- Debt is one of the key considerations when choosing life insurance coverage. Make sure your policy will cover any major debts you have, such as a mortgage.

- If you plan to use life insurance for income replacement, take into account your dependents’ expenses and needs.

- When choosing a life insurance coverage amount, it is also important to ensure you can afford the premiums.

- Some brokers suggest using the DIME method, accounting for Debt, Income, Mortgage, and Education expenses, but a life insurance needs calculator can asses your needs in more detail.

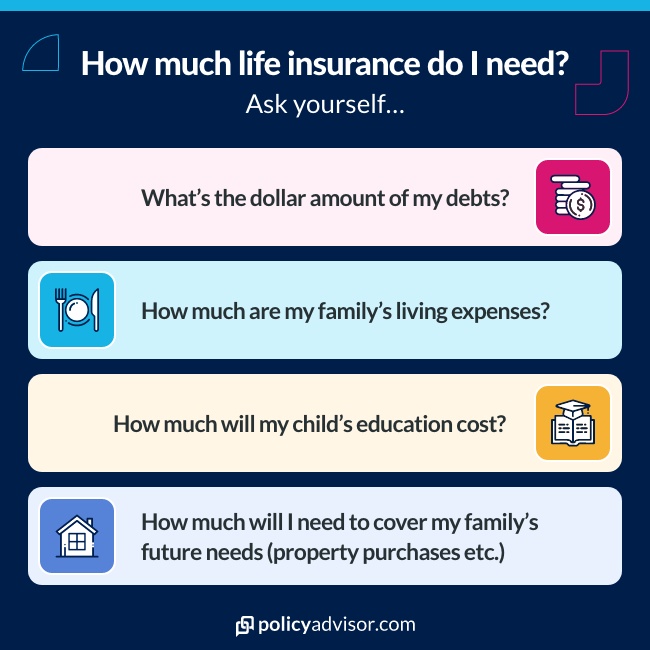

So, you have decided that you need to buy a life insurance policy. Now you’re wondering, how much life insurance do I actually need? To find this out, you’ll need to take a deeper look into your finances and expenses.

Everybody would love to leave a fortune for their family when they die. So they wonder “What’s the right amount of life insurance?”

After all, when you’re gone, there’s going to be a giant you-sized hole in their lives. They will have lost a parent, a spouse, a sibling, or a child… bummer is an understatement.

You might think of going with a multimillion-dollar term life insurance policy. With millions, at least your family will never have to worry about money for the rest of their lives. Choosing a life insurance coverage amount should be a no-brainer right? The higher, the better!

Well… frankly, it’s not that realistic for most people to own such a large life insurance policy. The higher your death benefit payout, the more expensive your premiums become. If you can’t afford to pay for your policy and you have to cancel it, your family will receive nothing.

On the flip side, you don’t want to pick too little coverage. In that case, your dependents will only receive enough to cover your funeral expenses. Our survey for Life Insurance Trends has shown that Canadians are underinsured.

It’s quite a conundrum. So, really, how much life insurance coverage should you get?

How do I determine how much life insurance I need?

