- Employee benefits for small businesses in Canada typically range from $80 to $350 per employee per month, depending on the type of coverage offered

- Basic plans generally cost $80 to $200 per employee, while enhanced plans can go up to $250 and comprehensive coverage can reach $350 or more

- Offering health benefits can lead to improved employee satisfaction, with 79% of employees prioritizing healthcare insurance over other compensation

- Small businesses can manage employee benefits costs effectively through strategies like leveraging virtual healthcare and optimizing benefit structures based on employee needs

- For a small business with 15 employees, total monthly costs for benefits can range from $1,200 to $5,250, while for 30 employees, the costs can range from $2,400 to $10,500. For 45-50 employees, total costs can range from $3,600 to $17,500 per month

Offering employee benefits is one of the smartest ways for small businesses in Canada to attract and retain top talent. In fact, according to CHLIA, 68% of all health insurance purchases in Canada come through group insurance plans.

On average, small business employee benefits can cost between $80 and $200 per employee for basic coverage, $100 to $250 for enhanced plans, and up to $350 for comprehensive options.

Several factors may influence the cost of employee benefits in Canada, including company size, employee age, industry type, and claims history. In this blog, we will highlight how small businesses can still find cost-effective group plans tailored to their budget and employee needs.

What are employee benefits for small businesses?

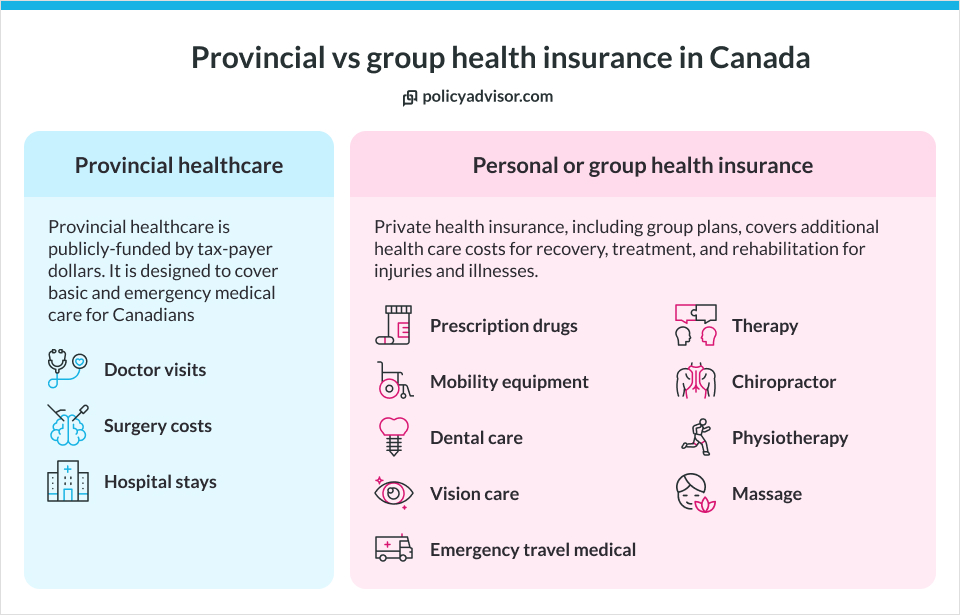

Employee benefits are non-wage benefits or compensations given to employees in addition to their regular salaries. For small businesses in Canada, these benefits typically include health insurance, dental care, life insurance, disability coverage, and other perks like mental health support and retirement plans.

Here are common employee benefits small businesses provide:

- Group health insurance: Provides coverage for medical expenses, including hospital visits, surgeries, and prescription medications

- Dental and vision coverage: Covers cleanings, fillings, eye exams, and prescription eyewear

- Mental health coverage: Offers access to mental health services, including counseling and therapy, promoting overall emotional well-being

- Life and disability insurance: Offers financial protection in case of death, critical illness, or long-term disability

- Employee Assistance Programs (EAPs): Provide access to counselling, addiction support, and stress management resources

- Retirement savings plans: Includes Group RRSPs, DPSPs, or pension plans with optional employer contributions

- Wellness perks: Can feature gym memberships, mental wellness apps, paid mental health days, or remote work options

What is the cost of a small business employee benefits package?

