- Vision care is usually included in your health insurance policy

- Coverage for eye care includes eye exams, glasses, contact, sunglasses, and more

- You may choose to opt out of eye care coverage if you have coverage elsewhere or prefer to pay out of pocket

Are you squinting while you read this? Maybe after a long day at your desk, you find you commonly have a headache. It may be time to invest in vision health insurance!

Optical health is important, but the cost to maintain eye health and prevent problems can be high. Health insurance plans usually cover the cost of vision care services, including glasses and contacts.

Read on to find out what’s covered in your vision plan, if you need to add more coverage for your needs, and where to find the best price for vision care insurance.

What is vision insurance?

Vision insurance is a way to protect your eyesight and help you maintain good eye health. It’s an insurance policy designed to cover the costs of vision care, such as annual eye exams, contact lenses, glasses, and even laser vision correction.

Generally, vision benefits are a part of your health insurance plan. Vision insurance plans vary by provider, so it’s important to research different plans and find one that works best for you and your family.

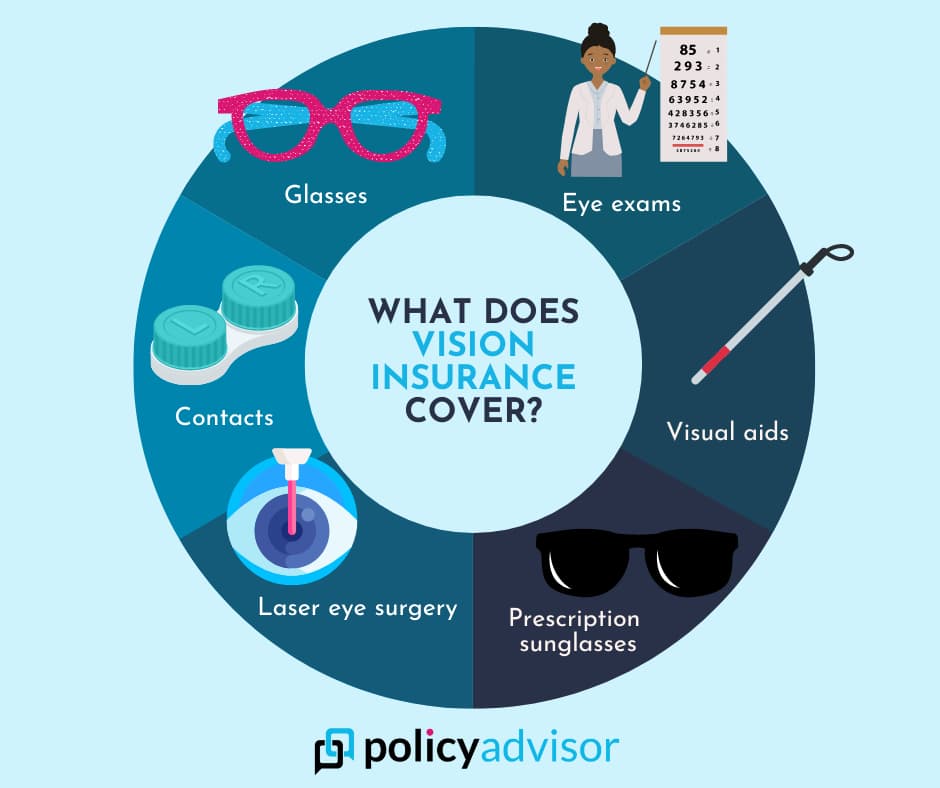

What does vision health insurance cover?

Generally, vision plans will provide coverage for routine eye exams as well as discounts on eyeglasses or contact lenses. Some providers also offer additional benefits such as discounts on laser vision correction procedures or coverage for certain medical conditions that may affect your eyesight.

Vision plans may include the following eye care services:

- Routine eye exams

- Prescription eyeglasses

- Prescription sunglasses

- Contact lenses

- Laser eye surgery

- Visual aids

Exactly what is covered and how much will depend on the types of vision insurance available to you. Many companies have various plan options with ascending coverage amounts.

Is eye surgery covered under vision insurance?

Whether or not your eye surgery is covered by your vision insurance benefits depends on what the surgery is. If the surgery is deemed medically necessary, then provincial health insurance will cover the surgery.

If the surgery is for aesthetic purposes or if your vision can be corrected in other ways (prescription glasses, contacts, etc.) then the surgery won’t be covered by government health insurance. Your eye doctor or ophthalmologist will determine if surgery is medically necessary.

Common eye surgeries include:

- Lasik (vision correction surgery)

- PRK (photorefractive keratectomy)

- Cataract surgery

- Glaucoma surgery

- Diabetic retinopathy surgery

- Macular degeneration surgery

In general, Lasik and PRK surgeries are not covered by provincial health, but surgeries for cataracts, glaucoma, or other eye diseases would be covered. Your private vision insurance coverage may cover laser eye surgery, depending on your plan.

Is eye care covered under health insurance?

Yes. Vision care is usually included in your health insurance benefits package. However, some basic packages may not include eye care or may just have minimal coverage for an eye exam and a single pair of glasses.

The higher tier level of health insurance you have, the more coverage you get. For example, a basic package may only cover $200 for a pair of glasses, whereas an enhanced package may cover up to $500 for glasses or contacts. It all depends on your provider and plan level.

