- Majority of Canadians feeling anxious about their finances

- Almost 2 in 5 Canadians rely solely on their employer for life insurance coverage

- Cutting expenses, but not premiums

- What types of insurance to Canadians value most

- How important is life insurance to Canadians?

- Are Canadians buying more life insurance coverage?

- Barriers to purchasing life insurance

- Customers expect insurance to work like other online retailers

Canadians are anxious right now. A global pandemic has changed the way we interact, live, and work. The State of the Nation: Life Insurance Trends 2020 – Pandemic Checkup is a follow-up to our 2019 State of the Nation. Back then we examined consumer trends and attitudes about life insurance planning across the country; but, a lot can change in a year! This year’s checkup seeks to determine consumer attitudes and buying behaviour towards life insurance coverage considering COVID-19’s impact on their lives.

Our research – which you can find below – shows that the recent Coronavirus pandemic has changed the way Canadians value life insurance and introduced an urgency to their need for coverage. Canadians are looking to protect themselves from unforeseen circumstances now more than ever, and are held back by misconceptions when it comes to extending their life insurance coverage during COVID-19.

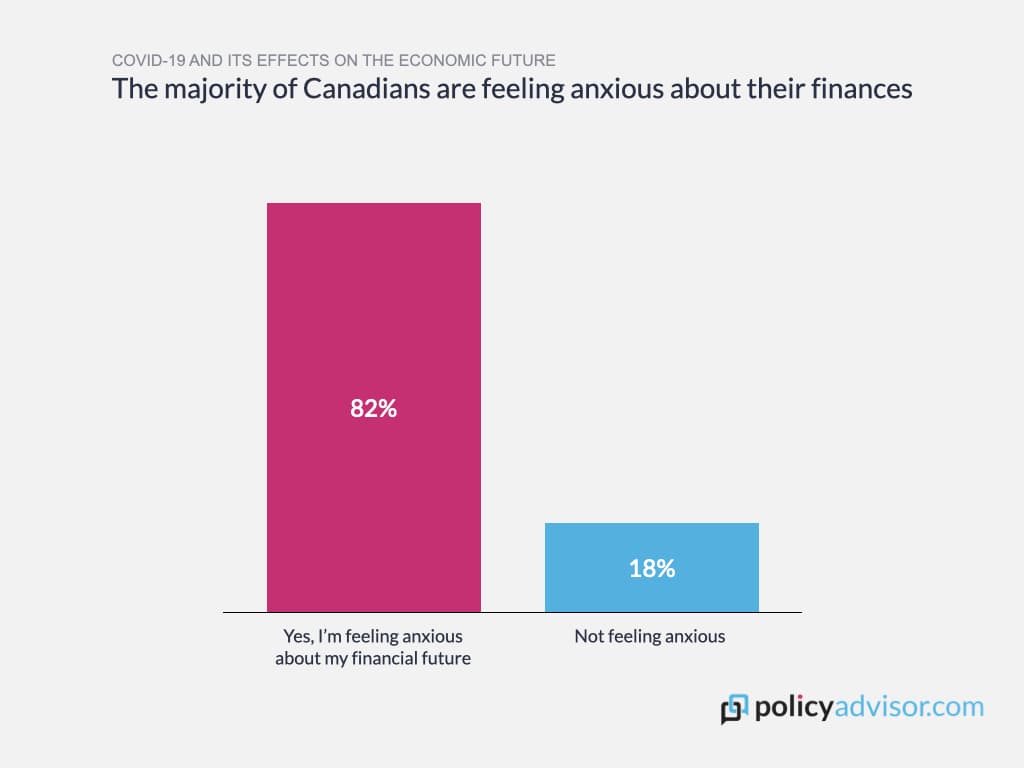

Majority of Canadians feeling anxious about their finances

More than 8 out of 10 Canadians with dependents feel anxious about their financial future in the face of COVID-19. This could be due to many factors including a pessimistic view on economic recovery, especially for those that have lost or are at the risk of losing employment or those needing to cash out their retirement savings at this time. As public and private debt continue to soar, austerity measures are expected in the medium term.

Hopefully, with recent news of effective vaccines on the way in early 2021, some of these anxieties will prove to be unfounded.

