- Health insurance premiums in Canada start at $61.32 per month for a 35-year-old single male, $110.38 for a 28-year-old couple, and $175.89 for a family of four

- Individuals with pre-existing conditions face higher premiums or exclusions in coverage

- Health insurance premiums vary by province, with Ontario, Alberta, and British Columbia showing distinct pricing

- Individuals should consider factors like deductibles, co-pays, and coverage limits for services such as dental, vision, and prescription drugs when choosing a plan

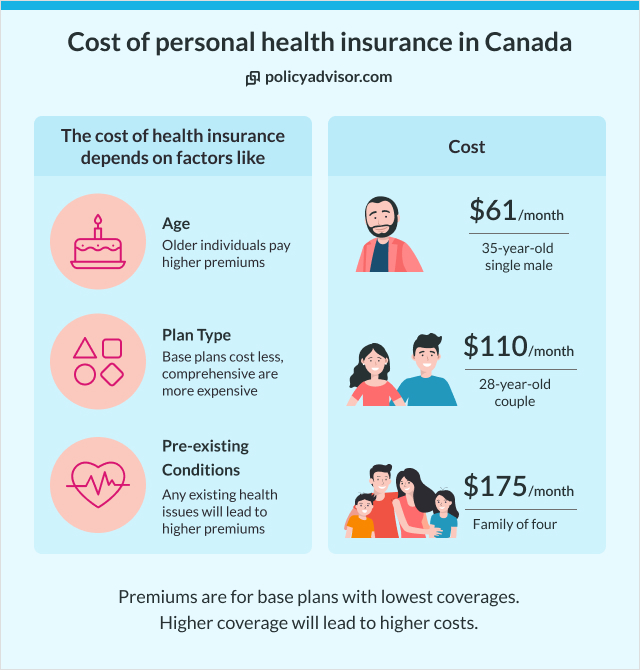

The average cost of personal health insurance in Canada varies based on age, family size, and coverage type. For individuals, premiums start as low as $61.32/month for a 25-year-old (e.g., Sun Life) and can range up to $348.40/month for a 75-year-old (e.g., Manulife).

Families of four pay between $167.24 and $818.30/month and plans with pre-existing conditions typically begin at $99.10/month for a 25-year-old, and can go up to $304.34/month for older individuals aged 75 years.

While Canada’s public healthcare system covers many medical expenses, private health insurance is often necessary for services like dental, vision, and prescription drugs. In this article, we’ll explore what these costs are, what influences them, how these costs vary across provinces, and more.

How much does health insurance cost in Canada?

For health insurance premiums in Canada without pre-existing conditions, a 35-year-old single male can expect to pay approximately $61.32 per month and a 28-year-old couple would see premiums starting at $110.38 per month.

However, for a family of four (comprising a 45-year-old male, 35-year-old female, and two children aged 10 and 5), the monthly premiums would be around $175.89. These premiums vary depending on the individual’s or family’s health insurance needs.

Cost of personal health insurance in Canada

| Age | Premiums (Without stable pre-existing conditions) |

| 35 years, Single male | $61.32 |

| 28 years, Couple | $110.38 |

| Family of four (45y, 35y, 10y, 5y) | $175.89 |

*Starting premiums are for base plans with the lowest coverages. Higher coverage will lead to higher costs.

What factors affect the cost of personal health insurance in Canada?

The cost of personal health insurance in Canada is influenced by several key factors: age, health status, coverage level, location, and the type of plan.

- Age: Younger individuals typically pay lower premiums due to lower health risks, while older adults face higher premiums due to the increased likelihood of medical needs

- Health status: Pre-existing medical conditions can result in higher premiums, or even exclusions from certain coverage, as insurers may consider you a higher risk

- Coverage level: Plans with more comprehensive coverage, such as dental, vision, and prescription drug benefits, are generally more expensive than basic plans that cover essential services

- Location: Insurance premiums can vary depending on where you live, with urban areas like Toronto and Vancouver often having higher premiums compared to smaller towns due to varying healthcare costs

- Type of plan: Individual health plans tend to be more expensive than group plans, as group plans are often subsidized by employers, offering more affordable rates but potentially with fewer options for customization

How much does private health insurance cost in Ontario?

The cost of private health insurance in Ontario varies based on the type and level of coverage. Basic plans start at approximately $100 per month, offering essential medical coverage with minimal extras. Comprehensive plans, which can range from $250 to $300 per month, provide broader benefits such as vision, dental, and prescription drug coverage.

How much does health insurance in Alberta cost?

Personal health insurance in Alberta is generally more affordable compared to other provinces, with costs varying based on the level of coverage. Basic plans range from $50 to $180 per month, providing essential health services, while comprehensive plans can cost up to $234 per month.

For example, a basic Sun Life plan for a 33-year-old may cost approximately $59.48 per month, whereas a more extensive plan could be priced around $145.54 per month, offering broader benefits.

