- Provincial health insurance in Canada covers essential healthcare services, like doctor visits, hospital stays, and emergency care, funded through taxes

- Personal health insurance complements provincial coverage by covering additional services, such as prescription drugs, dental, vision, and paramedical services

- Provincial insurance is standardized for all residents, while personal insurance is customizable, allowing individuals to tailor coverage to specific needs and preferences

- Combining provincial and personal health insurance provides Canadians with comprehensive healthcare coverage and helps reduce out-of-pocket costs

- What is provincial health coverage in Canada?

- What is personal or private health insurance?

- What is the difference between public and private insurance in Canada?

- What are the financial benefits of having both personal and provincial health insurance?

- What are the common limitations of provincial health insurance?

- Is personal health insurance worth it for individuals without dependents?

- How to choose the right personal health insurance plan?

- Frequently asked questions

In Canada, you can get health insurance in one of two ways—provincial and personal. Knowing how they differ can be the key to unlocking the best care for you and your family.

While provincial insurance provides a foundation by covering essentials like doctor visits and hospital stays, it often leaves out crucial services like dental, vision, and prescription drugs. That’s where personal health insurance steps in, bridging the gap and offering tailored coverage that brings peace of mind.

With the right mix, you can ensure your family is fully protected with comprehensive coverage, from routine check-ups to specialized treatments.

What is provincial health coverage in Canada?

Provincial health coverage in Canada is the publicly funded healthcare system that provides essential medical services to residents in each province and territory.

This coverage is funded through taxes and it includes doctor visits, hospital stays, emergency services, and necessary surgeries. It ensures that Canadians can access fundamental healthcare without direct out-of-pocket expenses.

However, each province and territory administers its plan independently, which can lead to variations in covered services. It often excludes areas like prescription drugs, dental, vision care, and various paramedical services.

What is personal or private health insurance?

In Canada, personal or private health insurance is supplementary coverage that individuals or families can purchase to cover healthcare services that do not come under provincial coverage.

While provincial healthcare covers essential and emergency medical care, such as doctor visits and hospital stays, it generally excludes services like prescription drugs, dental and vision care, mental health services, and more, which private health insurance can help cover.

Many Canadians opt for personal health insurance to manage these out-of-pocket costs, ensuring access to a broader range of healthcare services. Private insurance plans can be tailored based on individual needs and budgets, with options for various levels of coverage.

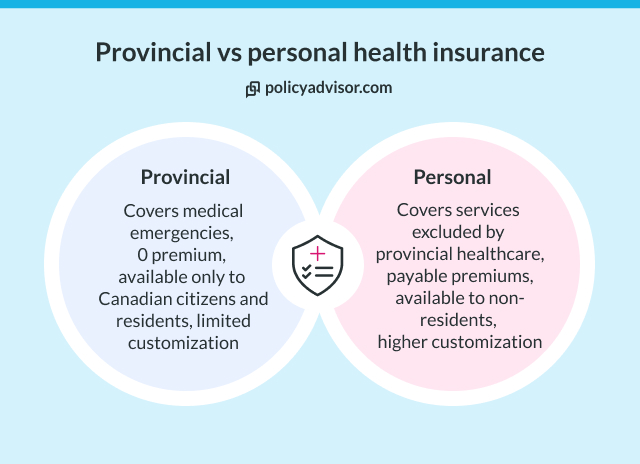

What is the difference between provincial and private insurance in Canada?

Provincial health insurance and private health insurance can vary in a number of ways, depending on factors such as coverage options, costs, premiums, eligibility criteria, customization options, and more. Here are a few ways in which they can vary:

Difference between provincial and private health insurance in Canada

| Criteria | Provincial coverage | Private health insurance |

| Coverage scope | Covers essential medical services, such as doctor visits, hospital stays, and surgeries. Excludes services like prescription drugs (outside hospitals), dental, vision, and physiotherapy | Extends coverage to services often excluded from public insurance, including prescription drugs, dental, vision, and physiotherapy, providing broader healthcare support |

| Cost and premiums | Funded through taxes, with no cost of premiums | Requires monthly or annual premiums, which vary by coverage level, age, health status, and insurer |

| Eligibility and access | Available only to Canadian citizens and eligible residents. May involve waiting periods for some services or specialists | Available to non-residents as well but may require medical underwriting. Provides quicker access to certain services |

| Flexibility and customization | Offers uniform, basic coverage to all eligible residents, with minimal customization options | Provides flexibility in customization according to specific needs such as family coverage, enhanced dental, or prescription drug options |

What are the financial benefits of having both personal and provincial health insurance?

