- Whole life insurance costs approximately between $42 and $462 per month, but the exact cost depends on factors like the coverage amount, policyholder's age, health status, etc.

- For non-participating whole-life insurance, you can expect to pay around $65/month for $100,000 in coverage, if you are in your 30s and in good health

- Whole life insurance policies have a growing cash value that builds over time and represents the amount that is your share of the death benefit

Whole life insurance typically costs between $45-$100 per month. However, nailing down the exact cost of whole life life insurance can be tricky.

First off, “whole life” is often used as a catch-all term for all types of permanent life insurance policies, when it’s actually just one type of permanent insurance. Secondly, whole life insurance has a lot of policy options that affect the price.

In this article, we’ll break down what whole life insurance is and all the factors that influence the monthly premium, so you can find out if whole life insurance is worth it.

What is whole life insurance?

Whole life insurance protects you for your entire life, making it one of the most popular permanent life insurance options in Canada. It pays out a tax-free lump sum of cash to your estate or your beneficiaries when you pass away.

The policy length is not a particular term; it lasts for as long as you live. As long as you pay your life insurance premiums, your policy never expires.

Whole life policies come with a living benefit called a cash value component. As you pay your premiums over your lifetime, part of that money is invested and generates a tax-deferred cash value that grows over time.

Whole life insurance is just one type of permanent coverage. There are also other types of permanent life insurance like universal life insurance and term to age 100 insurance.

How much does whole life insurance cost?

For non-participating whole-life insurance, you can expect to pay around $65/month for $100,000 in coverage, if you are in your 30s and in good health. The average cost for participating life insurance is about $75 for the same amount of coverage.

As we hinted above, whole life insurance tends to be more expensive than term life Insurance rates because the payout is guaranteed at the end of your life and there is a savings component to the policy.

Additionally, as with other types of insurance, whole life coverage costs more as you age. The later you buy, the less time your insurance companies has to collect enough premium to pay for the cost of insurance before they have to make a guaranteed payment.

Whole life insurance quotes in Canada

| Age | Male (Non-Participating) | Male (Participating) | Female (Non-Participating) | Female (Participating) |

| 20 | $47/month | $54/month | $42/month | $44/month |

| 30 | $65/month | $75/month | $57/month | $63/month |

| 40 | $92/month | $110/month | $85/month | $92/month |

| 50 | $149/month | $164/month | $127/month | $138/month |

| 60 | $245/month | $263/month | $202/month | $217/month |

| 70 | $462/month | $444/month | $376/month | $376/month |

*Quotes based on $100k in coverage for a non-smoker in regular health on a life-pay plan. Quotes based on average prices from leading insurance companies in Canada.

How much is a $25,000 whole life insurance policy?

The cost of a $25,000 whole life insurance policy is typically $11 to $38 per month for young, healthy applicants. The exact premium depends on several factors, including the insured’s age, health condition, and gender, as well as the underwriting criteria of the insurance provider. These factors collectively determine the overall cost of coverage.

How much is a $50,000 whole life insurance policy?

The cost of a $50,000 whole life insurance policy varies based on age, smoking status, and gender. For example, a 20-year-old male, non-smokers pay around $26.82 per month, while smokers pay $29.61. At age 30, female non-smokers pay approximately $31.46, compared to $36.41 for smokers.

The premium differences reflect the increased health risks associated with smoking and aging, highlighting the importance of maintaining a healthy lifestyle for affordable coverage.

How much is a $100,000 whole life insurance policy?

The monthly premium for a $100,000 whole life insurance policy typically ranges between $42 and $462. However, the exact cost depends on several factors, including the insured’s age, overall health, and lifestyle habits such as smoking. Additionally, the specific terms and underwriting policies of the insurance company can influence the premium amount.

How much is $500,000 life insurance?

For a $500,000 participating whole life insurance policy, premiums vary by age, gender, and smoking status. For a 30-year-old male, non-smokers pay approximately $232.15 per month, while smokers pay $280.93. At age 35, non-smokers pay around $311.14, compared to $358.93 for smokers.

