- Permanent life insurance offers lifelong coverage and a guaranteed death benefit when you die

- Permanent life insurance policies also come with a savings component, increasing in cash value as the policy matures.

- There are different types of permanent life insurance, including whole life insurance, universal life insurance, and term-to-100 insurance.

- What is permanent life insurance?

- How does permanent life insurance work in Canada?

- What are the different types of permanent life insurance policies?

- What is the cost of permanent life insurance policy in Canada?

- What’s the difference between term and permanent life insurance?

- Is permanent life insurance the same as whole life insurance?

- Can you cash out permanent life insurance?

- What are the benefits of permanent life insurance?

- What are the downsides of permanent life insurance?

- Is permanent life insurance a good investment option?

- How can I get permanent life insurance quotes?

- Frequently asked questions

Protecting your loved ones in the event of your untimely death is serious business. That’s why insurance companies offer you so many options. But understanding those options can be a bit of a challenge. We sat down to explain one of the least understood types of life insurance out there – permanent insurance, and its various types including whole life insurance.

What is permanent life insurance?

Permanent life insurance represents a category of life insurance products that provide lifetime coverage. In other words, permanent insurance offers coverage until the policyholder passes away.

As the name suggests, permanent life insurance is best suited to protect ‘permanent’ or ‘lifelong’ needs such as estate tax liabilities, care for a disabled child or dependent, liquidity for closely-held businesses and even funeral expenses.

How does permanent life insurance work in Canada?

Most kinds of permanent life insurance policies tend to include a savings or investment component, in addition to the pure lifetime insurance coverage. Part of the premium is used to pay for investments, which accumulate within the policy on a tax-deferred basis and generate a cash value that can be accessed as needed by the policyholder.

The policyholder may use the cash value as savings available for retirement through partial or full withdrawals or by taking loans against the cash value by offering it as collateral to a lender.

Due to the lifelong coverage and the embedded investment component, the premiums for permanent life insurance are much higher than other products.

Term life insurance is better suited as a strict protection product rather than an investment and planning tool.

What are the different types of permanent life insurance policies?

Permanent life insurance comes in two types: Whole life insurance and universal life insurance. These insurance options cater to the various financial needs and goals of the applicants. Explore these insurance options in detail:

Whole life insurance

Whole life insurance provides lifelong coverage with fixed premiums. It includes a savings component, often referred to as “cash value,” which grows at a guaranteed rate over time. Key benefits of whole life insurance include:

- Guaranteed death benefit payout

- Predictable premium payments

- The ability to borrow against the cash value if needed

Universal life insurance

Universal life insurance offers more flexibility compared to whole life policies. Policyholders can adjust their premiums and death benefit amounts to suit their financial situation. It also includes an investment component, where the cash value grows based on market-linked performance. Key features of universal life insurance include:

- Adjustable premiums and death benefits

- The potential for higher returns on the cash value

- The option to increase or decrease coverage as needed

How much does permanent life insurance cost?

Permanent life insurance costs can vary depending on the type of policy. For non-participating whole life insurance, a healthy person in their 30s can expect to pay about $65 per month for $100,000 in coverage. Participating whole life insurance, which offers benefits like dividends, is slightly more expensive, with an average cost of $75 per month for the same coverage amount.

The cost of permanent life insurance also increases with age. Purchasing a policy later in life results in higher premiums, as the insurer has less time to collect payments before the guaranteed payout is due. The following chart provides an example of average rates for whole life insurance based on age.

Here’s what the price of permanent life insurance for a male applicant can look like in Canada:

Cost of permanent life insurance in Canada

| Age | $100K coverage – Non-participating | $100K coverage – Participating |

| 20 | $47/month | $54/month |

| 30 | $65/month | $75/month |

| 40 | $92/month | $110/month |

| 50 | $149/month | $164/month |

| 60 | $245/month | $263/month |

| 70 | $462/month | $444/month |

*Quotes based on $100k in coverage for a non-smoker in regular health on a life-pay plan. Quotes based on average prices from leading insurance companies in Canada.

Who needs permanent life insurance?

