- ASD is a disorder but is not classified as a disease or a mental illness

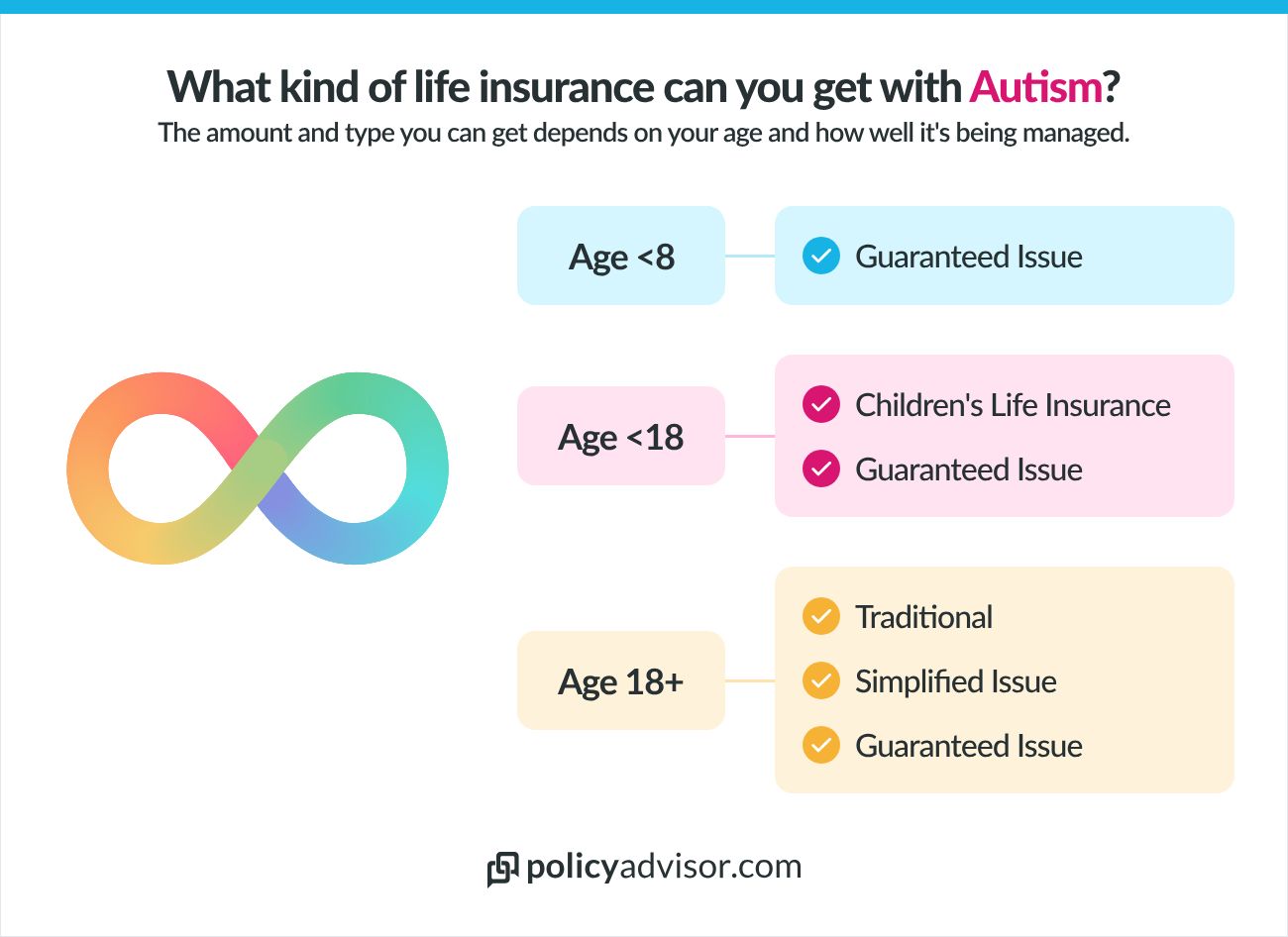

- Autistic children younger than age 8 may only qualify for guaranteed issue life insurance

- Autistic adults may qualify for traditional, simplified, or guaranteed issue life insurance

Autism is a wide spectrum that comes with a range of symptoms and conditions that can affect day-to-day living. It typically affects children, but a growing number of adults are diagnosed with it too.

