- As long as your policy includes a conversion rider and you're within the eligible time frame, you can switch to whole life insurance without undergoing new medical underwriting

- Whole life insurance guarantees lifelong protection, fixed premiums, and a cash value component that grows over time. This can support retirement income, estate planning, or legacy goals

- Each insurer has specific age limits and policy anniversary deadlines. If you miss this window, you’ll need to reapply and go through medical underwriting, which can be costly or impossible if your health has declined

- Some insurers let you convert just part of your term coverage (partial conversion), allowing you to balance permanent protection with manageable premiums while keeping the rest of your term policy for temporary needs

- After conversion, you’ll have to pay higher premiums based on your age at the time of conversion. Participating whole life policies (with dividends) cost more but can generate additional growth

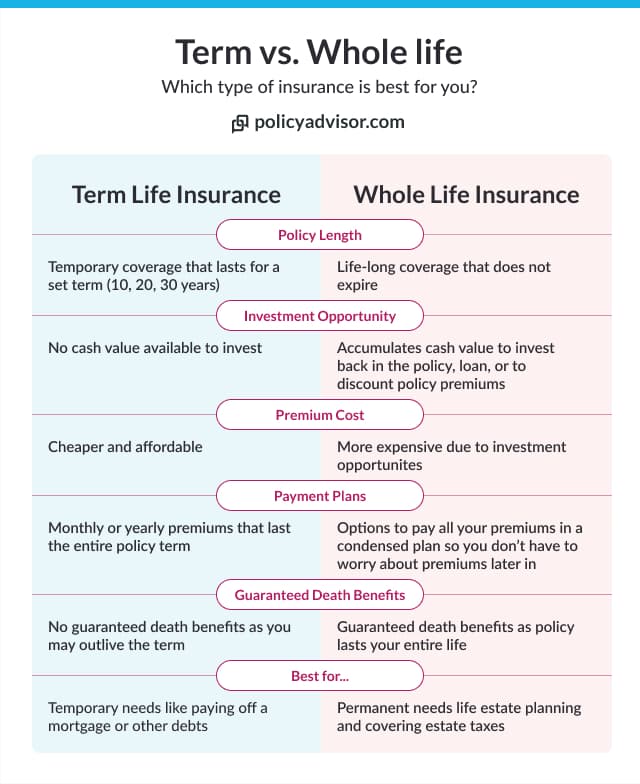

- Key differences between term life and whole life insurance

- How can I convert term to whole life insurance?

- Step-by-step process for converting term to whole life insurance

- What is a term conversion rider?

- Is it worth converting term life insurance to whole life?

- When does switching from term to whole life insurance make sense?

- How much does it cost to convert term life to whole life in Canada?

- Factors to consider before converting term to whole life insurance

- What are the benefits and drawbacks of converting term life to whole life insurance?

- Term conversion deadlines and age restrictions

- Partial conversion options and financial flexibility

- Checklist after getting a new permanent policy

- Can Term to 100 insurance be an alternative to whole life?

- Can you ever cash out a term life insurance policy?

- Frequently asked questions

You can convert your term life insurance to whole life insurance as long as your policy includes a conversion option and you’re within the eligible conversion period.

As circumstances evolve, many policyholders choose to convert term life insurance to whole life insurance for lifelong protection and added benefits.

In this article, we’ll explain everything you need to know about term life insurance and whole life insurance, including how to make the switch, when it makes sense, and what to consider.

Key differences between term life and whole life insurance

Term life insurance covers a set period, typically 10, 20, or 30 years. If you pass away during the term, your beneficiaries receive a death benefit. It’s simple, affordable, and ideal for short- to mid-term needs like mortgage protection or income replacement.

Whole life insurance, a type of permanent life insurance, covers you for your entire life and includes a cash value component that grows over time. Premiums are higher, remain fixed, and the policy builds equity you can borrow against.

The key difference between term life insurance and whole life insurance is duration and cost: term is temporary and cheaper, while whole life offers lifelong coverage and savings potential.

How can I convert term to whole life insurance?

Most term life insurance policies in Canada come with a term conversion rider or conversion options that allow you to switch your term policy to a whole life policy without a medical exam. This is especially valuable if your health has changed and you may no longer qualify for new coverage at standard rates.

Through this process, your temporary policy is converted into permanent coverage that never expires and includes a cash value component. The new policy can support long-term goals such as estate planning, legacy building, or retirement flexibility.

Insurers typically offer a range of permanent products for conversion, and you must act within a specific window, usually before a set policy anniversary or age limit, often 65 or 70. If you miss this window, converting term insurance to whole life won’t be possible without medical underwriting.

What is a policy anniversary?