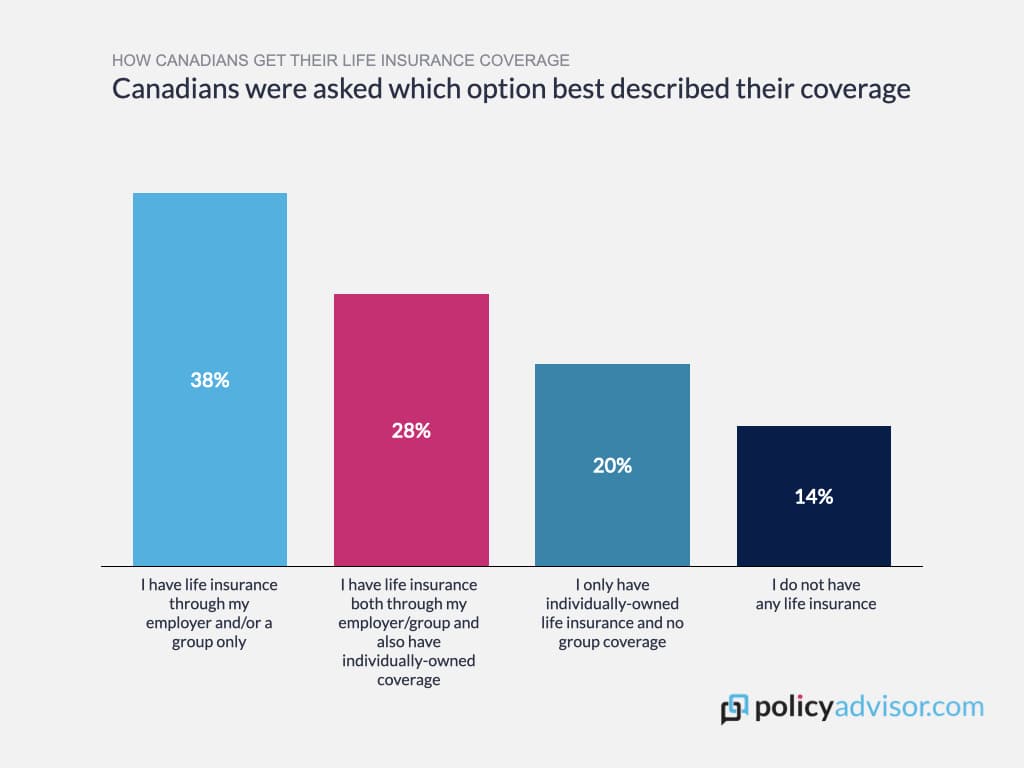

Almost 2 in 5 Canadians rely solely on their employer for life insurance coverage

38% of respondents stated they only have life insurance coverage through their group or workplace benefits, while 14% stated they don’t have any life insurance coverage at all.

Overall, 65% of Canadians say they rely on their group benefits for some or all of life insurance coverage. Recent research from the Conference Board of Canada suggests that 12% of companies making layoffs due to COVID-19 don’t plan on extending workplace benefits to laid-off employees. This could leave some Canadian households with a significant insurance shortfall.

Almost half of respondents say they have some sort of individually-owned coverage whether it is their sole coverage or augments the policy they have through their workplace benefits.