Having both personal and provincial health insurance in Canada offers several financial benefits such as very little out-of-pocket expenses along with access to specialized treatment and tax benefits. Here is a detailed overview of the benefits:

What are the common limitations of provincial health insurance?

Although Canada’s provincial health insurance provides several benefits, there are certain limitations when it comes to elective procedures, alternative treatment coverage, dental and vision care, prescription drug coverage and more.

- Limited coverage: Most provinces do not cover prescription medications outside of hospital settings, alternative medication, and other preventative medical care

- Exclusions for dental and vision care: Routine dental services, eye exams, and glasses are generally not covered for adults, leading many to seek private insurance or pay these costs directly

- Mental health and therapy gaps: While some mental health services are covered, access to counselling, psychotherapy, and specialized mental health treatments is often limited or requires long wait times

- Extended wait times: For certain non-emergency procedures, diagnostic tests, or specialist appointments, patients may face lengthy waiting periods, especially in densely populated areas

- Age-specific restrictions: Some benefits, such as routine vision care, are only covered for children and seniors, leaving other age groups responsible for these costs

Do I need personal health insurance since healthcare is free in Canada?

Yes, personal health insurance can be beneficial in Canada, even with free public healthcare. Provincial health plans only offer “breakdown coverage” or emergency coverage. It covers individuals who are sick and it does not cover preventative treatments.

Personal health insurance helps fill this gap, covering additional healthcare costs and reducing out-of-pocket expenses. This added coverage can be especially valuable for individuals with specific healthcare needs, families, or those seeking broader healthcare support beyond basic services.

Is personal health insurance worth it for individuals without dependents?

Yes, personal health insurance can be worth it for individuals without dependents. Personal health insurance coverage can go beyond your provincial coverage to manage unexpected medical expenses and provide peace of mind, especially for those with specific healthcare needs or limited employer benefits.

Can I combine personal health insurance with provincial coverage?

Yes, you can combine personal health insurance with provincial coverage in Canada. In fact, that is the only way to get both coverages because you have to be enrolled in a provincial plan to buy a personal health plan.

By combining both, you can benefit from comprehensive health care that addresses both basic and extended health needs, ensuring greater protection and flexibility in managing healthcare costs.

How to choose the right personal health insurance plan?

Even if you are covered by provincial health insurance, having the right personal health insurance can help you meet unexpected medical costs or save up on routine checkups or prescription drugs that can drain your finances.

However, choosing the right personal health insurance can be tricky and exhausting. This is exactly where our professionals at PolicyAdvisor come in!

With the help of our trusted experts, you can choose from a range of health insurance options that cover your overall medical needs. We can also help you with additional riders that can keep your family protected in times of emergencies.

Our experts can help you assess your needs and find the best solutions for you at the most affordable values. Schedule a call with us today and get a headstart on financial protection against all health risks today!

Frequently asked questions

Will personal health insurance cover services not covered by my provincial coverage?

Yes, personal health insurance in Canada is designed to cover services that provincial health plans typically exclude, such as prescription medications, dental and vision care, physiotherapy, and mental health services.

By filling these gaps, personal insurance helps reduce out-of-pocket expenses for a wider range of healthcare needs, providing more comprehensive and flexible coverage options beyond provincial benefits.

Is there a waiting period for personal health insurance?

Yes, personal health insurance in Canada often includes a waiting period, typically ranging from 30 days to several months, depending on the insurer and specific plan. During this time, certain benefits may not be accessible, especially for pre-existing conditions.

Does personal insurance include services like physiotherapy or mental health counselling?

Yes, many personal health insurance plans in Canada include coverage for services like physiotherapy and mental health counselling. However, the extent of coverage can vary by plan.

Some policies may cover a certain number of sessions per year or require a referral from a healthcare provider. It’s important to review your specific policy to understand the details and limits of coverage.

In Canada, healthcare coverage is divided into provincial and personal health insurance, each serving unique needs. Provincial health insurance is publicly funded, providing all residents with essential medical care. However, it often excludes services like dental, vision, and prescription drugs. Personal health insurance, offered by private insurers, bridges these gaps, covering additional services that provincial plans omit. This added coverage allows for customization, such as enhanced drug plans, dental, and paramedical services.

1-888-601-9980

1-888-601-9980