Life Insurance

Quotes

Save money. Save time.

Life insurance quotes in Canada

Comparing life insurance quotes in Canada is no easy task. Some of the biggest insurance companies in the world call Canada home. The process for getting a quote can be daunting, time-consuming, and frustrating. This is especially true if you don’t get your life insurance quote online.

But, getting the best quotes for your desired life insurance coverage and financial protection is easier than you think. Skip a lengthy life insurance process; use our online tool to get instant online insurance quotes for different types of life insurance plans. Or, read more about the quick and simple process of getting online life insurance quotes.

The easiest way to get free life insurance quotes online

Some online insurance brokers simply collect your contact information and have a representative call you to start the same old process to get a life insurance quote. We’re different.

- Provide basic details

Give us some quick details about your age, sex, and smoking status and we can get started. - Choose your coverage

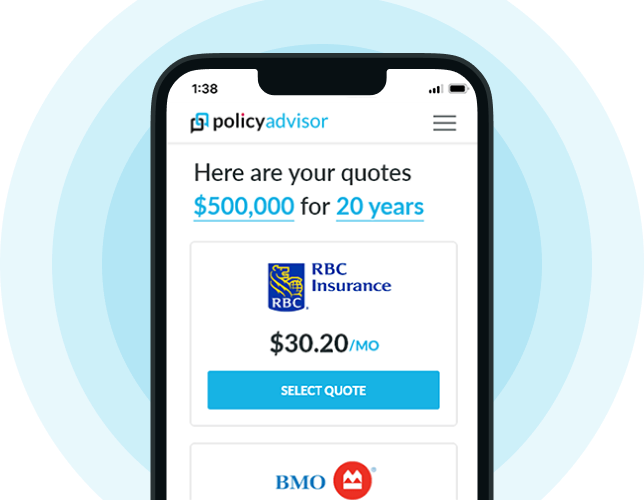

Enter the term and amount of insurance you’re looking for, or simply use a slider to get to the correct number. - Get a quote and customize it

Choose a quote from 30 Canadian insurance companies. Change the term, amounts, and more to suit your needs.

When it comes to life insurance, one of the first decisions you’ll need to make is what type of policy suits your needs best. There are primarily two types to consider: term life insurance and whole life insurance. But don’t worry — you can get quotes for both at the click of a button on PolicyAdvisor.com!

| Term Life Insurance | Whole Life Insurance |

|---|---|

| Term life insurance quotes are the most affordable. This kind of life insurance lasts a specific period of time, like 10 years, 20 years, 30 years, or more — or less! | Whole life insurance quotes are more expensive, but that’s because these policies let you invest the premiums you pay. You can then access that investment money during your lifetime |

| You should look at life insurance term policy quotes if you want life insurance to take care of short-term needs like paying off a mortgage or credit card debt, making sure your young children will be taken care of if something happens to you. | You should look at a whole life policy quote if you want life insurance for long-term needs like providing a legacy for your family or having some extra money for your retirement. It’s better for people who have already settled financial obligations — like if your mortgage is paid off and your children are already all grown up. |

YES, getting Canadian life insurance quotes online is your best course of action! And if you can get multiple life insurance quotes in one place, all the better! This saves you from having to spend hours calling around to different companies. Or having to deal with pushy salespeople who are more interested in making a buck than giving you genuine advice.

Save your time and skip the stress by shopping the best life insurance quotes all in one place today at PolicyAdvisor.com.

Need help to find the best life insurance quotes in Canada?

Reach out to our team of licensed insurance agents at any time. We’re happy to help walk you through it or find the best deals for you!

How do I find the best quotes?

The secret to finding the best life policy quotes online is to get started sooner rather than later. No, seriously!

Once you get a life insurance quote, that rate is locked in if you purchase the policy. So, no matter what happens in the future, you’ll be guaranteed that same rate!

On the other hand, insurance usually costs more the older you get. Getting an affordable life insurance quote today will always be your best bet to finding the lowest rates and locking them in!

