- A group life insurance policy pays out a tax-free lump sum amount to an employee’s beneficiaries upon the employee’s death, mitigating the financial impact on families who lose an earning member

- The key features of a group life insurance policy are: Non-Evidence Maximum (NEM), maximum benefit, premiums, waiver of premium, coverage amount, eligibility, portability, and tax implications

- All eligible employees are typically covered without any medical underwriting, with lower premiums for younger employees and higher costs for those over 50

- Group life benefits are not portable and the coverage ends with the termination of employment

An employee benefits package is incomplete without group life insurance. After all, nearly 2 in 5 Canadians rely solely on their employer for life insurance coverage. Offering life insurance coverage as part of employee benefits can influence a potential job seeker’s decision when they choose to work with an organization.

So, what is group life insurance, how does it work, and what can it be used for? Let’s find out.

What is group life insurance?

A group life insurance is a contract or an agreement that promises to pay an employee’s dependents a tax-free lump sum amount in the event of their demise. It is offered by an employer to a “group” of people—the employees. A group life insurance policy helps soften the financial impact that comes with losing an earning member of a family.

While individual life insurance policies are owned by one person, a group life policy is owned by the employer. Think of it as an umbrella that one person is holding but is protecting several people from the pouring rain.

Most group life benefits are offered as term life insurance that is renewed annually by the insurance provider. Unlike whole life insurance which covers an individual for their entire lifespan, term life policies provide coverage for a certain “term” or fixed period of time.

Know more about employee benefits in Canada

How does group life insurance work?

Group life insurance gives a tax-free lump sum payment to an employee’s family or beneficiaries upon their death. In most cases, employers pay the premium for group life benefits or split the cost with their employees.

Some insurance providers also let employees buy additional coverage for their dependents. In this case, the payout happens when the dependent passes away. It is typically a flat amount like $5,000 for a child or $10,000 for a spouse and is often used to cover funeral expenses.

Benefits of providing group life insurance to employees

There are several benefits to providing group life insurance to employees, including:

- Increased employee retention: Employee benefits like life insurance encourage employees to stay with the company long-term, as they would lose this coverage if they left

- Increased employee satisfaction: Offering financial security for employees’ families shows a commitment to their well-being, boosting morale and overall job satisfaction

- Reduced business risks: Group coverage protects companies from large, unexpected expenses by replacing potential lump-sum payments to bereaved families with manageable monthly premiums. This helps maintain financial stability while ensuring employees’ families receive proper support

Group vs individual life insurance

Group life benefits offered to the employees of an organization are less expensive than an individual life insurance policy. Apart from the pricing, there are several other differences between group and individual life insurance policies. Some of these are:

- Flexibility: Group life insurance policies are usually a standard plan for all the employees of an organization. They do not take into consideration the unique financial requirements of every single employee. Individual plans on the other hand, offer flexibility to an individual who can choose the coverage option based on their economic and personal circumstances.

- Underwriting: Most group life insurance policies do not require any underwriting and the plan is offered to all employees regardless of their age, gender, economic background, etc. Individual health policies require medical underwriting which can often be a tedious process, especially for those with pre-existing medical conditions.

- Coverage: Since individual life insurance plans are customized for an individual’s needs, they offer ideal coverage for the insured, as opposed to group life insurance plans that are standard for all employees.

Read more about individual life insurance

Group term life insurance

Group life insurance plans are usually offered as term insurance that covers the employees of an organization for a set period of time. It is a type of temporary life insurance which needs to be renewed, typically on a yearly basis. Group term life insurance policies pay a tax-free lump sum amount to the insured’s beneficiaries in the event of their demise.

Insurers usually give employees the option to purchase additional cover for their families. If an employee were to leave their employer, they often have the option to convert the group term life plan into an individual policy. The cost for this however, will go up.

Individual term life insurance

Similar to a group term life policy, individual term life plans pay a lump sum benefit to an individual’s beneficiaries if they die within the term policy. Individual term life plans can be for 10, 15, 20, 25, 30 years up to the age of 65.

Some life insurance companies in Canada (such as RBC Life Insurance or Industrial Alliance Life Insurance) allow you to pick your own term (6, 8, 11 years, etc.).

