- Standard plans often exclude or limit pre-existing conditions, while replacement plans and guaranteed issue policies offer options, each with unique terms and costs

- If moving directly from group to personal coverage, replacement insurance may cover pre-existing conditions without a gap

- Guaranteed issue policies provide coverage for all health conditions but generally involve higher premiums and benefit caps

- Coverage terms can be affected by provincial rules, waiting periods, benefit caps, and higher premiums for those with pre-existing conditions

In Canada, coverage for pre-existing conditions under personal health insurance varies by plan type. Standard personal health insurance often excludes or limits coverage for pre-existing conditions through waiting periods or exclusions.

Replacement health insurance can cover pre-existing conditions if you’re moving directly from group insurance without a gap, continuing prior coverage, and guaranteed issue health insurance, which accepts all applicants regardless of health history, and generally covers pre-existing conditions but may come with higher premiums or benefit caps.

This article offers a detailed look at how different types of health insurance plans address pre-existing conditions, what coverage you can expect, and how to find the right plan for your health needs.

What is a pre-existing condition?

A pre-existing condition refers to any health issue or illness that you had before applying for a health insurance policy. This includes both chronic illnesses, like diabetes or asthma, and recent conditions, like a broken bone or a recent surgery. Insurers may even consider high blood pressure, mental health conditions, or allergies as pre-existing if they were diagnosed or treated before you applied for new coverage.

Pre-existing conditions are evaluated by insurers based on their impact on your future health needs. If a health problem is ongoing or likely to need treatment, it may influence the terms of coverage. Insurers look at factors like symptoms, treatments, medications, and any recent hospitalizations to determine if a condition is pre-existing.

Why do insurers care about pre-existing conditions?

Insurers treat pre-existing conditions differently because they represent a higher financial risk. If a person already has a health condition that could lead to higher medical costs, the insurer might face significant expenses from the outset. To manage these risks, many insurers place certain limitations or exclusions on pre-existing conditions to balance the overall costs of coverage.

To assess this risk, insurers typically use an underwriting process, where they ask about your medical history in detail, reviewing any conditions that could lead to claims.

The underwriting process is crucial for determining what conditions they’ll cover and at what cost. For this reason, many standard personal health insurance plans either limit or exclude pre-existing conditions to keep premiums manageable for all policyholders.

Will my personal health insurance plan cover pre-existing conditions?

Personal health insurance plans in Canada typically do not provide full coverage for pre-existing conditions. Many require applicants to go through medical underwriting, which involves disclosing all past and present health issues.

Insurers use this information to assess how risky it would be to cover the applicant, and they often set conditions, exclusions, or waiting periods on coverage for any pre-existing conditions.

If you have a chronic condition like diabetes or asthma, the insurer might approve your policy but exclude those conditions from coverage. This means they won’t cover any treatments, medications, or complications related to those specific conditions. In some cases, insurers may apply a waiting period, meaning coverage for that condition may start only after a set time has passed—such as one or two years.

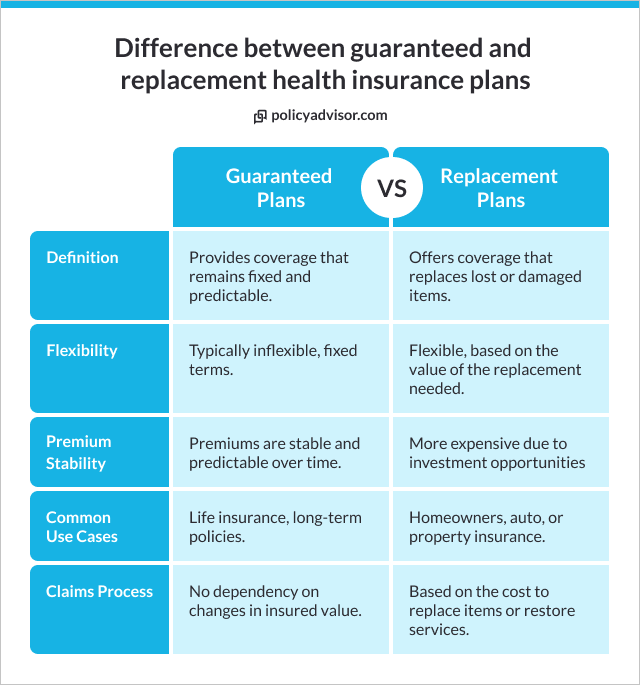

What is replacement health insurance?

