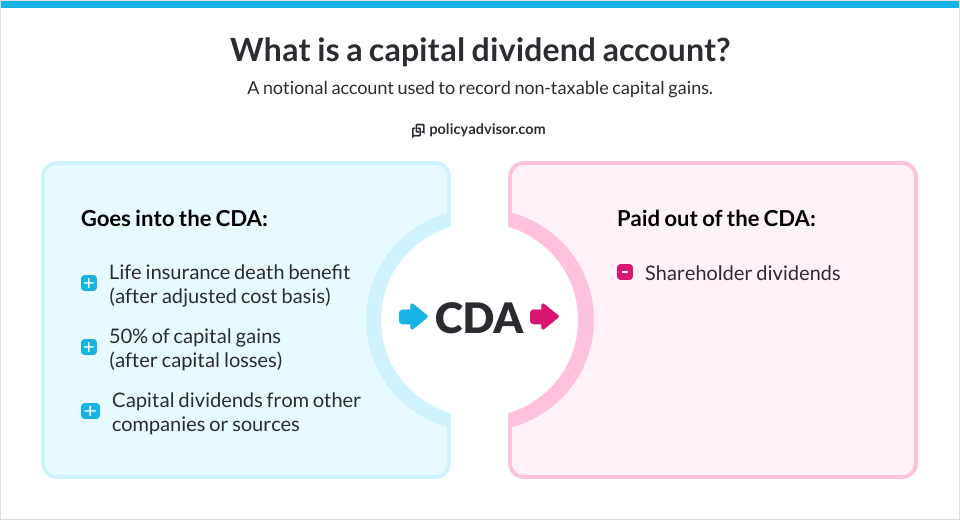

- The Capital Dividend Account (CDA) is a special corporate account used to allow private Canadian corporations to distribute eligible capital surpluses to their shareholders, in the form of tax-free dividends

- The CDA records various transactions, such as capital gains, tax-free life insurance proceeds, and capital dividends received from other corporations

- The Capital Dividend Account is vital for private corporations as it provides a tax-efficient way to distribute eligible corporation surpluses to its shareholders and facilitate estate planning and wealth management for business owners

- What is a capital dividend account?

- Who can set up a capital dividend account in Canada?

- How does a capital dividend account work?

- What goes into a capital dividend account?

- What is the adjusted cost basis of a life insurance policy?

- Why do you need a capital dividend account?

- How does the CDA enhance tax-efficient wealth transfer for small business owners?

- How do businesses calculate their CDA balance?

- Is a capital dividend account taxable in Canada?

- FAQs about capital dividend accounts

Tax savings are an important part of smart financial planning, and a capital dividend account (CDA) can help Canadian small businesses stay on top of it.

In this article, we’ll dive into what CDAs are, how they work within the context of life insurance, why they’re important for your business, and how they’re used in Canada.

What is a capital dividend account?

A capital dividend account (CDA) is a special type of account allowed under the Canadian tax law that records the tax-free surpluses that a privately-owned Canadian corporation can distribute to its shareholders, in the form of tax-free dividends.

It’s not an actual financial account like a chequing or savings account. Instead, it is considered a “notional account.” Its only purpose is to keep a record of tax-exempt surplus, available to be sent as dividends to shareholders.

Who can set up a capital dividend account?

In Canada, a Capital Dividend Account (CDA) can be established by small business corporations that are designated as Canadian-controlled private corporations (CCPCs). CCPCs are generally private corporations that are Canadian-owned and controlled, as defined by the Canada Revenue Agency (CRA).

The CRA decides how much can go into a business’ CDA. Normally, 50% of capital gains and all life insurance proceeds, minus the adjusted cost basis (ACB) goes into the CDA. (More on ACB below).

