- The cost of life insurance depends on personal details like your age, health, and gender, and coverage details

- Policies are generally less expensive when you are younger, not-smoking, and in good health

- On average term life insurance costs less than permanent insurance policies

The cost of life insurance in Canada depends on several factors, including your age, health, lifestyle, and the type of coverage you choose. Typically, life insurance rates range from $10 to $70 per month, though they can be significantly higher for individuals with pre-existing health conditions, high-risk jobs, or lifestyle habits like smoking.

Yet, many Canadians remain underinsured. According to the 2023 Canadian Insurance Barometer Study by LIMRA, 31% of Canadians, about 8.4 million adults, say they need or need more life insurance coverage.

In this blog, we’ll break down life insurance rates in Canada in 2025, the key factors that influence premiums, and tips to help you secure the right coverage at the best price.

Average cost of life insurance in Canada

The cost of life insurance in Canada varies based on factors such as age, health, coverage amount, and the type of policy you choose. For instance, a 20-year-old Canadian looking for $100,000 in coverage can expect to pay between $44 to $54 per month for a participating whole life insurance policy.

Generally, younger and healthier applicants pay lower premiums, while older individuals or those with pre-existing conditions may face higher costs.

Cost of life insurance by policy type

The cost of your life insurance premiums in Canada can also vary based on the kind of policy that you’ve purchased. There are a few policy types for you to choose from:

- Term life insurance

- Whole life insurance

- No-medical life insurance

- Children’s insurance

For instance, if you’re going for term life insurance, the cost of your premiums tends to be lower. Whole life insurance policies usually have a higher premium range, as it ensures that you are covered for your entire life!

Average cost of term life insurance

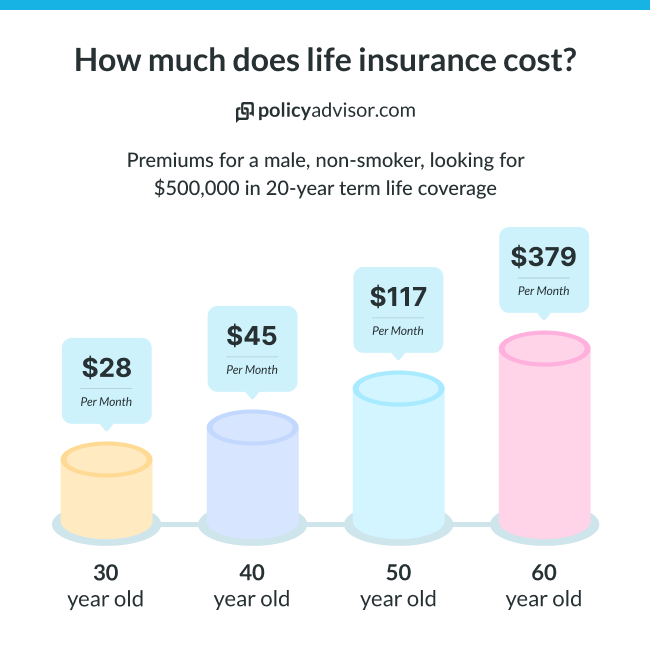

Term life insurance in Canada offers a budget-friendly way to secure financial protection. For a $500,000 coverage amount, monthly costs can range from $14 to $380, depending on the age of the applicant.

As individuals age or develop health conditions, premiums increase to reflect the higher risk of payout. Since term life insurance provides coverage for a fixed period, such as 10, 20, or 30 years, it is an affordable choice to safeguard a family’s financial future.

Cost of term life insurance for a 10-year period

| Age | Male | Female |

| 20 years | $22/month | $14/month |

| 30 years | $22/month | $15/month |

| 40 years | $27/month | $19/month |

| 50 years | $61/month | $45/month |

| 60 years | $200/month | $145/month |

*Illustrating the cost of term life insurance for a 10-year period for individuals of various age ranges opting for $500,000 in coverage

Average cost of whole life insurance

Whole life insurance, which is a type of permanent insurance, usually costs more because it covers you for your entire life. Typically, for $100,000 in coverage, participating whole life insurance may cost between $54 to $263 per month, whereas a non-participating policy may cost between $47 to $245 per month.