You can get even lower quotes by switching up some of the features of your policy.

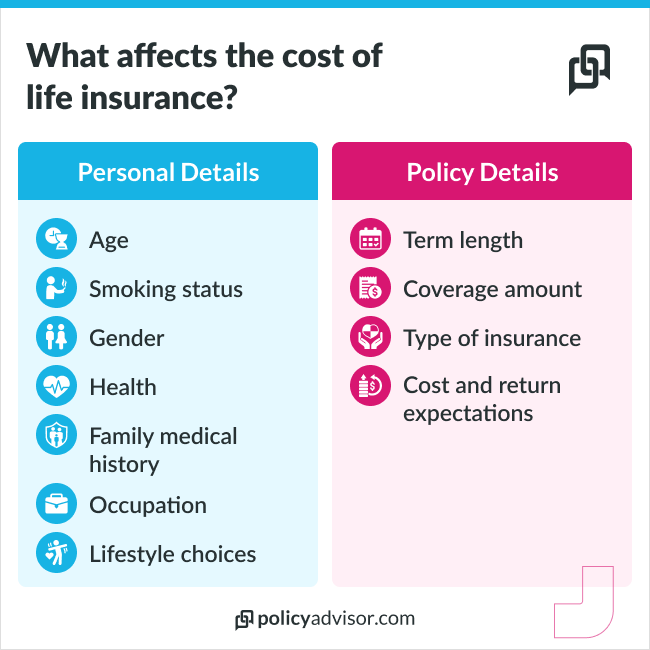

Life insurance prices can change based on a wide range of personal details, like gender, age, and health history. But it can also change based on the type of life insurance plan (term or permanent), term length, coverage amount, deductible, and payment options, among other factors.

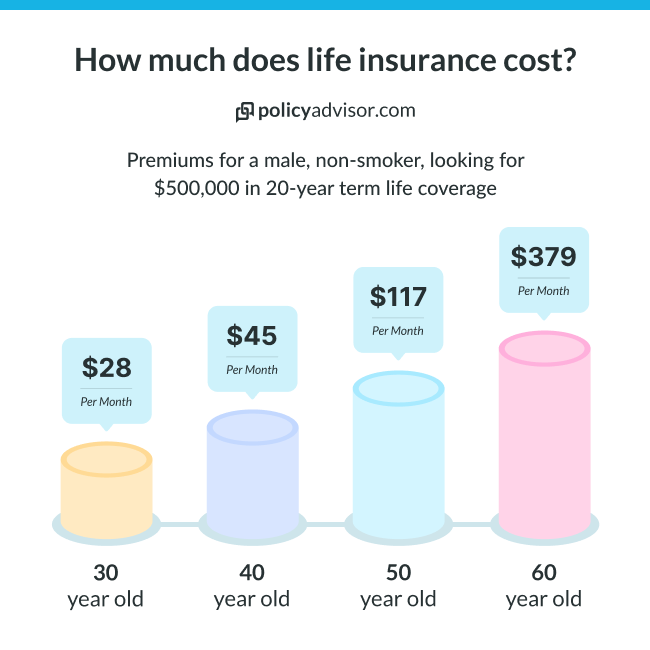

Take a look at the chart below to get an idea of how changing the amount of coverage can change your life insurance quote over different age ranges.

Remember, with PolicyAdvisor, your quotes are no-obligation. Try out different options and see which quote works best for you!

Term life insurance quotes for different ages

| Age | $100K | $250K | $500k |

|---|---|---|---|

| 20 | $10 | $18 | $30 |

| 25 | $10 | $18 | $31 |

| 30 | $19 | $31 | $58 |

| 40 | $29 | $48 | $88 |

| 50 | $72 | $124 | $235 |

| 60 | $97 | $226 | $393 |

*Representative values, based on a term life insurance quotation for a male in regular health.

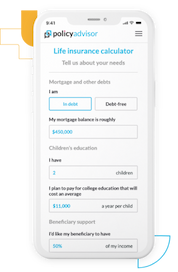

Our life insurance quotes calculator takes the guesswork out of the equation!