For females, the premiums are slightly lower. A 30-year-old non-smoker pays about $193.27, while smokers pay $225.35. At age 35, non-smokers pay approximately $253.43, while smokers face premiums of $284.31.

What is the cash value of a $10,000 whole life insurance policy?

The cash value of a $10,000 whole life policy depends on factors like the policy age, premiums, and dividends. In the illustration below, the table shows how the cash value of a $10,000 whole life insurance policy increases over time. Initially, the cash value is minimal, but it grows as premiums are paid and dividends accumulate.

By age 40, the cash value reaches $40,412, with dividends boosting it further. At age 60, the cash value rises to $301,902, and by age 70, it exceeds $439,000.

By age 80, the cash value reaches $555,467, with dividends pushing the total value above $2 million, illustrating the long-term growth potential of the policy.

Cash value growth in a $10,000 whole life insurance policy over time

| Age | Annual premium | Cash value | Death benefit | Annual dividend | Total cash value (With dividend) | Total death benefit (With dividend) |

| 31 | $10,000.00 | $0 | $792,393 | $594 | $594 | $795,321 |

| 35 | $10,000.00 | $1,585 | $792,393 | $2,105 | $8,559 | $822,583 |

| 40 | $10,000.00 | $40,412 | $792,393 | $4,429 | $66,864 | $890,001 |

| 50 | $10,000.00 | $180,666 | $792,393 | $11,188 | $305,357 | $1,130,311 |

| 60 | $10,000.00 | $301,902 | $792,393 | $22,584 | $658,582 | $1,515,883 |

| 70 | $10,000.00 | $439,778 | $792,393 | $43,452 | $1,261,372 | $2,090,329 |

| 80 | $10,000.00 | $555,467 | $792,393 | $72,420 | $2,015,918 | $2,763,312 |

Whole life insurance calculator, Canada

Wondering how much insurance you might need? The above numbers give you some idea what Whole Life Insurance might cost, but check out our life insurance calculator to get a full, holistic view of what it takes to solidify your financial security. There you can start comparing quotes and insurance plans for whole life coverage.

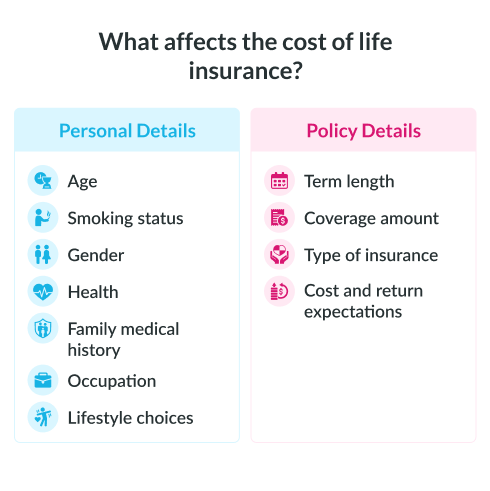

What affects the cost of whole life insurance?

The cost of insurance in Canada can change depending on your age, gender, smoking status, lifestyle, occupation, policy type, etc.

- Age and birthday: Life insurance costs increase with age due to higher statistical risks

- Gender: Women generally have lower life insurance costs due to longer life expectancy

- Smoking status: Smoking significantly raises life insurance premiums. Products like cigarettes, e-cigarettes, and marijuana usage impact rates. Quitting smoking for 12 months may lead to cost savings

- Health history: Healthy individuals with good BMI, no pre-existing health conditions, and favorable medical exam results receive lower premiums. Refusal of a medical exam or poor health leads to higher costs

- Family medical history: Hereditary conditions in family history impact life insurance rates

- Lifestyle: Engaging in risky activities, criminal history, or having a poor driving record increases costs

- Occupation: Dangerous occupations like firefighting or military service may lead to higher rates or coverage denial

- Foreign travel: Regular travel to high-risk nations may elevate life insurance costs

- Risk classification: Underwriters categorize individuals based on risk factors, affecting the premium

- Length and type of policy: Longer coverage duration leads to higher costs. Whole life insurance is more expensive than term life insurance products

- Coverage amount: Higher death benefit requests result in more expensive policies

- Policy options and riders: Additional features like convertibility, critical illness riders, and more increase costs. Adding optional life insurance riders enhances the policy but comes at a higher price

How much do you get when you cash out a whole life insurance policy?