Participating policies are more expensive because they have a cash value component that you can use in your lifetime.

Cost of whole life insurance in Canada

| Age | Participating ($100k coverage) | Non-participating ($100k coverage) |

| 20 years | $52/month | $45/month |

| 30 years | $73/month | $60/month |

| 40 years | $107/month | $85/month |

| 50 years | $163/month | $134/month |

| 60 years | $259/month | $224/month |

*Illustrative cost for a male individual of various age ranges seeking a whole life insurance policy with $100,000 in coverage

Cost of no-medical life insurance

The cost of life insurance policies that do not need a medical exam, also called no-medical insurance, tends to be higher than both term and whole insurance. This type of policy is popular for people who have poor health or who want to get coverage quickly.

Here is an illustration of the cost of a 20-year no-medical life insurance, with $500,000 in coverage under Canada Protection Plan’s Simplified Elite policy.

Cost of a no-medical life insurance policy by Canada Protection Plan

| Age | Male | Female |

| 20 years | $76.95/month | $48.15/month |

| 30 years | $80.10/month | $51.30/month |

| 40 years | $89.55/month | $74.70/month |

| 50 years | $233.10/month | $164.70/month |

| 60 years | $634.50/month | $418.50/month |

*Illustrative cost of a 20-year no-medical plan with $500,000 in coverage under Canada Protection Plan’s Simplified Elite policy

Cost of children’s life insurance

It’s generally a good decision if parents or grandparents opt to purchase life insurance for their children or grandchildren. The cost of children’s whole life insurance is quite low, and the child can reap the benefits of accumulated cash value throughout their life.

Here’s what a $100/month 20-pay whole life insurance policy for a 5-year-old girl can look like:

Cost of life insurance for children

| Age | Monthly premiums | Accumulated cash value | Death benefit |

| 5 years | $100/month | $0 | $180,000 |

| 20 years | $100/month | $15,000 | $180,000 |

| 35 years | No payment of premiums after the first 20 years | $50,000 | $250,000 |

| 50 years | $120,000 | $400,000 | |

| 70 years | $400,000 | $700,000 |

*Illustrative accumulated cash value and death benefit for a $100/month, 20-pay whole life insurance policy for a 5-year-old girl

What factors impact the cost of life insurance in Canada?

Apart from the type of life insurance that you choose, several other factors, such as age, smoking status, job profile, and more, can impact the cost of your life insurance policy. The cost can usually vary for:

- Individuals opting for higher coverage amounts

- Seniors

- Couples

- Smokers

- Individuals participating in high-risk activities

- Individuals with a risky job

Cost of life insurance by coverage amount

The cost of life insurance premiums can vary quite significantly based on the chosen coverage amount. Typically, if you’re opting for $50,000 in coverage, you have to pay between $10 to $58 per month, depending on your age and gender.

For a $500,000 coverage, the cost may go higher, ranging between $22 to $400 per month. For $ 1 million in coverage, you may have to pay between $35 to $787 per month, with older individuals paying higher premiums.

Cost of life insurance for a 20-year period with varying coverage amounts

| Age | $50,000 coverage | $500,000 coverage | $1M coverage |

| 30 years | $10/month | $29/month | $51/month |

| 40 years | $12/month | $44/month | $82/month |

| 50 years | $23/month | $121/month | $228/month |

| 60 years | $56/month | $399/month | $776/month |

*Illustrative costs for a 20-year term for a male individual of various age ranges, in good health, and maintaining a non-smoking status

Cost of life insurance for seniors

Life insurance premiums are usually expensive for seniors. Typically, the average life insurance rate for seniors in Canada is around $100/month. Although the cost will increase with age, whole life insurance policies can be a more affordable option as compared to term policies for seniors.