What can group or individual term life insurance payouts be used for?

With term insurance, an individual or employee (depending on the type of policy), can choose to match time-bound debts or liabilities. This could include financial obligations like:

- Mortgage

- Any outstanding debt

- Coverage for children’s education

- Living expenses for loved ones so they maintain the same standard of living

Group whole life insurance

Group whole life insurance provides coverage for an employee’s entire life. It is a type of permanent life insurance that has higher premiums and death benefits. Group whole life insurance is often offered at no cost to the employees. In cases where the cost is split or the employee chooses to add dependents or an advanced plan, the premium is deducted from their paycheck.

Most group whole life insurance plans are offered to employees after they have completed a probationary period or any other defined duration before they get coverage. Like with any other insurance policy, group whole life requires employees to designate at least one beneficiary. Employees have the option to change beneficiaries if they want to.

Unlike individual whole life insurance, group whole life benefits do not have a cash value component.

Individual whole life insurance

Individual whole life insurance provides coverage from the day an individual purchases a policy till their demise. It is a permanent life insurance policy that doesn’t expire as long as the premiums are paid on time.

Most whole life policies come with a cash value component. Part of the premium that an individual pays is invested and generates a tax-deferred cash value that grows over time. It can then be accessed in many ways such as:

- Withdrawing the cash value

- Borrowing the cash value

- Using it as loan collateral

- Cancelling the policy and cashing out the value

Key features of group life insurance

Group life benefits vary from one organization to another and all the decisions are made by the policy owner—the employer. Some of the key features of a group life insurance plan are:

- Benefits schedule

- Non-Evidence Maximum (NEM)

- Maximum benefit

- Premium

- Waiver of premium

- Coverage amount

- Eligibility

- Portability

- Tax benefits

- Benefit reduction and termination

Benefits schedule

A benefits schedule outlines the coverage an employee gets under a group life policy. This is usually based on the employee’s salary or a flat amount. Most insurers use two methods to calculate a group life insurance benefits schedule—earnings based schedule and flat benefit schedule.

- Earnings-based schedule: The coverage amount is based on the employees’ salary and may include commissions and bonuses. If the schedule is 2x of salary, an employee earning $100,000 will have coverage of $200,000

- Flat benefit schedule: This is a category or class-based coverage where members of a class have the same level of coverage, typically ranging from $25,000 to $500,000. Different categories of group members will get different benefits. For example, a senior vice president could get a benefit schedule of 2x their salary while a junior employee could get a flat benefit of $50,000

Non-Evidence Maximum (NEM)

Non-Evidence Maximum is the minimum coverage for which all eligible employees are enrolled without having to provide proof of insurability. An employee’s medical history and health condition is usually considered as proof of insurability.

NEM gives employees a minimum level of coverage through their group life insurance plan. It is particularly important for those group members who might not qualify for individual life insurance due to health issues.

The NEM amount can vary based on the size of the group and the perceived risk associated with it. Larger groups and those considered to be low risk may have higher NEMs that provide greater coverage without any underwriting.

Maximum benefit

The maximum benefit is the highest amount of coverage that employees can get under a group life insurance plan. This upper limit is pre-defined in the policy document and it does not depend on the type of benefits schedule.

Maximum benefit applies uniformly to all group members. It adds a certain degree of fairness and consistency to a group life insurance plan by ensuring that no individual exceeds the maximum coverage.

The maximum benefit varies based on three factors:

- Insurance provider’s guidelines

- Employer’s plan design or structure

- Regulatory guidelines

It is typically set to balance the need for adequate coverage with the insurer’s risk exposure.

Premium

Group term life insurance policies are generally less expensive for younger employees. The premium rates increase with an individual’s age. The policy document that an insurer provides will typically include details of the bands at which the cost of the premium will increase.

Employers can choose to offer group life insurance benefits at no cost. If employees wish to buy additional coverage or add their dependents, they may have to pay more.

Waiver of premium

With group life benefits there may be an option to waiver the premium for employees who become permanently or totally disabled while they are insured. Employees need to be under the care of a doctor and should be disabled for a period of at least six months to get group life benefits without a premium.