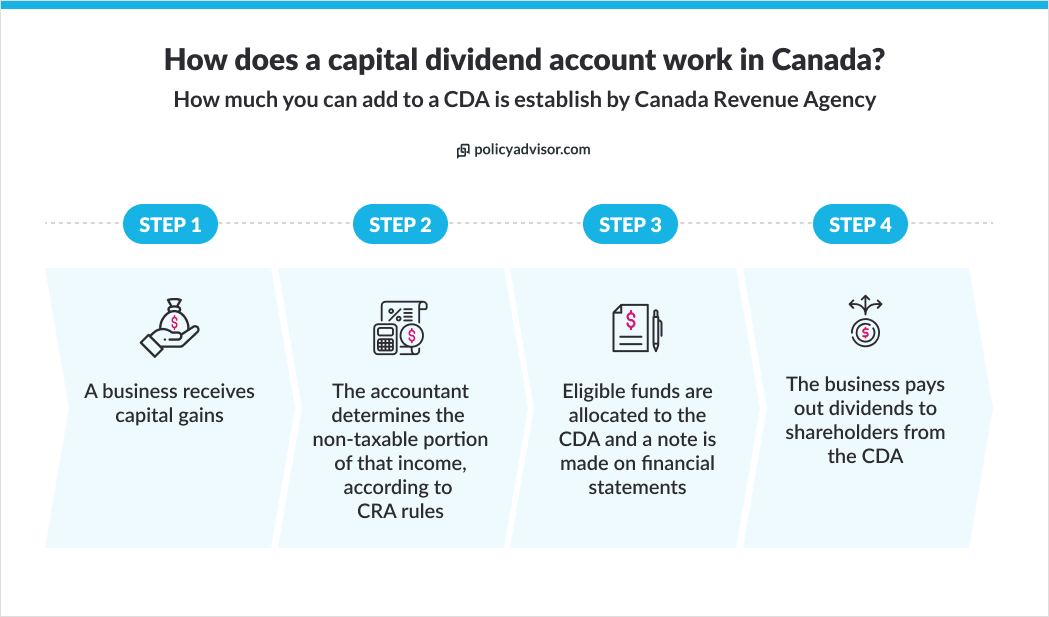

How does a capital dividend account work?

A capital dividend works like a record where certain forms of eligible capital surpluses flow through. It’s only notional — the money never sits in an account like it would a chequing or saving account. The CRA has established a set formula for how much capital a business can put into a CDA.

Setting up a CDA means keeping track of transactions like capital gains, tax-free life insurance proceeds, and capital dividends received from other subsidiary companies. Corporations need to follow CRA rules to manage the CDA correctly. It’s important for companies to work with tax accountants or lawyers who know Canadian tax laws to record and use the CDA effectively for distributing tax-free dividends to shareholders.

Here’s a breakdown of how it works:

Accountants and tax specialists play a crucial role in managing CDAs. For a business to get the most tax benefits and avoid mistakes that can lead to tax consequences, they need these professionals to keep accurate records of:

- Where those funds came from

- How much goes into the CDA

- How much comes out of the CDA

- Where those funds are going

- What the CDA balance is

What goes into a CDA?

Only specific types of income or surpluses can go into a capital dividend account in Canada. The types of income eligible for a CDA are mainly:

- Life insurance proceeds — Proceeds from a life insurance policy in excess of the adjusted cost basis of the policy

- Capital dividends — A private company can get dividend payments on a tax-free basis from other businesses. Capital dividends payable to a business can go into their CDA

- Non-taxable capital gains — The non-taxable portion of capital gains realized on the sale of assets and investments. In Canada, 50% of capital gains are not subject to tax. That 50% can be credited into the CDA, but only after accounting for losses. Any gains in excess of non-allowable capital losses will go into the CDA

What is the adjusted cost basis of a life insurance policy?

The adjusted cost basis (ACB) of a life insurance policy is its overall value, beyond the cost of the death benefit. These cost factors include:

- Premiums paid

- Dividends received

- Policy loans taken out

- Cash value withdrawals made

- Policy changes or upgrades

- Other adjustments to the policy

An insurance company looks at these factors to determine how much a life insurance policy is worth for tax purposes. This determines how much of a payout can be added to a company’s CDA.