Not sure of exactly how much insurance you need? No worries!

Our life insurance quotes calculator has you covered! It can help you determine your coverage and find out whether you want term or permanent insurance. Answer a few quick questions about your family and financial situation and our calculator does the rest. It will show how much coverage it would take to ensure you get the right financial protection for you and your loved ones. And we get you started with instant life insurance quotes online.

Still not sure where to start with your insurance quote?

Check out this video and let our licensed advisors help give you an idea!

Benefits of getting life insurance quotes online

Save Time

Save Money

More choice

Shop From Anywhere

Besides the points we mentioned earlier, there are many other reasons to get online life insurance quotes in Canada

- Comparing online insurance quotes offers all the advantages of traditional brokers with none of the downsides. You can find out Canada life insurance cost on any device you own, from anywhere, at any time with our online tools.

- When you compare life insurance quotes online, you save money on your premiums. It increases your chances of finding the best, most affordable option for your financial safety.

- Plus, the time it normally takes to compare just 2 or 3 different life insurance providers on your own can be discouraging. PolicyAdvisor.com helps you save time with an easy online search that takes just minutes. You can browse term insurance or permanent life insurance quotes, and compare the two at the click of a button.

- Once you find the right quote, you can compare Canada’s top insurance companies without the sales pressure of an in-person brokerage experience. We also give you the benefit of curated advice from licensed advisors who are only a chat message or phone call away.

- The entire life insurance application process is done online, so you never have to worry about even getting out of bed.

Your time is better spent with those you’re protecting! Save time and money with an online insurance quote right now – just click the button below.

Which company provides your insurance quotes?

We show you quotes from the best life insurance companies in Canada. This includes some of the most trusted insurance providers, such as:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Non-medical life insurance rates

|

|

|

|

||

By showing you quotes from the most reliable life insurance companies, we ensure you can pick the best policy to protect your finances and loved ones.

We show you quotes from the best life insurance companies in Canada. This includes some of the most trusted insurance providers, such as:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

We also offer no medical or simplified insurance quotes (for those with medical issues) from Canadian life insurance companies like:

By showing you quotes from the most reliable life insurance companies, we ensure you can pick the best policy to protect your finances and loved ones.

PolicyAdvisor saves you time and money when comparing Canada’s top life insurance companies. Check it out!

Who has the best life insurance rates?

There really is no one-size-fits-all answer here. Some Canadian insurance companies may generally have lower prices than others. But each provider ultimately assesses risks differently. Thus, one life insurance provider may have lower rates for 30-year-olds but higher for 50-year-olds, or vice versa. Not to mention, other factors like health conditions and family medical history can affect your insurance quotes too.

Your best chance to find significant savings is to compare the best life insurance quotes online using PolicyAdvisor’s easy tools. Or, you can simply talk to one of our licensed insurance agents. We can help assess your unique situation and find the best-priced insurance policy.

Which company provides your insurance quotes?

We show you quotes from the best life insurance companies in Canada. This includes some of the most trusted insurance providers, such as:

- Assumption Life

- BMO Insurance

- Canada Life (formerly Great West)

- Canada Protection Plan

- Desjardins

- Empire Life

- Equitable Life

- Foresters

- Humania

- Industrial Alliance (iA)

- ivari

- Manulife

- RBC Life Insurance

- Beneva

- Wawanesa

- And more!

We also offer no medical or simplified insurance quotes (for those with medical issues) from Canadian life insurance companies like:

- Canada Protection Plan

- iA

- Humania

- Other insurance providers with unique plans for your specific protection needs

By showing you quotes from the most reliable life insurance companies, we ensure you can pick the best policy to protect your finances and loved ones.

Canada's most trusted insurance companies

When you get insurance quotes online, you maximize your options. Instead of weighing just 2 or 3 insurance providers, PolicyAdvisor.com provides you with the most choice in online insurance quotes in Canada. Not only do you save time and money – you get to choose coverage for your unique needs and personal situation. Plus, you can compare insurance quotes and policies from the best providers in Canada: all in one convenient place.

