- Whole life insurance covers you for your entire life and is a great investment tool

- Whole life insurance gives you a guaranteed and growing death benefit, and living benefits you can use during your lifetime

- Premiums for whole life insurance are between $40 and $450 depending on your unique needs

Whole life insurance is a type of permanent life insurance that offers lifelong coverage and a cash value component, making it both a protective and investment tool.

Unlike term life insurance, which lasts for a set period, whole life insurance remains in force as long as premiums are paid. This article explains whole life insurance and how it works so you can invest in a policy that keeps you and your loved ones protected.

What is a whole life policy in insurance?

A whole life insurance policy is a permanent life insurance plan that provides coverage for the insured’s entire lifetime, as long as premiums are paid. It offers both a death benefit and a cash value component.

The death benefit is the amount paid to beneficiaries upon the insured’s death, while the cash value is a savings feature that grows over time, offering guaranteed returns. In Canada, whole life insurance is popular because it combines protection with a form of savings or investment.

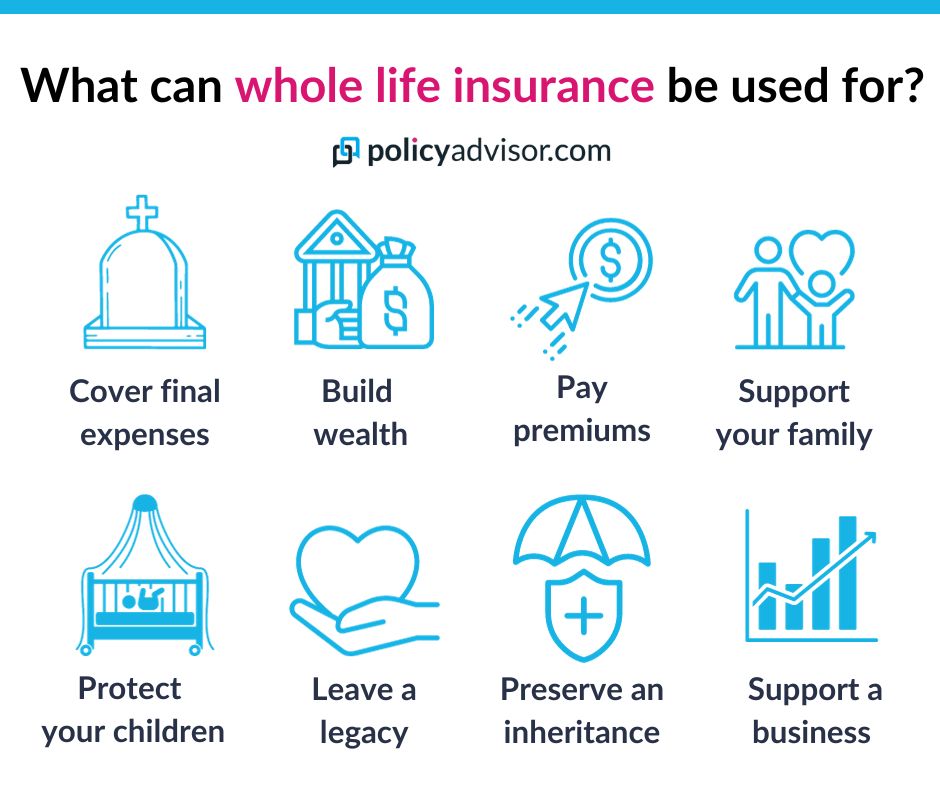

What can whole life insurance be used for?

Whole life insurance can be used for a variety of purposes such as to cover funeral expenses, build wealth, pay for premiums, estate planning and more.

- Cover funeral expenses

- Build wealth

- Pay premiums

- Support a family

- Protect your children

- Leave a legacy

- Preserve an inheritance

- Support a business

How does whole life insurance work?

