- Providing employee benefits helps small businesses improve employee satisfaction, retention, and productivity

- Most group health plans have health and dental insurance as the core coverage

- Other coverages for life insurance, disability insurance, Health Spending Accounts, and more, are optional add ons

- Small businesses can choose from basic to enhanced benefit packages, tailoring coverage to fit their unique needs

- Pooled benefits spread risk across multiple businesses, stabilizing premiums and making comprehensive coverage more affordable

Small businesses have access to various employee benefits plans that differ in coverage levels and features. These plans generally include essential health, dental, and vision care, with optional life insurance, accidental death and dismemberment (AD&D) coverage, and health spending accounts (HCSAs).

Are you a small business owner wondering if you should offer employee benefits? With about three-quarters of Canadian small businesses providing group benefits, the answer is a resounding yes.

Does your small business need to offer employee benefits?

Yes, small businesses in Canada must consider providing employee benefits, especially in today’s competitive job market. As per a Pacific Blue Cross report, around 72% of Canadian small businesses offer benefits, acknowledging the valuable returns these plans offer through increased employee satisfaction, retention, and productivity.

What are the most common group benefits offered to small business employees?

Small businesses most commonly offer health, dental, life, and disability insurance to cater to the different needs of their employees. Some employers may also offer Employee Assistance Programs (EAPs), Health Spending Accounts (HSAs), and other wellness benefits.

These benefits are designed to support both the physical and financial well-being of employees, fostering a healthier and more motivated workforce. The most common group benefits include:

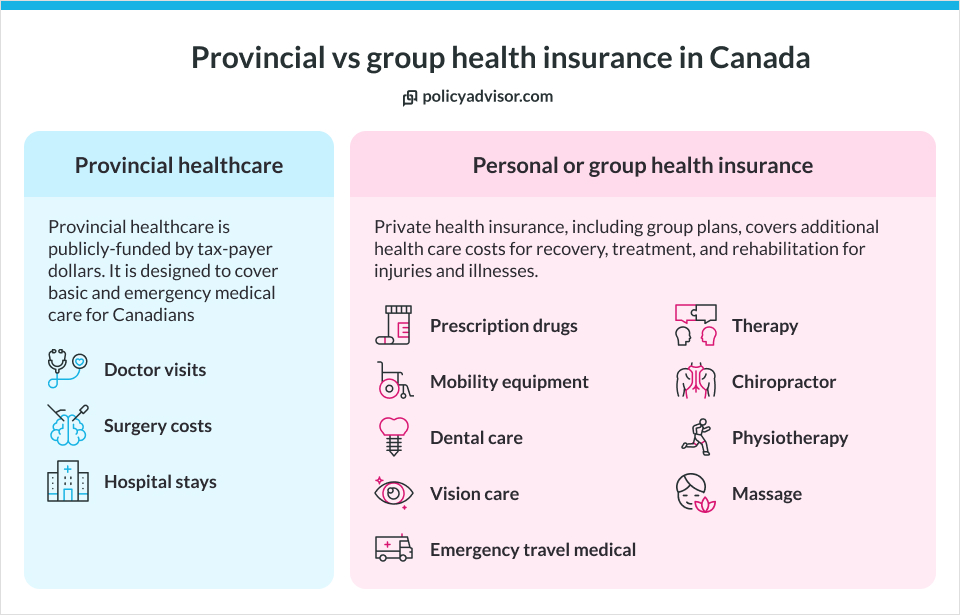

- Health insurance: This extends coverage beyond the provincial healthcare system and typically includes expenses for prescription drugs, vision care, paramedical services like physiotherapy, chiropractic care, and mental health services

- Dental insurance: Dental plans usually cover routine dental services such as cleanings, fillings, and preventive care. More comprehensive plans may also include coverage for orthodontics, major dental work, and surgeries

- Life insurance: In the event of an employee’s death, life insurance provides a financial safety net for their beneficiaries. This payout helps cover funeral costs, and outstanding debts and provides income replacement for the family

- Disability insurance: Disability coverage ensures that employees who are unable to work due to illness or injury receive a portion of their income during recovery

- Employee Assistance Programs (EAPs): EAPs offer confidential counselling and support services for personal, financial, or work-related challenges

- Health Spending Accounts (HSAs): If a business’s budget allows, offering a Health Spending Account can be a flexible way to provide additional healthcare benefits. HSAs give employees a set amount of funds to use for eligible health-related expenses not covered by traditional insurance, such as extended paramedical services or wellness programs

What are the different types of group benefits plans that small businesses can choose from?

Small businesses can choose from different tiers of group benefits that most Canadian insurers offer. Typically known as basic, standard, and enhanced plans, these packages include health, dental, and vision care, along with optional life insurance, Accidental Death and Dismemberment (AD&D) coverage, and Health Spending Accounts (HSAs).