Permanent life insurance is ideal for individuals with specific long-term financial needs or goals such as wealth transfer, estate planning, lifelong financial protection, and savings growth. Here are some scenarios where it may be the right choice:

- Wealth transfer: Ensures a tax-free inheritance for beneficiaries

- Estate planning: Covers estate taxes or supports legacy planning

- Lifelong financial protection: Offers guaranteed coverage for those needing permanent solutions

- Dependents with long-term needs: Supports families with dependents requiring lifetime care

- Business owners: Provides liquidity for buy-sell agreements or key person insurance

- Savings growth: Builds cash value for supplemental retirement income or emergencies

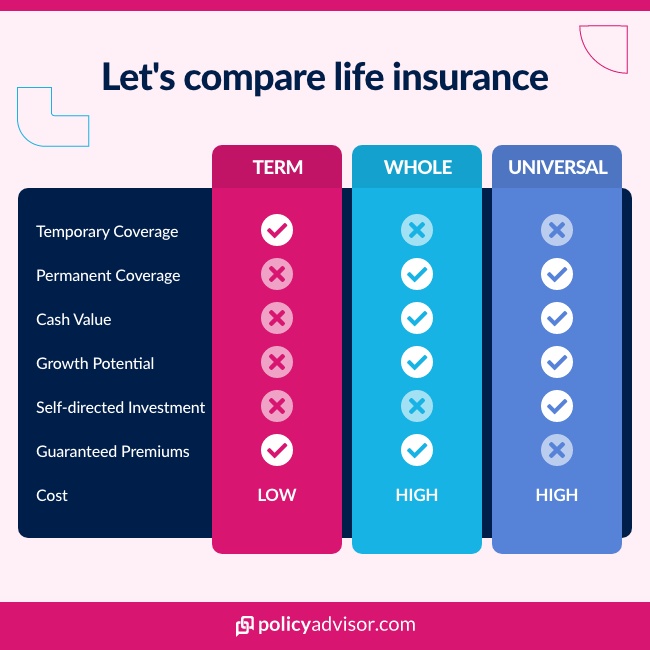

What’s the difference between term insurance and permanent insurance?

Permanent life insurance provides financial protection for an unspecified amount of time, from whenever you start the policy until the day you die. The policy will pay the death benefit to your beneficiaries at any time you pass away as long as you have been paying the policy premiums and have not cancelled the policy.

On the other hand, with term life insurance, you are covered and benefits are paid if you pass away within a specific period of time. The usual terms tend to come in increments of ten years, although some life insurance companies allow you to pick the specific years of coverage you want.

Here is a comparison between permanent and term life insurance:

Comparison between term and permanent life insurance

| Aspect | Permanent life insurance | Term life insurance |

| Coverage duration | Lifelong (as long as premiums are paid) | Fixed term (e.g., 10, 20, or 30 years) |

| Premiums | Higher, but remain level over the life of the policy | Lower, but increase significantly upon renewal |

| Cash value | Builds cash value over time, which can be borrowed or withdrawn | No cash value |

| Cost efficiency | Best for long-term goals, estate planning, or legacy creation | Cost-effective for temporary needs |

| Flexibility | Offers investment options and can serve as a financial asset | Simple and straightforward with no investment component |

| Suitability | Ideal for long-term wealth building, high net-worth individuals, or those needing lifelong coverage | Best for young families, temporary financial obligations, or limited budgets |

| Death benefit | Guaranteed, with potential for growth through dividends (depending on policy) | Guaranteed during the term but lapses at the end of a policy |

| Conversion option | Not applicable | Often convertible to permanent life insurance |

Is permanent life insurance the same as whole life insurance?

Whole life insurance, implying that you are covered for your entire life, is sometimes loosely used to refer to all categories of permanent insurance. However, there are different types of permanent life insurance Canadians can choose from. Besides whole life insurance, many Canadian companies also offer universal life insurance, term-to-100 insurance, or even variable life insurance. We cover the different types of permanent insurance in great detail here.

The most important differences between the different types of permanent life insurance products have to do with whether you want:

- To have an investment component and

- To actively manage the investment account or let the insurance company managers run with it

Once you understand the differences you can choose between whole life insurance, universal life insurance or term-to-100 insurance.

Can you cash out permanent life insurance?

Yes, you can cash out permanent life insurance in Canada. The policy’s cash value, which grows over time, can be accessed through withdrawals, loans, or surrendering the policy.

1. Full surrender

- Cancel the policy and receive the cash surrender value (cash value minus fees)

- Ends the policy permanently and may incur taxes on any gains

2. Policy loan

- Borrow directly against the policy’s cash value with interest

- The death benefit remains active but is reduced if the loan is not repaid

3. Collateral loan

- Use the policy’s cash value as collateral for a loan from a third-party lender

- Keeps the policy intact while allowing access to funds without affecting the death benefit

Withdrawals and loans reduce the death benefit and may have tax implications. Surrendering cancels the policy, providing you with the accumulated cash value but canceling your coverage altogether.

How long does permanent life insurance last?

Permanent life insurance lasts for your entire lifetime, as long as premiums are paid. Unlike term life insurance, which expires after a specific period, permanent life insurance provides lifelong coverage and includes a cash value component that grows over time.