A whole life insurance policy requires you to pay a fixed premium amount to keep the policy active. A portion of these premiums goes toward the death benefit, while the rest is invested in the policy’s cash value.

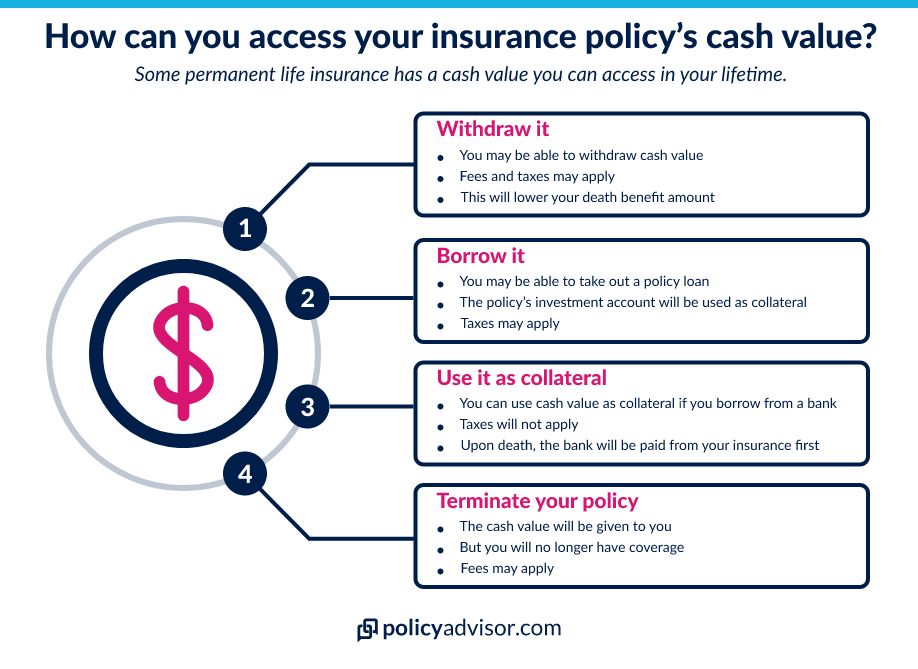

Over time, the cash value grows on a tax-deferred basis. You can borrow against it or withdraw funds under certain conditions. The policy remains in force as long as premiums are paid, ensuring that the death benefit is paid out when the insured passes away.

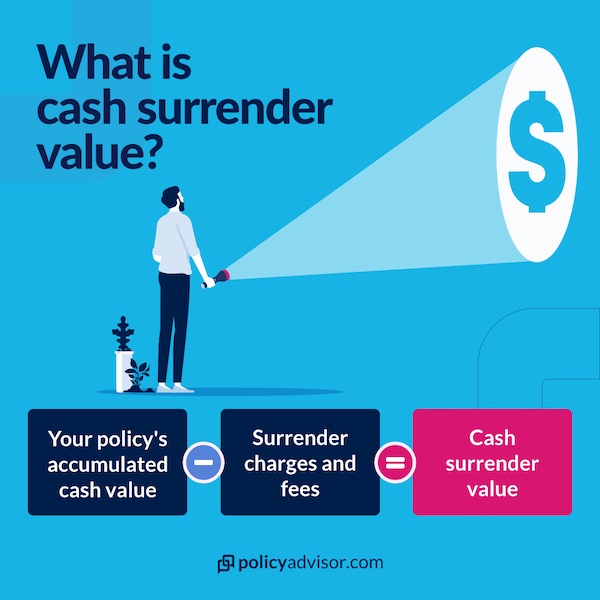

What are cash value and cash surrender value?

Cash value and cash surrender value are both “living benefits” that you can access from your whole life policy while you are alive.

Cash value is the amount of money that builds in a whole life insurance policy through the investment component. You can access this in multiple ways but only when you’re alive. Simply put, it is the policyholder’s share of the death benefit that can be claimed during the policyholder’s lifetime.

