- Manulife covers 25 full payout illnesses and 6 partial payout conditions, with coverage amounts up to $2 million

- The insurer provides four critical illness plans to choose from — LifechequeⓇ, CoverMeⓇ , LifechequeⓇ Basic and Synergy — each with unique features and benefits

- Manulife’s plans include features like partial payouts for early-stage conditions, return-of-premium options, and a waiver of premiums for total disability. Additionally, the Lifecheque® plan provides long-term care benefits and a recovery benefit for quicker financial assistance

- Manulife also offers family-oriented benefits, such as the Children’s LifeCheque rider, which allows children to secure their own critical illness coverage without medical underwriting at age 21

Manulife, one of Canada’s most trusted insurance providers, understands that life doesn’t always go as planned, especially when faced with a serious illness.

That’s why Manulife critical illness insurance is designed to provide you with the financial support you need during one of life’s most difficult times.

In this article, we’ll discuss the key features of Manulife’s critical illness insurance plans, including comprehensive coverage options, costs, and other benefits designed to help you focus on recovery without the stress of financial burdens.

What are the different critical illness insurance plans offered by Manulife?

Manulife has four critical illness insurance plans, Lifecheque®, CoverMe® critical illness insurance, Lifecheque® Basic and Synergy.

The Lifecheque® plan offers the most comprehensive coverage, with benefits for 25 critical illnesses, early intervention payouts, and long-term care benefits. It also offers add-ons for children and disability waiver of premium rider.

CoverMe® critical illness insurance focuses on five critical illnesses with fewer add-ons. It offers a premium refund at age 75 if there are no claims made on the plan.

Lifecheque® Basic covers the same five critical illnesses as the CoverMe® plan with limited coverage amounts based on age. Both CoverMe® and Lifecheque® Basic have a 30-day waiting period for certain conditions, while Lifecheque® offers broader options for financial and health protection.

Lifecheque®

Lifecheque, Manulife’s most comprehensive critical illness plan provides a cash benefit if you’re diagnosed with one of the 25 covered conditions.

This financial support allows you to focus on what matters most—getting better—without the added stress of mounting medical or personal expenses.

You can use the money for any purpose, including hiring a nurse or caregiver for home assistance, making mortgage payments, replacing lost income, paying for treatments and medications not covered by government or employer plans, etc.

Key features of the Lifecheque®

| Feature | Details |

| Core benefit | Tax-free, lump-sum benefit after satisfying any applicable waiting period if diagnosed with 1 of 25 critical illnesses |

| Coverage amount | $25,000 to $2,000,000 |

| Coverage for Life-Altering Conditions | Covered for conditions that may not be life-threatening but significantly alter your life |

| Partial Benefit | 25% payout (up to $50,000 per insured person) if diagnosed with 1 of 6 early intervention conditions, provided requirements in the contract are met |

| Recovery Benefit | Get money faster if diagnosed with a critical illness, without needing to fulfill the full waiting period. This unique benefit provides quick financial support to aid recovery |

| Monthly Care Benefit (LivingCare Benefit) | Receive a monthly benefit if you become functionally dependent and require long-term care (at home or in a facility) after satisfying a 90-day waiting period |

| Premium Refund | Get eligible premiums back if you surrender your policy early, your policy expires, or you die without making a claim |

| Child Coverage | Help protect your children and allow them to secure their own critical illness insurance at 21 without medical underwriting |

| Disability Waiver | Waive premiums if you become totally disabled (terms and conditions apply) |

Lifecheque® Basic

The Lifecheque® Basic plan covers 5 critical conditions and offers flexibility and coverage options for individuals aged 18-75, with guaranteed coverage and a 30-day money-back guarantee.

Additionally, it includes services like Medical Second Opinion and Health Service Navigator for quick, independent reviews of diagnoses and treatment recommendations.

Key features of the Lifecheque® Basic plan

| Feature | Details |

| Core plan benefit | Tax-free lump-sum benefit after diagnosis of a covered condition and meeting waiting period requirements |

| Covered conditions | Life-threatening cancer, Heart attack (30-day waiting period), Stroke (30-day waiting period), Coronary artery bypass surgery (30-day waiting period), Aortic surgery (30-day waiting period) |

| Coverage options | $25,000, $50,000, or $75,000 (ages 18-55)

$25,000 or $50,000 (ages 56-60) $25,000 (ages 61-65) |

| Optional add-on | If no claim has been made, premiums are refunded when you turn 75 |

| Additional services | Medical Second Opinion

Health Service Navigator powered by WorldCare Inc. |

CoverMe® Critical Illness Insurance

CoverMe Critical Illness Insurance provides affordable and simple financial protection in the event of being diagnosed with one of five covered critical illnesses. This coverage helps ensure that you have enough money to cover your expenses, allowing you to focus on recovery.

