- Group size, employee demographics, plan usage, occupation type, and plan selection impact group health insurance costs in Canada

- Employers can choose to cover the entire premium, split costs with employees, or divide expenses for different group health benefit packages

- Group health benefit plans can also be offered based on seniority with different coverage levels for various employee groups

- Companies can apply for group health insurance by researching carriers, connecting with their advisors, providing company and employee information, answering carrier questions, reviewing and selecting plans, and enrolling employees

If employees are the backbone of an organization, their health obviously becomes paramount. After all, only physically and mentally healthy employees can optimally perform their tasks and duties. So naturally, a group health insurance plan becomes a crucial employee benefit. But, how much does a group health insurance plan cost?

We’ve explained the factors that can influence group health insurance costs, how costs are split (or not), and if the premiums can be lower. All of this and more, are in this blog. Read on or click below to speak to one our experts to learn more!

What factors influence group health insurance costs?

Group health insurance costs in Canada are largely impacted by these five factors:

- Group size and health

- Employee’s age and gender

- Claim history

- Occupation type

- Plan selection

- Group composition

- Coverage levels

- Use of the group plan

Group size and health: The size of an employee pool influences premiums, with larger groups often enjoying lower costs, meaning group health benefits for small businesses come with higher premiums compared to larger companies. However, pre-existing conditions within the group can make these expenses vary. For example, a company with 200 employees might pay lower premiums per employee compared to a small business with only 20 employees.

Employees’ age and gender: Group health insurance premiums often take into account the age and gender distribution of employees. For instance, the premium for employees over the age of 50 will be higher as compared to the younger employees because aged employees have a higher risk of illness compared to young employees.

Claim history: If an organization has a higher number of group health insurance claims in the past, their premium will be higher upon plan renewal. This is because a higher number of claims increases the risk an insurer takes when offering a group health plan.

Occupation type: Office-based occupations generally incur lower premiums because the risk of falling sick or of an accident is far lower than in hazardous sectors like construction.

Plan selection: Depending on how comprehensive the plan is and the benefits it offers significantly impact the cost of group health insurance. For example, if a plan offers a Health Spending Account (HSA), this might raise premiums compared to a basic plan that covers only essential medical expenses.

Group composition: Employers may offer tiered benefit plans that provide different levels of coverage based on seniority or job level. Executives or senior management may have access to premium plans with enhanced benefits, while junior staff members may be enrolled in standard plans with basic coverage.

Coverage levels: Group insurance rates are influenced by the coverage levels chosen, including co-pays, deductibles, maximum coverage limits, and the volume of insured individuals. Plans with lower co-pays and deductibles or higher coverage limits typically result in higher premiums.

Use of the group plan: The claims experience, or how frequently and extensively the plan is used by members, also affects costs. Higher utilization rates and frequent claims can drive up the overall cost of the group health plan.

Average group health insurance costs and premiums in 2025

The estimated average costs and premiums for group health insurance in Canada for 2025 vary depending on the size of the business. Based on current trends and available data, the average costs are:

- Small Businesses (1-50 employees): $250 – $350 per employee per month.

- Medium Businesses (51-200 employees): $200 – $300 per employee per month.

- Large Businesses (201+ employees): $150 – $250 per employee per month.

How much does group health insurance cost?

Group plans are often offered in different packages that are priced differently with some that cover more benefits than others. Most insurers categorize group health insurance plans in three ways: basic, advanced, and premium.

To help you understand how much you’ll pay, we’ve created a table with the average cost of group health insurance per person per year in an organization for a plan with different benefits:

| Feature | Basic Plan | Advanced Plan | Premium Plan |

| Prescription Drug Coverage | 70% of lowest-cost-alternative up to $1,000 formulary & non-formulary drugs vaccines/immunizations | 80% of lowest-cost-alternative up to $3,000 formulary & non-formulary drugs vaccines/immunizations | 100% of lowest-cost-alternative up to $6,000 formulary & non-formulary drugs vaccines/immunizations |

| Health Practitioners | $250 combined | $350 combined | $400 per specialist per year |

| Counseling Services | $250 | $350 | $400 |

| Eye Exams, Glasses, Contact Lenses & Surgery | $60 per 2 years (eye exams only) | $150 per 2 years | $300 per 2 years |

| Assistance Program | Unlimited short-term services | Unlimited short-term services | Unlimited short-term services |

| Travel Coverage | 90 days, unlimited number of trips, $5 million total coverage | 90 days, unlimited number of trips, $5 million total coverage | 90 days, unlimited number of trips, $5 million total coverage |

