- Most choose a life insurance beneficiary based on their dependents, like a spouse, children, or parents Children of minor age cannot receive insurance payouts directly. So if you wish to designate your children as beneficiaries, be sure to choose a trustee you can rely on

- Life insurance beneficiaries and estate planning go hand-in-hand

- Evaluate and update your life insurance policy and beneficiaries regularly to make sure you are protecting those that mean the most to you

- What is a life insurance beneficiary?

- Can I appoint multiple beneficiaries to my life insurance policy?

- Why should you name a beneficiary?

- Who should you name as your beneficiary?

- What is a contingent beneficiary?

- Should I name my children or spouse as my beneficiaries?

- Can I change my beneficiary?

- Do I have to name my beneficiaries?

- Should I tell someone they are my beneficiary?

With all the choices that surround securing life insurance coverage, one can sometimes neglect one of the most important parts. Choosing a life insurance beneficiary may seem like an obvious choice, but between considering who you are trying to protect, their age, and whether they still need that protection further into your coverage period.

What is a life insurance beneficiary?

A life insurance beneficiary is the person, persons, or institution that you stipulate as the recipient of your life insurance policy’s payout if you were to die. In the case of privately purchased life insurance, this is a tax-free, lump sum, cash payment and is typically used to help a partner with living expenses, raising dependent children, end-of-life expenses (taxes, funeral arrangements) and to pay down existing debts so as not saddle your dependents with another expense in the unfortunate event of your passing.

While applying for life insurance, you can name a beneficiary within the life insurance application form. In case you missed appointing a beneficiary at that time, you can also make the nomination by simply completing a beneficiary declaration through your life insurance provider.

Can I appoint multiple beneficiaries to my life insurance policy?

You can name multiple beneficiaries and outline what percentage of your death benefit each should receive. Specifying the percentages up front avoids any disagreements in the future on the allocation of the proceeds.

Alternatively, you can name one beneficiary and a contingent beneficiary for the cases where something may happen to your main intended beneficiary between the time you name them and the event of your passing. More on these situations later.

Why should you name a life insurance beneficiary?

It is prudent to name a life insurance beneficiary.

Firstly, it ensures the timely payout of your death benefit. If you do not name a beneficiary in your insurance policy, your death benefit automatically goes to your estate, if you pass away. From there, your estate will enter probate, where it could take months or even years to determine where any leftover funds should be directed once your debts have been settled. If you name a beneficiary in your insurance policy, they will directly receive your death benefit once the insurance provider approves the claim, without going through any probate process. Head here to learn more about how life insurance, probate, and wills work.

Secondly, naming a beneficiary also ensures those you intended to receive your death benefit get it. If the death benefit from your life insurance policy is stuck in your estate, an individual or creditor you did not intend to could lay a claim to it. By naming a beneficiary, you protect the life insurance proceeds (or even the cash value of a policy) from claims of any creditors or litigants.

Who should you name as your life insurance beneficiary?

When choosing who to name as your beneficiary, it is important to consider why you purchased life insurance in the first place. Most contemplate and purchase life insurance in the wake of major life milestones and events: marriage, home ownership, and parenthood.

In these cases, the motivation for protecting oneself financially is to ensure a partner or children have the means to live comfortably in the absence of your monthly income. Given this consideration, a domestic partner (spouse or significant other) is one of the most common beneficiaries named for life insurance, as household expenses, child-rearing, or mortgage debt will transfer to them entirely in the event of your passing.

That said, there are several different scenarios for who to choose as your life insurance beneficiary:

- Your spouse – when raising children, maintaining a mortgage, and living expenses need to be considered

- Your children – if you are not in a domestic partnership with your children’s other parent, you most likely want to make sure they are taken care of. Many would also appoint children as their contingent beneficiaries, in addition to naming their partner as the primary beneficiary.

- Your parents – if your mother and/or father depend on you for financial support, or cosigned on any of your debts (student loans, lines of credit, mortgages), you would want to be sure they are taken care of as well.

What is a contingent beneficiary?

A contingent beneficiary is a person or persons you name as your policy’s beneficiary should something happen to your original beneficiary. Say for example you have named your spouse as your main beneficiary as you have children and a mortgage and those responsibilities would fall onto them. In the unfortunate circumstances where something happened to both you and your partner at the same time, your death benefit will still be paid out.

If you choose a contingent beneficiary – such as your children – the payout would then go to them. If you do not choose a contingent beneficiary then your death benefit will go to your estate. Even if you have stipulated in your will who or what your estate should go to, all of your assets and debts will enter probate and need to be settled before those you leave behind see any money from a life insurance death benefit.

If you name these dependents as a contingent beneficiary, the death benefit immediately goes to them, or their appointed trustees. More on that below.

Should I name my children as my beneficiaries?

You should definitely use your life insurance death benefit to take care of your dependent children, but leaving the cash directly to them may be counterintuitive.

In Canada, most provinces disallow children under 18 controlling money left to them in an insurance policy. If you are concerned with your under-age children having financial resources in such a situation, it’s important to set up a trust for them, and name a trustee you have faith in to distribute the funds to them appropriately through age 18, and in full when they reach adulthood.

Read more about how to set up a trust in Canada.

Should I appoint a trustee or set up a trust for my dependent children?

If you do not name a trustee or set up a trust, then the insurance company will pay the insurance proceeds into the provincial court or to a public trustee, who will administer the funds until the beneficiary reaches legal age.

While this exercise falls more in the realm of estate planning than purely life insurance, the two are intrinsically linked. Speaking with a licensed insurance broker like the ones at PolicyAdvisor can help steer you in the right direction with insurance decisions that may affect your estate planning. Schedule a call and see how they can help.