Employee benefits packages for small businesses typically cost between $80 and $350 per employee per month. However, the costs can greatly vary depending on the number of employees, the type of coverage offered, employee demographics, and other factors.

For small businesses with up to 50 members, the total cost of a group plan per month ranges between $1,185 and $6,412 per month, depending on the number of employees.

Total monthly cost of group insurance for small businesses

| Employee count | Basic plan | Standard plan | Enhanced plan |

| 15 employees | $1,185/mo | $1,380/mo | $2,025/mo |

| 30 employees | $2,370/mo | $2,760/mo | $4,050/mo |

| 45-50 employees | $3,752.5/mo | $4,370/mo | $6,412.5/mo |

*Illustrative costs for different plan tiers. Actual cost will vary based on plan design, company details, and employee demographics.

What is the average cost breakdown for different types of employee benefits?

In a small business employee benefits plan, various coverage options can significantly impact costs. For instance, life insurance typically ranges from $62.50 to $125 per employee per month, while health and dental coverage can cost between $300 and $400.

Estimated monthly costs for key group health benefits

| Benefits | Estimated monthly cost per employee | General coverage limit |

| Health and dental coverage | $300 – $400 | Up to $100,000 in medical expenses |

| Life insurance | $62.50 – $125 | $100,000 |

| Disability insurance | $62.50 – $125 | 40-70% of employee’s salary |

| Extended health benefits | $258 | $25,000 – $50,000 annually |

| Vision care | $19.50 | $200 – $400 every two years |

| Prescription drug coverage | $83.33 | $5,000 – $10,000 annually |

| Mental health and wellness coverage | $50 | $1,000 – $5,000 annually |

Should small businesses offer employee benefits?

Yes, offering employee benefits can significantly improve employee satisfaction and retention. In a competitive job market, employees often prioritize employers who provide comprehensive health and wellness benefits over those who do not.

According to a survey by Benefits Canada, 79% of employees would prefer employee benefits over an appraisal, and the most preferred benefit is healthcare insurance.

What will my small business employee benefits package look like?

When it comes to providing employee benefits for small businesses, offering benefits such as health insurance, which provides extended coverage for medical expenses, and dental insurance, covering 80% of basic dental care, can positively impact your workforce’s health.

Additionally, options like vision care, which includes an annual eye exam and $200 towards eyewear, and disability insurance, offering 60% of salary after 30 days of disability, are crucial for financial security.

Below is a breakdown of the key benefits and their corresponding coverage details, showcasing the value of investing in group insurance for your employees:

Small business employee benefits plan coverage details

| Benefits | Coverage details |

| Health insurance | Extended health coverage |

| Dental insurance | 80% coverage for basic dental care |

| Vision care | Annual eye exam + $200 towards eyewear |

| Disability insurance | 60% of salary after 30 days of disability |

| Life insurance | $50,000 coverage |

| Critical illness insurance | Lump sum payment upon diagnosis |

| Health Spending Account | $500 annually for health-related expenses |

| Emergency medical travel | Coverage for medical emergencies abroad |

*Illustrative coverage details for a sample small business employee benefits plan. Actual coverage details will vary.

How much does the cost of an employee benefits plan vary based on the industry?

In Canada, the cost of employee benefits can vary significantly across different industries, with estimates ranging from $7,500 to $25,000 per employee annually.

How much do group benefits cost employers?

The average annual premium for group insurance typically varies based on the size of the business. For smaller businesses, the cost usually ranges from 15% of payroll, reflecting their more limited risk pools and potentially higher per-employee costs.