How much does life insurance cost at my age?

Wondering what kind of life insurance quotes someone your age should expect? No worries, we’ve got you covered! Click any of the ages to the right to get an idea of how much life insurance costs for someone in their 30s, 40s, 50s, or 60s. This can give you a better idea of what kind of quotes you might see online.

But keep in mind that other key details play a major role in determining insurance quotes and premium payments too.

For example, a 35-year-old female non-smoker in excellent health will likely have a lower life insurance quotation than a 50-year-old male smoker with health issues.

What is the average life insurance cost per month?

There is such a wide variety of variables when it comes to insurance premiums that it’s tricky to provide an average life insurance premium for everyone. Take a look at the chart on the right to see the kinds of factors that can affect your Canada life insurance quote.

Term life insurance coverage is typically the most affordable type of life policy. The length of the term determines your yearly or monthly cost. Term coverage over a longer period of time has higher premium rates, but also usually a bigger death benefit if you die during the term.

Term life policies have many options and can be customized to fit most budgets. It’s a huge draw for those looking for the cheapest life insurance.

Permanent policies (like whole or universal life insurance) tend to be the more expensive type of insurance plan because many of them include an investment component.

Here’s a pro tip: You can sometimes get cheaper life insurance quotes online if you buy something called a joint life insurance policy for you and your spouse or partner. Other times, it might be cheaper to buy 2 separate policies.

This is the beauty of shopping around for life insurance quotes online — you get to compare the options to see what works best!

Get Quotes

Frequently Asked Questions

Can I get life insurance quotes online even if I have health issues or if I smoke?

Yes, you can get online life insurance quotes if you have health issues or if you smoke cigarettes, vape, or use marijuana. You may still be able to qualify for normal term or whole life insurance policies. Or you can look at no-medical life insurance options that are more accepting of people who have health concerns. All of this can be done right here on our website!

Keep in mind that life insurance quotes for smokers or those with health issues may not be as low as for people who are in regular health, though.

Can I get a whole life insurance quote online?

Yes, you can get PolicyAdvisor.com. We also provide term life insurance policy quotes. Basically, we want to give you expert advice and the most comprehensive choices for financial protection.

Can I compare term life insurance quotes and whole life insurance quotes online?

Most definitely you can compare term life insurance quotes and permanent life insurance quotes on our website, and consider which may be better for you.

But here’s a cheat sheet if you’re not sure which type of policy you need: the product you should get really depends on why you want to purchase insurance.

Many young Canadians opt for 30 or 20-year term life insurance products to cover their mortgage or provide for dependents. Term plans still pay out a death benefit to your beneficiary in the unfortunate case of your death. But only if that were to happen within a specified length of time or term.

In contrast, older Canadians tend to go for a permanent life insurance policy as a part of their estate planning. Permanent life insurance, like whole life, lasts for your entire lifetime. They’re great for covering end-of-life expenses like funeral costs, and for ensuring the financial security of loved ones left behind.

You can easily look at different options while comparing Canadian life insurance quote for these different types of policy. But if you’re still unsure, you can always speak with our expert advisors for some guidance!

Read more about term life insurance quotes Canada vs whole life quotes.

Do you provide non-medical life insurance quotes online?

Yes! If you have pre-existing conditions, you can get no-medical life insurance quotes online from PolicyAdvisor.com. This is a great insurance for smokers or for those who just want to avoid getting a medical exam.

You can start by using our easy online quoting tool! Our licensed insurance agents will tell you which insurance options have medical questions, and which ones you can sign up for without a medical.

No lab work, urine sample, or blood pressure tests required! You can get the best life insurance quotes in Canada no matter what your current situation is. We promise!

Do you provide mortgage protection quotes online?

Yes! We recommend a term policy for peace of mind when it comes to mortgage insurance. You can get quotes through our life insurance needs calculator. Or, you can use our life insurance quotes calculator in our quoting tool and we can easily include mortgage protection in your online quote.