Cash surrender value is the actual amount of money you get from cash value after fees if you cancel or surrender your whole life policy.

Types of whole life policies

Whole life insurance policies can be broadly categorized into participating and non-participating types. Participating policies allow policyholders to receive dividends, which can be used to reduce premiums, purchase additional coverage, or be taken as cash.

These dividends are not guaranteed but depend on the insurer’s financial performance. In contrast, non-participating policies do not offer dividends but often come with fixed premiums and guaranteed benefits, providing more predictable coverage.

Both types offer lifelong protection and a cash value component, but the choice depends on individual financial goals and risk preferences.

Advantages of whole life insurance

The main benefits of whole life insurance Canada are that it offers lifelong coverage, builds cash value, and pays a guaranteed death benefit.

- Lifelong coverage – Your policy will never expire once premiums are paid

- Cash value – Premium payments are reinvested and grow cash value that you can access during your lifetime by borrowing against it, using it as collateral, withdrawing it, or more

- Dividends (participating policies only) – Annual dividend payments can be used to reinvest, withdraw, buy more insurance, or more

- No market volatility – The investment component is managed by the insurance company and it does not fluctuate with the market

- Guaranteed death benefit – Life insurance will pay out when you pass away no matter what

- Stable, growing death benefit – Your death benefit or coverage amount can grow over time with cash value or dividends

- Level premiums – The amount you pay will stay the same for the duration of the entire life insurance policy

- Limited pay options – Your policy can be paid off in a short time frame so you don’t have to worry about it later

Disadvantages of whole life insurance

The disadvantages of whole life policies are they are expensive and have limited flexibility in choosing the coverage period.

- Premiums can be expensive – Whole life policies can cost more than other types of life insurance

- You can’t choose a coverage period – You cannot select coverage for just a set period; it can only last forever

- Investment potential may not be as large as with other investments – Growth from a portfolio managed by the insurer will be moderate

- Policy structure can be complex – Whole life policies involve cash value accumulation and annual dividends, which can be challenging to grasp at first

- Limited flexibility – Once set, premiums and coverage amounts are often fixed

Cost of whole life insurance in Canada

The cost of whole life insurance ranges between $40 and $450, depending on personal factors like your age, sex, and health, and also on your policy’s details. Check the chart below for some sample quotes.

Whole Life Insurance Quotes in Canada (2024)

| Age | $100K Coverage – Non-Participating (Female) | $100K Coverage – Participating (Female) | $100K Coverage – Non-Participating (Male) | $100K Coverage – Participating (Male) |

| 20 | $42/month | $44/month | $47/month | $54/month |

| 30 | $57/month | $63/month | $65/month | $75/month |

| 40 | $85/month | $92/month | $92/month | $110/month |

| 50 | $127/month | $138/month | $149/month | $164/month |

| 60 | $202/month | $217/month | $245/month | $263/month |

| 70 | $376/month | $376/month | $462/month | $444/month |

*Quotes based on $500k in coverage on a life-pay plan. Quotes based on average prices from leading insurance companies in Canada.

Is whole life insurance tax deductible?

While premiums paid for personal whole life insurance aren’t tax deductible, the policy offers several tax advantages, such as:

- Tax-deferred cash value growth: Whole life policies entail a cash value component that grows on a tax-deferred basis. That means you won’t incur taxes on the cash value growth until you withdraw it

- Tax-free death benefit: The death benefit paid to beneficiaries isn’t taxable

- Tax-free loans against cash value: If you borrow against your whole life policy’s cash value, the loan amount isn’t subject to taxes

- Tax-free interest-earning deposits: If you choose to receive your annual dividends in an interest-earning deposit, they remain tax-free unless withdrawn

How many years do you pay on a whole life policy?

The number of years you pay for a whole life insurance policy depends on the payment structure chosen at the time of purchase. Typically, whole life policies offer lifetime payments, limited payments, or single-premium policies.