This makes it a reliable option for long-term financial planning, estate preservation, or leaving an inheritance. Its longevity ensures your beneficiaries are protected regardless of when the benefit is needed.

What are the benefits of permanent life insurance?

Permanent life insurance offers several advantages, such as lifetime coverage, cash value growth, guaranteed payout, customizable add-on options, and more, making it an attractive option for those seeking lifelong financial security. Key benefits include:

- Lifetime coverage: Guarantees protection for an individual’s entire life, as long as premiums are paid

- Cash value growth: Builds a savings component over time, which grows tax-deferred and can be accessed through loans or withdrawals

- Guaranteed payout: Ensures a tax-free death benefit for beneficiaries, regardless of when the primary insurer passes away

- Flexible financial options: Offers access to the policy’s cash value for emergencies, retirement income, or investment opportunities

- Customizable add-ons: Riders, such as critical illness or disability benefits, enhance coverage to suit individual needs

What are the downsides of permanent life insurance?

Permanent life insurance is more expensive than a term policy. The investment component of a permanent life insurance policy can also sound complex, especially with universal life insurance where the policyholders have a say in how the premiums are invested.

The cash value component of a permanent life insurance policy has a slow initial growth, but grows exponentially in the later years of the policy.

Is permanent life insurance a good investment option?

The investment component of permanent (read whole life) policies has merits in facilitating a disciplined investment schedule, ability to access surplus cash when needed, like retirement, and tax-efficient estate transfers. While all of these sound alluring, make no mistake: the primary purpose of permanent life insurance is still protection so that your dependents have financial security when you pass away.

Permanent insurance should not be treated as a primary investment vehicle. The return embedded in such policies, while guaranteed is usually modest. The built-in management fees are higher than what fund managers may charge. There is a cost (‘surrender charge’) to accessing such cash during your lifetime.

Premiums for permanent life insurance may be better deployed in alternative investment vehicles such as RRSPs, RESPs or even to pay down your mortgage. So if you have maxed out on some of those registered products, then whole life policies can be a good place to deploy some of your surplus cash.

Which is better, permanent or term life insurance?

The choice between permanent and term life insurance depends on your needs. Term life insurance is affordable and provides coverage for a set period, ideal for temporary needs like mortgage payments or raising children.

Permanent life insurance offers lifelong coverage and builds cash value, making it better for estate planning or long-term financial goals. If cost is a concern, term insurance works well. But, for lasting benefits and asset growth, permanent insurance is the better choice.

How can I get permanent life insurance quotes?

If you are looking to purchase a permanent life insurance policy in Canada, there are many options available to you. As the best online life insurance brokerage in Canada, we have access to permanent life insurance quotes from the best life insurance companies in Canada. Schedule a call with one of our in-house insurance brokers so you can help you find the best whole life insurance quotes from leading Canadian insurance companies.

Do you still have some questions about the different types of life insurance plans out there? That’s understandable and exactly why we wrote the Honest Guide to Life Insurance. Check it out, or jump straight into our life insurance calculator to instantly see how easy it is to protect your loved ones for less.

Frequently asked questions

How does the cash value component of permanent life insurance work?

The cash value is a unique feature of permanent life insurance that acts as a savings or investment component. A portion of your premiums is allocated to build this cash value, which grows over time, often on a tax-deferred basis.

You can borrow against it, withdraw funds, or even use it to pay premiums in certain circumstances. However, borrowing or withdrawing can reduce the policy’s death benefit if not repaid. The cash value provides financial flexibility, making permanent life insurance both a protection tool and a financial asset.

What types of policies fall under permanent life insurance?

Permanent life insurance includes various policy types, such as whole life and universal life insurance. These insurance options offers benefits such as fixed premiums, a guaranteed death benefit, and predictable cash value growth, allowing policyholders to adjust coverage as needed. Each type caters to different financial goals, so it’s important to evaluate your needs before choosing a policy.

Is permanent life insurance taxable in Canada?

Permanent life insurance benefits are generally not taxable in Canada. The death benefit paid to beneficiaries is tax-free, providing financial security to your loved ones. However, the cash value growth within the policy is tax-sheltered while it remains in the policy.

If you withdraw funds or surrender the policy, you may face taxes on the amount that exceeds the initial deposit. To fully understand the tax implications, it’s wise to consult an insurance professional such as our experts at PolicyAdvisor.

Permanent life insurance lasts a lifetime – literally. As long as premiums are paid, permanent insurance will remain active until you die. When that day comes, your beneficiaries will receive the policy’s death benefit. Permanent life insurance also has several options when it comes to savings and investments, which can enable you to grow and pass down wealth.

1-888-601-9980

1-888-601-9980