| Survivor Benefit | 12 months | 12 months | 12 months |

| Diabetic Supplies & Equipment | $300 | $300 | $500 |

| Oxygen Equipment | $500 | $500 | $500 |

| Custom-Made Foot Orthotics | 1 pair every 5 years for adults 1 pair every year for children under 16 years of age | 1 pair every 5 years for adults 1 pair every year for children under 16 years of age | 1 pair every 5 years for adults 1 pair every year for children under 16 years of age |

| Ostomy Supplies | $300 | $300 | $300 |

| Ambulance | $1,500 | Unlimited | Unlimited |

| Air Ambulance | Unlimited | Unlimited | Unlimited |

| Casts & Crutches | Unlimited | Unlimited | Unlimited |

| Preferred Hospital Rooms | Unlimited | Unlimited | Unlimited |

| Private Duty Nursing | $2,500 | $2,500 | $5,000 |

| Accidental Injury to Natural Teeth | $2,000 per injury | $2,000 per injury | $2,000 per injury |

| Wheelchairs, Motorized Scooters & Hospital Beds | $500 per policy per 5 years | $500 per policy per 5 years | $500 per policy per 5 years |

| Artificial Limbs, Eyes, & Larynx | $10,000 lifetime | $10,000 lifetime | $10,000 lifetime |

| Patient Walkers | $200 per policy per 3 years | $200 per policy per 3 years | $200 per policy per 3 years |

| Breast Prosthesis | 1 if lateral / 2 if bilateral per 2 years | 1 if lateral / 2 if bilateral per 2 years | 1 if lateral / 2 if bilateral per 2 years |

| Health Supplies & Equipment | $500 combined | $500 combined | $500 combined |

| Out-of-Province Referral (within Canada) | Not included | $50,000 lifetime | $50,000 lifetime |

| Hearing Aids | Not included | $500 per 5 years | $500 per 3 years |

| Therapeutic Shoes | Not included | $200 | $200 |

| Blood Pressure Monitor | Not included | Not included | 1 per policy per 5 years |

How to manage and reduce group health insurance costs?

You can attempt to reduce your group plan costs by considering the following:

- Evaluate and customize plans: Regularly reviewing and tailoring health plans to fit the group’s specific needs can prevent overpaying for unnecessary coverage

- Promote preventive care: Encouraging preventive care measures, such as regular check-ups and screenings, can reduce the incidence of serious health issues and lower long-term costs

- Virtual healthcare: Offering virtual healthcare options can decrease costs by reducing the need for in-person visits and providing convenient access to medical advice

- Cost-sharing models: Implementing cost-sharing models, where employees contribute to the cost of their care through co-pays and deductibles, can help manage overall expenses

- Health and wellness programs: Introducing comprehensive health and wellness programs can improve overall employee health, leading to fewer claims and lower healthcare costs

- Wellness incentives: Providing incentives for healthy behaviors, such as gym memberships or wellness challenges, can encourage a healthier workforce and reduce healthcare spending

Who pays for a group health plan?

Different organizations have different rules when it comes to paying group health insurance premiums. Generally, there are three ways in which the premiums for group health insurance are paid. These are:

- Employer-sponsored plans: The employer pays the entire cost of the group health benefits plan and the employee is not expected to contribute

- Cost sharing with employees: An employer and their employees split the premium costs at a predefined rate. Commonly used splits are 50 percent each or 70 percent by the employer and 30 percent by the employee. These arrangements can differ depending on the specific plan and the agreements between the employer and their employees

- Employee add-on costs: If employees want to add dependents or get an advanced plan with additional benefits, they have the option to pay the extra premium

How does one choose between these cost-sharing options?

The choice truly lies with the employer! Depending on organizational budgets, goals, and employee requirements, employers can choose to pay for or split the cost of group health insurance premiums.

Let’s understand this with an example: A startup may opt for a cost-sharing arrangement, with the employer covering 70% of the premiums to make it more affordable, while still providing valuable benefits to employees. Alternatively, a larger corporation may choose to pay for a comprehensive group health insurance plan without any contribution from the employees.

Types of group health insurance plans

The cost of a group health plan varies depending on the type of package an employer purchases with options such as basic, advanced, premium offering different levels of coverage. Each package offers different coverage and depending on who is covered, the premiums can vary. For small businesses, a benefits plan can cost about 5-15 percent of the total payroll on an annual basis.

