Canadians are underinsured.

Our first State of the Nation: Canadian Life Insurance Trends 2019 seeks to determine consumer trends and attitudes about life insurance planning across the country, and it uncovers several stunning findings about the lack of financial protection amongst Canadians in 2019.

Unlike most life insurance surveys that poll all Canadians as respondents, our study sought feedback only from those Canadians who actually need Life Insurance. Thus the results you see below are based on answers from those Canadians that have financial dependents (i.e. family members that depend on their income for settling debts such as mortgage and credit cards, or for support in paying for education, living expenses, and more).

The results – presented below – are eye-opening, with hard numbers revealing startling truths about the state of Canadians’ financial protection and key takeaways around the national state of life insurance ownership, needs, knowledge, and appetite for change.

Canada: An uninsured nation?

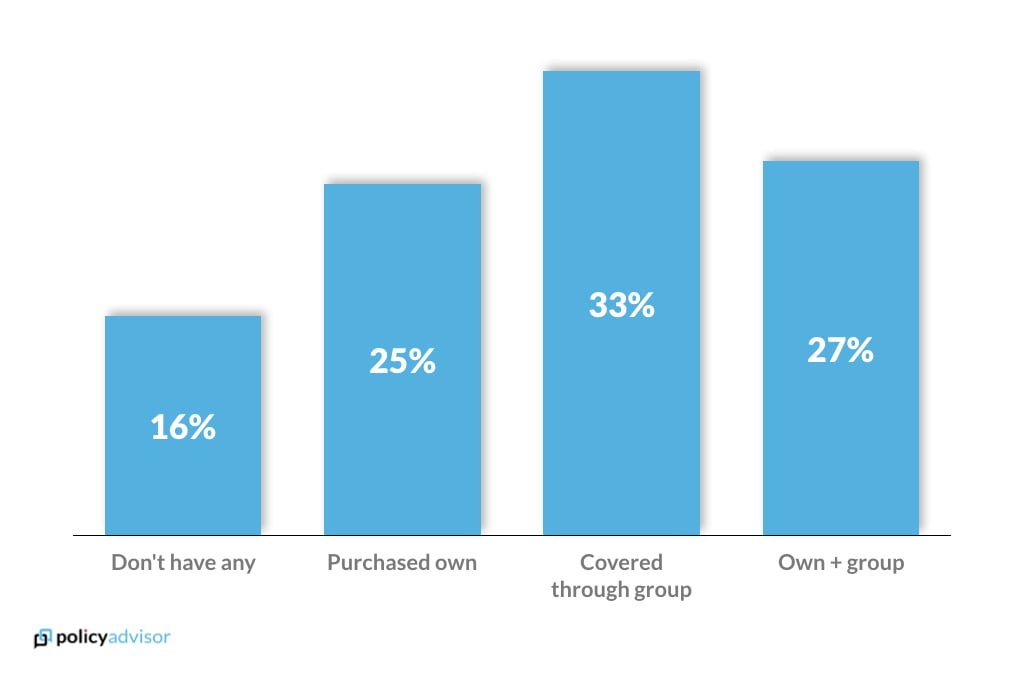

Of those who have financially dependent family members, 16% do not have any life insurance coverage. But almost as problematic is the fact that 33% of respondents have coverage solely through their employer or group. This means 49% of Canadians with dependents have never purchased life insurance themselves.

While a life insurance policy through one’s employer or group affiliation is better than none at all, it can be problematic for a couple of reasons. Firstly, in most cases employer-provided coverage is minimal: a typical group benefit life insurance policy is equivalent to only one or two years of the policyholder’s salary. The bigger issue is that if the insured leaves the particular job, group, or association through which they have the policy, they mostly lose this insurance coverage.

They also lose time; individual coverage is less expensive in one’s earlier years when there are fewer potential complications to medical underwriting. While a group policy is a nice top-up, it should not be the primary source of one’s coverage.

How did you acquire life insurance coverage?