💡 Life insurance proceeds in excess of a policy’s ACB can be added to a capital dividend account — this may or may not be the full death benefit amount.

Why do you need a CDA?

Capital dividend accounts are a powerful planning tool that can help businesses save on taxes. It can be used to:

- Hold tax-free life insurance proceeds from policies that were owned by the company or a business owner.

- Make tax-free dividend payments to shareholders or a deceased shareholder’s estate.

- Fund buy-sell agreements to buy out a deceased owner or partner’s shares.

- Manage tax-free assets for a Canadian business owner’s estate plan.

- Cover other commercial obligations like outstanding loan balances, business expenses, settlement payments, and more.

How does the Corporate Dividend Account (CDA) enhance tax-efficient wealth transfer for small business owners?

The CDA plays an important role in facilitating tax-efficient wealth transfer for small business using life insurance.

When the corporation receives the tax-free death benefit from the life insurance policy upon the owner’s death, a portion of this death benefit can be paid out to the corporation as a tax-free dividend through the CDA.

The CDA is a notional account that tracks the corporation’s tax-paid surplus, which represents the after-tax income and capital gains that have already been taxed at the corporate level. The CDA allows the corporation to distribute these tax-paid amounts as tax-free dividends to shareholders.

By using the life insurance death benefit to credit the CDA, the corporation can pay out a significant portion of the policy’s proceeds to shareholders as a tax-free dividend. This tax-free dividend from the CDA can be received by individual shareholders without any additional personal income tax implications.

In contrast, if the corporation did not have a life insurance strategy in place, any distributions from the corporation’s investment portfolio would typically be taxable dividends, subject to personal income tax for the shareholders.

The CDA mechanism, combined with the tax-free death benefit from the life insurance policy, allows for more efficient intergenerational wealth transfer by minimizing the overall tax burden on the corporation and its shareholders.

How do businesses calculate their CDA balance?

Businesses calculate their CDA balance based on the rules established by the CRA. Only the CRA can determine how much can go into a CDA and what type of income is eligible.

It’s up to the company to keep track of the balance. Most have accountants who are responsible for this. The balance of the account should reflect:

A corporation’s CDA account balance is reviewed annually during the corporate tax filing, specifically on schedule 89. This balance diminishes under two circumstances: firstly, when a capital dividend is paid from the corporation, each payment directly lowers the CDA balance. Secondly, selling assets at a loss causes a reduction in the CDA balance by 50% of the loss’s value.

Is a CDA taxable in Canada?

No, a capital dividend account is not taxable in Canada. No payments credited to the CDA account or paid out of the account will be taxed.

But, there is an exception for shareholders who live outside of the country. Foreign shareholders may be subject to a non-resident withholding tax rate for payouts from the CDA. Although, they can have a lower rate if they live in a country that has a tax treaty with Canada, such as the United States.

Frequently asked questions about capital dividend accounts in Canada

A business doesn’t “open” a CDA in Canada the way someone would walk into a bank and open an account. Instead, the business or its accountant will make note of funds that have been allocated to the CDA once the company receives capital gains that can be added to the account.

No, you cannot withdraw funds directly from a CDA like you would from a regular bank account. It’s just for record-keeping and tax purposes.

The actual money a company receives and pays out is kept elsewhere. Accountants just use the account for record keeping of which funds flow through the account.

No, a capital dividend account cannot technically have a negative balance. Either it has tax-free allocations or it doesn’t. If it has allocations, then it has a positive balance. If it doesn’t, then the amount is just $0.

But, a business or payor corporation can distribute more than the CDA’s actual balance. Similar to an overdraft on a savings account. If this is done, though, it could cause a lot of problems for the business — like heavy tax penalties and even legal disputes.

This is why proper accounting is so important for CDAs and tax planning.

A capital dividend account is a notional account that’s used to record the non-taxable portion of a company’s income. It’s not an actual banking account, but it is a powerful tool for tax planning. CDAs are commonly used to record life insurance payouts and to arrange tax-free distribution of dividends.

1-888-601-9980

1-888-601-9980