In the following table, we’ve included representative average premium costs for a group health insurance plan based on who is covered, the plan type, and coverage options:

| Coverage type | Benefits offered | Premium |

| Basic |

|

|

| Advanced |

|

|

| Premium |

|

|

Key considerations for choosing group insurance plans

Employers should look at supporting their employees’ health and wellness by offering a comprehensive group health benefits plan that includes:

- Benefits covering pharmacy, healthcare, and dental care needs

- Short and long-term disability coverage

- Critical illness benefits

- Employee and family assistance programs to aid stress management

- Resources on identifying and managing prevalent mental health concerns

Alongside diverse benefits, employers must also compare:

- Premiums: The monthly/annual payment for employees’ initial expenses for health insurance coverage

- Deductibles: Annual amounts employees must pay before insurance coverage starts, in addition to premiums unless the employer wishes to pay

- Copayments: Fixed charges employees incur for doctor visits and prescriptions

- Coinsurance: Amounts employees are obligated to pay after meeting deductibles and other conditions

How can I enroll in group health benefits?

Once hired, you need to enroll in the group health insurance plan within a deadline. If this deadline is missed, you might have to wait until the annual enrollment window is open. Typically, a new employee who joins after the enrollment period is over has to wait for a period of 30-90 days before they can get group health benefits. This period is designed to ensure a degree of commitment from the employee to the employer before benefit enrollment.

Some group health insurance plans offer supplemental benefits like dental and vision care. During the enrollment process, you can choose any additional benefits you might want and add your family members and/or dependents.

How can an employer apply for group insurance?

Applying for group health insurance in Canada is a straightforward process, typically initiated by the employer on behalf of their employees. Here’s a step-by-step guide:

- Research carriers: Start by researching insurance carriers in Canada that offer group health insurance plans. Some well-known carriers that offer group plans include Sun Life, Manulife, Canada Life, Equitable Life, Bluecross, GMS, Wawanesa, and several others. Each carrier may offer different plans and options, so it’s essential to compare their offerings to find the best fit for your organization.

- Connect with our advisors: Reach out to our advisors at PolicyAdvisor and inquire about our group health insurance plans. Our insurance experts will provide you with information about the plans we offer, including coverage options, premiums, and any additional benefits. They will also make it easy to review and compare plans across the market helping you find the best plans for your coverage needs.