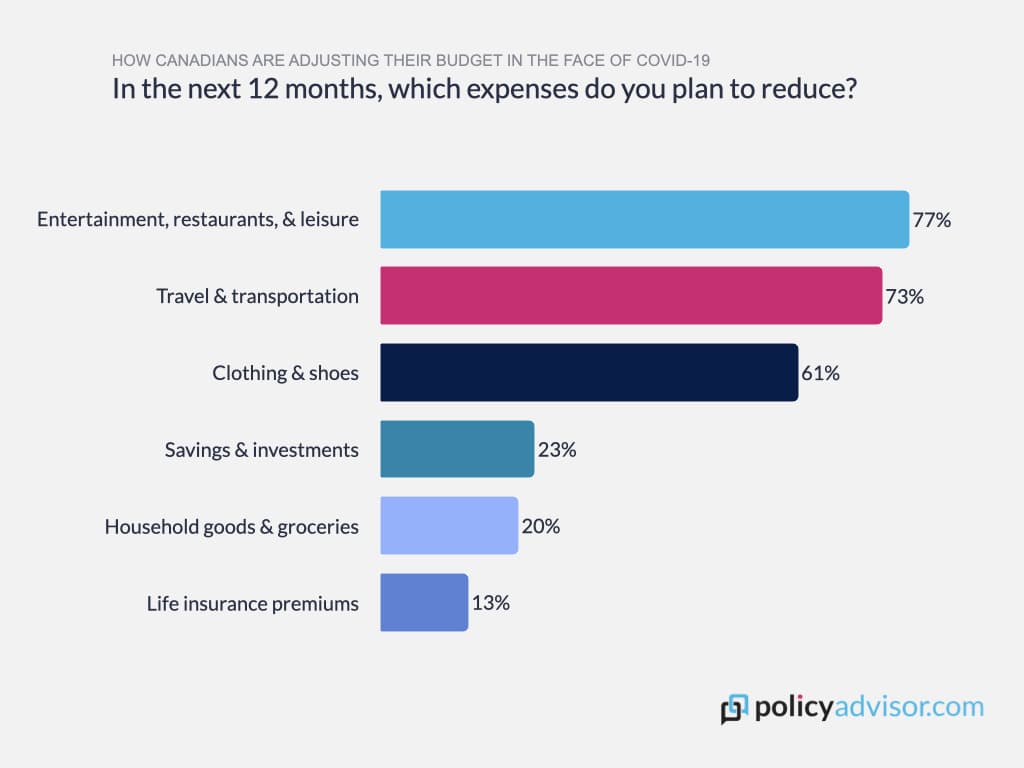

Cutting expenses, but not premiums

Only 13% of Canadians plan on trying to save money by reducing what they spend on life insurance premiums. Instead, most Canadians plan on tightening their budget when it comes to entertainment, restaurants, travel, and clothing.

It’s safe to say that Canadians value life insurance and the security it offers in tumultuous times. However, for those Canadians that do feel the need to take a critical financial eye to what they are spending on coverage, there are ways to save money on life insurance.

They have options such as:

- Evaluating their premiums with a broker and seeing if there is a less expensive alternative

- Getting a new policy instead of renewing coverage when their policy expires

- Replacing expensive creditor or mortgage insurance with individual term life coverage

- Choosing term life insurance coverage if their needs are short term instead of whole life or universal life policies

- Getting a medically underwritten policy, which is generally less expensive than non-medical policies

- Switching to non-smoker rates if they were initially approved as a smoker and have since quit smoking for at least one year