The policy offers a lump-sum, tax-free benefit that can replace income, manage medical expenses, and help maintain financial stability during a difficult time.

With coverage available up to age 75, even if your health or occupation changes, this plan also offers a 30-day money-back guarantee.

Key features of the CoverMe® Critical Illness Insurance plan

| Feature | Details |

| Core plan benefit | Tax-free lump-sum benefit after diagnosis of a covered condition and meeting waiting period requirements |

| Covered conditions | Life-threatening cancer, Heart attack (30-day waiting period), Stroke (30-day waiting period), Coronary artery bypass surgery (30-day waiting period), Aortic surgery (30-day waiting period) |

| Optional add-ons | Get up to 100% of premiums back at age 75 if no claims have been made |

| Additional services | Medical Second Opinion (MSO) powered by WorldCare Inc. |

| Protection period | Coverage until age 75, even if health or occupation changes |

| Guarantee | 30-day money-back guarantee |

Synergy

Manulife Synergy® offers 3-in-1 life, disability, and critical illness protection. This comprehensive insurance solution helps protect against everyday risks, ensuring that if you are unable to work due to injury, illness, or premature death, you can access a pool of funds.

These funds can replace your income, cover your mortgage and debts, and also supplement gaps in your employer’s group plan. With coverage ranging from $100,000 to $500,000, Synergy ensures financial security through a single, easy-to-manage policy.

You also have the option to convert your insurance to a permanent solution up to age 65. Additional add-ons, such as term life insurance (10-year renewable or term to age 65) and coverage for children up to age 25, provide further flexibility.

Synergy streamlines the process with one application, one premium, and one policy, offering simplicity and faster underwriting. Plus, some benefits are available before the end of the waiting period, making it easier for policyholders to receive payouts promptly.

Key features of the Manulife Synergy® 3-in-1 insurance plan

| Feature | Description |

| Coverage types | 1. Life Insurance: Provides a death benefit to beneficiaries

2. Disability Insurance: Offers monthly benefits if disabled 3. Critical Illness Insurance: Pays up to 25% of total coverage upon diagnosis of covered illness |

| Shared benefit pool | Claims are drawn from a common pool of insured amounts, reducing remaining life insurance if a claim is made (e.g., $250,000 coverage minus a $12,500 disability claim) |

| Age limitations | Coverage available for individuals aged 18 to 50, continuing until age 65 |

| Premium structure | 1. Term-10: Initial lower premiums that increase every ten years

2. Term-65: Level premiums until age 65 |

| Benefits | 1. Cost-Effective: Bundling insurance types offers more affordable premiums, especially in high-risk occupations

2. Simplicity: Single application and premium payment 3. Flexibility: Ability to add term life riders or children’s coverage |

Does Manulife offer different Lifecheque® plans?

Yes, Manulife offers four Lifecheque plans with coverage ranging from $25,000 to $2,000,000. You can choose the plan and coverage amount that best suits your needs:

- Primary (Term 65): Affordable coverage with fixed premiums until age 65, designed to protect you during your prime income-earning years

- Level (Term 75): Fixed premiums with coverage until age 75, ideal for those seeking protection into retirement

- Permanent Lifecheque: Lifetime coverage with fixed premiums. Choose between:

- Pay to age 100: Spread payments over your lifetime

- Limited Pay: Complete payments in 15 years for faster premium fulfillment

- Renewable (Term 10 or Term 20): Flexible coverage renewable every 10 or 20 years with increasing premiums. The coverage lasts until age 75 and can be converted to other Lifecheque plans (conditions apply)

Key features of the Manulife Synergy® 3-in-1 insurance plan

| Feature | Description |

| Coverage types | 1. Life Insurance: Provides a death benefit to beneficiaries

2. Disability Insurance: Offers monthly benefits if disabled 3. Critical Illness Insurance: Pays up to 25% of total coverage upon diagnosis of covered illness |

| Shared benefit pool | Claims are drawn from a common pool of insured amounts, reducing remaining life insurance if a claim is made (e.g., $250,000 coverage minus a $12,500 disability claim) |

| Age limitations | Coverage available for individuals aged 18 to 50, continuing until age 65 |

| Premium structure | 1. Term-10: Initial lower premiums that increase every ten years

2. Term-65: Level premiums until age 65 |

| Benefits | 1. Cost-Effective: Bundling insurance types offers more affordable premiums, especially in high-risk occupations

2. Simplicity: Single application and premium payment 3. Flexibility: Ability to add term life riders or children’s coverage |

What are early intervention conditions?