The following table outlines different types of employee benefits packages and their benefits with indicative coverage based on typical coverage options.

Different types of small business employee benefits plans

| Feature | Basic plan | Standard plan | Enhanced plan |

| Prescription drugs | $2,500 – $5,000/year | $10,000 – $25,000/year | $100,000/year – Unlimited |

| Co-insurance (Drugs) | 50% – 70% | 80% | 90% – 100% |

| Paramedical practitioners | $200 – $350/practitioner | $500 – $750/practitioner | $1,000 – $1,500/practitioner |

| Co-insurance (Practitioners) | 50%-70% | 70%-80% | 80%-100% |

| Vision coverage | Nil – $150/2 years | $150 – $200/2 years | $250 – $300/2 years |

| Dental (Basic) | $750 – $1,000 | $1,250 – $1,500 (combined) | $2,500 (combined) |

| Dental (Major) | Nil | Nil – $1,000 (combined) | $1,500 – $2,500 (combined) |

| Co-insurance (Dental) | 50% – 70% | 80% | 80% – 90% |

| Life insurance | Nil | $10,000 – $25,000 | $50,000 – $75,000 |

| Accidental death & dismemberment (AD&D) | Nil | $10,000 – $25,000 | $50,000 – $75,000 |

| Travel insurance | 60-day trips | 60-day trips | 90 to 180-day trips |

| Health Spending Account (HCSA) | $500 | $1,000 – $2,000 | $3,000 – $5,000 |

| Rate guarantee | 16 – 28 months | 16 – 28 months | 28 months |

*Illustrative coverage amounts for 8 employees, and actual numbers can vary depending on the provider, the number of employees, and the specific coverage selected.

What is the cost of a small business employee benefits package?

Employee benefits packages for small businesses typically cost between $80 and $350 per employee per month. However, the costs can greatly vary depending on the number of employees, the type of coverage offered, employee demographics, and other factors.

Total monthly cost of group insurance for small businesses

| Employee count | Basic plan | Standard plan | Enhanced plan |

| 15 employees | $1,185/mo | $1,380/mo | $2,025/mo |

| 30 employees | $2,370/mo | $2,760/mo | $4,050/mo |

| 45-50 employees | $3,752.5/mo | $4,370/mo | $6,412.5/mo |

*Illustrative costs for different plan tiers. Actual cost will vary based on plan design, company details, and employee demographics.

How does a small business’s choice of benefits affect the cost of group insurance premiums?

Factors like employee demographics, type of coverage, claims history, location of business and industry affect the cost of employee benefits for small businesses. Additionally, the benefits an employer chooses also impact the premiums. Let us see how:

- Addition of disability coverage: Disability insurance is one factor that can significantly affect your premiums. Adding short- or long-term disability coverage can increase the overall cost of your benefits package since it ensures employees are covered for lost wages due to injury or illness

- Prescription drug coverage: Higher prescription drug limits and co-insurance percentages will drive up premiums. For example, a plan offering unlimited prescription drug coverage and 100% co-insurance will be considerably more expensive than one with a lower drug limit and a 50% co-insurance rate

- Dental and vision care: Plans offering major dental and high-coverage vision care (such as exams and glasses) typically come with higher costs. If your workforce places a high value on comprehensive dental and vision coverage, investing in an enhanced package may lead to better retention but at a premium

- Health Spending Accounts (HSAs): Offering a health spending account gives employees flexibility to cover additional healthcare costs, but larger HSAs increase the total package cost. Small businesses often opt for a moderate HSA allocation to balance the cost with employee satisfaction

What do small business employee benefits packages look like?

A small business’s employee benefits plan typically includes health, life, dental, AD&D, and travel insurance, along with HSAs, wellness benefits, and other extended health care coverage.

Here’s a sample employee benefits plan for a small business with 10 employees:

| Benefit | Details |

| Health insurance | |

| Prescription drugs | Up to $10,000/year with 80% co-insurance |

| Paramedical practitioners | $500 per practitioner/year with 80% co-insurance |

| Vision coverage | Up to $200 every 2 years |

| Dental coverage | |

| Basic dental | $1,250 per employee (combined) with 80% co-insurance |

| Major dental | Up to $1,500 per employee (combined) with 50% co-insurance |

| Life insurance | $25,000 per employee |

| Accidental Death & Dismemberment (AD&D) | $25,000 per employee |

| Health Spending Account (HCSA) | $1,000 per employee/year |

| Travel insurance | Coverage for up to 60-day trips for business-related travel |

| Employee Assistance Programs (EAPs) | Confidential counseling services |

| Wellness programs | Annual reimbursement of up to $300 per employee for fitness-related expenses |

| Monthly premiums | |

| – Health Insurance | Approximately $500 per employee (total: $5,000/month) |

| – Life Insurance | Approximately $25/month per employee (total: $250/month) |

| – AD&D Insurance | Approximately $10/month per employee (total: $100/month) |

| Total estimated monthly cost | $5,350 |

| Total annual cost | $64,200 |

*Note that these are illustrative costs for 10 employees, and actual numbers can vary depending on the provider, the number of employees, and the specific coverage selected.

