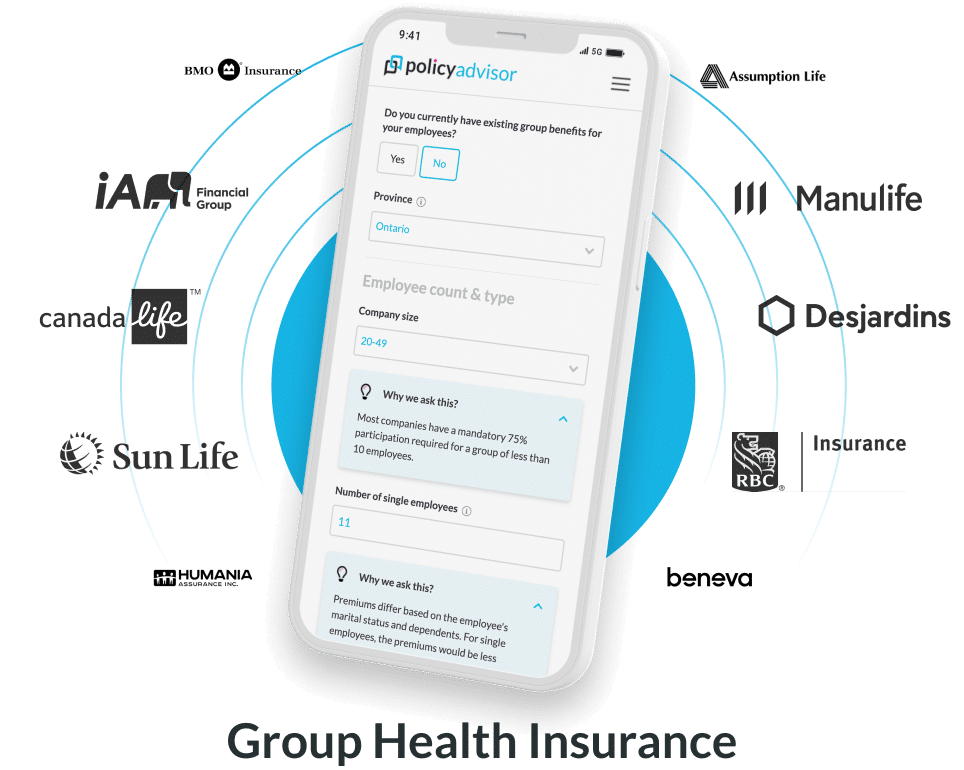

Canada Life’s small business benefits for employees stand out as a strategic investment in workforce well-being. Their Freedom at Work program for small business is an effective way to attract and retain top talent, costing between 1-5% of payroll, making it a budget-friendly option. Regardless of the budget, Freedom at Work can help you find the ideal plan while safeguarding your bottom line.

When it comes to group benefits and group retirement savings solutions, Canada Life is the leading provider in Canada. The coverages under Freedom of Work plan range from dental and vision care, disability, paramedical services to tax-free savings accounts. The blogs will give detailed insights into what the program covers, its features, about Canada Life’s Consult+ virtual healthcare services and more.

What are the key features of Canada Life small business benefits for employees?

Canada Life small business benefits for employees is tailored for teams of 3 to 75 employees. It requires a minimum participation rate of 70%, with employers typically covering most premiums.

Key features of Canada Life group health plan

| Category | Details |

| Minimum group size | 3 employees |

| Maximum group size | Up to 75 employees |

| Minimum participation | 70% of eligible employees |

| Business eligibility | Businesses must have at least 3 employees and demonstrate stable operations |

| Employee eligibility | Employees must typically be full-time to qualify, part-time employees may also be included depending on the specific plan |

| Cost sharing | Employers often cover a significant portion of premiums while employees may contribute through payroll deductions |

| Termination age | Coverage generally terminates upon retirement or when an employee reaches age 75 |

| Reduction | Benefits may be reduced starting from age 65 |

| Waiting period | 3 months for new employees |

What does Canada Life’s small business benefits for employees cover?

Canada Life offers a comprehensive coverage package that includes essential life and disability insurance options, healthcare benefits, and support for dental and vision care. The coverage amount of basic life insurance goes up to up to $1.25 million. The coverage amount of Accidental Death and Dismemberment (AD&D) insurance goes up to a maximum of $500,000. With additional options for spouse and child coverage, businesses can tailor their benefits to meet employee needs effectively.