Early Intervention Conditions are specific medical conditions that may not be as severe or life-threatening as full critical illnesses but still warrant financial support.

If diagnosed with one of these conditions, you are eligible to receive a partial benefit, typically 25% of your coverage amount, up to a maximum of $50,000, provided you meet the criteria outlined in your policy.

Manulife’s Early Intervention Conditions include:

- Chronic lymphocytic leukemia (CLL) Rai stage 0

- Coronary angioplasty

- Ductal carcinoma in situ of the breast

- Papillary or follicular thyroid cancer (stage T1)

- Stage A prostate cancer (T1a or T1b)

- Stage 1 malignant melanoma

What if my policy expires and I don’t renew it?

With the Return of Premium at Expiry (ROPX) option, 100% of eligible premiums paid will be returned if your policy reaches its expiry date, and you haven’t made a claim or become eligible for a covered condition benefit.

What if I never get sick and want to cancel my coverage?

If you’ve never made a claim and wish to cancel your Lifecheque coverage, the Return of Premium with Early Surrender (ROPS) option allows you to get back 100% of eligible premiums paid, provided:

- The coverage and ROPS rider have been active for at least 15 years

- You are not eligible for a covered condition benefit

- You cancel your Lifecheque coverage

What if I never get sick but pass away?

In the event of death without a prior claim, the Return of Premium on Death (ROPD) option provides a refund of 100% of eligible premiums paid.

What are the critical illnesses covered by Manulife?

Manulife CoverMe® and Lifecheque® Basic plans cover 5 critical illnesses: life-threatening cancer, heart attack, stroke, coronary artery bypass surgery, and aortic surgery.

On the other hand, the Lifecheque® plan provides coverage for 25 critical conditions including deafness, benign brain tumor, kidney failure, Parkinson’s, and more. Here is a complete list of the illnesses that the plan covers:

| Covered Condition | Description |

| Aortic surgery | Surgical treatment of aortic conditions |

| Aplastic anemia | Bone marrow failure resulting in decreased blood cell production |

| Bacterial meningitis | Severe bacterial infection affecting the brain and spinal cord |

| Benign brain tumor | Non-cancerous tumor within the brain that causes significant impairment |

| Blindness | Permanent loss of sight in both eyes |

| Cancer (life-threatening) | Advanced-stage cancer, excluding early or non-invasive cancers |

| Coma | Prolonged unconsciousness lasting for at least 96 hours |

| Coronary artery bypass surgery | Open-heart surgery to correct narrowing or blockage in coronary arteries |

| Deafness | Permanent loss of hearing in both ears |

| Dementia, including Alzheimer’s disease | Progressive deterioration of mental and cognitive abilities |

| Heart attack | Death of heart muscle caused by insufficient blood flow |

| Heart valve replacement or repair | Surgical replacement or repair of one or more heart valves |

| Kidney failure | Permanent failure of both kidneys requiring dialysis or transplant |

| Loss of limbs | Total and permanent loss of use of two or more limbs |

| Loss of speech | Permanent loss of the ability to speak |

| Major organ failure (on waiting list) | End-stage failure of a major organ requiring placement on a transplant waiting list |

| Major organ transplant | Transplant of organs such as heart, lung, liver, or pancreas |

| Motor neuron disease | Progressive neurological disease, such as ALS, causing significant disability |

| Multiple sclerosis | Chronic disease affecting the central nervous system, leading to physical or cognitive impairment |

| Occupational HIV infection | HIV contracted from work-related exposure |

| Paralysis | Total and irreversible loss of muscle function in two or more limbs |

| Parkinson’s disease and specified atypical disorders | Progressive neurological conditions affecting motor skills |

| Severe burns | Third-degree burns covering a significant percentage of the body |

| Stroke | Sudden loss of brain function due to interruption of blood flow or bleeding in the brain |

What conditions are excluded from Manulife Critical Illness Insurance?

Manulife’s critical illness insurance excludes pre-existing conditions that were diagnosed or treated within 24 months prior to applying, self-inflicted injuries or illnesses, conditions related to substance abuse, and any condition diagnosed within the first 90 days of the policy effective date, which specifically applies to cancer and benign brain tumours. Additionally, any other specific exclusions are defined in the policy document.

How much does Manulife critical illness insurance cost?

The monthly premiums for Manulife’s life insurance coverage vary depending on factors like age and smoking status. For younger individuals, premiums tend to be lower, with male non-smokers enjoying slightly lower rates than smokers.

However, premiums increase significantly with age, especially for smokers. For instance, a 20-year-old male non-smoker pays $16.33 monthly for $50,000 coverage, while a 55-year-old non-smoker pays $172.43 for the same coverage amount.