- Lifetime payments: You pay premiums throughout your entire life to keep the policy active. This option spreads the cost over time, resulting in lower annual premiums

- Limited payment policies: You pay premiums for a set number of years, such as 10, 20, or 30 years, or until a specific age (like 65). After this period, the policy is fully paid, but coverage continues for life

- Single premium: You make a one-time lump sum payment upfront, and the policy remains active for your lifetime without any further premiums

Do you get your money back at the end of a whole life insurance?

No, you don’t get your premiums back at the end of a whole life insurance. Instead, you get a cash surrender value that depends on the total cash value minus any applicable charges that the insurer may levy.

If your policy has a cash value of $50,000 and has accumulated $5,000 in dividends, but has $2,000 as surrender charges, your cash surrender value would be $53,000. This is calculated in the following way:

$50,000 + $5,000 – $2,000 = $53,000.

The cash value can be withdrawn or used as collateral for a loan. The death benefit is paid to beneficiaries upon your passing provided the policy remains active.

Does your money grow in whole life insurance?

Yes, your money grows in a whole life insurance policy through its cash value component. In Canada, whole life insurance not only provides lifelong protection but also builds cash value over time.

A portion of your premiums is allocated to this cash value, which grows at a guaranteed rate, often supplemented by dividends if you have a participating policy.

The cash value can serve as a valuable financial resource—you can borrow against it, use it for future premiums, or even access it for retirement or other expenses.

This growth is tax-advantaged, meaning you won’t pay taxes on the cash value growth as long as it remains within the policy. Whole life insurance offers both security and a way to build wealth over time, making it a popular choice for Canadians seeking long-term financial planning.

Can you cash out life insurance before death?

Yes, you can cash out life insurance before death if the policy has a cash value component. You can do so through a policy loan, partial withdrawal, or complete policy surrender.

- Policy loan: Borrow against the cash value, usually at a competitive interest rate

- Partial withdrawal: Take out part of the cash value without cancelling the policy

- Surrender: Cancel the policy and receive the full cash value minus fees

How much whole life insurance should I buy?

Choosing the right amount of whole life insurance depends on your financial goals and the needs of your loved ones. While whole life insurance offers lifelong coverage and cash value growth, it’s essential to determine how much coverage will adequately protect your family.

Two common strategies to help you decide are the ‘Ten times salary’ and the ‘Years to retirement’ rules.

The ‘Ten Times Salary’ Rule: This rule suggests buying a policy with a death benefit equal to ten times your annual salary. For example, if you earn $80,000 per year, you would aim for a policy with an $800,000 death benefit. This method ensures that your family can maintain their current lifestyle, cover debts, and manage expenses in the event of your passing. It’s a straightforward approach that offers a solid financial cushion.

The ‘Years to Retirement’ Rule: This strategy focuses on covering your income until retirement. Multiply your annual income by the number of years left until you retire. If you earn $80,000 annually and plan to retire in 20 years, you’d need $1.6 million in coverage. This method ensures that your family can replace your income until you’re no longer working.

What are the payment options for whole life policies?

Whole life insurance offers several flexible payment options to fit different financial needs. You can opt for lifetime payments, where premiums are spread across your entire life, keeping the annual cost lower.

Alternatively, limited payment plans allow you to pay off the policy within a set timeframe, such as 10, 20, or 30 years, or by a specific age like 65. For those looking for convenience, a single premium option is available, where a lump sum is paid upfront, securing lifetime coverage without any further payments.

Children’s whole life insurance

Whole life insurance for children provides lifelong protection with added financial benefits such as growing cash value over time. Here’s why whole life insurance for children can be a smart choice:

Cost-effective payments: Premiums for children’s whole life policies are generally lower, making it an affordable way to secure coverage for life. Since rates are locked in early, you avoid higher costs later

Guaranteed lifetime coverage: Once a policy is in place, the child is covered for life, regardless of future health changes. As long as premiums are paid, the policy cannot be canceled by the insurer.

