- Group insurance plans for small businesses offer comprehensive benefits to the employees of an organization

- Small businesses in Canada are increasingly recognizing the importance of group benefits which help with cost savings and tax advantages

- Pooled insurance plans are a collaborative strategy that allow multiple small businesses to come together and provide coverage to their employees

- The cost of a group insurance plan for a small business will depend on employee demographics, claims history, and plan details

- It's not mandatory to provide health and dental benefits to your employees, but it's an important part of maintaining a healthy workforce

- Group health insurance for small businesses

- Why do small businesses need group health insurance?

- Factors to consider when choosing a small business benefits package

- How much does a small business employee benefits package cost?

- Which are the best companies for small business health insurance in Canada?

- Pooled insurance plans for small businesses in Canada

- How to choose the best company benefits package for your small business?

- Common mistakes in selecting group health insurance plans

- How is a small business benefits package set up?

- Participation requirements for group health insurance plans for small businesses

- What will insurers ask on a company benefits package application?

- Are group benefits tax deductible?

- Compliance and regulations

- Frequently asked questions

When you run a small business, your tiny (but mighty) team means everything. They deserve to be compensated for their hard work—and we mean more than just their salary. Health insurance for small businesses is a great way to attract and retain workers for the long term.

In fact, according to Canada Benefits survey, 79% of employees prefer employee benefits over an increase in pay and the most preferred benefit is healthcare insurance.

These employee benefits or group benefits make employees feel protected against all odds, enhancing job satisfaction. They also promote substantial work-life balance and help employees develop a sense of loyalty towards their company.

Our blog gives insights into what a company health package covers and how to get the best deal for group health insurance for small businesses.