Here are the monthly premium costs for $50,000 and $100,000 critical illness coverage on a 10-year term, for male smokers and non-smokers at different ages:

| Age | Coverage Amount | Monthly Premium (Male Smokers) | Monthly Premium (Male Non-Smokers) |

| 20 | $50,000 | $18.26 | $16.33 |

| 30 | $100,000 | $39.77 | $30.40 |

| 35 | $50,000 | $33.20 | $21.55 |

| 40 | $100,000 | $83.06 | $48.07 |

| 45 | $50,000 | $81.22 | $41.08 |

| 55 | $100,000 | $395.98 | $172.43 |

Can I cancel or modify my Manulife critical illness policy?

Yes, you can cancel or modify your Manulife critical illness policy by submitting a written request to Manulife.

Cancellation:

- Submit a written request to Manulife. Cancellation takes effect on the next payment due date

- If cancelled within 30 days, you’ll receive a full refund. After 30 days, refunds may not be available, especially if a claim has been made

Modification:

- For changes like adding or adjusting benefits, we recommend contacting your advisor

- To reduce coverage or remove riders, submit a Request for Change form by mail or fax

What are the pros and cons of Manulife’s critical illness insurance?

Manulife’s critical illness plans offer large coverage amounts of up to $2 million, multiple term options, including permanent coverage, and comprehensive protection for 25 full-payout illnesses.

Partial benefit payouts for early intervention conditions and return-of-premium options add flexibility, while the availability of a Children’s LifeCheque rider provides additional family-focused protection.

However, return-of-premium options can be costly, monthly payments are only available for loss of independent existence, and the plans lack coverage for a second event.

| Pros | Cons |

| Large coverage amounts (up to $2 million) | Return-of-premium options are expensive |

| Multiple coverage terms (including permanent) | Only monthly payments for loss of independent existence |

| Comprehensive coverage (25 full payout illnesses) | No second-event coverage available |

| Generous partial benefit payouts | |

| Return-of-premium and limited-pay options | |

| Payment for temporary loss of independent existence | |

| Children’s LifeCheque rider available |

Should I choose Manulife for critical illness insurance?

Manulife’s critical illness insurance is an excellent option for individuals looking for robust protection against unexpected medical challenges.

With coverage amounts of up to $2 million, Manulife’s plans are particularly appealing to those seeking substantial financial security.

It’s also a great fit for individuals with a family history of serious health conditions who want to prepare for potential health risks.

How can I buy Manulife’s critical illness insurance?

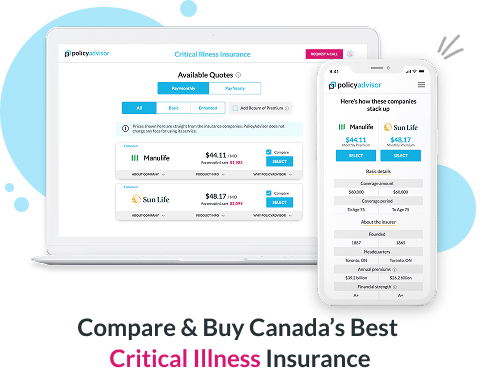

If you’re looking for affordable Manulife critical illness insurance quotes, we recommend speaking to our licensed advisors to compare and find the best plan for your needs.

With PolicyAdvisor, you’ll receive free instant quotes, the lowest rates in the market, and lifetime after-sales support.

Frequently asked questions

Can I cover my children under Manulife Critical Illness Insurance?

Yes, Manulife offers the Children’s LifeCheque rider, which provides critical illness coverage for children. It includes the option for children to transition to their own critical illness insurance policy without undergoing medical underwriting when they turn 21.

Does Manulife Critical Illness Insurance cover early-stage illnesses?

Yes, Manulife provides partial benefit payouts for early intervention conditions. For conditions such as ductal carcinoma in situ of the breast or coronary angioplasty, you may receive up to 25% of the coverage amount, capped at $50,000, depending on your policy. These payouts provide financial support during the initial stages of a serious illness.

How can I purchase Manulife Critical Illness Insurance?

You can purchase Manulife Critical Illness Insurance through licensed advisors or brokers, such as PolicyAdvisor. Our advisors can help compare plans, explain the policy terms, and provide affordable quotes tailored to your needs. The application process can be completed online, and you’ll also have access to digital policy documents for easy reference.

Manulife Critical Illness Insurance provides comprehensive protection with coverage amounts up to $2 million, safeguarding against 25 full payout illnesses and 6 partial payout conditions. With multiple coverage terms, flexible payment options, and return-of-premium benefits, it offers financial security during challenging health events. Manulife’s plans include unique benefits like partial payouts for early intervention conditions, child coverage, return of premiums, and access to health navigation services.