Securing insurability: Buying insurance early ensures that the child has coverage even if they develop health issues later. This helps avoid challenges in obtaining insurance as an adult

Cash value that builds over time: Children’s whole life policies build cash value over time, offering a financial asset they can access later for education, a home, or other needs. The cash value grows tax-deferred, adding long-term benefits

Case study: A whole life insurance example

Let’s look at how whole life coverage works in a case study. In this example we’ll look at John, a 30-year-old Canadian who’s thinking about estate planning. He wants a lifetime insurance policy so he can leave something behind for his family after he passes away.

The chart below shows his projected cash value over time.

Age: 30

Gender: Male

Policy type: Whole life (non-par)

Death benefit: $250,000

Annual premiums: $1,565

Payment type: Life pay (premiums paid every year for entire life)

| Feature | Whole life insurance | Universal life insurance |

| Cash value | Yes | Yes |

| Dividends | No (for participating policy) | Yes |

| Investment choice | No | Yes (limited to select portfolios) |

| Premiums | Steady for the entire policy | Varies (depending on investment returns) |

| Tax advantages | Tax-free death benefit for your estate | Tax-free death benefit for your estate |

| Policy disadvantages | Lower returns than traditional investing | Generally more expensive premiums |

*Figures from an insurance illustration for a Desjardins non-participating whole life insurance policy purchased through PolicyAdvisor.com for a 30-year-old male in normal health.

Remember, John can use the cash value from his policy to build up his savings while still making sure his family would have enough money to carry on when he’s no longer around.

Can you borrow from whole life insurance?

Yes, you can borrow against the cash value of a whole life policy. This is called a policy loan and comes with several benefits like a no credit check and flexible repayment.

- No credit check: The loan is secured by your cash value

- Flexible repayment: You can choose when and how to repay the loan. However, if the loan is not repaid, it will reduce the death benefit. Interest also accrues on the borrowed amount

- Tax-free loan: A whole life policy loan remains tax-free as long as you do not exceed the amount you have paid in premiums

How to find the right whole life insurance policy?

Choosing the right whole life insurance policy requires careful consideration of several factors to ensure it aligns with your financial goals. Here’s a step-by-step guide to help you make an informed decision:

Choose the amount of coverage you need: Determine how much coverage will adequately protect your family. Consider factors like income replacement, debt, future expenses, and long-term financial goals

Examine riders: Riders are optional add-ons that enhance your policy. Popular options include critical illness coverage, waiver of premium, and accelerated death benefits. Assess which riders suit your needs

Look at the rate of return on cash value: Whole life policies build cash value over time. Evaluate the guaranteed rate of return and any potential dividends if you’re considering a participating policy

Be aware of surrender charges

If you cancel your policy early, surrender charges may apply. Understand these fees and how long they last to avoid surprises

Understand the different approval processes: Some policies require a medical exam, while others offer simplified or guaranteed issue options. Choose the process that best suits your health status and preferences

Check the insurer’s financial strength: A financially strong insurer is more likely to meet its long-term obligations. Review ratings from agencies like AM Best or Moody’s to gauge stability

Speak with our advisors: Our experienced advisors help you compare life insurance quotes from 30+ top insurers across Canada so you can choose a plan that best meets your needs

What other types of life insurance can I get in Canada?

If you’re looking for alternatives to whole life insurance, these are the other types of life insurance that you can get in Canada, such as term life insurance, term-to-100 insurance, universal life insurance, funeral insurance, and no-medical life insurance.

