- Mental health is considered a factor when determining life insurance eligibility

- Severity, frequency, and treatment of depression are rating considerations

- If you are at high risk of suicide, you may be declined

- There may be a suicide provision placed on your policy for the first two years

- Anti-depressants and life insurance

- How is depression defined by life insurance companies?

- How is anxiety defined by life insurance companies?

- Does depression or anxiety disqualify you from life insurance?

- What to expect when applying for a policy

- What happens if you conceal your mental health diagnoses?

- Will life insurance pay for suicidal death?

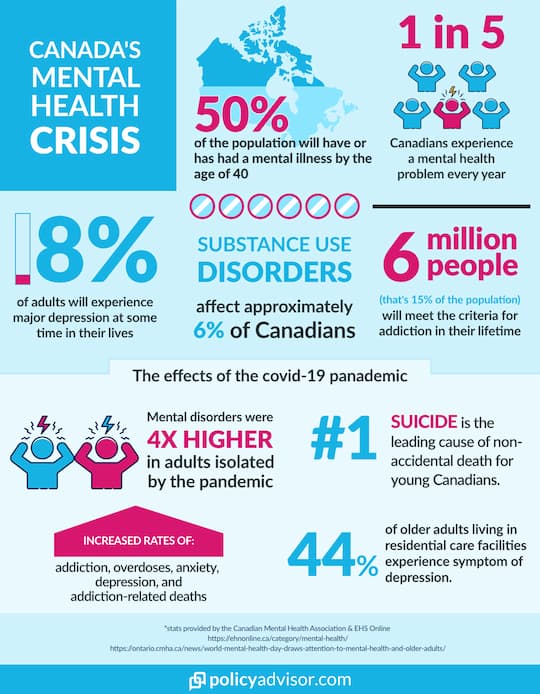

Life insurance companies take many factors into consideration when deciding whether to approve an insurance application. These factors include your age, job, lifestyle, general health, and mental health status. With 1 in 4 Canadians receiving a diagnosis for depression, anxiety, or PTSD (Government of Canada statistics), mental health affects us all.

As we understand more about mental health’s impact, insurance carriers are adjusting their underwriting guidelines. Mental health status can affect your eligibility for life insurance and your insurance premiums, so it’s important to understand what life insurance underwriters are looking for on your life insurance application and the information you have to provide.

Does seeing a psychiatrist affect life insurance?

If you’ve been referred to a psychiatrist or other professional in the course of treating a mental illness, you need to disclose it to your life insurance company. While this information will not exclude you from receiving life insurance coverage, it may influence the premium rate class for which you are eligible.

Psychiatrists—not to be confused with psychologists—are medical doctors that specialize in mental health. Most who suffer from mild clinical depression remain under the care of a primary physician. If the patient’s depression becomes less manageable and is disrupting their day-to-day life, they will often be referred to a psychiatrist for specialist care.

In the eyes of a life insurance underwriter, seeing a psychiatrist can therefore be indicative of a more serious case of depression, anxiety, or bipolar disorder, which could exclude you from a preferred rate category. You may still, however, be eligible for a standard rate.

Antidepressants and life insurance

Taking anti-depressants does not automatically disqualify you from life insurance coverage. When you fill out a life insurance application, you will be asked about any existing medical conditions you may have as well as any medications you may be on. This includes any anti-anxiety or anti-depressant medication such as:

- fluoxetine (Prozac)

- paroxetine (Paxil)

- fluvoxamine (Luvox)

- citalopram (Celexa)

- escitalopram (Cipralex)

- sertraline (Zoloft)

Like other pre-existing conditions, your insurance provider will want to know about the stability and treatment of your condition. If you are actively treating your depression with medication or seeking help from a mental health professional, you may have to provide further details.

How is depression defined by life insurance companies?

Most people feel depressed at some point in their lives, but there is a difference between feeling down and having a mood disorder, such as depression. Life insurance companies, therefore, consider depression a pre-existing health condition if and only if you’ve been diagnosed by a medical professional prior to your application.

Like many physical health conditions, depression can be diagnosed in many forms, including seasonal defective disorder, persistent depressive disorder, and major depression. Life insurance companies differentiate between people with depression into the following three categories and consider how they rate you according to your depression type:

- Mild depression– up to one type of medication and no history of hospitalizations

- Moderate depression– those who take more than one medication and consult a psychiatrist

- Severe depression– those who have suicidal ideation or attempted suicide in the past

Postpartum depression

Postpartum depression commonly occurs within the first three months of having a baby. It eventually dissipates. However, some insurers still treat it like clinical depression, which can mean a higher insurance premium. This is especially notable because many parents purchase life insurance immediately after the birth of their first child.