Understanding group insurance for small businesses

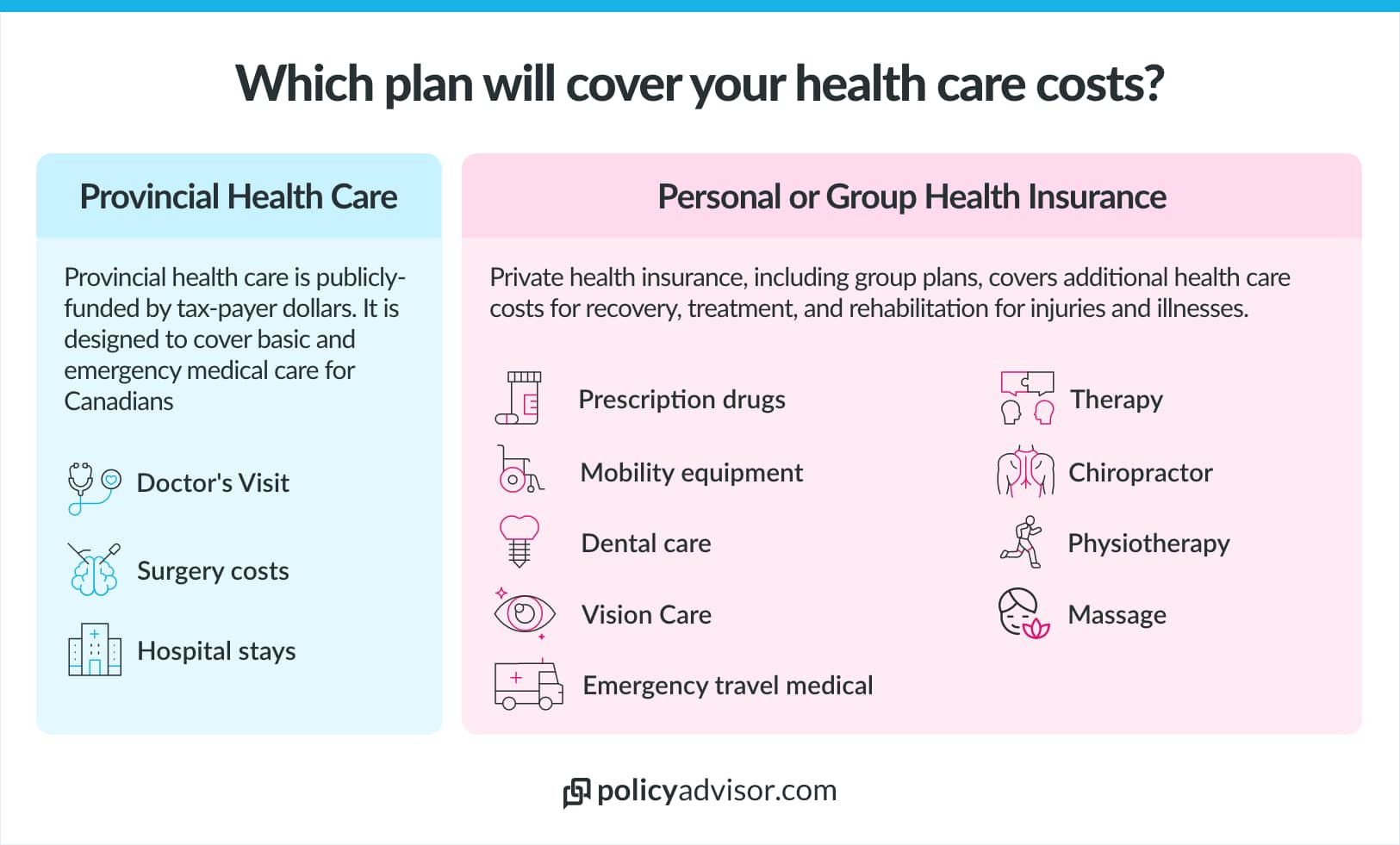

Group health insurance plans for small businesses offer comprehensive benefits to the employees of an organization. A group benefits package typically includes:

- Health and dental care: Supplementing provincial healthcare by covering services such as elective surgeries, medical equipment, physiotherapy, care home and nurses, and more

- Vision care: Provides access to eye exams, glasses, and contact lenses

- Disability benefits: Salary replacement if an employee become disabled and cannot work for a short or long period of time

- Critical illness insurance: A lump sum payment when an employee is diagnosed with a critical illness

- Life insurance: A lump sum payment to an employee’s beneficiaries, if they pass away from natural or accidental death

- Accidental death and dismemberment benefits (AD&D): Financial assistance if an employee has an accidental death, are dismembered or lose your sight. This would be in addition to a life insurance payment

- Health Spending Account (HSA): A set amount per year that employees can spend on any item or service that improves their health

- Emergency medical travel: Coverage if employees have a medical emergency while travelling

Learn more about the types of group health insurance for small businesses in Canada

Group employee benefits can cover a variety of insurance products, depending on the benefits package the business owner chooses.

| Coverage Category | Covered Services & Items |

|---|---|

| Healthcare | Private hospital coverage, medical expenses and equipment, some elective surgeries, care homes and nurses |

| Vision care coverage | Eye exams, glasses, contacts |

| Dental coverage | Teeth cleanings, x-rays, cavity fillings, orthodontics (braces) |

| Prescription drugs | Cost for medication prescribed by a medical practitioner |

| Health spending account | A set amount per year that employees can spend on any item or service that improves their health |

| Health access | Some providers have online access to doctors and health service providers when you sign up for their group insurance plans |

| Emergency travel medical | Coverage if you have a medical emergency while traveling, trip cancellation/interruption |

| Critical illness | A lump sum payment when you are diagnosed with a critical illness |

| Life insurance | A lump sum payment if you pass away from natural or accidental death |

| Short & long-term disability insurance | Salary replacement if you become disabled and cannot work for a short or long period of time |

| Accidental death and dismemberment (AD&D) insurance | Financial assistance if you have an accidental death, are dismembered or lose your sight. This would be in addition to a life insurance payment |

Why do small businesses need group health insurance?