- Term life insurance

A type of life insurance that lasts for a certain number of years, called a term. Usually inexpensive and great for short-term needs. - Term-to-100 life insurance

A type of life insurance policy that covers you for your entire life, but does not have a cash value or investment component like whole life does. - Universal life insurance

A type of permanent life insurance that gives the policyholder more control over the investment part of the policy. - Funeral insurance

A type of permanent life insurance that is designed specifically to cover end-of-life expenses. Also called Final Expense Insurance. - No-medical life insurance

A type of insurance coverage that does not require a medical exam, and can ask just a few or no health questions at all. Usually gives lifelong coverage but comes with a lot of downsides.

Difference between universal and whole life insurance?

Universal and Whole are both types of permanent life policy. But one of the main differences between a universal policy and a whole life policy is that universal gives you more control over your investments. This means it has greater growth potential, but it’s also more risky.

| Feature | Whole life insurance | Universal life insurance |

|---|---|---|

| Cash value | Yes | Yes |

| Dividends | No (for participating policy) | Yes |

| Investment choice | No | Yes (limited to select portfolios) |

| Premiums | Steady for the entire policy | Varies (depending on investment returns) |

| Tax advantages | Tax-free death benefit for your estate | Tax-free death benefit for your estate |

| Policy disadvantages | Lower returns than traditional investing | Generally more expensive premiums |

What age to get whole life insurance?

Although there is no ideal age to get a whole life insurance, the sooner you buy one, the better it will be for you. The youngest age limit to get life insurance in Canada is 18 years. Starting early on whole life insurance can have certain benefits such as:

- Lower premiums: Premiums are significantly cheaper when you’re young and healthy

- Guaranteed coverage: Secures lifelong coverage, even if health conditions develop later

- Builds cash value early: More time for your policy to accumulate cash value, creating a financial safety net

- Long-term savings: Spread costs over a longer period, making it more affordable

- Future financial security: Provides stability for dependents and can be used for estate planning or retirement

Is whole life insurance a good investment?

We do not recommend buying life insurance exclusively as an investment strategy. Its purpose is to provide lifelong protection and financial security your family can rely on, not to provide capital gains.

The average rate of returns for whole life insurance varies, but is usually around 2-4% per year. This is not bad. But, if you’re only looking for an investment vehicle to generate high returns in a short amount of time, you would be better off with other options.

Should I buy whole life insurance or put my money into savings?

If you’re wondering whether you should buy whole life insurance or put the money into savings, a whole life policy is a much safer bet. Here’s why:

- Unexpected emergencies can arise and cause you to dip into savings

- The death benefit payout your family receives is usually far greater than you would be able to save and far greater than you pay in premiums in that same amount of time

- There are added tax advantages because the death benefit is paid out tax-free, so your family gets to hold onto more of the money

What happens if I surrender my whole insurance policy?

You can surrender your policy by ending it at any time. In that case you would get the cash surrender value and no longer have coverage. You may have some options to change your coverage into a policy with a lower death benefit, or to a term life policy.

But it depends on your provider — you should ask your insurance advisor about your options.

How soon can I cash out my whole life insurance policy?

It depends on your provider. Most Canadian companies will let you access your policy’s cash value on the anniversary after 5 or more years. This is whether you want to withdraw it, borrow against it, or access it any other way.

But you may want to wait. The longer you let whole life insurance cash value accumulate, the bigger the amount you can use and the more benefit you can have.

How much can I borrow from a whole life policy?

You can normally borrow up to 90% of your policy’s cash value if you want to take out a policy loan directly from your insurance provider. If you want to borrow from a bank or lender and just use your policy as loan collateral, you can borrow up to 100% of the premiums you paid.

We’ll help you find the best whole life insurance policy!

If you’re looking for the best whole life insurance policy, speak to a PolicyAdvisor expert who will help you compare and choose the best plan based on your requirements and budget.

With PolicyAdvisor, you also get free instant quotes, the lowest rates across the market, and lifetime after-sales support. Schedule a free consultation with one of our licensed advisors today!

Frequently asked questions

How can I find cheap whole life insurance quotes in Canada?

Find the cheapest whole life insurance quotes online using our free quoting tool. Our platform scans the market in seconds to show you your best life insurance match instantly.