What is the cost of health insurance in British Columbia?

In British Columbia (BC), private health insurance costs vary based on the plan’s scope and benefits. Basic coverage starts at approximately $70 per month, providing essential health services, while comprehensive plans covering drug, dental, and vision care, can go up to $200 per month.

How can I get health insurance with pre-existing conditions?

Most insurers offer guaranteed or assured acceptance plans, and replacement plans for individuals with pre-existing conditions. Guaranteed health insurance plans provide coverage for individuals with pre-existing conditions, ensuring approval regardless of medical history.

These plans do not require any medical underwriting, meaning you don’t need a health assessment to qualify. Coverage typically starts immediately or after a short waiting period, offering quick access to benefits. However, the premiums are higher to account for the increased risk of covering pre-existing conditions.

Replacement plans are designed for individuals transitioning between insurance policies, such as after losing group medical coverage or switching providers. These plans may cover pre-existing conditions if continuous coverage has been maintained, ensuring seamless protection.

While they often come with higher premiums due to the inclusion of pre-existing conditions, replacement plans typically provide more comprehensive benefits than guaranteed plans, offering broader networks and additional services.

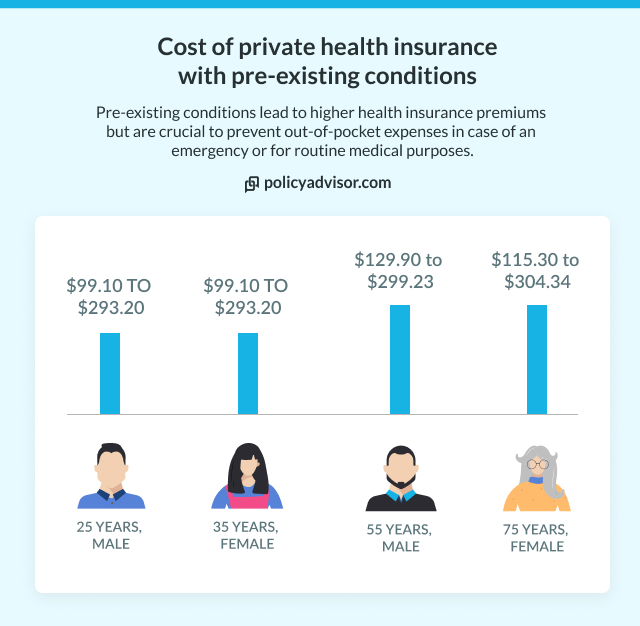

For individuals with pre-existing conditions, monthly premiums vary by age and gender. For instance, a 25-year-old male can expect costs ranging from $99.10 to $293.20, while a 55-year-old male may pay between $129.90 to $299.23.

Cost of guaranteed health insurance plans

| Age | Premiums (With stable pre-existing conditions) |

| 25 years, male | $99.10 to $293.20 |

| 35 years, female | $99.10 to $293.20 |

| 55 years, male | $129.90 to $299.23 |

| 75 years, female | $115.30 to $304.34 |

*Average premiums for sample plans. Higher coverage will lead to higher costs.

How are dental and vision coverages included in personal health insurance plans?

Many personal health insurance plans in Canada offer dental and vision benefits as part of their extended health coverage. These benefits help individuals manage routine and unexpected healthcare expenses not covered by provincial plans.

Dental coverage: Most plans provide reimbursement for preventive care (cleanings, exams, and X-rays), basic procedures (fillings, extractions), and major services (crowns, bridges, root canals). Some also cover orthodontics, typically with a lifetime maximum.

Vision coverage: This typically includes partial reimbursement for eye exams, prescription glasses, and contact lenses, with coverage limits renewing every one to two years. Some plans also contribute to corrective laser eye surgery.

These benefits are especially valuable for individuals without employer-sponsored coverage. They ensure continued access to essential care while managing out-of-pocket costs.

How do pre-existing conditions affect the cost of health insurance in Canada?

Pre-existing conditions can significantly impact the cost and coverage options for private health insurance in Canada, often leading to higher premiums or limitations in coverage.

- Higher premiums: Individuals with pre-existing conditions often face higher premiums as insurers consider them higher risk due to ongoing medical needs

- Rated policies: Insurers may issue a “rated” policy, where the premium is increased to reflect the additional risk posed by the applicant’s medical history

- Coverage limitations: Some policies may exclude treatments related to pre-existing conditions or impose waiting periods before coverage for these conditions takes effect

- Disclosure requirements: When applying for private health insurance, applicants must fully disclose any pre-existing conditions. Failure to do so could result in policy denial or claim rejection

- Types of coverage available: Canadians with pre-existing conditions can access guaranteed acceptance plans, comprehensive plans, or supplemental insurance, though these options may come with higher premiums or waiting periods

Where can I find the cheapest health insurance quotes?