How is anxiety defined by life insurance companies?

Life insurance companies take anxiety into account in the underwriting process if someone has been professionally diagnosed with an anxiety disorder. As with depression, it is important to distinguish between the feeling of anxiety and anxiety disorders.

Anxiety disorders are among the most common mental health conditions in Canada affecting an estimated one in ten people (source: Government of Canada statistics). Depending on the severity of the diagnosis and the course of treatment you follow, an anxiety disorder can also impact your eligibility for life insurance and the premium rates you will pay.

Most people feel anxious throughout their lives at particularly stressful times or in certain situations. Anxiety disorders, on the other hand, cause anxiety in people even in situations that may not warrant it. Put another way, people with anxiety disorders often have stress responses that are out of proportion with their setting.

There are a range of different anxiety disorders that can be diagnosed, including panic disorder, phobias, post-traumatic stress disorder, obsessive-compulsive disorder, and generalized anxiety disorder. Often, many of these can be managed and treated using medication and therapy.

Life insurance companies also typically take the following into account when considering an applicant with anxiety:

- how many medications have been prescribed

- whether the applicant has ever been hospitalized

- whether the applicant has taken significant time off work due to an anxiety disorder

Does having depression or anxiety disqualify you from life insurance?

Being diagnosed with clinical depression or anxiety will not automatically disqualify you from obtaining life insurance. In some cases, it may not even affect the premium rates you are eligible for. Depending on the nature of the diagnosis and the treatment followed, it is very likely that you will be approved for a life insurance policy with certain exclusions and/or a higher premium rate.

It is not, however, unheard of for life insurance providers to deny life insurance coverage due to a mental illness disclosure. In 2019, CBC News covered the story of an Ontario man who was denied life insurance because of an anxiety disorder. Applications are treated on a case-by-case basis, and if your particular health record is deemed too risky to insure, your application could be rejected.

For the insurance companies, someone who dies of a pre-mature death isn’t a good financial choice for them to insure as they have less time to collect premiums. For example, a life insurance company is more likely to deny a person who has been hospitalized or has made a previous suicide attempt.

Life insurance companies may also choose to postpone a life insurance application. This is not an outright denial and indicates that you may become eligible for coverage in the near future—for instance, if you find an effective course of treatment for your depression or anxiety.

What to expect when applying for life insurance coverage when you have anxiety or depression

Life insurance applications can get pretty personal, so it’s a good idea to know what kind of information you will be asked to reveal. In addition to the general information about your identity, you will have to answer a series of questions about your lifestyle and health. In the former category, you may be required to provide information about your hobbies and travel history, as well as about your smoking status, driving record, drug and alcohol use, and criminal offenses.

A depression diagnosis will come up in the health portion of your life insurance application. In the medical questionnaire, you will need to provide up-to-date information about your personal health history, including all physical and mental health diagnoses, what medications you currently take, and any procedures you’ve undergone. Many life insurance companies will also ask about your family health history to understand any possible predispositions to certain conditions.

Underwriting factors and requirements for those with mental health conditions

If you suffer from a mental health condition, an insurer may focus on the following to determine your risk:

- Age

- Recent improvements or worsening of symptoms

- Drug and/or alcohol consumption levels

- Whether your condition affects daily activities

- Medication and/or hospitalizations related to mental health conditions

- Severity and regularity of symptoms

- Prior suicide attempt

If you do disclose a mental health diagnosis such as depression, life insurance companies will usually follow up with a series of questions to understand the extent of your diagnosis. You will be asked to provide details about your treatment, such as medication and whether you see a psychiatrist. Based on your responses, you may be required to answer additional questions and provide an Attending Physician’s Statement from your doctor.

If a mental health diagnosis is raising questions about your eligibility for life insurance, critical illness insurance, or disability insurance, reach out to one of our expert advisors. We can explain how your situation will influence an insurance application and help you find the best life insurance providers to meet your specific needs.

Frequently Asked Questions

How do I get the best life insurance if I have a mental health concern?

There are multiple ways to reduce your insurance premiums despite mental health concerns. First, if you can show that your condition is stable and its severity and regularity are improving, insurers may consider this favourably and reduce your rates.

If you previously faced mental health-related hospitalizations or attempted suicide, the passage of time can reduce how severely this affects your premiums. Additionally, waiting until your body has adjusted to any medications can also result in lower premiums, as your symptoms or side effects become more consistent and stable.