You can also check out our listing of current life insurance promotions in Canada. Or book a free consultation call with one of our licensed advisors.

How long does it take to build cash value?

It usually takes years to build up a substantial amount of cash value — anywhere from 10 years or more. You can also help speed things up by paying more into the policy.

Alternatively, some policies are made to help you build cash value as quickly as possible. UV Insurance Company is a great example of this with their Whole Life High Values permanent policy.

Can I get life insurance riders with whole life insurance?

Yes, you can enhance a whole life insurance policy by adding riders, depending on the options your insurance provider offers. Commonly available riders include a term rider, child rider, accidental death and dismemberment benefit rider, guaranteed insurability rider, return of premiums rider, critical illness rider, and disability waiver of premiums rider, among others.

Do I need a medical test to get a whole insurance policy?

It depends, but a medical exam is not needed in many cases. In general, if you’re a Canadian citizen or resident in good health and you’re getting under $500K in coverage, you will probably not be asked to take a medical exam.

Are whole life insurance policies taxable?

The relationship between taxes and whole life insurance can be viewed from various perspectives. Generally, certain aspects of whole life insurance are non-taxable, such as death benefit payouts, dividends if reinvested in the policy, policy loan proceeds below the adjusted cost basis, and third-party collateral loans using the cash value.

On the other hand, some elements are taxable, including cash dividends, policy withdrawals exceeding the adjusted cost basis, and policy loans that go beyond the adjusted cost basis. It is essential to consult a licensed insurance advisor or tax professional to understand how these rules pertain to your specific situation.

Can I use a whole life policy to “be my own bank”?

No, you cannot use your insurance policy to become your own bank.

You may have seen this claim on social media platforms like TikTok, where some people claim you can use whole life insurance for “infinite banking.” But if something seems too good to be true, it usually is.

The concept of “infinite banking” does exist, but it’s very complicated. And it doesn’t work the way some catchy videos suggest.

Can I convert my term life insurance policy to a whole life policy in Canada?

Yes, many Canadian term life insurance policies offer a conversion option, allowing you to switch to whole life insurance without a medical exam. This is beneficial if you want permanent coverage or have developed health issues that might make it difficult to qualify for a new policy. Converting ensures lifelong protection and the added benefit of cash value growth. However, premiums will likely be higher after conversion.

What happens if I miss a premium payment on my whole life insurance policy?

Missing a premium payment on your whole life policy can have varying consequences depending on the policy’s terms. Many policies include a grace period, typically 30 days, during which coverage remains active. If you fail to pay within this window, the insurer may use the policy’s cash value to cover premiums. If no cash value is available, the policy may lapse, leading to a loss of coverage. Some policies offer options like automatic premium loans to prevent lapses.

How does whole life insurance affect my eligibility for government benefits in Canada?

The cash value of a whole life insurance policy can affect eligibility for certain government benefits. For programs like Old Age Security (OAS) and the Guaranteed Income Supplement (GIS), only income is assessed, not assets. However, if you withdraw cash from your policy, it may count as income, potentially reducing your GIS benefits. Proper planning can help minimize any impact on government assistance.

Can I use my whole life insurance policy as collateral for a loan in Canada?

Yes, you can use your whole life insurance policy as collateral for a loan, thanks to its cash value component. Many Canadian lenders accept this arrangement, allowing you to borrow against your policy. Alternatively, you can take a policy loan directly from the insurer. In both cases, it’s important to maintain the policy and repay the loan to avoid reducing the death benefit or risking a policy lapse.

Whole life insurance is a type of permanent life insurance that covers you for your entire life. It can be used to help pay for final expenses like funeral costs or managing estate taxes after you pass away. Whole life coverage also gives you a cash value that increases your death benefit and that you can use in your lifetime. Some types are also called “participating,” and can pay you dividends in addition to the cash value.