When looking for the cheapest health insurance in Canada, Sun Life offers the most affordable starting rate, beginning at $61.32 per month. On the higher end, GreenShield starts at $142.00 per month. Other options include Canada Life, with plans starting at $87.70, and Blue Cross at $92.60 per month. Manulife and GMS have starting costs of $99.80 and $103.25, respectively. Finally, Desjardins offers coverage starting at $123.64 per month.

The cost of private health insurance in Canada can be managed by selecting basic plans that cover essential services, opting for higher deductibles, or finding plans that allow you to exclude non-essential services.

Cheapest health insurance plans in Canada

| Company | Premiums |

| Sun Life | $61.32/month |

| Canada Life | $87.70/month |

| Blue Cross | $92.60/month |

| Manulife | $99.80/month |

| GMS | $103.25/month |

| Desjardins | $123.64/month |

| GreenShield | $142.00/month |

*Premiums for a base plan for a 25-year-old without pre-existing conditions in Ontario. Higher coverage will lead to higher costs.

What factors should I compare when choosing health insurance quotes?

When comparing health insurance quotes, consider premiums, deductibles, coverage limits, provider networks, and customer service ratings.

Cost is a major factor, but there are other elements that you must consider when choosing a health insurance plan. For instance, the deductibles and co-pays associated with each plan can significantly impact overall costs, as can the coverage limits for services like dental or physiotherapy. Here are some key factors to review:

- Premiums and deductibles: Premiums are the monthly payment you make, while deductibles are the out-of-pocket costs before coverage starts

- Coverage limits and exclusions: Each plan will have limits on certain services; make sure to check if the services you need are adequately covered

- Provider network and accessibility: Some insurers work with specific hospitals and clinics, so check if your preferred providers are within their network

- Customer service and claims processing: Reviews can indicate an insurer’s reliability in handling claims and customer inquiries

How can I get private health insurance quotes in Canada?

To get private health insurance quotes in Canada, we recommend speaking with our experienced advisors to compare quotes from across 30+ top insurance providers.

With PolicyAdvisor, you also get free instant quotes, lowest rates across the market, and lifetime after-sales support. Schedule a free consultation with one of our licensed advisors today!

Is healthcare coverage different in each province?

Yes, healthcare coverage varies by province, as each province manages its own public health insurance, which affects private insurance needs. Canada’s healthcare system operates at the provincial level, meaning each province determines the coverage scope for its residents.

For example, OHIP in Ontario provides limited mental health and dental services, while Alberta’s health insurance covers select emergency services but not out-of-province care. Consequently, private health insurance fills the gaps in coverage, and the need for it differs depending on provincial healthcare policies.

Frequently Asked Questions

What is the most affordable personal health insurance in Canada?

Sun Life, Manulife, Canada Life, and Blue Cross Ontario, offer some of the most affordable personal health insurance plans in Canada. Basic plans typically start around $50 per month, though actual costs depend on factors like age, health needs, and location.

These basic plans usually cover essentials, such as prescription medications, paramedical services, and limited emergency care, making them a good option for those looking for cost-effective coverage. However, these lower-cost plans may not cover more extensive services like dental or vision, so it’s important to evaluate what’s included and consider potential out-of-pocket costs.

How do I know what health insurance plan is best for me?

To determine the best health insurance plan for you, start by assessing your individual needs. Consider your requirements for prescription drugs, dental care, vision care, and other services, as well as any pre-existing conditions or ongoing treatments.

After defining these needs, speak with our advisors and compare quotes from several providers and compare the coverage, premiums, deductibles, and limitations.

Can I get private health insurance even if I have a pre-existing condition?

Yes, it’s possible to get private health insurance if you have a pre-existing condition, but there are important considerations. Insurers offer guaranteed acceptance plans and replacement plans but may place limitations on coverage related to the condition, or they may adjust the premiums accordingly.

Some insurers might offer plans that exclude coverage for pre-existing conditions altogether, while others may impose a waiting period before they cover treatments related to that condition. To avoid unexpected costs, it’s crucial to disclose any pre-existing conditions during the application process and understand how your plan handles these conditions.

Are dental and vision included in standard health insurance plans?

Dental and vision care are generally not included in standard health insurance plans; instead, they are typically offered as add-ons or in bundled packages. Many basic health insurance plans cover only medical essentials, such as prescription drugs and limited hospital care.

If you need dental or vision care, you can opt for an expanded plan that includes these services or purchase a separate policy specifically for dental or vision. Bundled health plans that include both dental and vision are available from many insurers and may offer cost savings compared to purchasing each type of coverage individually.

The average cost of personal health insurance in Canada is influenced by several key factors such as the level of coverage, age, health status, and geographical location. Health insurance premiums in Canada start at $61.32 per month for a 35-year-old single male, $110.38 for a 28-year-old couple, and $175.89 for a family of four. The province you live in also impacts pricing, as each has its own healthcare gaps and needs. When choosing a health insurance plan, it’s important to consider factors such as premiums, deductibles, coverage limits, and additional services like dental and vision care.