- Inflation can have direct and indirect effects on insurance policies

- Whole life policies withstand inflation better than term life policies

- Insurance companies can have fewer sales but better portfolios due to inflation

Inflation affects most Canadians. It affects all aspects of our lives. From furniture to electronics, prices are rising like never before.

Insurance is not immune to inflation. But it affects life insurance differently than, say, bread or gasoline. Policies are a complicated product. Just because the cost of everything else is going up doesn’t necessarily mean your policy will too.

This article will take a look at the potential impact of inflation on your insurance policy, if any. It also tells you more about some of the different types of inflation and some steps you can take to come out on top.

What is inflation?

Inflation is when goods and services get more expensive over time. For instance, you might have noticed the cost of staples like broccoli or T-shirts increasing in the past months.

We can also view inflation as a silent killer of our purchasing power — our dollar six months ago was able to purchase more than that same dollar today.

Although stable inflation over time is healthy for the economy, significant inflation over a short period can hurt businesses and put Canadians in a bind. Bread might cost 30% more than a year ago, but our salaries and retirement funds aren’t necessarily keeping the same pace.

Economists measure inflation through the value of the Consumer Price Index (CPI) — a basket of fixed Canadian goods and services. As these goods and services get more expensive, the CPI appreciates. This appreciation determines how much inflation is part of our economy. Statistics Canada usually shows this information as inflation rates for a given period of time.

The CPI has 8 categories: food, shelter, household expenses, clothing, transportation, health and personal care, recreation and education expenses, and drugs such as alcohol and tobacco.

How inflation comes about is usually blamed on demand-pull inflation and/or cost-push inflation.

Demand-pull inflation

Demand-pull inflation

Demand can pull up prices when it outpaces supply. Because there is more demand than suppliers can fulfill at the current price, suppliers increase their prices until demand and supply are equal again.

The world is coming out of COVID-19, and many are spending the money they couldn’t spend during the lockdown. Canadians are now travelling more than in the past two years.

We’re also purchasing more goods and services because we’re going to dinners, parties, and social events again. This ultimately means more demand for clothes, salons, etc.

Cost-push inflation

Cost-push inflation means companies need to raise prices because the cost of their inputs is going up. As a result, the increased costs are pushed to the end consumer, making it more expensive for us.

Global issues like the war in Ukraine and the lockdowns in China are causing cost-push inflation. As supplies for necessities like wheat or computer parts are short, their prices rise. Companies that need wheat to make pastries, or that need fuel, etc., pass these price increases to you so that they can maintain their profits.

Inflation and interest rates

Inflation also has an essential impact on interest rates. When there’s significant inflation, it causes central banks, like the Bank of Canada (BoC), to increase the overnight interest rate. This is the rate at which private banks and other lending institutions borrow from each other. Increasing this interest rate is one way to tamp down inflation.

When the BoC increases this rate, banks also increase their interest rates. This increased rate can mean a higher yield on investments like bonds, guaranteed investment certificates (GIC), or certain equities.

It also means people will save more money instead of spending it because deposits earn a higher return. Low consumer spending means lower demand, causing businesses to slow down or eliminate price increases. This is how increases in the overnight rate ultimately reduce inflation.

How does inflation affect life insurance?

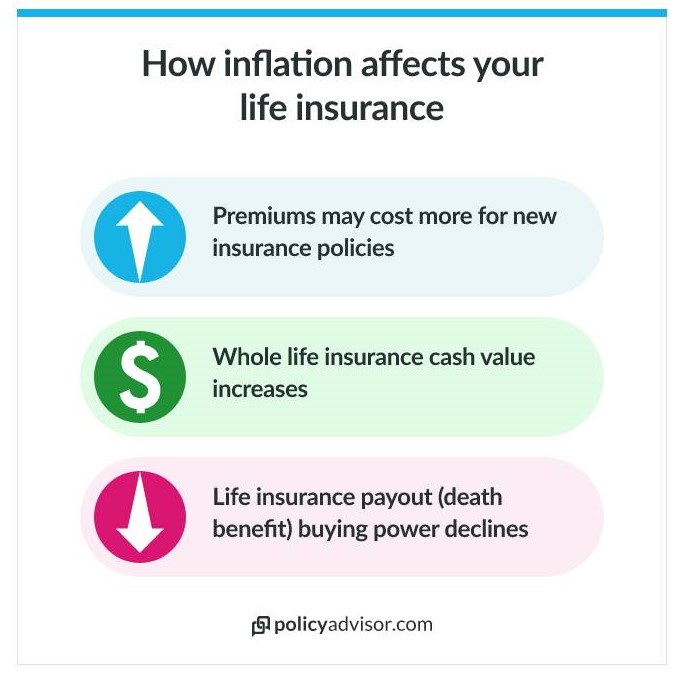

The effects of inflation can be both direct and indirect when it comes to your life insurance policy. Here are 3 ways inflation affects life insurance:

1. New policy premiums might go up

Inflation makes everything cost more. Life insurance companies also face these higher prices. As a result, you may experience rate increases. But the industry is competitive, and insurance corporations do everything they can to prevent price increases so that clients don’t switch to a competitor.

Better investment yields resulting from higher interest rates help mitigate the impact on insurance pricing. We’ll go into this more below. But basically, if higher interest rates mean an insurer earns more from its investments, it might not need to raise prices to maintain its bottom line.

You shouldn’t be surprised to see an increase in life insurance quotes when there’s a high rate of inflation. But don’t forget — once your insurance policy is approved, your life insurance premiums will remain the same. Existing policyholders won’t have to worry about inflation causing any changes to their monthly or annual bills. And that’s just one more reason to lock in insurance rates sooner rather than later!

Plus, inflation or not, you can still rely on PolicyAdvisor to find you the best life insurance rates.

2. Your insurance cash value may go up, too

Whole or universal life policies often pay variable death benefits. With such a policy, an insurer takes your premium payments and invests it — the performance of these investments and the value of your cumulative premium payment determine the final value of your death benefit.

Inflation generally leads to higher interest rates. As a result, it can mean higher returns on your life insurance investments and a greater policy cash value.

3. Your death benefit will have less buying power

Inflation causes the buying power of a dollar to decrease. For example, corn might be $1.00 today but $1.05 a year from now. While your dollar could buy a stalk of corn today, it’s not enough for the same product next year.

Term life insurance policies usually provide a predetermined amount upon someone’s death. This amount doesn’t change if the policyholder dies today or five years from now. But $500,000 received from a term insurance policy today won’t have the same buying power if your beneficiary receives it a year or two (or more) from now.

You should revisit your policy regularly to ensure that your coverage amount is enough to sustain your family well into the future. Inflation can erode the value of your death benefit. You don’t want to leave your loved ones with less than what they need.

We always recommend seeking professional advice, such as from PolicyAdvisor, for your insurance needs.

Does inflation affect whole life insurance the same way as term insurance?

Whole life policies generally withstand inflation better than their term life counterparts.

If you purchase a term insurance policy, you risk inflation eroding the death benefit. Unless you purchase certain insurance riders, a term policy’s benefit is the same regardless of inflation’s consequences. (We’ll tell you more about these policy riders below)

But whole life insurance policies are different. Whole life insurance, or universal life insurance, can have a death benefit that grows based on the insurance provider’s investment portfolio. It’s common for such investments to keep pace with inflation.

Read more about term life insurance vs. whole life insurance.