If you’re unsure of your coverage, you can contact your insurance company directly or you can speak to one of our expert insurance advisors. We can review your plan and make sure it fits your insurance needs. If it doesn’t, we can shop around and find the best rate on vision insurance for you.

| Have vision coverage through your employer?

Your employer may provide a basic vision plan in your employee benefits package. But, sometimes you’ll need more coverage than what they’re offering. For example, if you have a family history of eye issues or every one of your dependents needs a new pair of eyeglasses every year, you may surpass the coverage in basic packages. In that case, we would recommend purchasing a private health insurance plan to cover those extra vision care expenses. |

Can you get stand-alone vision care insurance?

It’s not common to have a stand-alone vision plan. Most major insurance providers will have plans that start with basic health insurance and then have additional coverage for vision services to create comprehensive vision care benefits.

Each vision service plan varies from company to company. Most cover the same services, but the maximum coverage amount will vary.

How much does eye care insurance cost?

As mentioned, vision care insurance is usually included in health benefits, which usually cost between $50 and $300. Your monthly premiums for vision insurance options will depend on your personal health history and insurance needs.

| Plan type | Might have |

|---|---|

| Basic |

|

| Standard |

|

| Enhanced |

|

Is vision care worth it?

Absolutely. Vision care is an essential coverage and an important part of taking care of your overall health—it’s why it’s included in most health and dental plans!

If you don’t have vision insurance, here are some out-of-pocket expenses you may face:

- Eye exam: $125

- Glasses (including frames): $150 – $500+ depending on the type of lens

- Contacts: $120 – $800 a year depending on the type

- Laser eye surgery: $500 – $300 depending on severity

Especially if you have dependents that wear glasses, vision insurance is worth it—kids lose and break glasses all the time. Not to mention, your eyes can change every year due to factors such as:

- Stress

- Hormones

- Aging

- Hereditary or other health conditions

This may mean you need a new prescription and new glasses every year, which can add up if you’re covering the cost yourself. The cost of vision insurance through your health benefits becomes justified when your yearly premium is less than the cost of your eye exam and contact lenses.

Get a quote for the best eye care insurance

At PolicyAdvisor.com, we work with Canada’s best health plan providers to get you the best price for eye care coverage. Whether you have no coverage at all and are starting from scratch, or you’re looking to top up your existing plan, our licensed insurance advisors can find the perfect solution for you.

Our licensed agents will ask you a few simple questions about your health history and insurance needs and shop the insurance market to find the best rate for you. Contact an advisor today for a quote!

Frequently asked questions

How much do contacts cost?

The cost of contacts can range from $125 – $1,000 a year, depending on your lens type. Some contacts are daily wear, while others are for more long-term use (making them more expensive). Additionally, your prescription type can affect the cost of your contacts. If you have a particularly strong or complicated prescription, it costs more to make.

How much do glasses cost?

On average, the cost for a single pair of glasses runs about $300. The cost of corrective eyewear has two different components: the frame cost and the lens cost. Frames can be relatively cheap—sometimes as low as $20 if you buy them online. The cost of the lens is the most expensive aspect of glasses cost. Single vision is the least expensive lens type.

This means there is only one type of prescription in the lens. Single-vision lenses can cost $75 – $300. If your prescription calls for dual vision or progressive lenses (meaning two different types of prescription in each lens) it can be more costly. Dual-vision lenses can cost $250 – $700.

How much do glasses cost?

On average, the cost for a single pair of glasses runs about $300. The cost of corrective eyewear has two different components: the frame cost and the lens cost. Frames can be relatively cheap—sometimes as low as $20 if you buy them online. The cost of the lens is the most expensive aspect of glasses cost. Single vision is the least expensive lens type.

This means there is only one type of prescription in the lens. Single-vision lenses can cost $75 – $300. If your prescription calls for dual vision or progressive lenses (meaning two different types of prescription in each lens) it can be more costly. Dual-vision lenses can cost $250 – $700.

Does insurance cover blue light glasses?

If the blue light glasses are prescribed by your optometrist, they may be covered under your health insurance plan. Especially if you work at a computer all day, your eye doctor may prescribe this type of blue-light-blocking lens. However, if you want to buy them on your own accord, they may not be covered by your plan—they usually are not unless specified.

How much does it cost for an eye exam?

The average cost for an eye exam can range from $90-$160. The cost will depend on your province and the eye care professional you see. In some provinces (like Alberta and Ontario), if you are under 18 or over 65, you can get yearly comprehensive eye exams for free. If you are between 19 and 64, you can get coverage for eye examinations through your private health insurance.

Should I opt out of vision insurance?

It depends on your circumstances. If you have medical insurance elsewhere, like through your parent’s plan, you may consider opting out of vision care if it’s offered under your student plan. If you’ve already done eye exams in the past and know you have decent vision, you might also consider opting out.

However, there may come a day when you need to see an eye doctor and find yourself paying hundreds in out-of-pocket expenses. Just like all insurance, vision insurance is there for your immediate needs and your “just-in-case” needs as well.

Most health insurance policies include coverage for vision and eye care. Coverage usually includes eye exams, glasses, contacts, prescription sunglasses, and more. It’s uncommon to find a stand-alone vision care insurance policy—most have at least basic health care included in their packages in combination with comprehensive vision care.

1-888-601-9980

1-888-601-9980