Because more and more people with autism are sharing their stories online, there is a better understanding of how autism can impact a person’s life. The impact is very little for some, but for others it may mean relying on others to function. This growing awareness allows the stigma about autism to get better with time.

It’s not impossible to get life insurance with autism, but it can be confusing to know where to start and what your best options are. Insurance companies might need more information and assessments, and the coverage could have limitations or cost more.

In this article, we’ll explore some of the options and show you what some of Canada’s biggest life insurance companies will look for on your application.

Can people with autism get life insurance?

Yes, you can qualify for life insurance if you have autism. There are several options available, although different companies look at autism differently in children and in adults. So, age will play a major factor in determining what kind of insurance someone on the spectrum can get. But even in the most severe cases, people with autism will still have options.

What is Autism Spectrum Disorder (ASD)?

Autism Spectrum Disorder (ASD) is a mental condition that affects the nervous system and changes the way the brain functions. It’s called a “neurodevelopmental disorder” and is most commonly diagnosed in childhood. Autism affects how people see and interact with the world. It can make social communication and interaction difficult and cause repetitive behaviors.

While autism is a health condition, it is not considered an illness or disease. And although it affects the brain, it’s not considered a mental illness. ASD is called a “spectrum” disorder because it includes a wide range of symptoms and abilities. Each person with ASD is unique and experiences it differently.

There is no cure for autism, so it is a lifelong condition. But there are ways that people on the spectrum can manage their condition well and live a “normal” life. ASD is not expected to shorten someone’s life expectancy on its own, but it can lead to more serious health concerns like physical or mental health conditions, such as epilepsy, seizures, or depression/anxiety.

What are the 5 types of autism?

The five most common types of autism spectrum disorder are:

- Autistic Disorder: This is the most well-known type of autism. It’s also known as Kanner’s Syndrome. People with Autistic Disorder may have difficulties communicating and be extra sensitive or reactive to specific senses.

- Asperger Syndrome: Individuals with this type may be able to speak and function normally but may have trouble with social interactions.

- Childhood Disintegrative Disorder: This rare type of autism involves a significant loss of previously acquired skills, such as language and social skills.

- Pervasive Developmental Disorder-Not Otherwise Specified (PDD-NOS): Used to describe individuals who have some autism symptoms but may not fit into the other categories.

- Rett Syndrome: Mostly affects girls and leads to severe physical and mental impairments. Since 2013, Rett is not technically still considered an autism disorder in a medical sense. But it still often comes up in discussions about autism.

What kind of life insurance can someone with autism get?

Depending on their specific health conditions, people with autism can get:

For children under age 18:

For adults over age 18:

Note that for standard insurance, there can also be a few different outcomes if the policy is approved. The policy could

- Be treated as normal, with the most affordable rates

- Be given a rating, meaning they may charge more than usual because of the pre-existing condition

- Have a 2-year deferral period, where they only provide temporary coverage for the first 2 years

- Have a limited amount of coverage because of the health condition

To see how likely it is that someone with autism could qualify for each type of life insurance, check out the section below.

Can an autistic child get Children’s Life Insurance?

Just as the name suggests, this type of life insurance specifically covers children — usually under age 17 or 18. It’s purchased by a child’s parents for two main reasons: for the death benefit in the unfortunate circumstance the child passes away before the parent, and to help the child get insurance coverage when they become an adult. Most children’s life insurance policies can start as early as when the child is 15 days old.

✅ A child with autism may qualify for standard children’s life insurance if:

- They were diagnosed over age 9

- They were diagnosed more than 1-3 years ago

- Their diagnosis is mild

- The condition is being managed well

- There is little to no risk of health complications

Most Canadian insurance carriers don’t offer coverage to autistic children who are under 8 years old. Some will also decline anyone with autism who is under 18. But some companies may offer guaranteed acceptance policies if you cannot get a traditional children’s policy (more on that below).