How to plan for inflation if you’re getting a new policy

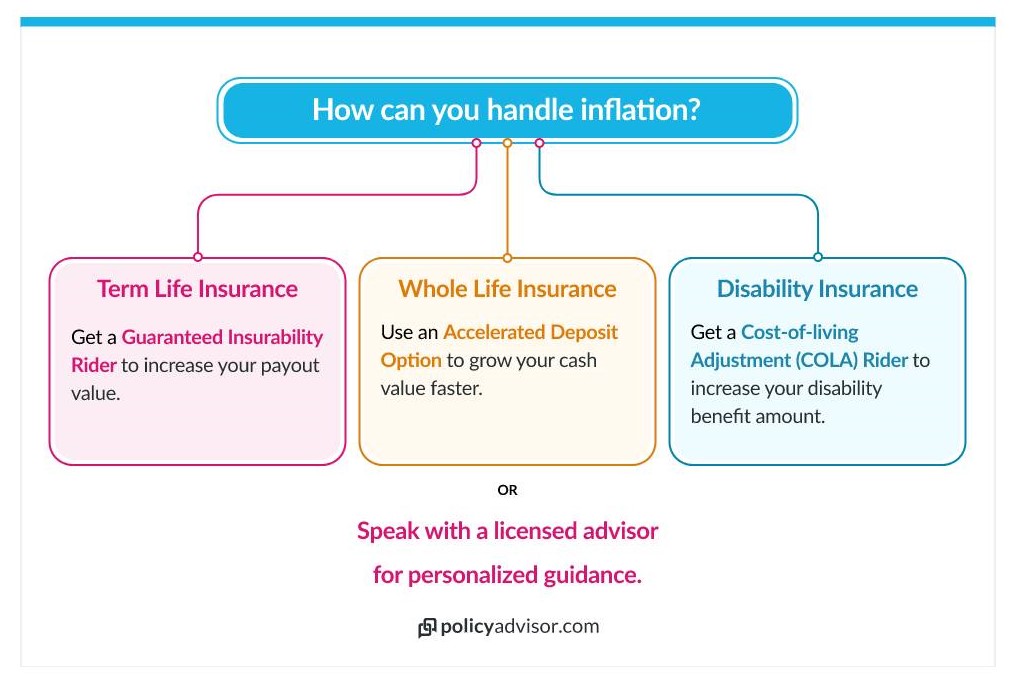

If you’re thinking about getting a new insurance policy in times of inflation, you may want to consider getting an insurance rider to help you manage.

A life insurance rider is an optional feature you can add to your life insurance coverage to better address your unique insurance needs. They usually come at an additional cost. But there are a wide range of riders to cover a number of scenarios.

Disability

Take, for instance, disability. A disability insurance rider can provide some measure of financial protection against inflation. If you were to become disabled, you could get a higher monthly benefit by the inflation rate with this rider. It’s a useful option to boost the monthly payout available on your disability policy in the event of inflation.

For example, after seven years, the policy payout could increase by the rate of inflation to adjust for prices going up. This option ensures you won’t leave your loved ones with less than they need if you pass away.

Term Life

Alternatively, if you have a term life insurance plan, you could leverage a rider like the guaranteed insurability rider. This allows you to increase your insurance’s payout value without undergoing another medical examination. It’s great for future changes that may be difficult to predict, which is exactly what can happen when high inflation rates hit.

Whole Life

You could also consider an accelerated deposit option if you have permanent life insurance, such as a whole life insurance policy. This lets you contribute more to your policy and grow its cash value faster. If you realize your death benefit might not cover your family’s needs because of inflation, you can contribute additional premiums to grow your policy. This can come in handy if you may need to access your cash value in the future.

Of course, you’re always welcome to speak with the insurance experts at PolicyAdvisor to map out your best move. We can help show you how to get the better of inflation with your insurance!

How does inflation affect the insurance industry?

As we mentioned, inflation can cause insurance companies’ investment portfolios to perform better. But it can cause negative ramifications for life insurers, too. It generally causes a substantial decline in new sales and renewals of insurance products.

High inflation causes consumers to reduce their spending. The cost of groceries, gas, and everything else is up, so you need to reduce other expenditures. Some policyholders, as a result, might choose not to renew their life insurance policies to save money. Others who do not have insurance may decide to put off buying a policy during this time.

In this way, inflation can have a major influence on companies’ bottom lines.

Do insurance companies do well during inflation?

There’s a give-and-take when it comes to how insurance companies bear the brunt of inflation overall.

Even the biggest life insurers face challenges such as rising costs with limited opportunities to raise prices. But they may also see greater returns on their investments during inflationary environments.

Whether a life insurance company “does well” during inflation ultimately depends on the specific insurer, their investment portfolio, and how much inflation they face. For example, a sudden spike in inflation might hurt insurance companies because sudden inflation creates volatility and uncertainty, which hurts the general economy.

Inflation impacts Canadian life insurance in significant ways. It creates both opportunities and challenges for insurers and insured.

As we traverse today’s inflationary environment, it could be time to revisit your life insurance policy. You should ensure that your policy has enough to cover your loved ones despite rampant inflation eating away at the dollar’s buying power.

Schedule a call with one of PolicyAdvisor’s friendly, licensed advisors today. We can look at the overall environment and your personal circumstances to determine the best plan for you.

Inflation affects everyone and everything — including insurance companies. But just because you’re paying more for eggs and milk doesn’t mean you’ll be paying higher insurance premiums too. It is possible, but it’s more likely that your cash value will increase while your death benefit will lose buying power. We tell you exactly what you can expect in this article.

1-888-601-9980

1-888-601-9980

Demand-pull inflation

Demand-pull inflation