Sample plan design for Canada Life’s group benefits solutions

| Option 1 | Option 2 | Option 3 | |

| Benefit aount | 100% of annual salary to a

maximum of $1,250,000 |

200% of annual salary to

a maximum of $1,250,000 |

300% of annual salary to a

maximum of $1,250,000 |

| Termination | Age 65,

You retire or your employment ends, whichever is earlier. |

||

Optional life insurance

| Employee | $10,000 units to a maximum of $500,000 | ||

| Spouse | $10,000 units to a maximum of $500,000 | ||

| Child | Available in $5,000 units to a maximum of $25,000 | ||

| Combined maximum | $1,500,000 | ||

| Termination | Age 65 | ||

Accidental death and dismemberment insurance

| Employee | $10,000 units to a maximum of $500,000 | ||

| Spouse | $10,000 units to a maximum of $500,000 | ||

| Child | Available in $5,000 units to a maximum of $25,000 | ||

| Termination | Age 65 | ||

Short-term disability

| Maximum benefit period | 17 weeks (including waiting period) | ||

| Amount | 100% of your weekly salary for the first week; 75% for the next 15 weeks | ||

| Termination | Age 65 | ||

| Waiting period | Injury: 7 calendar days

Disease: 7 calendar days |

||

Long-term disability

| Option 1 | Option 2 | |

| Waiting period | 17 weeks | 17 weeks |

| Monthly amount | -50% of the first $2,500 of monthly

salary. -42% of the next $3,500. -35% of the remainder to a maximum benefit of $25,000 |

-62% of the first $2,250 of monthly salary

-54% of the next $3,000 -40% of the remainder to a maximum benefit of $25,000 |

| All source maximum | 80% of your pre-disability take-home pay | 85% of your pre-disability take-home pay,

whichever is less |

Extended healthcare

| Coverage type | Option 1 | Option 2 | Option 3 | Option 4 |

| Vision care | Not covered | $200/24 months | $75-$200/24 months | $75-$250/24 months |

| Prescription drugs | Not covered | 70% until $6,000 out-of-pocket, then 100% | 80% until $4,000 out-of-pocket, then 100% | 95% until $1,000 out-of-pocket, then 100% |

| Hospital | Not covered | Semi-private room | Semi-private room | Semi-private room |

| Home nursing care | Not covered | $10,000/year | $20,000/year | $25,000/year |

| Paramedical expenses | Not covered | $600/year | $1,000/year | $1,500/year |

| Out-of-country emergency | $5,000,000 lifetime | $5,000,000 lifetime | $5,000,000 lifetime | $5,000,000 lifetime |

| Out-of-country non-emergency | Not covered | Not covered | $50,000 lifetime | $50,000 lifetime |

Dental care – Endodontic and periodontal, oral surgery except denture-related stents and others.

| Coverage | Option 1 | Option 2 | Option 3 | Option 4 |

| Basic coverage | Not covered | 60% | 80% | 100% |

| Major coverage | Not covered | Not covered | 50% | 50% |

How does Canada Life’s Freedom at Work program benefit small businesses?

Canada Life’s Freedom at Work program helps small businesses by offering affordable benefits and savings plans tailored to their size and budget. These plans, which typically cost 1-5% of payroll, allow businesses to attract and retain talent.

Options include health benefits like prescription drugs, dental care, and disability coverage, along with savings options such as Registered Retirement Savings Plan (RRSPs) and Tax-Free Savings Account (TFSA). The program is flexible, providing solutions for companies with up to 75 employees, and even offers packages for self-employed individuals.

What Retirement and Savings plan offered by Canada Life for small businesses?

Canada Life offers two key retirement and savings plans for small businesses: a Registered Retirement Savings Plan (RRSP) and a Deferred Profit Sharing Plan (DPSP). The RRSP encourages employees to save for retirement, while the DPSP allows employers to share profits with employees. Both plans can be supplemented with an optional Tax-Free Savings Account (TFSA).

Canada Life manages the administrative tasks, helping small businesses stay compliant while providing their employees professional investment management options. The plans are designed to be easy to operate, with low fees, compliance support, and online tools for employers and employees.