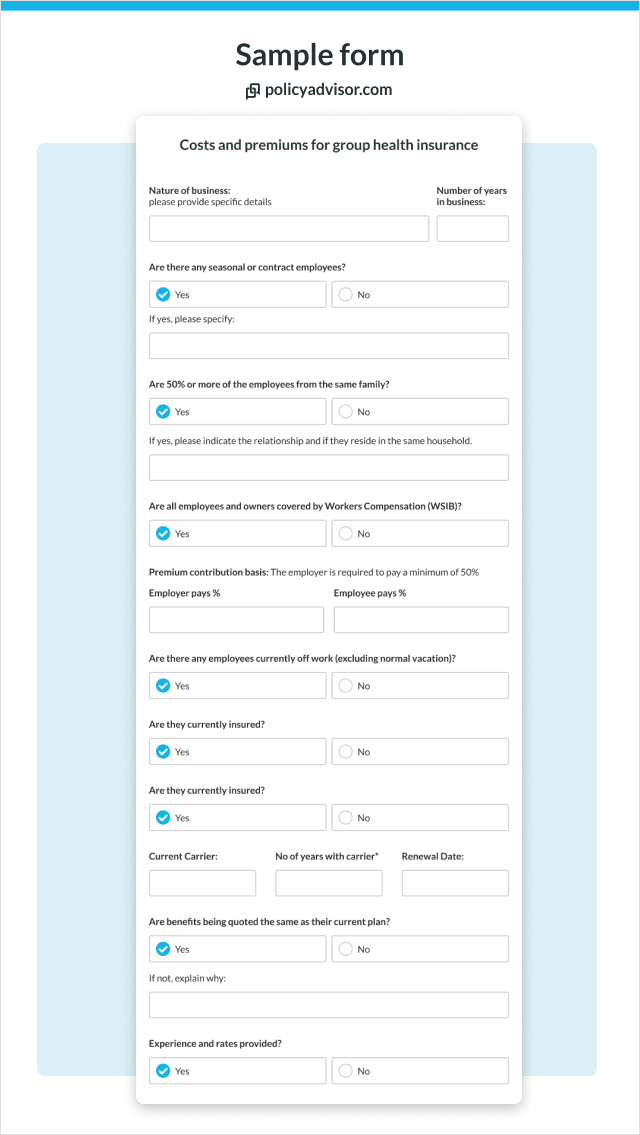

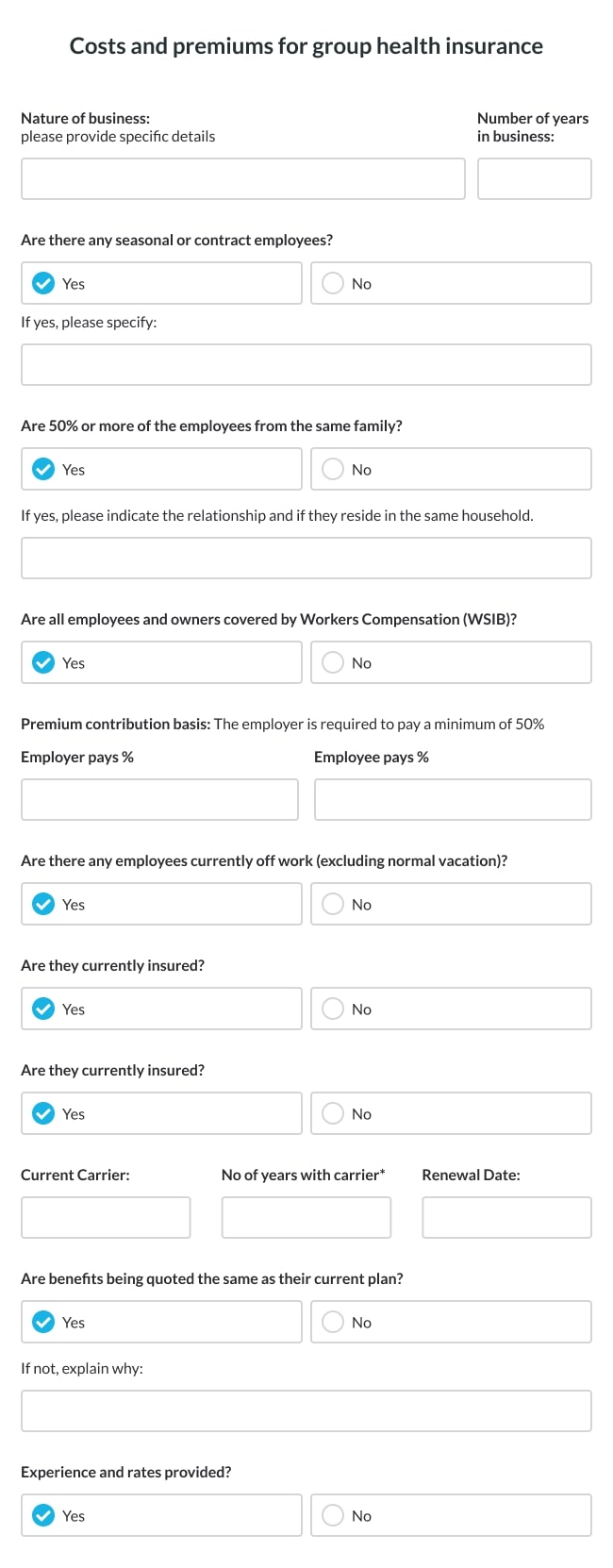

- Provide information through a form: During the application process, the insurance carrier will likely ask for details about your company, such as the number of employees, industry type, and business structure. They may also request information about the desired coverage levels and any additional benefits you wish to include in the plan.

- Review and select: Once you’ve provided all the necessary information, the insurance companies will review the information and provide quotes for the proposed plans. You can then review the proposed group health insurance plans from each carrier. Consider factors such as coverage, premiums, network of healthcare providers, and additional benefits before making a decision.

- Enrollment: After selecting a plan, the next step is to enroll your employees in the group health insurance program. The carrier will assist with the enrollment process, including providing enrollment forms and instructions for your employees to complete.

Know more about the best health insurance companies in Canada

How to buy an affordable group health insurance plan? Trust our experts to help you find it!

At PolicyAdvisor, we have a team of licensed insurance experts who will help you buy the best group health insurance plans and provide you with information about the coverage options, premiums, and any additional benefits that you’d like to offer your employees. Schedule a call with our experts today!

Frequently asked questions

Who is eligible for a group health policy in Canada?

Typically, organizations mandate that the employees must be Canadian residents, or be temporarily assigned outside their country of residence. Additionally, their Government Pension Plan and Government Health Insurance must be in force.

What is the average cost of premiums per employee in Canada?

On average, group insurance plans typically cost between $1,500 and $4,000 annually per employee.

How much does group health insurance cost for small businesses?

The average expense for a small business is approximately $1,822 per employee per year.

Understanding and calculating the costs of group health insurance plans in Canada can be daunting, with various factors influencing premiums. In this article, we shed light on the key determinants affecting pricing, such as group size, claims history, and plan selection. Moreover, we provide insights into applying for group insurance and offer expert advice on finding affordable plans tailored to your organization’s needs.