Second, seeking mental health help can improve your chance at a lower premium. A mental health professional can create a treatment plan that ultimately improves your symptoms and possibly bring your cost back to the standard rate.

Lastly, you can shop around for a different insurer. Every insurer considers mental health factors differently. As a result, you could see vastly different premiums between providers. Even if one company rejects your life insurance application, others may still approve it.

What happens if you conceal your mental health diagnoses?

When submitting a life insurance application, it is imperative that all questions are answered truthfully and any physical and mental health diagnoses are disclosed. If you lie or omit a critical piece of information like a depression diagnosis, you risk invalidating your policy and your beneficiaries may ultimately be denied your policy’s death benefit.

No-medical policies, which do not require you to disclose as much medical information or go through a medical exam, may also be an option, though they have significantly higher premiums than fully underwritten policies.

Will life insurance pay for a suicidal death?

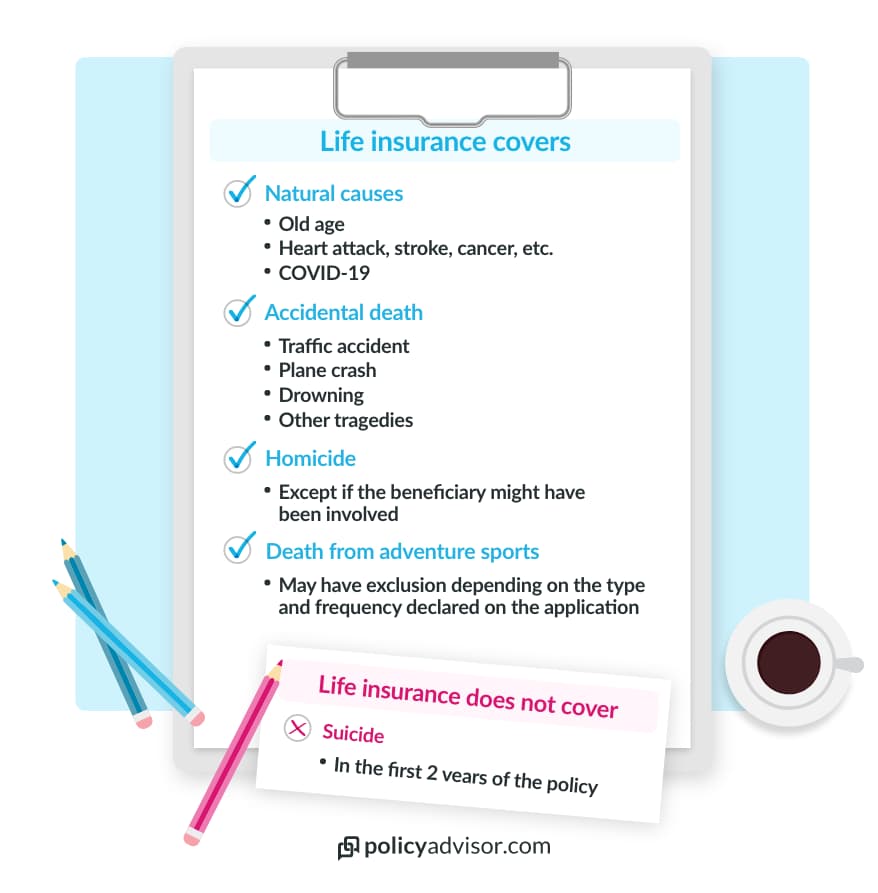

Across the board, it is common for life insurance policies to include a suicide provision or clause. This clause specifies that a life insurance provider will not pay the policy’s death benefit if the insured dies by suicide within the first two years of the policy’s coverage period. The reason for the suicide clause is logical from the perspective of the insurance company: it is designed to stop applicants from having a financial incentive to commit suicide. In cases where an insured person commits suicide after the exclusion period, their beneficiaries are entitled to the whole death benefit.

That being said, if a person disclosed a depression diagnosis in their life insurance application and was approved for coverage with certain exclusions (such as suicide), death by suicide would automatically void their coverage and death benefit.

Read more about whether life insurance will pay out for suicide.

Life insurance companies take all health factors into consideration when determining eligibility and policy rates. You can get a life insurance policy if you have been diagnosed with a mental health disorder such as anxiety or depression. However, you may be charged a higher premium depending on the frequency, severity, treatment, and diagnosis details of the mental health condition.

1-888-601-9980

1-888-601-9980