Can an autistic adult get traditional Term Life Insurance?

Term life insurance is a type of coverage lasts for a specific period of time, such as 10, 20, or 30 years. Traditional life insurance policies are fully underwritten, meaning the company might ask you to do a medical exam. This makes it more difficult for people with health conditions to qualify. But that’s not usually the case with autism. Many Canadian adults on the spectrum can get standard policies and a standard rating.

✅ An adult with autism may qualify for term life insurance if:

- You are at least 18 years old

- You were diagnosed more than 1-3 years ago

- Your diagnosis is mild to moderate

- Your condition is being managed well

- You have proof of being able to function normally (such as having a job or attending school)

- There is little to no risk of health complications

- No history of alcohol abuse, drug usage, or self-harm

- No history of serious medical health events (such as heart attack, stroke, epilepsy, etc.)

Can an autistic adult get traditional Whole Life Insurance?

Whole or permanent life insurance is another type of traditional policy. The difference between whole and term life is that whole life policies last your entire life, not just for a set number of years. Just as with term life insurance, an adult with autism can likely get this type of coverage.

✅ An adult with autism may qualify for whole life insurance if:

- You are at least 18 years old

- You were diagnosed more than 1-3 years ago

- Your diagnosis is mild to moderate

- Your condition is being managed well

- You have proof of being able to function normally (such as having a job or attending school)

- There is little to no risk of health complications

- No history of alcohol abuse, drug usage, or self-harm

- No history of serious medical health events (such as heart attack, stroke, epilepsy, etc.)

Can an autistic adult get Simplified Issue Life Insurance?

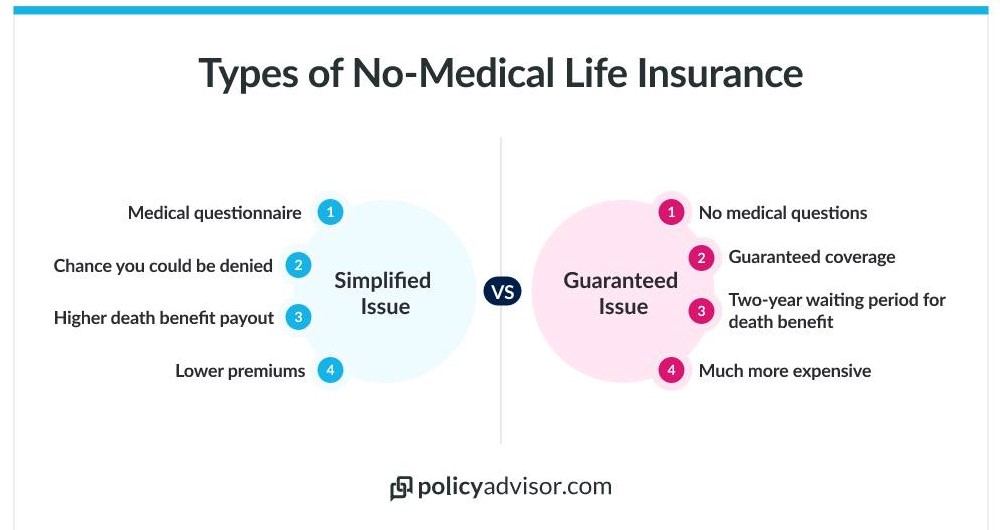

If an adult with autism can’t get regular coverage, they can consider getting a special type of insurance called no-medical life insurance. One example of no-medical insurance is Simplified Issue Life Insurance. Instead of a medical exam, they will have to answer some health questions — the process is simplified. It’s a good option for people who have big health problems or don’t want to do a full medical exam. But it might cost more than traditional life insurance policies do.

✅ An adult with autism may qualify for simplified issue (no medical) life insurance if:

- You are at least 18 years old

- You were diagnosed more than 1 year ago

- Your diagnosis is mild to moderate

- You have a high level of functioning and independence

- No history of serious medical health events (such as heart attack, stroke, epilepsy, etc.)

Can an autistic adult get Guaranteed Issue Life Insurance?