Waiver of group life insurance premium is usually available to employees under the age of 65.

Coverage amount

The coverage amount in a group life insurance policy can be different for people at various levels of the organizational hierarchy. So a senior executive or manager will typically have a higher coverage amount as compared to a junior member of the organization.

Eligibility

All employees are typically enrolled in a group life insurance plan provided they meet certain eligibility criteria that can include:

- The number of hours they work per week

- The duration of their employment

A group plan does not require the employees to go through any underwriting—the risk-assessment process that insurers use for individual policies. All eligible employees, regardless of their age, gender, health, etc. are covered.

Portability

As we previously mentioned, group life benefits are owned by the employer. This means that the coverage an employee gets will end with their employment. If an employee resigns or their employment is terminated by the employer, they will lose their group life insurance coverage.

There are some insurers who give employees the option to convert their group life benefits into a whole or permanent life insurance policy. However, the premium for these can be high and they will also require underwriting and medical evaluation and evidence.

Tax implications

The premiums for group life benefits that are paid by the employer are taxable to the employee. An employee will have to pay taxes on the value of the premium because it is seen as additional income.

However, the premiums that an employee pays are not a taxable benefit. Since the employee is using their own money to pay for the premium, they don’t have to pay any tax on that amount.

Benefit reduction and termination

When an employee reaches the age of 65, their group life benefits will be reduced. So, if an employee had $100,000 coverage, it will be reduced to about 50% to $50,000 once they reach the age of 65. Some insurers also reduce the coverage to a predefined flat rate that varies from one plan to another.

The reduced coverage typically continues till an employee reaches the age of 70 or retires, whichever comes first.

Common exclusions in group life insurance policies

Most group life insurance providers will not pay death benefits when death is caused by:

- Intentional self-harm, regardless of mental state or capacity to understand the consequences

- Viral or bacterial infections, except for pyogenic infections caused by injury

- Any form of illness or mental or physical infirmity

- Medical or surgical treatment, except for surgical reattachment procedures

- War, insurrection, or voluntary participation in riots

- Service in the armed forces of any country

- Aviation incidents: Death during air travel when:

- Serving as a crew member

- Flying in employer-owned or leased aircraft

- Flying in aircraft with flight restrictions

- Flying with an uncertified pilot

What can group life insurance be used for?

The tax-free payout from group life benefits can be used by the beneficiaries to:

- Cover everyday expenses (groceries, bills, rent, etc.)

- Pay off existing debt (mortgage, loans, credit card bills, etc.)

- Fund their children’s education

- Pay for funeral arrangements

- Make a donation to a charity in the deceased’s name

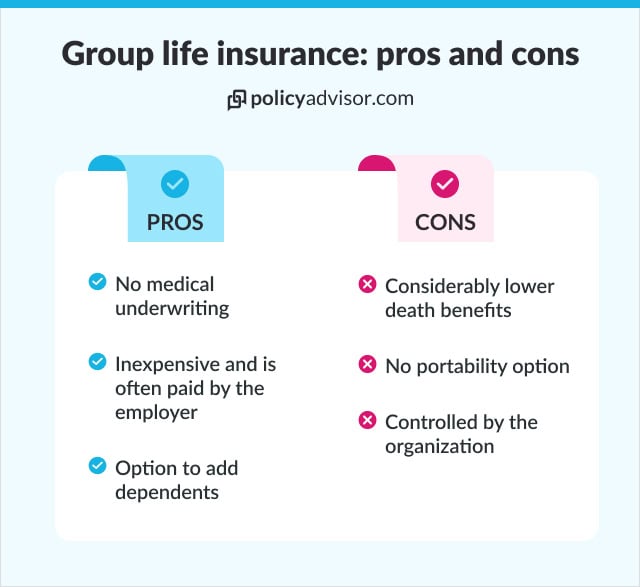

Pros and cons of group life insurance

While group life insurance policies are an important part of an employee benefits package, they do come with their own set of pros and cons.