The amount you get when cashing out a whole life insurance policy depends on the policy’s accumulated cash value, which grows over time. Factors such as how long you’ve maintained the policy, premium payments, and any loans or withdrawals can impact your cash-out value.

- Policy duration: The longer you’ve held the policy, the more time the cash value has had to grow through premium payments and interest accumulation

- Premium contributions: Higher or consistent premium payments can increase cash value over time

- Loans or withdrawals: Any outstanding loans or prior withdrawals reduce the death benefit

- Surrender charges: Cashing out early may result in surrender fees, which can significantly lower the payout amount

- Policy type and features: Some policies may offer dividends or other bonuses that add to the cash value

Before cashing out, consult with an insurance professional (like our experts at PolicyAdvisor) to understand the full implications and make sure it aligns with your financial goals.

What happens when you pay off whole life insurance?

Once you pay off a whole life policy, it becomes fully paid-up, meaning no further premiums are required. This type of policy is known as limited pay whole life insurance.

The policy remains active for life, and the death benefit stays intact. The cash value will continue to grow, and you can still access it through loans or withdrawals.

This is especially helpful if you are buying a whole life policy for your children. While you pay the premiums till your child is 20-years-old, they remain protected for life and have access to cash value that they can use for any future financial obligations such as education costs.

Here’s what a paid-up policy would look like for a 5-year-old child:

Paid-up life insurance for a 5-year-old

| Age | Accumulated Cash Value | Life Insurance Value | Monthly Premiums |

| 5 | $0 | $100,000 | $35 |

| 20 | $5,000 | $100,000 | $35 |

| 35 | $20,000 | $105,000 | $50 |

| 50 | $60,000 | $160,000 | $0 |

| 70 | $180,000 | $300,000 | $0 |

Whole life insurance costs by province

Whole life insurance premiums in Canada are influenced not only by personal factors like age and health but also by regional differences. While base rates remain fairly consistent, provincial variations can cause premiums to shift slightly above or below the national average.

Across all age groups and genders, the typical monthly premium for whole life insurance in Canada ranges from $150 to $250 for a $100,000 policy. However, where you live may affect where your rate falls within that range.

Higher-cost provinces

Alberta: Premiums are typically 5% to 8% above the national average, meaning monthly costs may range from $158 to $270. Higher incomes and lifestyle-related risk factors contribute to this increase.

British Columbia: Rates tend to be 3% to 5% higher, translating to premiums of about $155 to $262 per month, especially in urban centres.

Ontario: Generally aligns with the national average of $150 to $250 per month, though slightly higher rates may apply in cities like Toronto due to cost of living and underwriting considerations.

Lower-cost provinces

Quebec: Premiums are usually 2% to 4% below average, resulting in typical costs of $144 to $245 per month, helped by distinct regulatory conditions and efficient claims experience.

Maritime provinces (Nova Scotia, New Brunswick, PEI): Rates are often 1% to 3% lower, with monthly premiums around $146 to $248, due to stable population health and lower average claims.

Manitoba: Typically 1% to 2% below average, with costs around $147 to $248 per month, benefiting from moderate living expenses and consistent risk profiles.

Note: These provincial differences are estimates. Your individual premium will depend primarily on factors such as age, gender, health, smoking status, and coverage amount. For a precise quote, use our free calculator to compare options from top Canadian insurers.

Is whole life insurance worth it?

