Life Insurance

Calculator

Calculate your life insurance needs in seconds

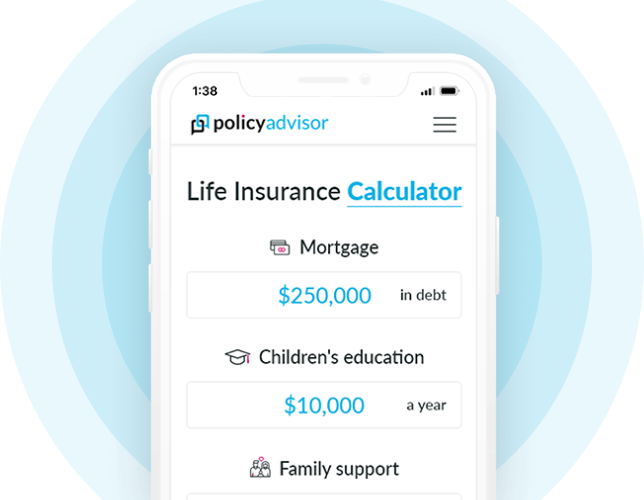

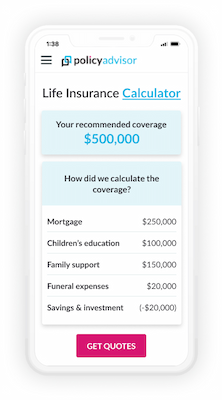

Are you unsure about how much life insurance you need? No worries! Our easy online calculator sorts it all out for you. It considers your current debts, mortgages, family, and more to suggest your perfect coverage — no more guesswork!

Plus, we help you save time and money by comparing top online insurance quotes to give you a head start on finding the policy that best meets you and your family’s needs.

Ready for financial security? Dive into our calculator below. Or keep reading to learn more about how we calculate term life insurance needs in Canada and what the other types of life insurance in Canada are.

Let’s make securing your future as easy as 1-2-3! We’ve got you covered.

Key factors to consider when using our

Canadian life insurance calculator

Mortgage

Got a mortgage? Term insurance that matches your mortgage length is a common choice for young Canadian adults

Young Children

New parents can pick a policy that would help cover the costs of raising a family as it grows up

Education Needs

If you plan to provide for a child’s future educational costs, that will also affect how much coverage you need

Dependents

Dependents aren’t just kids; they could be a parent, sibling, or anyone who relies on you for money. Taking care of them matters in your insurance decisions

Savings

If you’ve saved a lot of money, you might not need a big policy. You can think about getting a smaller plan

Existing Insurance

If you already have current life insurance coverage through a group/job, our calculator can show you how much life insurance you need to fill any gaps

How much life insurance do I need in Canada?

Figuring the perfect amount of how much life insurance you need can be tricky. You don’t want too little, so it covers everything you owe and helps your family. But getting too much might cost you more than needed.

Our easy-to-use life insurance calculator takes into account what Canadians like you need. It helps you pick the right coverage that’s not too much or too little, finding the sweet spot for the right price.

Wondering, “How do I calculate how much life insurance I need?”

Click the button below to get the answer!

Still not sure where to start with your calculating your needs?

Check out this video and let our licensed advisors help give you an idea!

Life insurance depends on lots of things, like debts and family. Our term life insurance calculator checks it all and tells you the perfect amount to keep you and your loved ones safe.

Ready to find your ideal coverage?

How to use our life insurance calculator?

5 easy steps

Our life insurance needs calculator uses an advanced algorithm to assess your unique details and account for things like inflation rates and taxes in seconds.

-

Basic details

Enter in some personal information like your name and birthday to get started. Enter in some personal information like your name and birthday to get started. -

Financial estimates

Answer some simple questions about your current finances — things like your annual income and if you have any debt. Answer some simple questions about your current finances things like your annual income and if you have any debt. -

Children/dependents

The calculator will ask if you have any children or anyone else you are supporting financially, and how many. -

Future goals

Enter in how much money you want your beneficiaries to get, how much you want to leave for funeral expenses, etc. -

Get results

The calculator will give you an estimate of the lowest amount of insurance coverage you should get to meet your needs.

From there, you can check out some life insurance rates using our free quoting tool. We give you the best quotes from Canada’s top companies so you can see who has the best deal right away.

Why use a term life insurance calculator online?

Save Time

Save Money

More Choice

Shop From Anywhere

When you use an online life insurance calculator in Canada, it becomes easy and clear to get the coverage you need.

Online insurance calculators give you the best of both worlds. You get all the perks of a traditional, in-person insurance broker and none of the drawbacks! It’s convenient to use your cell phone, computer, tablet, or any device to access our calculator from anywhere and anytime you want.

Once our life policy calculator shows you how much insurance coverage you need, the next step is to use our quoting tool to shop and compare prices from more than 30 of Canada’s top life insurance companies.

Save time and money with our insurance needs calculator – just click the button below to get started now.