Group life insurance pros for employers

- Affordable coverage for employees and their families: Offering group life insurance is a cost-effective way for employers to provide financial protection for their employees and their families

- Recruitment and retention tool: Group life insurance can be a valuable benefit that attracts and retains top talent, demonstrating a commitment to employee well-being

- Tax advantages: Employers receive tax benefits for offering group life insurance and can write these off as business expenses

Group life insurance cons for employers

- Limited customization: Group life insurance plans may not meet all employees’ needs, potentially leading to dissatisfaction among some staff

- Cost management: While generally affordable, the cost of providing group life insurance can increase with the size of the workforce or as the demographics of the employee population change

Group life insurance pros for employees

- Affordable coverage: Employees typically receive life insurance coverage at little or no cost, offering financial protection without a significant financial burden

- Peace of mind: Having life insurance through work provides employees with a sense of security, knowing their families will have financial support in case of an unexpected event

- Convenience: Enrollment in a group plan is often automatic or requires minimal effort, making it an easy way for employees to obtain life insurance coverage

Group life insurance cons for employees

- Limited coverage: Group life insurance may not provide enough coverage for individual needs, requiring employees to seek additional policies

- Coverage linked to employment: If an employee leaves the company, their coverage may be reduced or terminated, leaving them without life insurance at a critical time

- Lack of customization: Employees may find that the one-size-fits-all approach of group life insurance doesn’t align with their personal financial goals or family needs

Adding supplemental life insurance to your group policy

Adding supplemental life insurance to your group policy can provide the additional coverage needed to ensure comprehensive financial security. Basic group life insurance might not always meet all your personal or family protection needs.

By opting for supplemental coverage, you can tailor your policy to better align with your specific circumstances, offering enhanced peace of mind for you and your loved ones.

Supplemental life insurance is particularly beneficial for employees who need higher coverage limits due to significant financial responsibilities or dependents relying on their income.

It’s also ideal for those who wish to extend coverage to family members, such as a spouse or children, providing the flexibility to meet specific needs and ensuring that your loved ones are well-protected in unforeseen circumstances.

Group life insurance and switching jobs

Understanding how your group life insurance policy behaves when you switch jobs is crucial for maintaining continuous coverage. Here’s what you need to know:

- Portability of coverage: One of the advantages of group life insurance is that it may be portable, allowing you to continue your coverage even if you change jobs. This means you won’t have to undergo a new underwriting process or face potential gaps in coverage

- Premium payments after leaving: If you decide to continue your supplemental life insurance after leaving your employer, you may be responsible for paying the full premium. This transition ensures that you can maintain your coverage without interruption, though you’ll need to handle the payments directly

- Coverage termination: Typically, your group life insurance coverage will end when your employment with the company is terminated or if the policy is canceled. It’s important to review your policy’s specifics and plan for alternative coverage options if you’re considering a job change

Frequently asked questions

Are dependents covered under group life insurance policies?

Employees have the option to add their dependents to a group life plan. This typically requires employees to pay an additional premium out of their own pocket.

Is group life insurance enough?

While group life plans are an excellent employee benefit their premiums are inexpensive and the death benefit is also lower. Generally, the death benefit is paid as a fixed amount that can be between $20,000-$50,000 or it can be based on an employee’s salary (1x or 2x their annual compensation). This amount might not always be enough for the beneficiaries.

Is group life insurance taxable in Canada?

Group life insurance premiums that are paid by an employer are a taxable benefit for the employee. Additional premiums for dependents that are paid by the employees are not a taxable benefit for them.

Who is the beneficiary of group life insurance?

Employees can add their family members as beneficiaries to a group life policy. The tax-free lump sum benefit will go to these predefined beneficiaries as per the policy document.

Does group life insurance pay for suicidal death?

Different insurers can have different clauses when it comes to suicidal death. Some insurers may cover these from the day the policy comes into effect. Others might have a waiting period of a few months or a year before suicidal death is covered.

Note: If you, or someone you know, need help, please reach out to the Canadian Association of Suicide Prevention on 9-8-8.

Group life insurance is offered by an employer to their employees. It is an agreement that promises to pay an employee’s beneficiaries a tax-free lump sum amount in the event of their demise. It helps soften the financial impact that comes with losing an earning member of a family.