Small businesses in Canada are increasingly recognizing the importance of group benefits. Some of the key reasons why small businesses need to offer group benefits to their employees are:

- Cost savings: Group health insurance pools risk among a group of people, leading to lower premiums. This makes it easier for small businesses to offer comprehensive coverage to their employees in a cost-effective manner

- Comprehensive coverage: Get a wide range of coverage benefits, including hospitalization costs, preventive care, chronic disease management, and mental health support

- Guaranteed coverage: Small business health insurance plans cover employees with pre-existing conditions with no underwriting

- Tax advantages: Premiums paid for employee benefits packages are tax-deductible for businesses. This means that the cost of offering group benefits can be offset against the business’s taxable income

- Employee retention: Job seekers are increasingly prioritizing group benefits when considering employment opportunities. Offering comprehensive group benefits ensures higher rates of employee retention

- Wellness resources: Provides easy access to additional resources such as wellness programs and health management tools

- MetLife

Factors to consider when choosing a small business benefits package

While choosing a company benefits package, there are a few things that small businesses must take into consideration. These are:

- The company size and demographics

- Budget

- Coverage options

- Customization options

- Ease of administration

1. Company size and employee demographics

Company size can play a crucial role in choosing the right group health insurance plan. Small to mid-sized companies have fewer employees than large organizations with thousands of employees worldwide. It is important to understand your employees’ needs and craft personalized plans that suit them.

2. Budget and cost considerations

An in-depth budget consideration is a must before making a group health insurance purchase. Conducting thorough research before choosing an insurance plan may help you get a reasonable premium quote. It will also help you avoid the added burden of scaling your revenue just to keep up with the costs.

3. Coverage options

While purchasing a medical insurance plan for your employees, it’s important to consider the types of benefits that you might want to add. Some companies provide only health and dental benefits. Others may provide additional coverage such as vision care, pre-existing disease coverage, disability rider, and more.

4. Flexibility and customization

Every individual may have a unique set of medical problems or complications. Offering customization options may also help your employees choose the benefits that they want, curated to their diverse needs.

Additionally, small businesses may customize their group health insurance plans based on their business parameters and employee demographics. Providing flexibility helps cater to a diverse range of medical requirements with ease.

5. Ease of administration

Businesses look for insurance plans that provide complete support, guidance, and additional tools to streamline record maintenance, premium deposit, payout, and more. This ensures smooth plan management from start to finish.

6. Digital access

Consider the availability of digital tools when selecting an insurance package, including dedicated apps that streamline employee onboarding, enrollment, and claims submission. At PolicyAdvisor, we work with leading insurers like Blue Cross, Sun Life, Manulife, and Desjardins, all of which offer comprehensive digital solutions that simplify policy management for small businesses.

How much does a small business employee benefits package cost in Canada?

The cost of an employee benefits package for a small business will depend on employee demographics, claims history, and plan details. Typical costs vary between:

- $80-$200/month/employee for a very basic plan

- $100-$250/month/employee for a more enhanced plan

- $150-$350/month/employee for comprehensive coverage

These are indicative costs only and they will change based on the coverage a small business chooses and the plan details.

In general, the larger the employee base, the cheaper the cost per employee. For a small business, the price will be more contingent on industry type and claims history.

Read more about costs and premiums for small business group health insurance in Canada.

Sample cost for small business employee benefits

| Coverage | Basic Plan | Standard Plan | Enhanced Plan |

| Health | |||

| Employees – single | $50/month | $70/month | $92/month |

| Employees – couple | $98/month | $130/month | $180/month |

| Employees – family | $110/month | $170/month | $195/month |

| Dental | |||

| Employees – single | $30/month | $60/month | $81/month |

| Employees – couple | $100/month | $128/month | $140/month |

| Employees – family | $170/month | $200/month | $250/month |

| Pooled Benefits | |||

| Life insurance & AD&D ($25,000/$50,000/$75,000) | $12/month | $18/month | $26/month |

| Critical illness | Not selected | Not selected | Not selected |

| Long-term disability | Not selected | Not selected | Not selected |

| Total monthly premium for 20 employees | $3,000/month | $4,100/month | $5,500/month |

| Cost per employee | $150/month | $205/month | $275/month |

*Illustrative pricing for a small business with 20 employees. Actual costs will vary.

What does a small business benefits package look like?