In contrast, larger companies may see premiums as high as 30% of payroll, due to their larger risk pools and more extensive benefits offerings.

However, there are cost-effective options available for small businesses, where group insurance plans can be customized to fit tighter budgets, costing as little as 1% to 5% of payroll. This flexibility allows small employers to provide valuable benefits without overwhelming their financial resources.

How much does health insurance cost for a small business per employee in Canada?

On average, the cost of employee benefits in Canada can range between $80-$200 per month per employee for a very basic plan, $100-$250 per employee for a standard plan, and $150-$350 for an enhanced pla. These are indicative costs only and they will change based on the coverage a small business chooses and the plan details.

Depicting the cost for basic, standard, and enhanced group health plans

| Benefits | Basic plan | Standard plan | Enhanced plan |

| Health coverage | |||

| Employees – Single | $50/month | $70/month | $92/month |

| Employees – Couple | $98/month | $130/month | $180/month |

| Employees – Family | $110/month | $170/month | $195/month |

| Dental coverage | |||

| Employees – Single | $30/month | $60/month | $81/month |

| Employees – Couple | $100/month | $128/month | $140/month |

| Employees – Family | $170/month | $200/month | $250/month |

| Pooled benefits | |||

| Life insurance & AD&D | $12/month ($25,000) | $18/month ($50,000) | $26/month ($75,000) |

| Critical illness | Not selected | Not selected | Not selected |

| Long-term disability | Not selected | Not selected | Not selected |

| Total monthly premium | $3,000/month | $4,100/month | $5,500/month |

| Cost per employee | $150/month | $205/month | $275/month |

*This table provides an indicative cost for a small business that has 20 employees.

Do employers pay for benefits in Canada?

Yes, employers in Canada typically bear the responsibility for funding group health benefits. This can be structured in different ways, including paying for the full cost of the benefits themselves or establishing a cost-sharing arrangement with employees.

By providing these benefits, employers can enhance their recruitment and retention efforts, making their compensation packages more attractive.

Do employees ever pay for group health benefits in Canada?

Absolutely. While employers often cover a substantial portion of group health benefits, employees may also contribute to the costs. A common cost-sharing model is an 80/20 split, where the employer covers 80% of the plan costs, leaving employees responsible for the remaining 20%.

Which are the cheapest group benefits plans available for small businesses?

Group health benefits plans can start as low as $79 per employee, depending on the level of coverage and the specific options selected. These lower-cost plans may include basic coverage, such as essential health and dental services, but they can be customized to include additional benefits as needed.

Small businesses can explore various options to find a plan that meets their budget while still providing valuable protection for their employees.

How much do group employee benefits cost per paycheck in Ontario?

In Ontario, group employee benefits typically cost between 10% to 25% of an employee’s annual salary, depending on the plan type and coverage level. For an employee earning $54,630 annually, the total yearly benefits cost would range from $5,463 to $13,658. This breaks down to about $454 to $1,138 per month, or roughly $227 to $569 per bi-weekly paycheck.

Several factors, such as plan design, number of insured employees, and industry type, influence the actual cost. Comprehensive health and dental insurance, disability coverage, and retirement savings plans can drive up premiums. However, basic coverage plans offer more affordable options.

What factors affect employee benefit costs for small businesses?

Factors like employee demographics, type of coverage, claims history, location of business and its industry affect the cost of employee benefits for small businesses.

- Business size and workforce demographics: The number of employees and their ages, health conditions, and family size influence benefit costs, as larger or older workforces typically result in higher premiums

- Type and extent of coverage: Offering more comprehensive benefits, such as dental, vision, disability, or prescription drug coverage, increases costs compared to basic health plans

- Location and industry: Regional healthcare costs and the industry in which the business operates can impact benefit expenses. Some regions or industries may face higher premiums due to risk factors or local healthcare costs

- Claims history: A company’s history of claims affects its premiums, as frequent or high-value claims may lead to increased costs in subsequent years

- Plan design and contributions: The way a plan is structured, including deductible amounts, co-pays, and employer-employee contribution splits, plays a key role in determining the overall cost of benefits

How can small businesses lower the costs of employee health benefits?