✅ As a last resort, any child or adult on the autism spectrum can get Guaranteed Issue Life Insurance.

This is also sometimes called Guaranteed Acceptance Life Insurance. This type of coverage is exactly as it says: someone who applies is guaranteed to be approved. It sounds convenient, but there’s a reason why it’s treated as a bit of a last resort for life insurance options. Guaranteed issue policies come with some heavy cons:

- Price

It’s by far the most expensive form of life insurance. - Waiting period

It also has a two-year waiting period where death by natural causes will not be covered. Accidental deaths would still be covered, though. - Limited coverage

The provider may only approve you for a lower amount of coverage than you want. - Limited type of policy

Some providers will only issue permanent coverage for this type of life insurance. - No riders

No optional coverage options or riders.

If you’re unsure which option is best for you, please speak with one of our licensed insurance agents who can give you tailored guidance on what would work best for you and your family.

What will they ask on the life insurance application?

During the life insurance application process, the company will ask personal details about you and your health history. All types of life insurance will ask about your age, sex, smoking status, and health to assess how much of a risk it might be to give you insurance. For autism in particular, the insurance company will also ask about:

They may also ask you to provide an Attending Physician Statement (APS), which is an official letter from your doctor confirming details about your diagnosis.

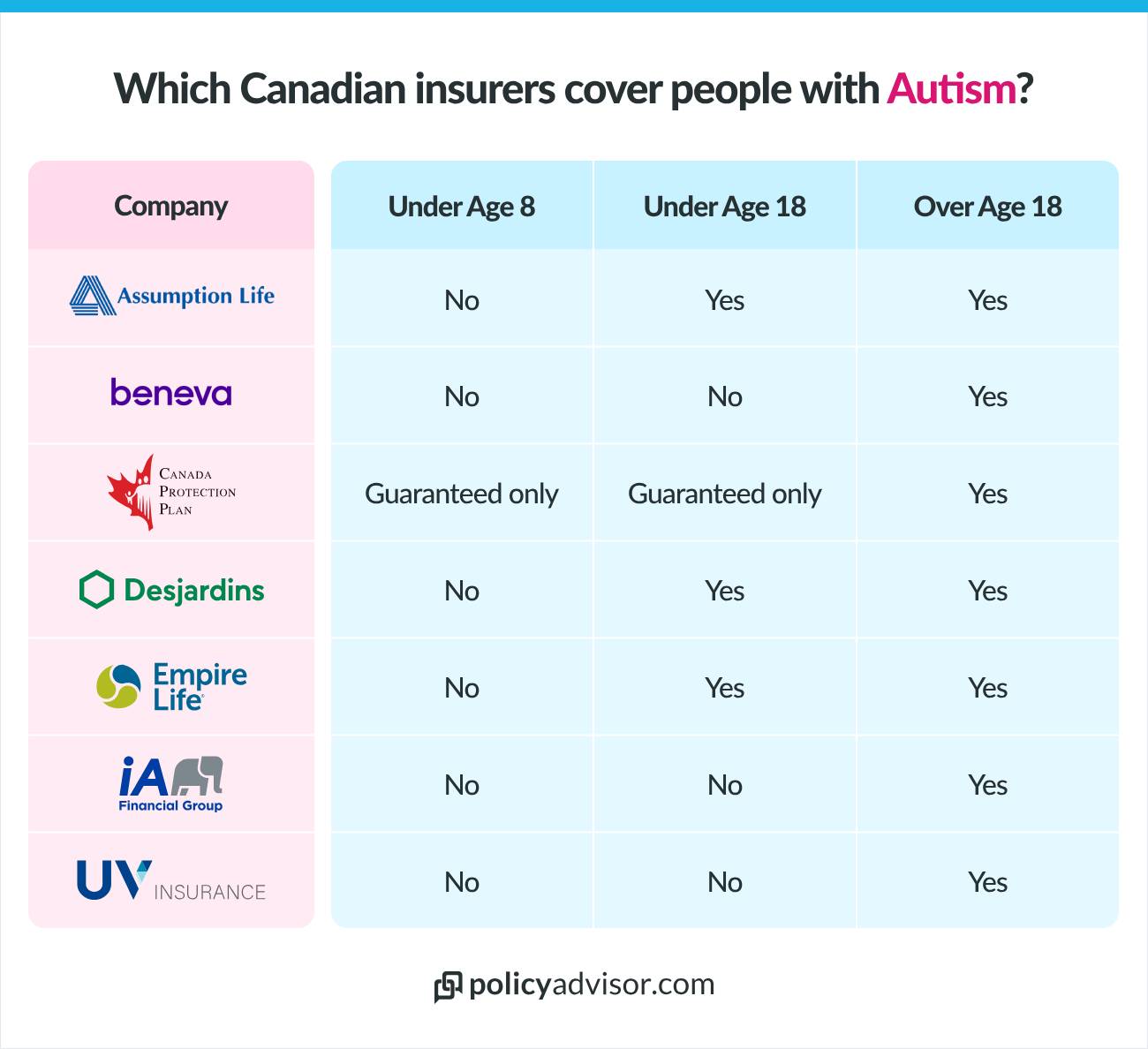

Which Canadian life insurance companies will approve someone with autism?

Here is a table that shows how likely it is for someone with autism to get life insurance from some of the best life insurance companies in Canada.

Note that this list isn’t inclusive, so it’s still a good idea to shop around for quotes or speak with a life insurance expert who can help you find the best company for your needs.

How to get life insurance if you’re on the autism spectrum

The best way someone with autism can get life insurance is by speaking with a licensed professional at PolicyAdvisor.com. Our advisors can help you through the entire process based on your specific needs and abilities. Autistic adults usually have tons of options for coverage, and can easily shop for and compare life insurance quotes right here on PolicyAdvisor.com. Options can vary a lot more with children, though, so speaking with a licensed advisor who can help is your best bet.

Does an autism diagnosis affect existing life insurance?