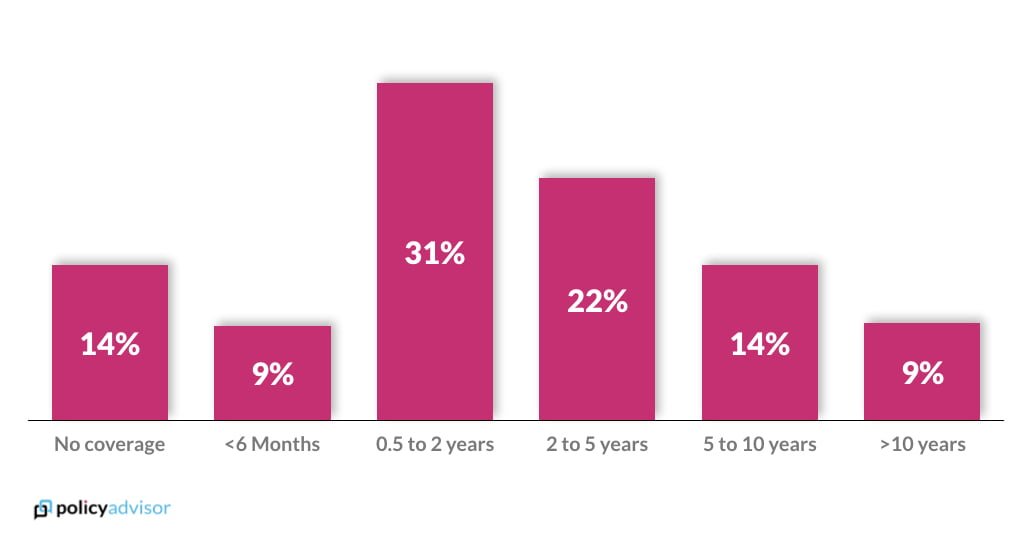

The biggest surprise was the extent to which Canadians are underinsured: The Financial Consumer Agency of Canada suggests that life insurance should cover between seven and ten years of the holder’s annual income, which is in line with many industry practitioners’ recommendation of ten years of annual income coverage. Yet, well over half of the study’s respondents (54%) have coverage equal to only two years or less of their annual salaries. A mere 22% had between two and five years’ worth of coverage.

Only nine percent of those surveyed are solidly within the recommended range.

Overall, this means 77% of Canadians are dramatically under-insured, with policies that will only cover their obligations for at most five years, a full two years less than the minimum recommendation.

How much of your annual income would your life insurance cover?

Key life insurance ownership takeaways

- 49% of Canadians with dependents have never purchased life insurance

- 54% of the same group have only covered 2 years or less of their salary should they pass

- 91% of Canadians are dramatically under-insured

Life insurance needs: Canadians not honest with themselves

Just how significant is this life insurance shortfall? When asked for hard numbers, the average shortfall among respondents was $256,000. What is even more startling is that this is a self-acknowledged shortfall that respondents know exists but they haven’t started bridging it yet.

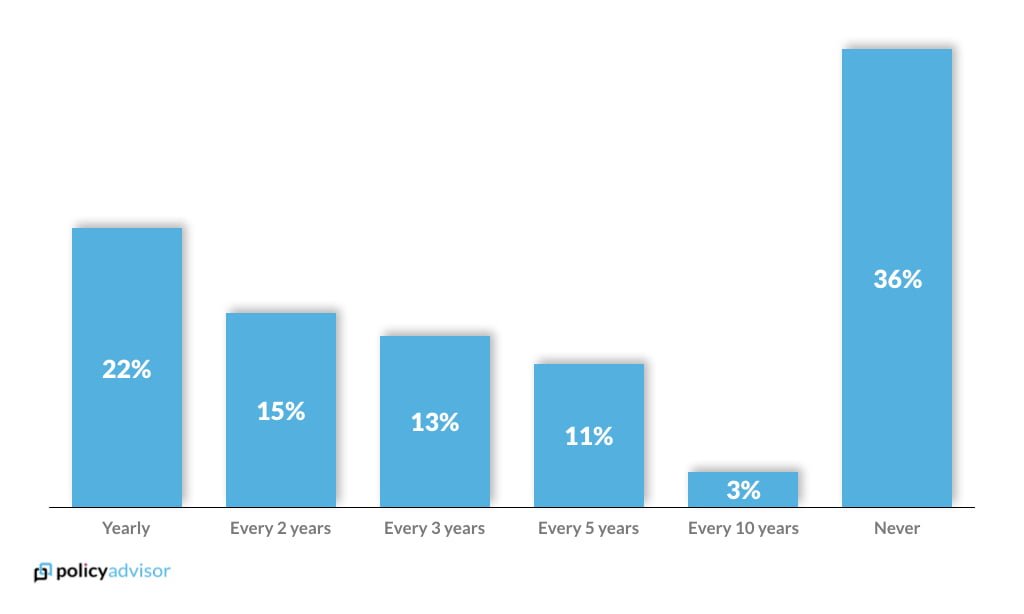

There are several potential reasons for a shortfall like this to exist. First, many may not realize how underinsured they really are, until they are asked the question. When asked how often they reviewed their life insurance coverage, less than a quarter (22%) of respondents indicated they did so annually (the recommended frequency).