Managing employee health benefits can be challenging for small businesses in Canada, however, by reducing prescription drug costs, and by incorporating government programs, small businesses can offer competitive benefits while keeping expenses under control.

Here are a few things small businesses can do to manage the costs of employee benefits:

- Cap prescription drug costs: Implementing caps on drug coverage or exploring hybrid spending accounts to manage rising prescription drug costs

- Incorporate virtual healthcare: Virtual consultations are cost-effective, improving access to care and reducing overall healthcare expenses

- Leverage government programs & tax credits: Take advantage of tax credits and government initiatives that support small businesses in offering employee health benefits

- Invest in preventive care: Wellness programs reduce long-term healthcare costs by promoting healthier lifestyles and preventing chronic diseases

- Pooled benefits: Small businesses can pool their employee benefits plans with other businesses, allowing them to share risks and lower premium costs. This collective approach allows small businesses to offer comprehensive health benefits while sharing the cost burden with other companies

Are employee benefits tax-deductible in Canada?

Yes, group benefits provided by an employer are generally tax-deductible in Canada. Employers can deduct the cost of providing group benefits, such as health and dental insurance, from their business income when calculating their taxable income.

It’s important for employers to consult with a tax professional or review the CRA guidelines to ensure they are complying with the specific rules and requirements for deducting group benefits.

How to get the cheapest group benefits insurance quotes in Canada?

Finding affordable group benefits insurance for your small business doesn’t have to be complicated. With PolicyAdvisor, you can secure comprehensive employee coverage at competitive rates, starting as low as $80 per employee per month.

At PolicyAdvisor, we make the process quick and hassle-free. You can rely on us to:

- Compare quotes from 30+ leading Canadian insurers in one place

- Get personalized group benefits quotes in under 60 seconds

- Tailor your plan to meet the specific needs of your employees and budget

- Speak with licensed advisors for expert guidance on the best coverage

- Rely on after-sales support, including claims assistance and plan updates

Whether you’re a startup or an established small business, PolicyAdvisor helps you find the best group insurance plan at the lowest possible rate. Schedule a call with us today to get the best employee insurance quotes!

Frequently Asked Questions

Which employee benefit do employees value the most?

Health and dental insurance is often considered the most valued benefit among employees.

Which are the best small business employee benefits insurance companies?

Top providers include Manulife, Sun Life Financial, and Canada Life, recognized for their comprehensive offerings and competitive pricing.

How do employee demographics impact the cost of group benefits?

Employee demographics significantly affect group benefit costs; younger employees generally incur lower healthcare costs compared to older employees, which influences premiums.

What is the average cost per employee for benefits in Canada?

On average, employee benefits can cost between 15% and 30% of payroll, including both mandatory and supplemental benefits.

How can small businesses balance benefit costs with employee satisfaction?

Small businesses can balance benefit costs with employee satisfaction by offering flexible options that allow employees to choose benefits that suit their needs, promoting wellness programs to reduce long-term healthcare costs, and encouraging cost-sharing through copayments or deductibles. Focusing on key benefits like health and dental and regularly communicating the value of the benefits package can enhance employee appreciation and satisfaction.

What are the typical costs for a basic health and dental plan for small businesses?

Basic health and dental plans generally range from $80 to $200 per employee per month, depending on the coverage options selected.

The cost of for small business employee benefits in Canada typically ranges from $80 to $350 per employee per month, depending on the plan design. Factors influencing these costs include the number of employees, their demographics, industry type, and claims history. The most common benefits included in these packages are health insurance, dental care, vision care, life insurance, and disability coverage.

Canadian Life and Health Insurance Association. Fact Book 2023. Toronto: CLHIA, 2023