A typical company benefits plan will include the coverage details, plan details, and costs. The following table illustrates what a group benefits plan looks like:

| Coverage | Plan 1 | Plan 2 | Plan 3 |

| Health | |||

| Drug maximum | $3,000/person | $5,000/person | $10,000/person |

| Drug coinsurance | 80% | 80% | 80% |

| Paramedical services | $300/practitioner | $300/practitioner | $500/practitioner |

| Vision care | NA | $150/person for 24 months | $200/person for 24 months |

| Dental | |||

| Basic dental maximum | $700/practitioner | $1,000/practitioner | $1,500/practitioner |

| Basic dental coinsurance | 80% | 80% | 80% |

| Recall exam | 1 every 9 months | 1 every 6 months | 1 every 180 months |

| Pooled benefits | |||

| Life insurance | Optional | Optional | Optional |

| Accidental Death & Dismemberment (AD&D) | Optional | Optional | Optional |

| Disability benefits | Optional | Optional | Optional |

| Other benefits | |||

| Health Spending Account (HSA) | $100/year | $500/year | $1,000/year |

| Allowance account | As requested | As requested | As requested |

| Travel insurance | Yes | Yes | Yes |

*Representative illustration of what a small business health insurance plan looks like. Actual costs will vary.

Which are the best companies for small business health insurance in Canada?

There are several group insurance providers out there with a wide range of plans to fit your business’s needs. At PolicyAdvisor, we work with 30 of Canada’s top insurance companies to get you the best rates on the benefits plans you need for your business.

| Company | PolicyAdvisor rating | What sets them apart |

| Sun Life | 4.5/5 |

|

| Canada Life | 4.5/5 |

|

| Manulife | 4.5/5 |

|

| Desjardins | 4.5/5 |

|

| Green Shield Canada | 4.5/5 |

|

| Blue Cross | 5/5 |

|

| Equitable Life of Canada | 4.5/5 |

|

| Benefits by Design (BBD) | 4.5/5 |

|

| Empire Life | 4.5/5 |

|

While some companies offer different benefits and different prices, ultimately the best insurance company is the one that works best for your business needs. Like all insurance products, pricing and coverage will be specific to your unique business needs.

Pooled insurance plans for small businesses in Canada

Pooled insurance plans are a collaborative strategy that allow multiple small businesses to come together and provide coverage to their employees. Offering pooled group benefits in Canada helps reduce costs and administrative efforts for small businesses in Canada.

Advantages of pooled group benefits for small businesses

- Lower premiums: Combining multiple small businesses, the premiums for group benefits are reduced when compared to individual health plans

- Access to comprehensive coverage: Individual small businesses may not always be able to offer comprehensive coverage such as dental, vision, disability, etc. Joining a larger pool increases the range of group benefits that a small business can offer to its employees

- Reduced administrative efforts: Pooled group benefits plans are managed by the insurer. This reduces the administrative burden of a group plan on the small business, allowing it to focus on their core operations

- Customization options: Many pooled insurance plans offer some kind of customizations. This allows businesses to offer tailored coverage to their employees

How to choose the best company benefit package for your small business?

When choosing a company benefit package for your business in Canada, ask yourself the following questions:

- What kind of plan is the most suitable for my business?

Depending on your budget, decide if you want to pay for all the coverage or split the cost with your employees. You should also think about whether you want to offer group health benefits to your part-time employees or only to full-time staff.

- What kind of coverage do my employees need?

Analyze your employees’ needs and find a plan that truly works for them. For instance, if you operate in a high-risk industry such as construction, you might want to consider a plan with comprehensive disability or accident coverage.

- How much do I want to spend on group health benefits?

Assess your employees’ needs and finalize a budget that works for your organization. Compare plans and choose the one that best suits you.

Common mistakes in selecting group health insurance plans

When buying group health insurance as a small business in Canada, avoid these four mistakes:

- Not reviewing your options (at renewal/ purchase): Don’t renew or buy a group health insurance plan without comparing enough providers. Consult a licensed insurance advisor to identify what works well for your company and your workforce. You may also want to explore customized options that align better with your business’s evolving needs

- Not understanding policy terms and conditions: Review your plan’s coverage limits, exclusions, waiting periods, and claims processes to avoid any dissatisfaction among employees or unforeseen expenses

- Ignoring employee needs: Consider factors like employee age, family status, and health profiles. Survey employees about their healthcare priorities and review past claims data to ensure the selected plan addresses actual needs rather than assumed ones

- Overlooking cost-sharing structures: Consider how premium costs will be shared between the employer and employees, and how this may affect both your budget and employee satisfaction

How is a small business benefits package set up?