Twenty-eight percent said they review life insurance coverage either every two or three years, but more than a third (36%) say they have never reviewed their life insurance coverage and needs. All in, almost 80% of Canadians fail to sufficiently review their life insurance coverage.

Suggested reading

How often do you review your life insurance coverage?

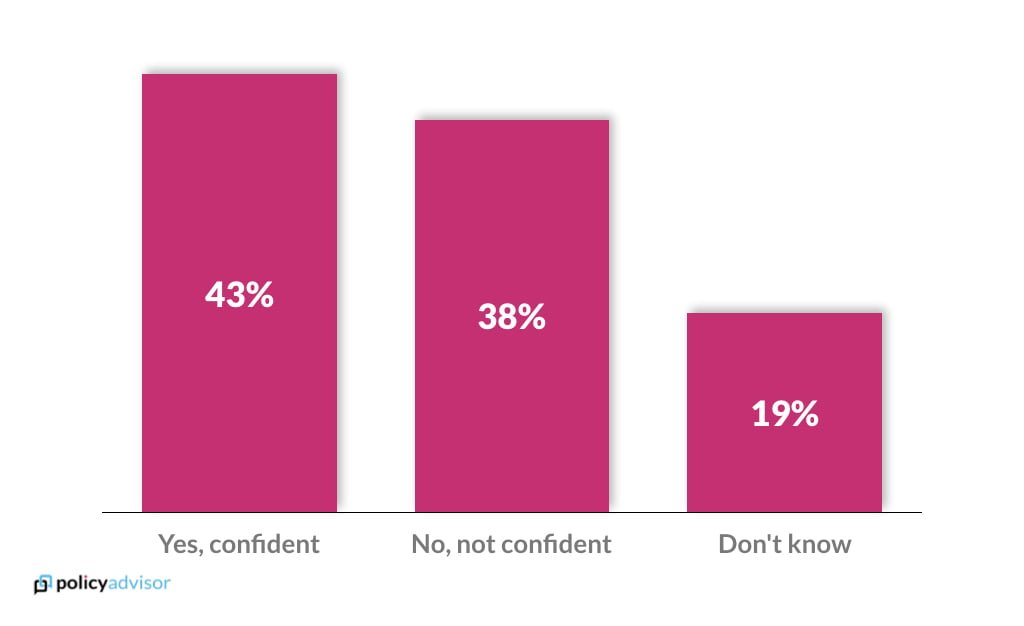

And, despite more than three quarters of Canadians being significantly under-insured, nearly half of respondents (43%) say they are confident that they have adequate life insurance, with 57%knowing about or unsure of the adequacy of their coverage.

How confident are you in the adequacy of your life insurance coverage?

This shows a definite disconnect between the perception and reality of the country’s financial protection. Canadians are either misinformed, or simply don’t understand what their life insurance needs are. Traditional advisors and brokers don’t make it easy to educate ones’ self in regards to the ins and outs of life insurance.

Regardless, it’s clear Canadians require more education when it comes to making life insurance decisions – and luckily PolicyAdvisor.com is dedicated to giving them the answers they seek.

Key life insurance needs takeaways

- The average self-acknowledged life insurance shortfall for Canadians with financial dependents is $256,000

- Almost 80% of Canadians fail to adequately review their life insurance coverage.

- Fifty-seven percent don’t know or acknowledge they don’t have enough life insurance coverage.