Replacement health insurance plans are designed for people who are replacing their group insurance coverage (usually from an employer) and moving to an individual health policy.

These plans aim to provide continuous health coverage without a break in benefits, making them ideal for those who may have pre-existing conditions that were covered under their employer’s group plan.

The appeal of replacement health insurance is that it can often carry over the coverage you had in your group plan, including for pre-existing conditions. To qualify, you must move directly from your group plan to a replacement plan without any lapse in coverage.

This seamless transition can provide continued support for chronic conditions or past injuries that would otherwise be excluded in a new individual policy.

Will replacement health insurance cover pre-existing conditions?

Yes, replacement health insurance can cover pre-existing conditions, provided there’s no gap between your group insurance and your new replacement policy.

When you switch without any lapse, insurers may allow your pre-existing condition to be covered under the new plan, acknowledging that the condition was already covered by the prior group insurance.

However, eligibility often depends on a few key factors:

- Continuous coverage: You need to transition directly from group to replacement insurance without any break

- Plan terms: Not all replacement plans cover pre-existing conditions in the same way, so it’s crucial to verify with the provider

- Type of coverage needed: If the condition requires high levels of ongoing care, some plans may place caps or limits on coverage amounts

Replacement insurance is particularly useful for those with conditions that require ongoing management, as it prevents the disruption in care that could occur when switching to a plan that excludes those conditions.

What is guaranteed issue health insurance?

Guaranteed issue health insurance is a unique plan type that allows anyone to qualify for coverage, regardless of their health history. These plans are particularly popular for individuals who may have multiple or severe pre-existing conditions and find it challenging to get approved through standard personal health insurance underwriting.

Unlike typical health plans, guaranteed issue policies don’t require applicants to complete medical underwriting. This means there are no health questionnaires, and no existing health conditions can disqualify you from getting coverage. As a result, guaranteed issue insurance can be a reliable option for those who face limited options elsewhere.

Guaranteed issue policies do tend to come with higher premiums because they cover people with potentially higher medical needs. They may also have limitations on benefits, such as a maximum benefit cap or a limited range of services covered.

Does guaranteed issue health insurance cover pre-existing conditions?

Yes, guaranteed issue health insurance typically covers pre-existing conditions, making it an accessible choice for people with chronic or complex health issues. However, while these plans offer acceptance without medical screening, the extent of the coverage might be limited. Insurers offset the increased risk by charging higher premiums or capping benefits at certain limits.

Guaranteed issue plans are a good fit for those who may not qualify for other insurance due to their health history, though individuals should review the details carefully.

For example, coverage may be limited to basic medical needs, while more extensive treatments or medications might still have restrictions or higher out-of-pocket costs.

Which companies offer coverage for pre-existing conditions in personal health plans?

In Canada, several insurers provide health coverage for individuals with pre-existing conditions, though eligibility requirements vary. For example, Tugo provides options through specific riders that cover unstable pre-existing conditions for an additional cost, allowing policies to be customized based on the applicant’s health status.

CoverMe by Manulife offers guaranteed issue plans that accept applicants regardless of pre-existing conditions, without the need for medical questions or tests. These plans provide comprehensive coverage, often including services like prescription drugs, dental care, and mental health support, making them a flexible option for individuals with diverse health needs.