How to choose the best group benefits plan for a small business?

When choosing a small business health insurance plan, start by considering what type of coverage fits your business size, budget, and employees’ needs. Whether you want basic health-only coverage or a more comprehensive plan with dental, vision, and wellness benefits, make sure it aligns with what your team values most.

Cost is important, but don’t just focus on premiums—also consider deductibles and out-of-pocket expenses to ensure the plan is affordable for both you and your employees.

How do small business employee benefits packages compare to those of larger companies?

Health benefit plans for small businesses often exhibit distinct differences compared to those provided by larger companies. Small businesses typically offer more standardized plans with limited negotiating power, resulting in higher premiums per capita and a focus on basic coverage options.

In contrast, larger companies benefit from greater customization, enhanced negotiating power, lower premiums through economies of scale, and the ability to provide comprehensive packages that may include wellness programs.

Differences between group plans for small businesses and large corporations

| Feature | Small businesses | Larger companies |

| Plan customization | Typically more standardized due to a smaller employee base | Highly customizable to meet diverse employee needs |

| Negotiating power | Limited negotiating power with insurers | Greater leverage due to larger employee pools |

| Cost structure | Higher premiums per capita due to smaller risk pools | Lower premiums achieved through economies of scale |

| Types of benefits offered | Basic coverage options | Comprehensive packages that often include wellness programs |

How can small businesses get affordable employee benefits packages?

Small businesses seeking affordable employee benefits packages can consider pooled benefits, tiered plans, and HSAs to ensure they provide valuable coverage without straining their budgets. Pooled benefits are effective and allow multiple small businesses to come together to share the costs and risks associated with insurance.

Pooled benefits result in more predictable and often lower premium costs for each business involved in the pool. By sharing the burden of claims, small businesses can enjoy comprehensive coverage at a fraction of the cost they would face individually.

In addition to pooled benefits, small businesses should also:

- Consider Health Spending Accounts (HSAs): These accounts allow employees to manage their health expenses tax-efficiently and can be a cost-effective addition to traditional benefits

- Implement wellness programs: Promoting wellness initiatives can reduce overall healthcare costs by encouraging healthier lifestyles among employees, which may lead to fewer claims

- Offer tiered plans: Providing different levels of benefits allows employees to choose what suits them best, which can help manage costs while still offering valuable options

- Speak to PolicyAdvisor’s licensed advisors: Our experienced advisors help you compare quotes from across 30+ Canadian insurers to find the best small business employee benefits rates for your company

Frequently Asked Questions

How much do group health benefits cost per employee in Canada?

On average, the cost of employee benefits in Canada can range between $80-$200 per month per employee for a very basic plan, $100-$250 per employee for a standard plan, and $150-$350 for an enhanced plan. This includes benefits like health insurance, dental care, and life insurance. The actual cost will depend on various factors, including the size of the workforce, the specific benefits offered, and the overall compensation strategy of the business.

What is the minimum number of employees required to qualify for group benefits?

You need at least two employees to qualify for group health benefits. Some group plans allow flexibility for small businesses to start with a minimal number of employees and gradually expand coverage as the company grows.

Can part-time or contract workers be included in group plans?

Yes, part-time or contract workers can be included in group benefit plans, but it depends on the specific policy and plan design. Employers may choose to extend coverage to these workers, especially if they want to offer competitive benefits to attract and retain diverse talent. However, eligibility requirements, such as minimum working hours, may apply.

What are the tax implications of providing group benefits?

The employer’s share of premiums for health, dental, and vision insurance is generally not considered a taxable benefit for employees. However, life insurance and certain other benefits may be treated as taxable income. Tax treatment can vary by province, so it’s essential to consult with a tax expert to ensure compliance and optimize your tax benefits.

How often can I change or update the benefit plans?

Group benefit plans can be reviewed and updated annually, usually during the renewal period. Changes can include adjusting coverage options, adding new benefits, or modifying employee cost-sharing arrangements. Employers should work closely with their benefits provider to determine the best time for any updates based on business needs and budget.

Approximately 72% of Canadian small businesses recognize the importance of providing group benefits, which can lead to increased employee satisfaction, loyalty, and productivity. This blog outlines the most common types of employee benefits, including health, dental, life, and disability insurance, and explores various group benefits plans available for small businesses. It also highlights ways in which small business owners can make group health insurance more affordable.