Also note, if you have a child with special needs, whether they are a minor or dependent adult, you may want to name a trustee or set up a trust as a beneficiary so that they don’t lose access or disqualify for government benefits. Some government benefits that are meant to ease the financial burden of medical care are contingent on those receiving them falling below a certain income level or not having significant financial assets. By leaving a large sum of money in that dependent’s name could possibly disqualify them for some of these benefits.

Do I have to name my spouse as my beneficiary?

While it is common to name one’s spouse as the beneficiary on their life insurance policy, it is not mandatory. The choice of your beneficiary is just that: yours. Keep in mind, however, that some Canadian provinces have spousal rights that can supersede what you intend in your wills, estate, and beneficiaries.

As well, take special care to update your beneficiaries in the event of a change in marital status. If you divorce or remarry, you want to ensure your death benefit is going where you then intend it to. Read more about the ins and outs of life insurance and divorce.

Can I change my life insurance beneficiary?

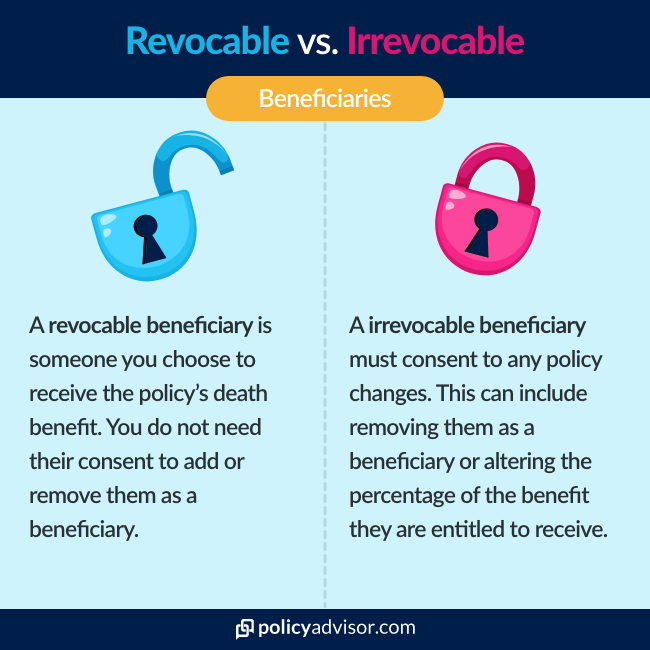

Yes, you can change your life insurance beneficiary but the process is different depending on if you have a revocable or irrevocable beneficiary.

What is a revocable beneficiary?

A revocable beneficiary is a named life insurance policy beneficiary that can be changed at any time without informing them or seeking their approval.

What is an irrevocable beneficiary?

An irrevocable beneficiary is a named beneficiary in a life insurance policy that cannot be changed without the consent of said beneficiary. In Quebec, the spouse (if married or in civil union) is always considered an irrevocable beneficiary, unless you specifically designate otherwise.

Do I have to name my beneficiaries?

It may seem strange to not name a beneficiary, but some ask if they can instead use generic terms like “spouse” or “children” as their named beneficiary to save themselves the time of having to update their policy in the future. While this may seem like a clever time-saving measure, it’s better to directly name the beneficiary and update your policy as needed through the years.

Using a generic term like children or spouse may end up denying those you intend to receive the funds from your death benefit. For example: some provincial laws don’t consider step-children as children in these matters. In other cases you may intend to for your benefit to be dispersed equally amongst your children and their dependents. By only using the generic term “children” then only living children, and not your predeceased children’s families, would receive that benefit.

For these reasons you should always use the specific name of your intended beneficiary.

Should I tell someone they are my life insurance beneficiary?

While it can be an awkward conversation – you are talking about your death after all – it’s very important you let your beneficiaries know that you have named them in your policy. Most importantly, the beneficiary should know about the policy so they know they can make a claim. The insurance company will not pay the proceeds unless a claim for payment is received.

As mentioned earlier, there can be tax/government assistance eligibility implications to receiving the proceeds from a life insurance death benefit, and your beneficiary may want to alter how these funds are received to ensure they are not penalized or lose any government assistive benefits they currently partake in.

Other choices for your life insurance beneficiary

While children and partners dominate life insurance beneficiary considerations, there are other choices you may need to make for a beneficiary given your personal situation.

As we mentioned above, it is not uncommon for a parent to be named as a life insurance beneficiary. With Canadians living longer than ever, some seniors depend on financial help from their children in their final years, and some want to make sure their parents can live in comfort if something unexpected happens to them. Another reason to name your parent(s) as a beneficiary is if they lent you funds or cosigned any financial agreements with you, and would thus be on the hook for this debt in the event of your death.

Other beneficiary choices can be more simple. Some name close friends as beneficiaries of their life insurance policy, especially in cases of whole life policies when there are no obvious dependent recipients for an asset that has accumulated significant cash value.

Another choice is leaving the death benefit or a portion of it to a charity or association which the policyholder feels passionate about. Whether it’s a group you volunteered for in the past, a local SPCA chapter in memory of a beloved pet, or a medical group or association completing research in a field of significant interest, Canadians are increasingly directing a part of their death benefit to leave a legacy that exists beyond them.

Who can I talk to about choosing a life insurance beneficiary?

Our licensed insurance agents have decades of experience guiding Canadians through picking the right coverage and determining how to choose their beneficiaries. Book some time today to figure out how you plan to protect yourself and your dependents and find some of Canada’s best life insurance quotes and companies.

Choosing a beneficiary for your life insurance policy is an important step. After all, they will receive your policy’s tax-free benefit when you pass away. You can also choose to name several beneficiaries who will share the death benefit when the time comes. Without a beneficiary, your death benefit will automatically go to your estate, where it may be subjected to probate.

1-888-601-9980

1-888-601-9980