Mortgage protection insurance covers your mortgage payments if you, unfortunately, pass away. But we actually recommend getting term coverage since it can cover your mortgage AND anything else your family needs. Compare quotes for both mortgage and term insurance policies (or permanent policies, if you’d prefer) right here on PolicyAdvisor.com in minutes!

Read our review of the best mortgage insurance companies in Canada.

Do you have online quotes for other types of insurance?

Absolutely! You can get quotes, all in one place, for a range of products:

Where can I get the best life insurance quotes?

You can compare insurance quotes for life insurance right here! Our online tools make it easy to compare quotes for different types of policies in less than the time it takes to brew a cup of coffee. Whether it’s term insurance with a tax-free death benefit, or permanent life insurance with a cash value component, or anything in between. We provide you with the best quotes for the most affordable coverage no matter what stage of life you’re at.

Need more help? Just reach out to our friendly, licensed Canadian brokers. We can help with all your insurance needs!

Where can I find the cheapest life insurance in Canada?

You can find the cheapest life insurance quotes in Canada on PolicyAdvisor.com, thanks to our simple quoting tool that lets you compare top advisors in less than a minute!

The price of life insurance is based on many factors, so what’s cheapest for you will depend on your needs. But by shopping around and comparing using our website, you’re bound to get the best rate! Start by getting a free quote for term life insurance right here.

What happens after I get an online quote?

After you use our easy online tools to browse the top insurance providers in Canada for your preferred policy type, amount of coverage, and other customization options, your quote will be saved in our online system for free.

From there, you submit an online application and our licensed advisors guide you through the entire process from start to finish. If there’s a medical questionnaire or the unlikely medical exam needed, we arrange that for you too.

Don’t worry, we’ll do all the talking with the insurance company during the underwriting process. We’ll also tell you when you can expect to hear back (usually around 2 weeks) and let you know once you’re approved.

Did we mention that you never have to pay us anything? We take you from online quote to approved policy without you having to reach for your wallet.

It’s literally that easy, and it’s right in the palm of your hands too!

Will I get temporary coverage after I apply?

Yes! Once you submit your application, you will get temporary insurance that will cover you until your actual policy starts. This means you’ll have some protection right away, so you don’t have to worry about being without insurance in the meantime.

Is there anything else I need to know about getting a Canadian life insurance quote online?

It’s quick and easy to get life insurance quotes online, and it’s a great way to find the best rates and the best plan for your specific needs. PolicyAdvisor.com makes it simple and transparent too! Here are a few other tips you can keep in mind:

- It’s no obligation! You don’t have to rush into picking the first quote you see. Take your time and try out different options to make sure you’re getting the best deal.

- Be honest. When you enter the information in yourself, don’t change the facts to try to force a better rate. Putting your real data will get you the most accurate quotes so you’ll know exactly what your premiums will be if you decide to apply.

- Read reviews. Don’t just take our word for it! Check out real reviews from customers on our website or on Google Reviews or Reviews.io. Hearing from other everyday Canadians will help you know what to expect on your life insurance journey!

Do I really need life insurance?

As we mentioned in our Honest Guide – a better question to ask yourself is: Do the people in your life need you to have this type of coverage?

Life coverage has three major purposes:

- Clear outstanding debt

- Cover end-of-life costs like funeral expenses

- Provide an income replacement source to those who rely on you in the unfortunate circumstance that you’re no longer around

Life policies can help ensure your loved ones aren’t left with unexpected financial burdens once you pass away. And, most people want to use their death benefit to leave something behind so their children or other dependents can uphold their same standard of living.

Don’t put it off until it’s too late! Compare online life insurance quotes from reliable life insurance companies, apply for your perfect plan, and start protecting your financial future today!

Getting life insurance is one of the biggest decisions of your life, so it makes sense that you want to be sure. Reach out to our team if you need any help! Or visit our Life Insurance Learning Centre to get all the answers to your questions before you get started.