A policy anniversary is the annual date that marks the anniversary of when your insurance policy became active. It’s usually based on the issue date or effective date of your policy, but not necessarily the date you signed the application.

Step-by-step process for converting term to whole life insurance

Converting term insurance to whole life can be a straightforward process, especially if your policy includes a built-in conversion option. Here are the key steps to follow for a smooth transition from term life insurance to whole life insurance:

Step 1 – Check your conversion window

Review your term life insurance contract to confirm it includes a term conversion rider. Most policies from Canadian insurers include this feature, but it’s important to verify the exact terms, eligible permanent products, and deadlines. Then, you must understand your policy’s conversion window.

Most insurers allow you to convert your term coverage up to a certain policy anniversary or before a specific age. If you miss this deadline, you’ll lose the option to convert term to whole life insurance without new medical underwriting

Step 2 – Speak to a licensed insurance advisor

Schedule a call with our experienced advisors to help you understand which whole life insurance options are available through your existing provider. Insurers offer different conversion products, so it’s crucial to choose the best life insurance policy that fits your financial plan and goals

Step 3 – Start your new premiums

Here’s where you need to be prepared for a change in cost. Whole life insurance comes with higher premiums than term, but those rates are fixed for life and reflect the permanent nature and cash value features of the new policy

What is a term conversion rider?

A term conversion rider is a built-in feature in many term life insurance policies that allows policyholders to convert term insurance to whole life insurance without undergoing a medical exam. This rider helps protect your insurability if your health changes after your term policy is in place.

Here are the key features of term conversion riders:

- No medical underwriting required: You can convert your term life insurance to whole life regardless of changes in your health

- Available on most Canadian term life policies: Many major insurers include this feature automatically at no extra cost

- Limited conversion window: You must convert within a specific time frame, typically before age 65 or 70, depending on the insurer

- Access to permanent options: Most insurers offer a choice between whole life insurance, universal life, or term to 100 insurance when converting

- Same insurer requirement: You can only convert to permanent policies offered by your current insurance provider

- Maintains original health rating: The new permanent policy uses the same underwriting class as your original term policy, helping you avoid higher premiums

This rider is a key tool for switching from term to whole life insurance without the risks of reapplying or losing coverage due to health changes. It adds long-term flexibility to an otherwise temporary insurance product.

Is it worth converting term life insurance to whole life?

Whether converting term insurance to whole life is worth it depends entirely on your long-term financial goals, current life stage, and evolving insurance needs. For many Canadians, a term policy makes sense in the early years when affordability is key and the focus is on covering temporary obligations, like a mortgage, income replacement, or raising children.

However, as you move into a different phase of life, you may begin to value permanent protection, especially if you’re thinking about estate planning, business succession, or leaving a tax-efficient legacy.

The benefits of converting term life to whole life insurance include lifetime coverage and cash value. This means that your beneficiaries are guaranteed a payout no matter when you pass away. The cash value component grows on a tax-deferred basis, which can be accessed later in life through policy loans or withdrawals.

For example, a 45-year-old business owner with a 20-year term policy may want to convert part of their coverage to whole life insurance to fund a buy-sell agreement or leave a legacy for their children. Converting now locks in permanent protection while avoiding the risk of higher premiums or denial later due to future health issues.

When does switching from term to whole life insurance make sense?

Switching from term to whole life insurance can be a strategic decision, depending on your personal circumstances, financial goals, and health status. At PolicyAdvisor, our experienced advisors often recommend this move if you are looking for permanent protection and long-term planning advantages.

Here are some situations where converting term insurance to whole life may be the right choice:

- You’re approaching the end of your term, but still need coverage

As your term life insurance nears expiration, you may find that you still need protection to support dependents, cover outstanding debts, or ensure financial stability for your family. Converting to whole life allows you to maintain lifelong coverage without undergoing new medical underwriting

- Your health has declined, making new insurance expensive or unavailable

If your health has worsened since you first bought term life insurance, getting a new policy could be costly or even impossible. Converting your existing term policy to whole life ensures continued coverage based on your original health rating, with no new medical exams

- You want to leave a guaranteed legacy or pay estate taxes

Whole life insurance is ideal for estate planning. It provides a tax-free death benefit that can be used to leave a legacy for heirs, fund charitable donations, or cover estate taxes, so your beneficiaries aren’t burdened with those costs

- You need the tax-deferred growth of a cash value policy

Whole life insurance builds cash value over time, which grows on a tax-deferred basis. This can be an attractive option if you’re looking to diversify your savings strategy, access funds later in life, or use the policy’s value for retirement planning or emergencies

How much does it cost to convert term life to whole life in Canada?

There are no upfront costs to convert a term life insurance policy to whole life insurance in Canada. However, you end up paying higher premiums after the policy conversion. Whole life insurance is significantly more expensive than term insurance due to its permanent coverage and built-in cash value.