What are Canada Life’s Consult+ virtual healthcare services?

Consult+ enables plan members to connect with healthcare professionals through a secure mobile app or website, available 24/7 in English and French. Members can access these services via mycanadalifeatwork.com. This service is available to plan members and their dependents, provided they have health coverage through their Canada Life benefits plan.

Key features

Members can use Consult+ for various services, including:

- Consultations: Speak with healthcare professionals about non-urgent conditions that do not require a physical exam, such as common infections or minor injuries

- Prescriptions: Obtain prescriptions or refills for most medications, which are sent electronically to the member’s pharmacy (delivery charges may apply)

- Referrals: Receive referrals for lab work when medically indicated

- Mental health support: Access self-led therapy for mild to moderate depression and anxiety, as well as find specialists like psychologists, dietitians, and work and life coaches

- Account history: View account history, including chats, prescriptions, referrals, and care plans

Access to healthcare professionals

Through a partnership with Dialogue, Consult+ offers virtual access to a qualified medical team, including:

- Doctors

- Nurses (nurse clinicians, practitioners, etc.)

- Care coordinators

- Psychologists

- Dietitians

- Work and life coaches

Privacy and confidentiality: All information shared through Consult+ is kept private, accessible only to the participating healthcare professionals, similar to visiting a family doctor.

Self-led therapy: Internet-based cognitive behavioral therapy (CBT), is available for individuals with mild to moderate symptoms of depression and anxiety. After completing a health questionnaire, members receive suggestions for modules they can complete at their own pace, providing a convenient and timely way to access support.

Additional services: Members have the option to add an Employee Assistance Program (EAP) and mental health services (MHS) to their plan for an additional cost. Dependents aged 14 and older can also register for their own Consult+ accounts.

What we like about Canada Life’s employee benefits for small businesses plan?

Canada Life’s offers a wide range of personalized services and digital tools that enhance employee well-being. Their plans focus on comprehensive health care, financial security, and fraud prevention while integrating virtual services and financial programs for a well-rounded benefits package. Let’s look at what we truly liked about their group health plan for small business:

How long does Canada Life take to process claims?

Canada Life typically processes health and dental claims within seven calendar days after receiving all required information. For simpler claims, particularly those from providers already in their system, payments can often be issued within 24 to 48 hours. However, processing times may vary depending on the complexity of the claim and potential backlogs, which could result in longer wait times in some instances

How to get the best employee benefits rates from Canada Life?

To get the best employee rates from Canada Life, it is best to speak to one of our licensed insurance advisors who can help you navigate the options available and build a plan that fits your budget and meets the unique needs of your employees.

Frequently Asked Questions

What happens to my benefits if I leave my job?

When an employee leaves their job, their group benefits typically end immediately. However, Canada Life offers options to extend coverage through individual plans or conversion options. This allows former employees to maintain some insurance without needing medical underwriting, helping them retain coverage during the transition.

How can small businesses customize their benefits packages with Canada Life?

Small businesses can customize their benefits packages with Canada Life by selecting from base and specialty benefits, bundling plans for potential discounts, and incorporating savings options like RRSPs, TFSAs, and DPSPs. These flexible options help businesses tailor coverage to their specific needs while also managing costs.

What specific mental health resources are included in the Freedom at Work program?

Canada Life’s Freedom at Work program includes a range of mental health resources designed to support employee well-being. These resources feature access to face-to-face counseling, virtual cognitive behavioral therapy (CBT), and stress and health coaching. The program also offers digital tools such as the Workplace Strategies for Mental Health platform, providing workshops, team activities, and assessments. These tools are accessible at no cost to employees and employers, helping businesses create a healthier and more supportive workplace

Can part-time or contract workers be included in Canada Life’s Employee Benefits?

Yes, Canada Life’s group life insurance plan can include part-time employees, zero-hour contract workers, fixed-term contract employees, and temporary staff. However, eligibility for coverage depends on the specific policy terms and how the plan is designed for each business.

Canada Life’s Freedom at Work program offers small businesses an affordable way to attract and retain top talent, with benefits costing just 1-5% of payroll. This comprehensive plan includes essential health coverages, retirement savings options, and access to Consult+ virtual healthcare services, ensuring a healthier, more productive workforce.

1-888-601-9980

1-888-601-9980