If you already have an insurance policy, you don’t have to worry about whether an autism diagnosis would affect your policy. Your policy is underwritten at the time you apply. Health changes after the policy is already in force do not change the policy’s validity. This is the case for both children’s policies and adult policies.

It’s also one of the reasons why children’s life insurance coverage can be such a good option. It makes sure they can get coverage for the rest of their lives no matter what health conditions may come up in the future.

Frequently Asked Questions

Does life insurance cost more for people with autism?

The cost of life insurance for people with autism depends on what kind of policy they qualify for. An autistic child or adult who’s approved for a traditional policy with standard premiums would be paying the same regular rates as anyone else. But if their policy is rated, based on their diagnosis, then it can cost more. No medical insurance policies like simplified issue and guaranteed issue also cost a lot more than traditional life policies.

Does critical illness insurance cover autism?

Autism can be covered in children’s critical illness insurance policies. But it’s not usually covered in adult policies. It also depends on your own coverage. A few companies may cover developmental or neurological disorders, which would include autism. When in doubt, check your policy wording to see exactly which conditions are covered.

Does disability insurance cover autism?

Autism can be considered a lifelong disability in some contexts, but whether disability insurance covers it will depend on several factors. Disability insurance is meant to replace your income if you can’t work because of an unforeseen disability, such as mental illness, broken limbs, or other physical/mental conditions. This coverage is short-term or long-term (up to age 65 depending on the policy). But the emphasis here is that it’s a sudden disability that causes the inability to work.

Some types of government assistance provide disability benefits to parents of children on the autism spectrum. There are also some programs for adults to supplement their income, but this again depends on the severity of the diagnosis.

Connect with a licensed insurance advisor

If you’re unsure about getting life insurance with autism, schedule a call with us for one-on-one advice. Our life insurance agents know the ropes of navigating the different insurance options in Canada. Let us help assess your individual situation and find the best way to get you or your child insured.

People with autism have several life insurance options, based on things like their age, how severe their autism is, and how well they can function. Adults with mild to moderate autism that is well-managed can likely qualify for regular life insurance. Children on the spectrum who are under 8 years old may not be able to get standard insurance, but can still get guaranteed issue coverage.