A small business benefits package is set up in the following way:

- Sign up documents and group set up: Your sign up documents are shared by your advisor and need to be completed and signed. Once done, your group coverage is set up which can take up to two weeks

- Employee enrolment: Employees will get an activation email with instructions on how to enroll

- Billing: Once your employees are enrolled, you will receive the first billing statement

- Plan activation: Your plan is activated and your employees can start using their benefits

- Administrator access: Once your plan is all set up, you will receive the credentials to the administrator portal and the insurer will walk your designated administrator through the portal

What are the participation requirements for group health insurance plans for small businesses?

The participation requirements for a group benefits for a small business in Canada are:

- Group size: Most insurers need a minimum 2-3 member participation requirement, some may have a 50 people requirement

- Eligibility: Canadian citizens under age 75 covered by their provincial healthcare plan and working full-time

- Participation basis: Mandatory to join the plan

- Family content: Must be a true-employer-employee relationship receiving wages and/or a T4 from the plan sponsor

- Plan level changes: 1 level renewal with 24 months lock-in period

- Termination age: Retirement or age 75

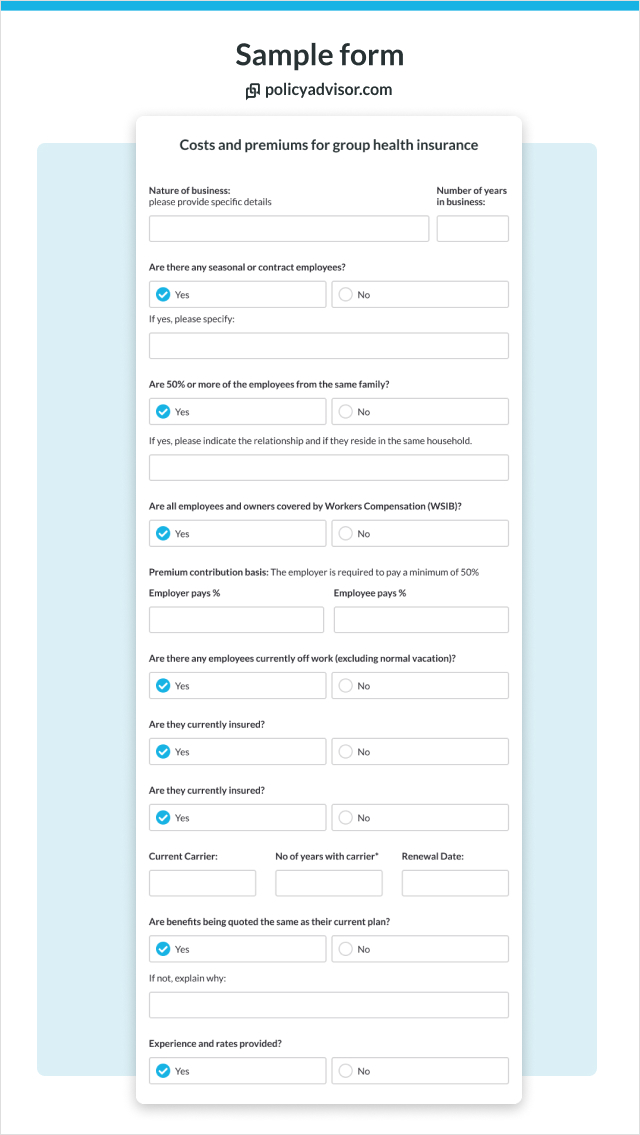

What will insurers ask on a company benefits package application?

Insurers will ask you about your company profile and employee demographics. Some of the questions that they might ask are:

- How many employees do you have?

- What industry is this business?

- Has your company had group insurance before? If so, provide a claims history.

- Is your company associated with a group or union?

- Do you want your benefits to differ by class (i.e. managers get one plan, regular employees get another)

- Are there any employees currently absent or on maternity leave?

- Are all your employees participating in this plan?

- Are your employees covered by worker’s compensation?

- Are any of your employees regularly working outside of Canada?

- About your employees. Tell us about their…

- Job title

- Date of employment

- Salary

- Hours

- Province of residence

- Date of birth

- Sex

- Family status (married, single, common-law)

- Dependents

Are group benefits tax deductible in Canada?