For example, a healthy 40-year-old woman might pay around $35/month for a $500,000 term policy. If converted to whole life, that same coverage could cost approximately $340/month. The factors that affect this cost are:

- Age at conversion: Premiums are based on your age at the time of conversion, not when you bought the policy

- Coverage amount: Converting more coverage results in higher premiums

- Policy type: Participating whole life policies (with dividends) are costlier than non-participating ones

- Partial conversions: Some insurers allow you to convert only a portion of your term coverage to help control costs

Factors to consider before converting term to whole life insurance

Converting term insurance to whole life is a significant financial decision that can impact your long-term insurance strategy, retirement planning, and estate goals. While the option to convert provides flexibility and protects your insurability, it’s important to assess whether this move truly aligns with your current and future needs.

Before you switch from term to whole life insurance, you must ask yourself the following key questions:

- Can you afford the higher premiums?

Whole life insurance offers lifetime coverage and builds cash value, but it comes with significantly higher premiums than term life insurance. Make sure the cost fits comfortably within your long-term budget.

- Will you need the policy for life or just a few more years?

If your insurance needs are temporary (e.g., until your mortgage is paid off or your children are financially independent), maintaining term coverage or buying a new short-term policy may be more cost-effective than converting.

- How does this decision align with your retirement and estate plans?

Converting can be a smart move if you’re focused on leaving a guaranteed legacy, covering future tax liabilities, or supplementing retirement income using the policy’s cash value. Make sure the conversion supports your long-term planning objectives.

- Can my term life insurance be converted to whole life insurance now?

Check your policy’s conversion privileges. Most term life policies allow conversion within a specific window often before a certain age or within the first 10 years of the term. If you’re approaching the deadline, it’s worth reviewing your options now.

- What are the new premium costs?

Premiums for the new whole life policy will be based on your age at the time of conversion. Schedule a call with an experienced advisor to understand the long-term cost and evaluate whether it aligns with your budget.

- Is partial conversion an option?

Some insurers allow partial conversions, letting you convert only a portion of your term coverage to permanent insurance. This can help you secure lifetime coverage while keeping premiums manageable.

- When is my conversion deadline?

Most policies have a conversion deadline, and missing it could mean you lose the opportunity to convert without undergoing a medical exam. You must review your policy documents or contact your advisor to confirm the timeline.

- Will the new policy match my financial goals?

Not all whole life policies are created equal. Some may offer better cash value growth or dividend performance. Make sure the product you’re converting to supports your financial objectives, whether that’s long-term stability, estate planning, or wealth accumulation.

What are the benefits and drawbacks of converting term life to whole life insurance?

Before you convert term insurance to whole life, it’s important to assess the benefits of converting term life to whole life insurance and any potential drawbacks it may have

| Pros of converting term to whole life insurance | Cons of converting term to whole life insurance |

| No medical exam required | Higher cost than term life insurance |

| Locks in lifelong coverage | May require reducing the death benefit to fit your budget |

| Builds tax-deferred cash value, and dividends in case of a participating policy | |

| Fixed premiums for life |

Term conversion deadlines and age restrictions

Most term life insurance policies in Canada come with strict conversion deadlines either tied to a specific policy anniversary or a maximum age, often 65 or 70. These deadlines determine how long you have to convert term insurance to whole life without medical underwriting.

If you miss the conversion window, the option to switch expires, and term insurance can no longer be converted to whole life insurance. At that point, you would need to apply for a new permanent policy with full medical underwriting, which may not be feasible if your health has changed.

| Insurance company | Conversion deadline (Age) | Available permanent products | Partial conversion allowed |

| Assumption Life | 75 | Non-participating whole life | No |

| Beneva | 71 | Term-100, non-participating whole life, universal life | No |

| BMO Insurance | 70 | Term-100, non-participating whole life, universal life | Yes (Minimum 50% permanent coverage) |

| Canada Life | 70 | Participating whole life, universal life | Yes (Minimum 40% permanent coverage) |

| Canada Protection Plan | 70 | Non-participating whole life | No |

| Desjardins | 70 | Term-100, non-participating whole life, participating whole life, universal life | No |

| Empire Life | 75 | Non-participating whole life, participating whole life | No |

| Equitable Life | 71 | Participating whole life, universal life | Yes (Minimum 50% permanent coverage) |

| Foresters | 71 | Non-participating whole life, participating whole life | No |

| Humania | 65 | Term-100 | No |

| Industrial Alliance | 71 | Non-participating whole life, participating whole life, universal life | No |

| ivari | 71 | Universal life | No |

| Manulife | 75 | Participating whole life, universal life | Yes (Minimum 50% permanent coverage) |

| RBC Insurance | 71 | Term-100, participating whole life, universal life | Yes |

| Sun Life | 75 | Non-participating whole life, participating whole life, universal life | Yes |

| UV Insurance | 70 | Non-participating whole life | No |

How long does the conversion process take?