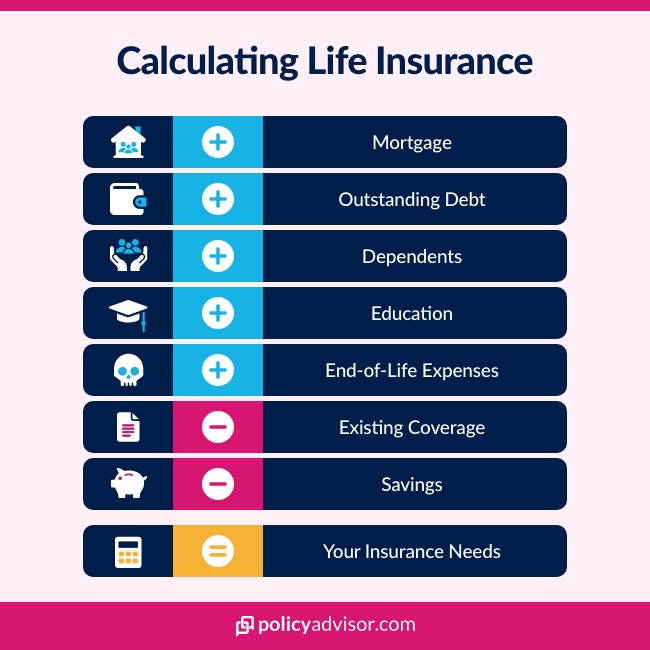

The best way to figure out how much insurance you need is to use a life insurance calculator. These calculators perform an instant audit of your personal and financial situation. It looks at both your assets and liabilities. Then, it lets you know how much insurance you need to cover those liabilities.

But wait, hold on! Before you close your browser to go find a calculator, we have one right here! Our life insurance needs calculator can help determine your needs in a matter of minutes. We focus on a few key areas of your finances to keep things simple.

How much life insurance do you need to cover your debt?

Do you owe anybody money? We’re not talking about your buddy for dinner last week, but rather big debts. We’re talking credit card debt, car loan debt, your mortgage, etc. If you die unexpectedly, someone is on the hook for paying back any debts you owe. This is one of the main motivating factors in getting life insurance. An appropriate coverage amount gives you peace of mind. Life insurance ensures your spouse, children, or even parents wouldn’t have to deal with your debt on top of grieving your death.

The primary source of debt for most Canadians is usually their mortgage. But it’s not uncommon to have balances owing on lines of credit, credit cards, and student loans.

Adding up these liabilities can be used as a starting point for figuring out your base coverage needs.

How much life insurance do I need to cover my family’s living expenses?

The next step in figuring out your coverage needs is by asking yourself three questions:

- How many dependents do I have?

- How much of my after-tax annual income do they rely on?

- How many years will they rely on my money?

A dependent is anyone who needs your financial support. If you’re the primary breadwinner in your house and/or have kids, then you already have dependants. You may also have elderly parents or disabled family members that depend on you financially. Their needs should all be considered when calculating the coverage amount. They will be the beneficiaries of the life insurance payout.

Now that you’ve decided who relies on you, ask yourself: how much will they need each year?

Does your partner earn an annual salary, even if you pay most of the bills and cost of living? How much rent or mortgage does your family pay? What about food, clothing, utilities, etc.? How much money would they need every year to maintain their standard of living? Add these expenses up for a yearly total.

What percentage of my after-tax annual income do I think they’d need?

The rule of thumb is 10-15x your annual salary. That’s just your base insurance needs, though. Other things to consider are the ages of your children and your partner. They may only need the annual figure for a temporary amount of time. If your children are teenagers, for instance, they may be self-sufficient in less than a decade. Or, if your children have disabilities or require other care into adulthood, you might factor in more years.

How much coverage do I need to provide for the future?

Life insurance isn’t just about covering your debts, mortgage payments, or your family’s living expenses after your untimely death. Your life insurance payout can also pay for:

Other than these costs, it’s wise to include around $10,000 in additional coverage for final expenses such as funeral costs.

How much life insurance do I need to protect my savings?

Do you have any savings? Whether it’s in your bank account, an investment portfolio, an RRSP you opened at 19, or wads of cash stuffed under your mattress, any assets you’ve stored away can help reduce your life insurance coverage needs.

While some people reduce their life insurance coverage because they have savings, others may buy life insurance to protect it. That way, their dependents won’t need to dip into savings that have been allocated for long-term growth (like investments) or sell assets (such as a home, car, etc.).

If you have existing life insurance plans you should also factor them in.

Discussing life insurance coverage with your dependents

No one enjoys planning for death. But crunching the numbers gives you cold, hard, facts about your family’s financial needs. But don’t forget to discuss your financial protection plan with your loved ones. Talk about what they think they’d need if you were to die.