How to calculate the cost of life insurance in Canada

As we already said, age is a major determining factor when it comes to calculating the cost of insurance premiums. BUT, there’s more to it than just how old you are.

When you use our online life insurance quote tool, it will look at other personal information to find out how much your premiums will be.

Premium costs are affected by:

Personal Details

Policy Details

Age

Type of insurance

Smoking status

Coverage amount

Gender

Term length

Health

Cost and return expectations

Family medical history

Occupation

Lifestyle choices

But you don’t have to just wonder about how to calculate your insurance cost — use our quoting tool to find out in minutes!

Getting insurance quotes online is a smart money move in Canada. It helps you save money and find the best policy with the lowest cost and the right amount of coverage you need.

Click the button below to get started.

Calculate your costs in seconds

Frequently asked questions

What information do I need to calculate my insurance coverage needs?

The formula our tool uses to help calculate your current life insurance needs is often called the DIME formula. DIME is an acronym that stands for debts, income, mortgage, and education.

You’ll need to know:

- Debt. How much your debts are.

- Income. Your current income level or how much money you make every year.

- Mortgage. How much you have left to pay off on your mortgage.

- Education. How much money you want to put towards the cost of education for your children.

Our calculator uses this info, and some info about the people who depend on you for money, to figure out your insurance coverage needs.

How do I calculate life insurance needs for my spouse or partner?

Once you know your partner’s details, you can use the online life insurance needs calculator to help figure out how much coverage they should get.

But, calculating insurance coverage for your partner is something you should do together. It’s best to schedule a call with our licensed insurance brokers to get unbiased advice.

Our insurance agents have years of experience helping couples out their insurance needs together and helping them save time and money in the process. They can walk you through your coverage options (like joint insurance policies) and other areas where you can save money.

Is there a life insurance cost calculator?

Yes, our life insurance quoting tool is just like a smart calculator. It lets you check and compare life insurance rates from some of the biggest insurance companies in Canada.

Just provide some info about your health, how much insurance coverage you want, which type of life insurance you want, and other details.

You can get a personal quote in less than a minute!

When should I buy a life insurance policy?

Our Canadian insurance calculator will help you figure out if it’s the right time for you to get insured based on your age, outstanding debts, and other factors.

Some of the biggest signs that you may need life insurance coverage are if you recently:

Got married

Got married Purchased a home

Purchased a home Had children

Had childrenIf you’re unsure about when you should buy a life policy and how much coverage you need, our insurance needs calculator is perfect for you!

Just click the button below to launch the calculator and determine your needs.

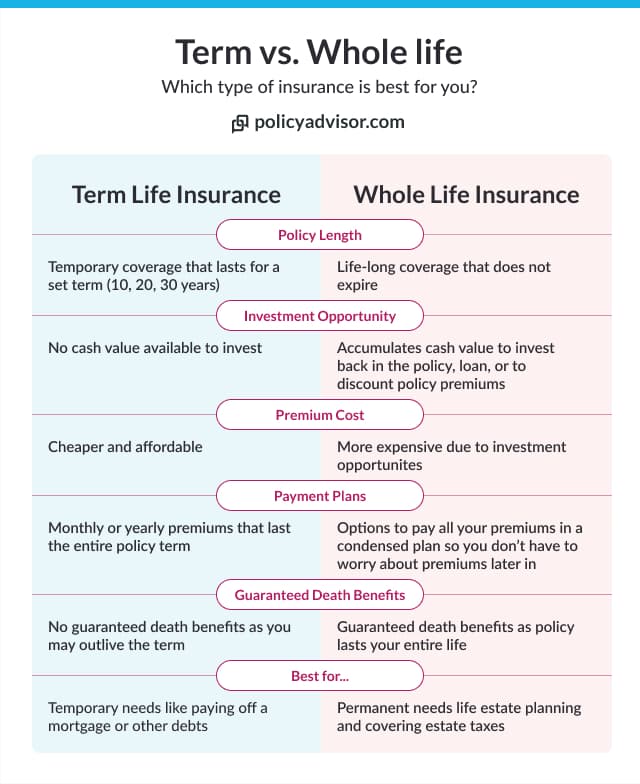

What type of life insurance is best?

Picking the best insurance mostly depends on your needs and your financial situation.

There are several types of life insurance you can choose from. Most people think about getting either a term policy or a whole policy.

Term life insurance covers you for a specific period of time. It has a pre-determined tax-free death benefit that will be paid to your loved ones if you die while you have a policy.

Most people get term insurance to cover things like a mortgage, debt, or child care for young kids.

Whole life insurance covers an individual for the rest of their life. It has both a death benefit and an investment component that lets you get extra savings during your life.

Most people get whole life insurance to cover funeral costs or estate taxes, or to help add to their pension.

Still not sure? We’re here to help!

Getting life insurance is one of the biggest decisions of your life, so it makes sense that you want to be sure. Reach out to our team if you need any help! Or visit our Life Insurance Learning Centre to get all the answers to your questions before you get started.

1-888-601-9980

1-888-601-9980