Yes, group benefits provided by an employer are generally tax-deductible in Canada. Employers can deduct the cost of providing group benefits, such as health and dental insurance, from their business income when calculating their taxable income.

It’s important for employers to consult with a tax professional or review the CRA guidelines to ensure they are complying with the specific rules and requirements for deducting group benefits.

Group health insurance regulations in Canada

Health insurance in Canada is strictly regulated and under the constant supervision of certain federal and provincial enforcement bodies. Canadian federal regulations, such as the Canada Health Act and Income Tax Act, govern most health insurance policies.

If you’re a small business owner buying group health insurance for your workforce, you must abide by regulatory guidelines for the greater good of your company and its assets. Using various educational resources and remaining up to date with the latest laws will help you keep up with regulatory changes.

Get quotes for small business benefits package

If you’re looking for an affordable group benefits package for your small business, or business of any size for that matter, our licensed insurance experts at PolicyAdvisor are here to help. We’ll ask some questions about your business (like the ones listed above) and shop around to find you the best rate for health benefit plans for your employees.

Book a call with one of our friendly expert insurance advisors to chat about protecting your personal and financial health today!

Frequently asked questions

Is group insurance for small business mandatory in Canada?

No. Employee benefits, such as health insurance, are not mandatory. However, providing insurance for your employees may provide that competitive edge your business needs to maintain employee retention.

The premium costs may seem like another additional expense to take on, but ultimately having a healthy and consistent employee base will save you money in high turnover costs. Plus, insurance premiums can be claimed as tax-deductible business expenses.

Are there tax benefits associated with group insurance for small businesses?

Yes. The premiums paid for group benefits are tax-deductible for businesses. This means that the cost of offering group benefits can be offset against the business’s taxable income.

What is an HSA?

A Health Spending Account (HSA) is a personal fund designated for employees and their eligible dependents. It covers health and dental expenses not included in provincial health insurance or employer-sponsored group benefit plans for a fixed amount.

The benefits provided through an HSA are fully tax-deductible, offering businesses an opportunity to save money while ensuring the well-being of their employees.

How can small businesses in Canada manage company health insurance plans?

Small businesses can manage group health insurance by working with licensed insurance advisors such as those at PolicyAdvisor. They can utilize online tools for employee enrollment and claims processing that insurers such as Sun Life, Benefits by Design, Equitable Life, etc. offer.

How can small businesses qualify for lower insurance premiums in Canada?

Small businesses can qualify for lower insurance premiums by evaluating their providers for competitive rates, opting for a higher deductible (which reduces premium costs), and regularly reviewing their plan (typically annually) to avoid any redundancies, such as covering employees no longer on their payroll.

Small businesses can also manage their premiums better by offering subsidized gym memberships or preventive care programs, that can lower long-term costs.

What are the consequences of not providing group health insurance for employees in small businesses in Canada?

There are significant consequences for small businesses that don’t provide group health insurance to employees:

- Difficulty in attracting and retaining talent: Nearly half (49%) of small business employees would choose health benefits over a pay raise, while 76% of employees without health benefits would leave their current job for one offering better coverage. These numbers highlight that any business, irrespective of its size, will find it difficult to attract or retain talent without employee benefits

- Lower employee productivity: A lack of health benefits can lead to decreased morale and engagement, as employees may feel undervalued and unsupported

- Increased business risks: Over 160,000 small businesses in Canada (1 in 8) have seen employee resignations due to better health benefits elsewhere. This turnover not only disrupts operations but also incurs significant costs (in recruiting and training new employees), and increases business risks

How often should small businesses review and adjust their group health insurance plans?

Small businesses in Canada should review and adjust their group health insurance plans annually to evaluate changing employee needs, compare market offerings, adapt to workforce demographics, and optimize costs while maintaining valuable benefits.

Employee benefits plans attract and retain workers, promoting work-life balance. These plans usually include health and dental insurance, life insurance, disability insurance, retirement savings, and more. The cost of a small business employee benefits package depends on factors like employee demographics, location, claims history, and plan details. Employers can deduct the cost of providing group benefits from their taxable income.

1-888-601-9980

1-888-601-9980