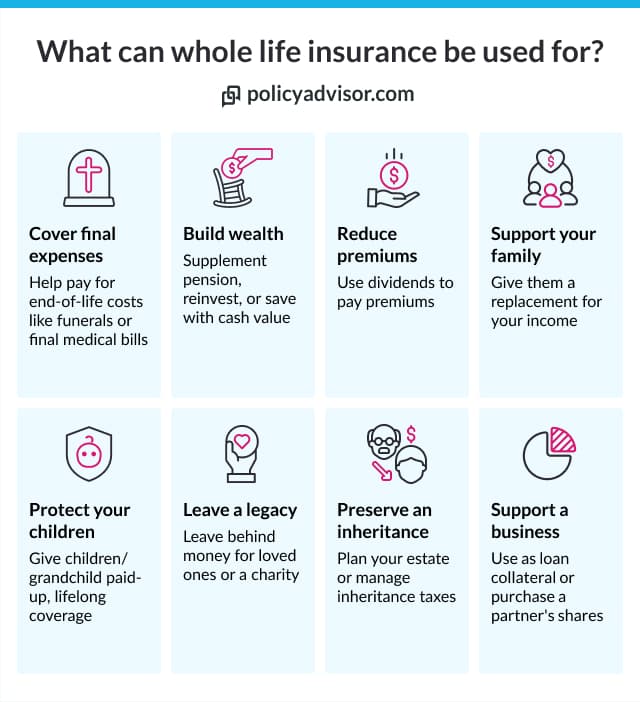

Whether or not you need whole life insurance depends entirely on both your personal choice and circumstances. It can provide a financial safety net while you’re alive by utilizing the cash value as well as provide security for your family after you pass away.

Key benefits of whole life insurance include:

- Lifelong coverage– Your policy will never expire once premiums are paid

- Cash value growth– Premium payments are reinvested and grow cash value that you can access during your lifetime

- Dividends (participating policies only) – Annual dividend payments can be used to reinvest, withdraw, buy more insurance, or more

- No market volatility– The investment component is managed by the insurance company and it does not fluctuate with the market

- Guaranteed death benefit– Life insurance will pay out when you pass away no matter what

- Death benefit growth– Your death benefit or coverage amount can grow over time with cash value or dividends

- Level premiums– The cost of your policy will remain consistent as long as your policy

- Limited pay options– Your policy can be paid off in a short time frame so you don’t have to worry about it later

Get a whole life insurance quote in Canada

If you need answers about whole life insurance right away, don’t hesitate to schedule a call with one of our licensed insurance advisors.

They can answer any of your questions about whole life insurance, help you identify any gaps or shortfalls in your current coverage, and start you on the path to coverage if you so wish. In the meantime, calculate your life insurance coverage needs or get life insurance quotes online.

Frequently asked questions

How does the cost of whole life insurance differ for smokers vs non-smokers in Canada?

The cost of whole life insurance is significantly higher for smokers compared to non-smokers in Canada. Insurance companies view smoking as a high-risk factor due to its association with health issues like heart disease and cancer. For example, a smoker’s premium could be nearly double that of a non-smoker of the same age. This difference emphasizes the importance of lifestyle choices in determining insurance costs and provides smokers with actionable insights to potentially reduce premiums by quitting.

Does the province you live in affect whole life insurance prices in Canada?

Yes, the province you live in can influence whole life insurance prices. Regional differences in health care systems, average life expectancy, and insurance regulations may impact premium rates. For instance, provinces with higher living costs or unique health care challenges might see slightly elevated premiums. Knowing these variations helps individuals understand the factors affecting their insurance costs based on location.

How does adding riders affect whole life insurance premiums?

Adding riders, such as critical illness coverage, accidental death benefits, or disability waiver of premium, increases whole life insurance premiums. Riders provide additional benefits tailored to individual needs but come at an added cost. For example, a critical illness rider might add 10–20% to the base premium.

Whole life insurance can cost anywhere from $45-$100 per month, depending on your personal profile and the type of coverage you need. Whole life insurance rates tend to be more expensive than term life insurance rates because the payout is guaranteed at the end of your life and there is a savings component to the policy. Whole life insurance is worth the price if you want your life insurance to offer investment growth opportunities, stable premiums, and lifetime coverage.