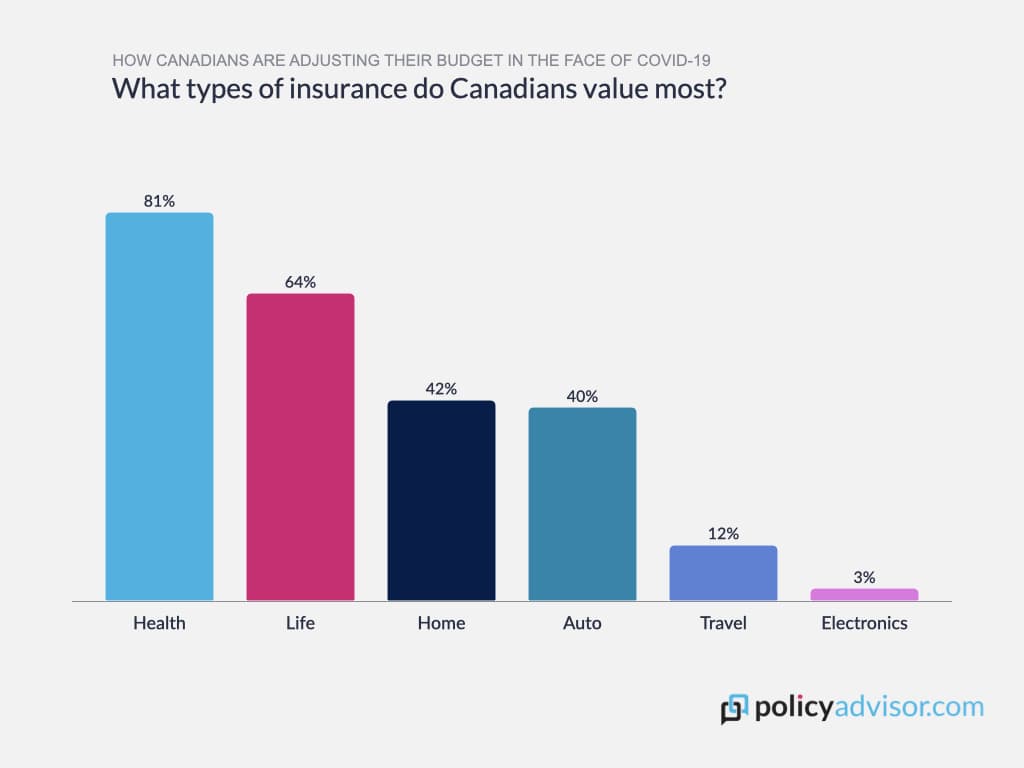

What types of insurance to Canadians value most

Coverage that protects one’s life and health is considered the most essential to Canadians right now; this is understandable given the health concerns of the current pandemic.

Home and auto coverages are deemed a little less important. The devaluation of auto insurance can be attributed to more people working from home and no longer using their vehicle to commute; this has led to many Canadians choosing a lower mileage tier in their auto coverage.

Travel insurance is not highly valued at the moment with travel restrictions in place in most parts of Canada. This answer may have been different in March when COVID-19 travel restrictions were new and led to many trip cancellations for Canadians, both abroad and in their own country.

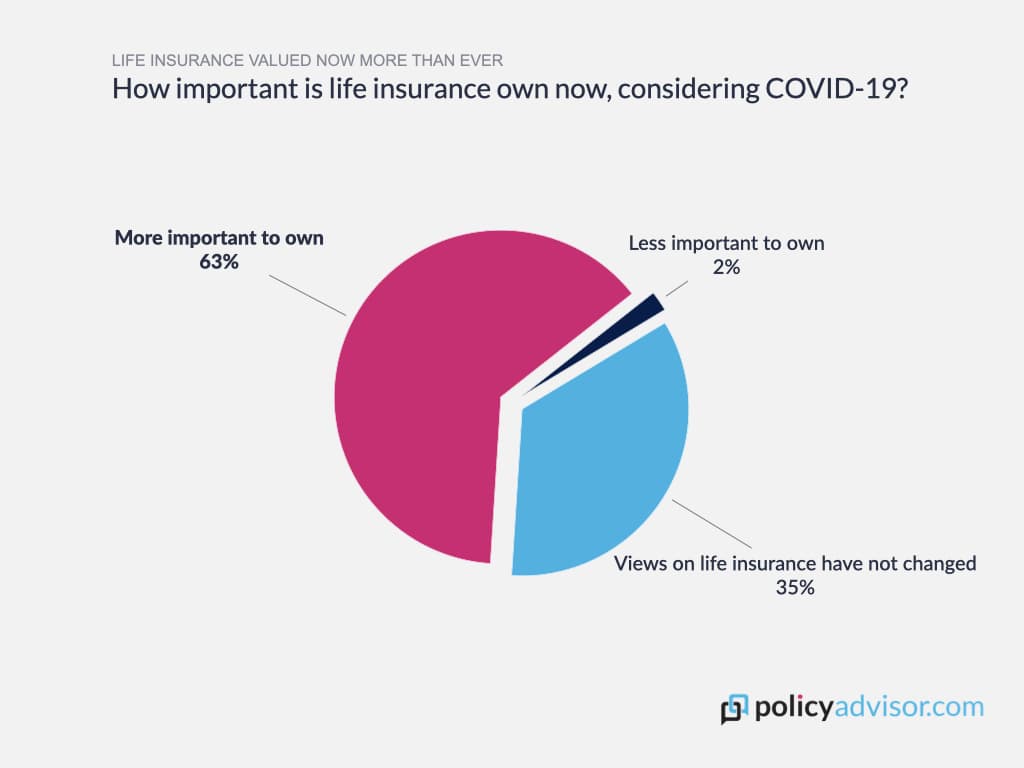

How important is life insurance to Canadians?

Only 2% of Canadians feel life insurance is less important to own considering COVID-19, while 35% have not changed their views one way or the other.