Life insurance literacy – not a thing yet

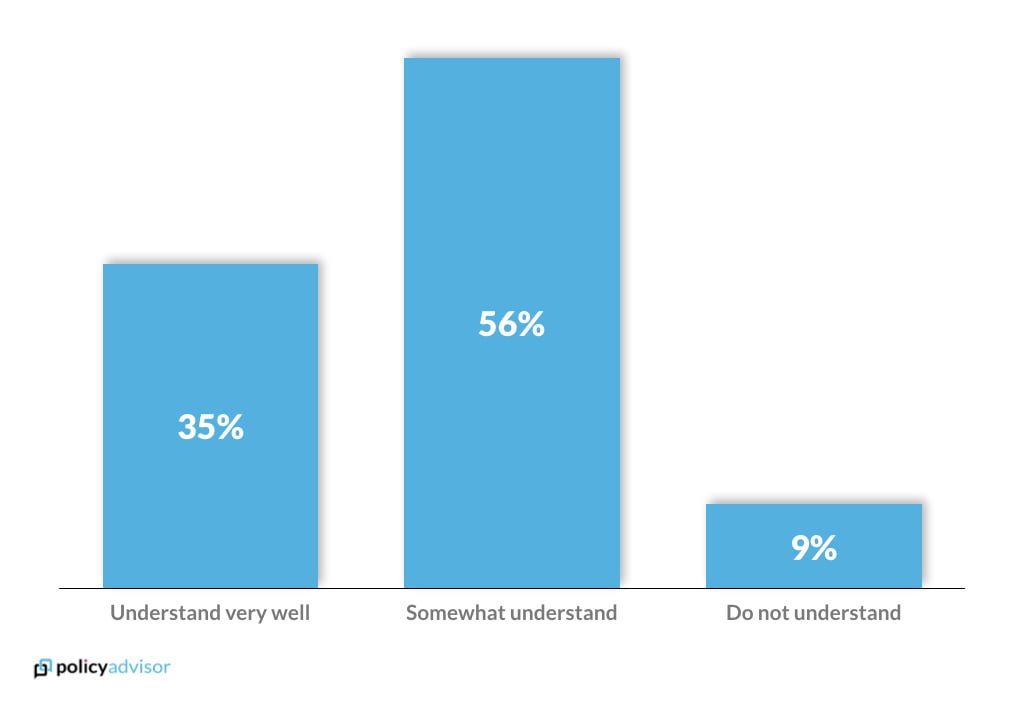

Only 35% of Canadians claim they understand how their life insurance policy works “very well,” versus the balance who only understand their coverage “somewhat” or not at all.

Do you understand how your life insurance policy works?