Depicting the cost of life insurance for seniors

| Age | 10-year term policy | Whole life policy |

| 50 years | $35/month | $111/month |

| 60 years | $55/month | $149/month |

| 70 years | $94/month | $99/month |

| 80 years | $205/month | $131/month |

*Quote for $100,000 in life insurance coverage for a non-smoking female resident of Ontario in good health

Cost of life insurance for smokers

Premiums for smokers can cost almost twice as much as non-smoker rates. This is because smoking can lower your life expectancy.

- A 30-year-old smoker in normal health can expect to pay upwards of $60/month for $500,000 in coverage for a 20-year term

- Compare that to the $30/month in premiums a non-smoker would have to pay for the same amount of coverage

Cost of life insurance for couples in Canada

The average cost of life insurance for couples is around $30/month if they purchase a joint policy that covers both of them together, and they’re both fairly young and healthy. The price doesn’t differ that much from individual term life insurance quotes, and it covers both partners at once.

Below are some sample monthly premium costs based on a $500,000 term life insurance policy.

Depicting the cost of life insurance in Canada for smoking and non-smoking couples

| Age group | Monthly premium (Non-smoking couples) | Monthly premium (Smoking couples) |

| 25-35 years | $35 – $60/month | $70 – $110/month |

| 36-45 years | $60 – $90/month | $120 – $170/month |

| 46-55 years | $90 – $140/month | $180 – $250/month |

| 56-65 years | $140 – $220/month | $280 – $400/month |

*Quotes based on $500k in coverage for smoker and non-smoker couples in regular health.

Cost of life insurance for high-risk activities

Engaging in high-risk activities can significantly impact life insurance premiums, as insurers assess these activities as potential threats to longevity. Life insurance for individuals involved in high-risk activities can range from $80 to $350 per month, depending on the activity, coverage amount, and personal risk profile.

Moreover, individuals who participate in hazardous hobbies or professions often pay higher premiums or may be required to obtain specialized coverage. Below are some high-risk activities that can increase life insurance costs:

- Extreme sports: Skydiving, scuba diving, bungee jumping, and rock climbing

- Motorsports: Motorcycle racing, car racing, and dirt biking

- Aviation: Private piloting, flying experimental aircraft, or aerial acrobatics

- Hazardous professions: Construction work, firefighting, offshore oil rig work, and logging

- High-risk travel: Visiting politically unstable regions or countries with high crime rates

Do individuals with pre-existing health issues pay higher life insurance premiums?

Yes, individuals with a history of pre-existing health conditions typically pay higher life insurance premiums. However, insurers assess applicants based on their overall health and medical history to determine the level of risk they pose.

If an individual has pre-existing conditions or a history of serious illnesses, they are considered a higher-risk applicant, leading to increased premium rates. Here are some of the health conditions that may lead to higher premiums:

- Heart disease & hypertension: Individuals with a history of heart attacks, high blood pressure, or other cardiovascular issues

- Diabetes (Type 1 & Type 2): Those with diabetes, especially if poorly managed, are at risk of complications like kidney failure or neuropathy.

- Cancer history: A past diagnosis of cancer, even if in remission, can impact premiums

- Obesity: Higher BMI levels, which can lead to various health risks, including diabetes, heart disease, and sleep apnea

- Mental health disorders: Conditions such as severe depression, bipolar disorder, or anxiety, especially if there is a history of hospitalization or medication use

- Respiratory conditions: Chronic illnesses like asthma or COPD (Chronic Obstructive Pulmonary Disease)

How much life insurance do I need to buy?

The right life insurance coverage depends on your financial responsibilities, income, debts, and family’s needs. Here’s how to estimate the amount:

- Income replacement: Aim for 7-10 times your annual income. For instance, if you have an annual salary of $70,000, your life insurance coverage should at least range between $500,000 to $700,000

- Debt & expenses: Payout should be able to cover mortgage, loans, funeral costs, and daily living expenses for dependents

- Future needs: Consider childcare, education, and long-term financial security for your family

- DIME formula (Debt, Income, Mortgage, Education): Use the DIME formula and add up these expenses for a tailored estimate

- Affordability: Balance coverage with budget to make sure you purchase a plan that you can afford to pay for