However, almost two-thirds (63%) of Canadians now feel life insurance is more important to own than before the pandemic hit. COVID-19 has led to a majority of Canadians realizing how suddenly life-changing events can affect the financial outcome of those that depend on them.

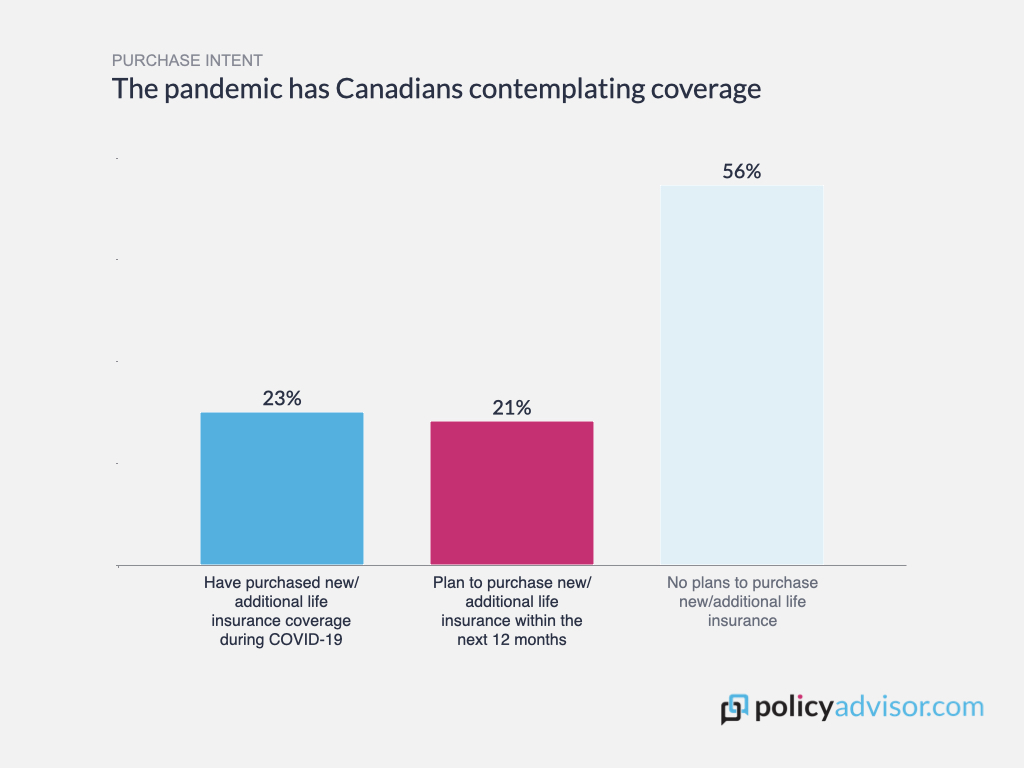

Are Canadians buying more life insurance coverage?

44% of Canadians plan on or have already purchased additional life insurance coverage because of COVID-19. COVID-19 has been a trigger for Canadians to purchase life insurance and a wake-up call for them to understand the state of their finances, create a budget and plan, and lock in the financial support and security they require to feel safe and sound for anything life may throw at them next.

While the other 56% of Canadians may have made no changes to their life insurance, this can be attributed to their comfort with their level of coverage and knowledge that the insurance products they’ve chosen can adequately protect them at this time.