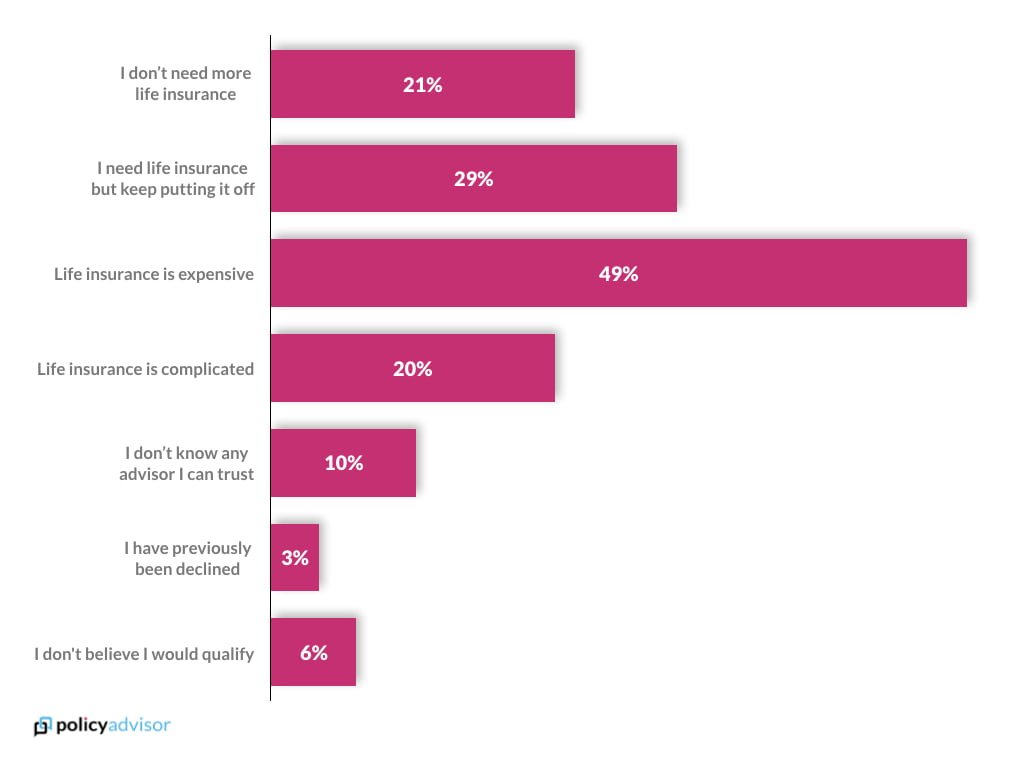

In light of this knowledge deficit, Canadians offered many reasons for not obtaining additional life insurance, with almost half indicating cost and 20% the aforementioned lack-of-understanding as a barrier.

This further underscores the need for better education and transparency around life insurance. There is a clear misconception that life insurance policies are unaffordable and complicated. This is unfortunate, as there are potentially many ways Canadians can provide themselves with financial protection within their budget with straightforward terms and coverage.

Other reasons for not obtaining additional insurance included procrastination (29%) and lack of a trusted advisor (10%).

Why have you not purchased life insurance?

Key life insurance knowledge takeaways

- Sixty-five percent of those surveyed don’t totally understand how insurance works

- Almost half of those surveyed think life insurance is prohibitively expensive

- Twenty percent of those surveyed put off purchasing life insurance because they think it is too complicated

Appetite for digital disruption

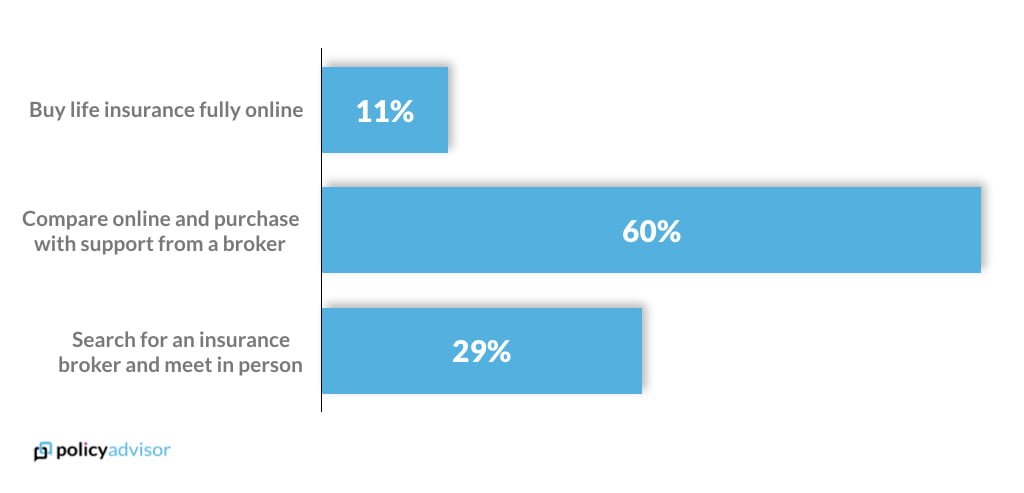

Thanks to an evolving digital landscape and a tech-savvy population, Canadians are able to better educate themselves about their insurance needs. However, while they are happy to seek information online, they are slower on the uptake when it comes to purchasing life insurance digitally.

This is gradually improving. Although 29% of respondents said they prefer a traditionally fulfilled in-person process with an advisor, 60% indicated a preference for an online process with some support to complete the transaction. The main takeaway? Over 70% of Canadians crave an online component to their life insurance buying journey.

How would you prefer to purchase life insurance?

While globally, digital fulfillment for life insurance is quite common, this is still new territory for Canadians. Despite some hesitations, we see a definite appetite amongst Canadians to add life insurance coverage, if supported through online pathways, and PolicyAdvisor.com is here to help guide them through their life insurance buying journey. One life insurance purchase at a time.

Download the report below, or check it out and pass it along using Slide Share.

The survey was conducted via Survey Monkey’s Canadian panel in September 2019 and included 500+ qualified respondents. All graphs rounded to the nearest percentage point.

Our State of the Nation report on life insurance trends in Canada shows how underinsured the country is and why we are hesitant to buy life insurance.