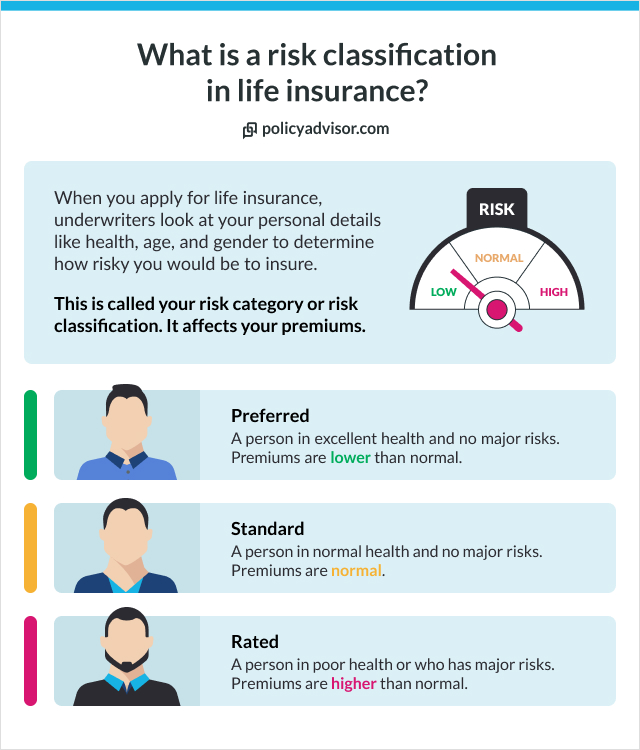

How do insurance companies calculate the cost of your life insurance premiums?

Insurance companies base your premiums on your risk profile — this is their assessment of how risky it would be for them to cover you.

- Insurance companies want to avoid risk as much as possible

- The shorter your life expectancy, the higher the chance that they will have to pay out a lot of money soon — and that’s a risk for them

- Insurers look at personal information about you and your lifestyle to gauge your life expectancy

- They then compare your life expectancy against how much you’re asking them to cover you for, and use that to decide how much it will cost you — and whether to cover you at all

What are life insurance premiums?

Life insurance premiums are the payments policyholders make to maintain their coverage. However, these can be paid monthly, quarterly, or annually, depending on the policy. The cost of your premium will be based on factors like age, health, coverage amount, and policy type.

Is life insurance paid monthly?

Life insurance payments can be made either monthly or annually. Most people choose monthly payments. However, you can get lower prices by switching to a yearly plan.

For permanent insurance, you also have the option to condense your payments so you only pay for a certain number of years. This is called a limited-pay plan.

What is the cheapest life insurance?

The cheapest form of coverage is term life insurance. This type of insurance policy provides coverage for a set period of time or term. So, term life insurance rates tend to be less than permanent coverage that lasts your entire life.

Learn more about the cheapest life insurance in Canada.

How can I get preferred rates for life insurance?

Preferred rates are only offered to people who have a low-risk profile. This usually means they:

- Maintain excellent health

- Don’t smoke or have quit smoking

- Don’t participate in risky activities like extreme sports

- Have regular checkups

Is life insurance worth the cost in Canada?

Yes, life insurance is well worth the cost. Especially since premiums are often very affordable. You get the benefit of:

- Financial security for your family

- Peace of mind in knowing that they’ll be provided for

- Reliable estate planning

- A way to clear outstanding debts

- Future college funding for young children

- A business continuity strategy

- Tax-free savings

Does inflation affect the price of life insurance premiums in Canada?

Yes, inflation can affect life insurance rates by:

- Increasing the cost of new premiums

- Making the death benefit have less buying power

- Making your whole life cash value increase

The cost of life insurance depends on a lot of factors. Age, gender, health, lifestyle, and smoking status influence your price for a life insurance policy. Policy type, insurance provider, and coverage amount will also directly impact the cost of life insurance premiums. In general, you can expect to pay around $10 a month for $100,000 in coverage for a 10-year term policy if you are young and healthy.

Nearly One-Third of Canadian Adults Report Living with a Life Insurance Coverage Gap.” LIMRA, November 28, 2023.