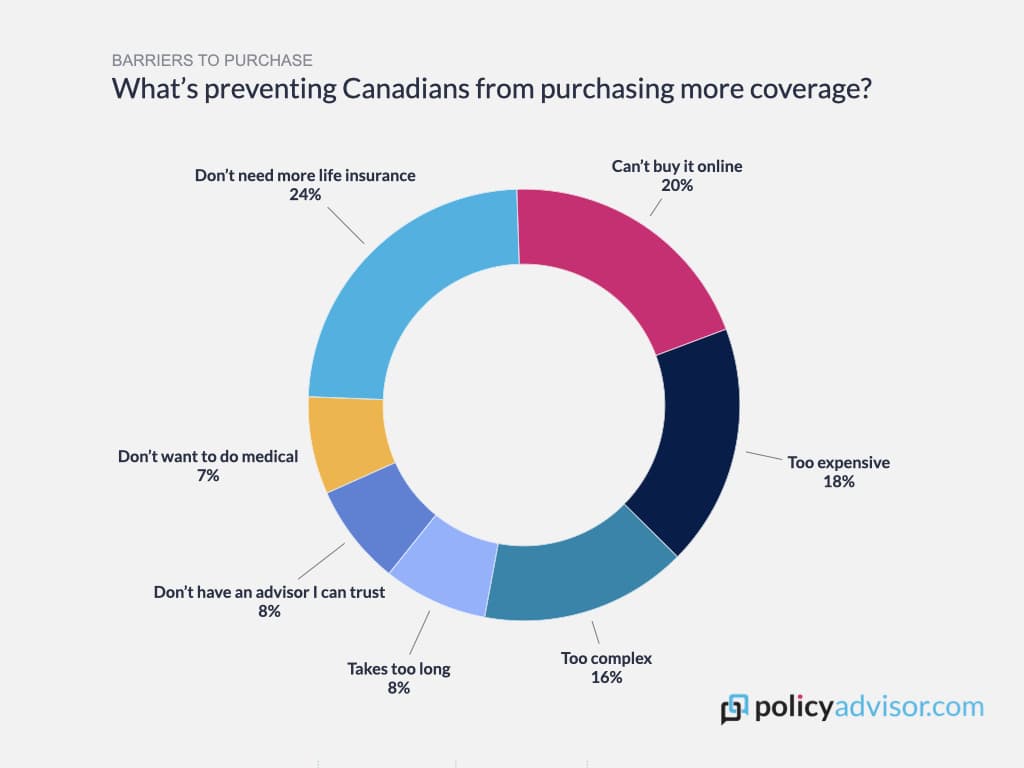

Barriers to purchasing life insurance

The perceived inability to purchase coverage online prevents 30% of Canadians from purchasing life insurance or adding to their existing coverage. Since COVID-19, Canadian consumers have seen industries and legacy companies adapt to the new reality of online service fulfillment. In turn, they expect insurance companies to work like e-commerce but have not seen that expectation realized.

27% feel life insurance is too expensive and 23% cite product complexity. There is a clear knowledge gap when it comes to the life insurance marketplace.

Canadians can save money and learn more about their potential policies by comparing quotes with an online broker.

Almost 12% of respondents feel buying life insurance takes too long, which can also be addressed with more modern insurance tools and practices via an online broker. 11% of respondents don’t want to participate in the exams or blood collection that can accompany medical underwriting. This speaks to another blind spot for Canadian insurance seekers unaware of the many non-medical life insurance options available.

Lastly, a lack of need prevents 36% of Canadians from purchasing any additional coverage, as they most likely already have coverage and feel no need for an additional policy.

Customers expect insurance to work like other online retailers

Speaking to the aforementioned expectations of shoppers in the post-COVID landscape, the majority of Canadians would purchase life insurance online if given the choice. Only 21% of respondents now insist on meeting with a broker (compared to almost 30% in our previous survey).

Luckily for Canadians, online options for life insurance have increased post-COVID. Many insurance companies are approving up to $1 million in coverage (with some even going up to $2 million) without requiring a medical exam (for those below the age of 50 and in regular health).

Unfortunately, almost a quarter of respondents are not sure one way or the other if they would purchase life insurance if they complete their transaction online. More solid education from carriers and brokers around the options that are available to them could help them make an informed choice.

Final thoughts

The biggest realization one can take away from this research is that COVID-19 has changed Canadian opinions about how much coverage they need and how they want to get it. 44% of respondents have either taken out new life insurance coverage or plan on doing so in the near future.

The appetite for online fulfillment of a life insurance policy has increased 50% year over year. Coronavirus has jump-started several industries into a new online era, and life insurance is no different. If there is any silver lining, it is the innovation in Canadian policy delivery that we have seen so far in 2020, and the even greater advances we’ll see in 2021 and beyond.

The survey was conducted via Survey Monkey’s Canadian panel in November 2020 and included 500+ qualified respondents. All graphs rounded to the nearest percentage point.

A global pandemic has changed the way we interact, live, and work, and life insurance is affected too. Canadians value life insurance more than ever in 2020 as COVID-19 changed their outlook on life, while also completely rearranging their work and spending habits.

1-888-601-9980

1-888-601-9980