Factors that affect coverage for pre-existing coverage in personal health insurance plans

Even if your health insurance plan covers pre-existing conditions, there are some factors such as waiting periods, benefit caps, deductibles and co-payments, and policy riders that might still affect the extent of that coverage:

- Waiting periods: Some insurers enforce a waiting period of several months to a year before they start covering pre-existing conditions. This means that, during this period, any treatments or medications related to your pre-existing condition won’t be reimbursed

- Benefit caps: Insurers may place a maximum cap on benefits related to pre-existing conditions, meaning only a limited amount is covered annually

- Deductibles and co-payments: If you have a pre-existing condition, your plan might have higher deductibles or co-pays specifically for treatments related to that condition

- Policy riders: In some cases, you may be able to add a rider (additional coverage) to increase coverage for a pre-existing condition, though this can increase your premiums

How to choose the best health insurance plan for pre-existing conditions?

To choose the best health insurance plan for pre-existing conditions, we recommend speaking with our licensed advisors. Our experienced advisors help compare plans from across 30+ top health insurance companies in Canada to find you the plan that best meets your health needs.

Frequently Asked Questions

Does pre-existing condition coverage vary by province?

Yes, while the overall structure of health insurance in Canada is similar across provinces, there can be notable variations in private insurance policies and regulations that impact coverage for pre-existing conditions. Each province sets certain guidelines that insurers follow, which can affect aspects like benefit caps, waiting periods, and definitions of a pre-existing condition.

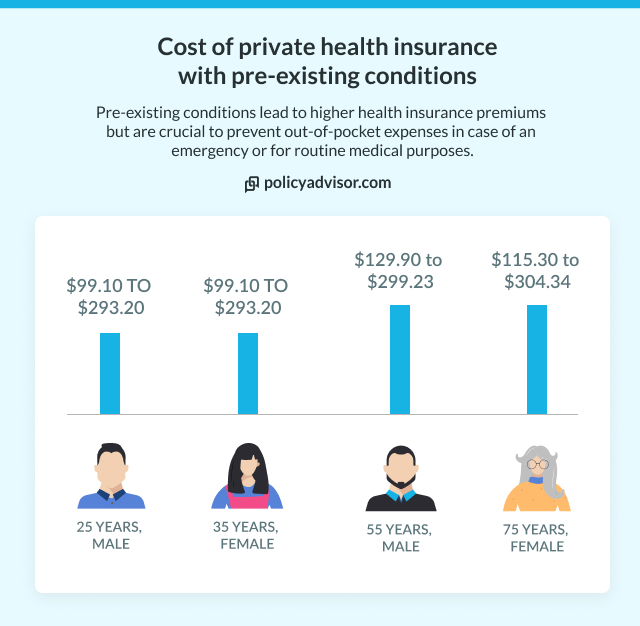

Will my premium be higher if I have a pre-existing condition?

Yes, if you have a pre-existing condition, your premiums are likely to be higher, especially in plans like guaranteed issue or certain personal health plans that accept applicants regardless of health status. Insurers increase premiums for these plans to offset the higher anticipated costs associated with covering ongoing medical care, treatments, or medications for chronic conditions.

Can I change plans if my condition worsens?

Yes, you may be able to change your health insurance plan if your condition worsens, but this depends on the terms of your current policy and the acceptance criteria of the new plan. In some cases, insurers allow policy adjustments, such as adding riders or increasing benefit limits, for individuals whose health needs have increased. However, if your condition has worsened significantly, switching to a new plan may involve re-evaluation of your health status, potentially leading to higher premiums or exclusions.

Are mental health conditions considered pre-existing?

Yes, mental health conditions are often considered pre-existing conditions if they were diagnosed or treated before the start date of the policy. This means that conditions such as anxiety, depression, bipolar disorder, or any other mental health diagnoses may be evaluated under pre-existing condition criteria during the underwriting process. Coverage for these conditions can be subject to exclusions, waiting periods, or higher premiums, depending on the insurer. It’s important to disclose any mental health conditions accurately when applying, as nondisclosure can lead to claim denials.

In Canada, coverage for pre-existing conditions in personal health insurance depends on the plan type. Standard personal health plans often exclude or limit pre-existing condition coverage, while replacement and guaranteed issue plans may provide coverage with specific terms. Replacement plans allow continued coverage if transitioning directly from group insurance, whereas guaranteed issue plans accept all applicants, often with higher premiums or capped benefits.