The conversion process for term life insurance to whole life typically takes 2 to 6 weeks, depending on the insurer and how quickly you submit the required paperwork

Partial conversion options and financial flexibility

When converting term insurance to whole life, you don’t have to convert the entire policy. Many Canadian insurers allow partial conversions, giving you the option to transfer only a portion of your term life insurance coverage into whole life insurance.

This approach offers valuable financial flexibility because:

- It allows you to secure permanent coverage without committing to the full cost of converting 100% of your policy

- You can retain the remaining term life insurance to cover short-term needs, while the converted portion provides lifelong protection and cash value growth

- It helps manage premium costs, especially if you’re not ready to take on the higher full cost of whole life insurance

Checklist after getting a new permanent policy

After converting to or purchasing a new permanent life insurance policy, make sure you review and confirm the following:

- New coverage details: You must verify the coverage amount, policy type (e.g., whole life, universal life), and premium structure (e.g., limited-pay, like 20-pay, or lifetime pay) to ensure they match your needs and budget

- Policy features: You must also understand how the policy builds cash value and what dividend options are available (if it’s a participating policy), and check whether riders and benefits from your previous term policy have been transferred or if they need to be reapplied for

- Ownership and beneficiary designations: You need to confirm who owns the new policy, especially if the policy is part of a business or estate plan. Additionally, you must review and update beneficiary designations to reflect your current wishes, and clarify whether they are revocable or irrevocable

- Coordinate cancellation of the old term policy: Finally, if your term policy is still active during the conversion, ensure there’s no lapse in coverage before cancellation. Once the permanent policy is issued and in force, cancel the old term policy to avoid duplicate coverage and billing

Can Term to 100 insurance be an alternative to whole life?

Term to 100 insurance can offer permanent coverage, but it lacks many of the long-term benefits that come with whole life insurance. While both options provide lifetime protection, whole life goes a step further by building guaranteed cash value, offering tax-sheltered growth, and creating an asset you can leverage during your lifetime.

Whole Life vs. Term to 100 insurance

| Whole life insurance | Term to 100 insurance |

| Builds cash value that can be accessed through loans or withdrawals | No cash value or living benefits |

| Offers tax-efficient estate planning with a guaranteed payout | Lifetime death benefit only |

| Stable premiums with lifelong coverage | Stable premiums, but no added value or growth |

| Can be participating, earning dividends to grow the policy | Non-participating; no potential for dividends |

| Suitable for wealth building, estate planning, and flexibility | Suitable for basic lifetime protection at lower cost |

Can you ever cash out a term life insurance policy?

No, term life insurance does not have any cash value, so you cannot cash it out. It provides pure protection for a set period if you outlive the term, the policy simply expires with no payout or residual value.

Unlike whole life insurance, which builds cash value over time, term life is designed for affordable, temporary coverage without savings or investment components. If you’re looking for a policy that allows you to build equity or access funds while you’re alive, consider converting your term insurance to whole life before your conversion window closes.

Frequently asked questions

Can term insurance be converted to whole life without a medical exam?

Yes, most Canadian term life insurance policies with a conversion option allow you to convert to a whole life policy without medical underwriting as long as you remain within the policy’s conversion period. This feature is especially valuable if your health has changed, making it difficult or expensive to qualify for new coverage.

Is converting term insurance to whole life a good idea?

Converting term insurance to whole life can be a beneficial move if you’re looking for permanent coverage, tax-advantaged cash value growth, or estate planning benefits. However, it’s not ideal for everyone. If budget is a concern or your insurance needs are temporary, it may be better to keep your existing term policy or explore other options. Always assess your long-term goals and financial capacity before making the switch.

How long do I have to convert term to whole life insurance?

Most term policies in Canada allow you to convert to whole life until a specific age typically 65 or 70, or until the end of the level term period, whichever comes first. Missing this deadline means losing the ability to convert without medical evidence.

Are there any fees associated with converting term to whole life insurance?

There are no direct fees associated with converting a term life insurance policy to a whole life policy in Canada. However, the cost implication lies in the higher ongoing premiums of whole life insurance.

Term life insurance provides affordable protection for a specific period but as your financial needs evolve, so should your insurance. Converting your term policy to whole life insurance can offer permanent coverage, guaranteed premiums, and the added benefit of cash value accumulation. This article breaks down how the conversion process works in Canada, the deadlines to watch for, and whether it’s the right move based on your goals, health, and budget.

1-888-601-9980

1-888-601-9980