For example, say your partner has their own income and you both do not have children. In this case, a $1,000,000 term life insurance policy, might not be necessary. Your partner may be comfortable living off their own current income. However, if you have a large family with young children who will need child care and their cost of living met for over a decade, plus college costs and inheritance, and a mortgage balance on top of that, perhaps $1,000,000 isn’t out of the question.

Other methods to determine your life insurance needs

DIME Method

The DIME method is often used by brokers and financial advisors to determine your life insurance needs on the fly. It stands for four major aspects that you should consider in your financial strategy: Debt, Income, Mortgage, and Education. However, this common rule is an oversimplified calculation. It doesn’t consider:

- your savings

- your existing life insurance policies

- paying for funeral expenses

- paying for any other future expenses your family may have

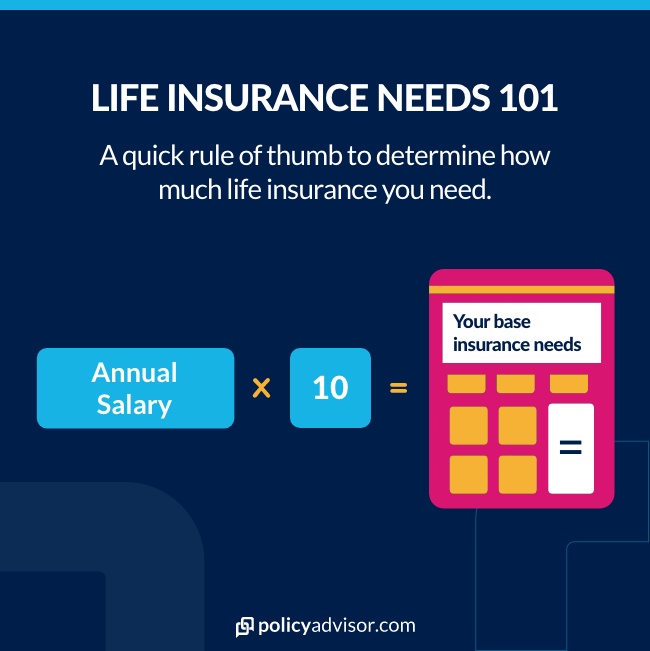

Multiply your money

Looking to simplify even more? This popular rule of thumb is used by Many life insurance companies. You simply multiply your annual income by 10 – 15x to determine the right amount of coverage.

These methods work in a pinch, but only using a life insurance calculator will give you an accurate answer to how much life coverage you actually need.

Frequently Asked Questions

How much coverage do I need to plan for my children’s education?

If your child chooses to go to post-secondary, you should account for their tuition fees. Just one year of tuition, books, lodging etc. can cost around $20,000 on average. It’s a major expense that they might not be able to afford if your children were to lose your salary.

What kind of life insurance do I need?

One last consideration in deciding how much coverage you need is picking the type of life insurance. There are two types of life insurance: term and permanent.

The final thing to consider is life insurance premiums—what’s the cost of life insurance? A life insurance payout can be invaluable to your family, but you have to be able to afford your premiums today. A term life policy is cheaper because it’s only for a temporary period of time. A permanent life insurance policy can be more costly because coverage continues until you die. You want to choose a policy that not only has the right coverage amount but that also has manageable premium payments for your living financial plan.

How much life insurance coverage should I buy?

The short answer: 10-15 times your annual salary. But, the best way to get the answer to that question is to use a life insurance calculator that performs an instant audit of your personal and financial situation.

After you’ve talked things over with your family and entered your financial information into our calculator, PolicyAdvisor can help! Our licensed agents will provide you with a life insurance quote that matches your individual circumstances and coverage needs. We work with dozens of life insurance companies to provide you with affordable life insurance rates.

If you‘re still not sure how much life insurance you need, that’s perfectly ok. Feel free to experiment with different coverage levels in our online tools until you find the perfect match, read our company reviews, or check out our honest guide to life insurance.

Figuring out how much life insurance you need is a personal process. You have to take into account your personal finances and debts, as well as your lifestyle and goals. Fortunately, it’s easier than ever to evaluate how much life insurance you need—we have an online life insurance coverage calculator for that!