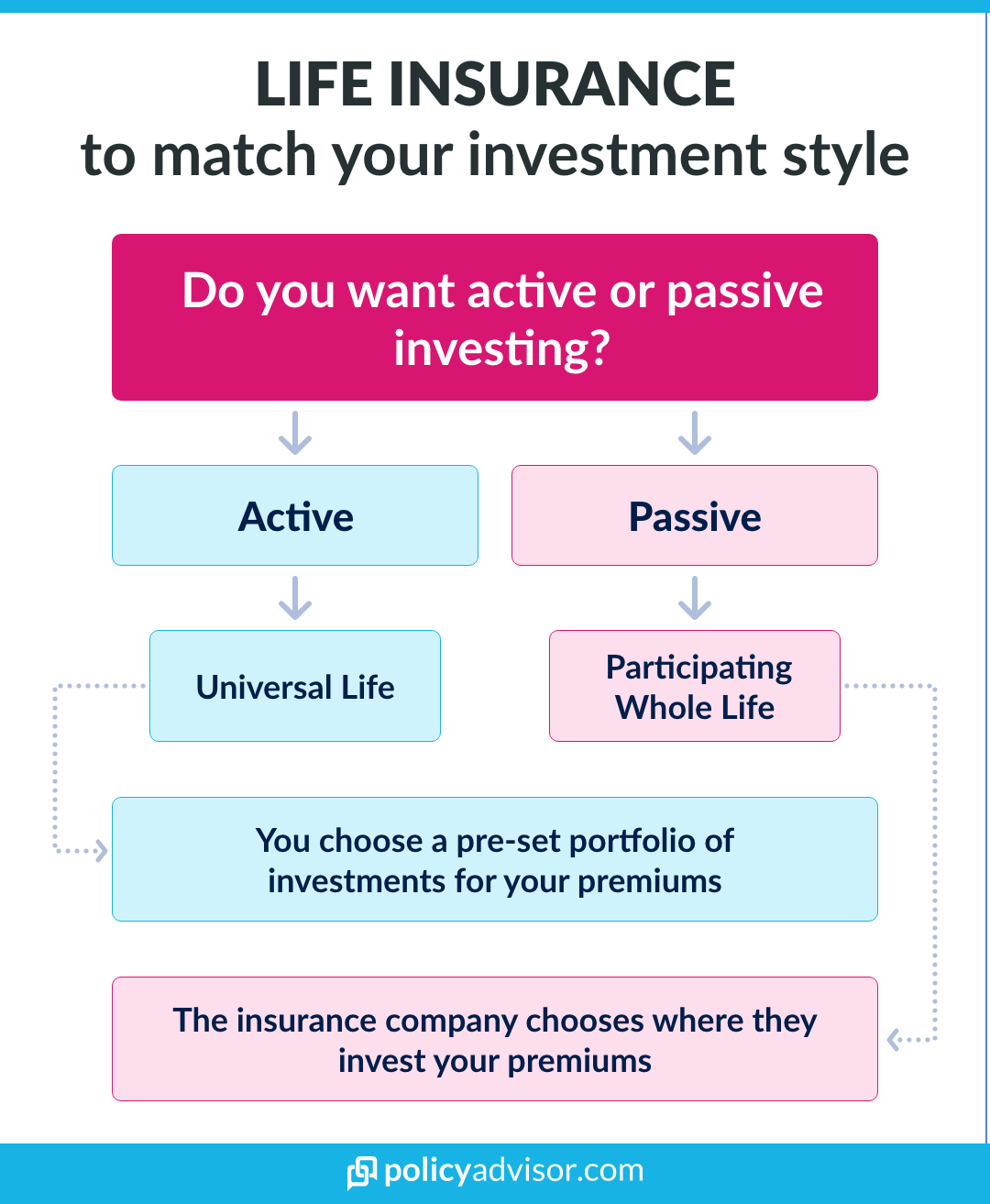

- Participating whole life insurance and universal life insurance have investment components; but term life insurance does not

- Because whole life insurance is more complicated and more expensive, many Canadians are better served by a simpler term life insurance policy

- Investment through life insurance can prove useful in cases where you need permanent coverage, you’ve exhausted tax-free investment options like TFSAs and RRSPs, or are doing estate planning

Life insurance is a good investment for many reasons, with peace-of-mind being number one. You may only think of life insurance as a way to protect your loved ones, but you can also use it as an investment tool to save and grow your wealth.

This article explains how some life insurance policies can also act as investments. We review how such policies can be good investments and why some may not choose this route.

What types of life insurance have an investment component?

Participating whole life insurance (aka participating permanent life insurance)

Participating whole life insurance provides lifetime insurance coverage with a fixed premium. You won’t see your premiums change as you grow older, change occupations, or participate in certain activities.

Your insurance company invests the cash value of your premiums, which accumulates over time and grows tax-free. You can additionally withdraw money from your policy or use it as collateral for a third-party loan. However, doing so can reduce your coverage and produce tax liabilities. If investments do substantially well, it may provide dividends that you can reinvest or withdraw.

Universal life insurance

Universal life insurance is similar to participating whole life insurance but provides more flexibility. You have the same lifetime coverage, tax-free growth, and ability to withdraw and use it as collateral. However, universal life insurance offers different options on how you can grow your policy’s cash value.

You can vary your investments depending on your risk tolerance and objectives. The growth of your policy’s cash value ultimately depends on how well your investment choices perform. Premiums are also flexible with universal life insurance. You can choose to pay a steady premium or pay a premium that’s as little or as much as you want as long as you cover the regular deductions made by your insurance provider.

Read more about whole life insurance vs. universal life insurance.

Reasons why life insurance makes a good investment

Permanent Life Insurance Coverage

Life circumstances are different for everyone. Some individuals are fine with an insurance policy that only lasts for 10-30 years. However, you may have lifelong dependents that may need a life insurance payout regardless of when you die.

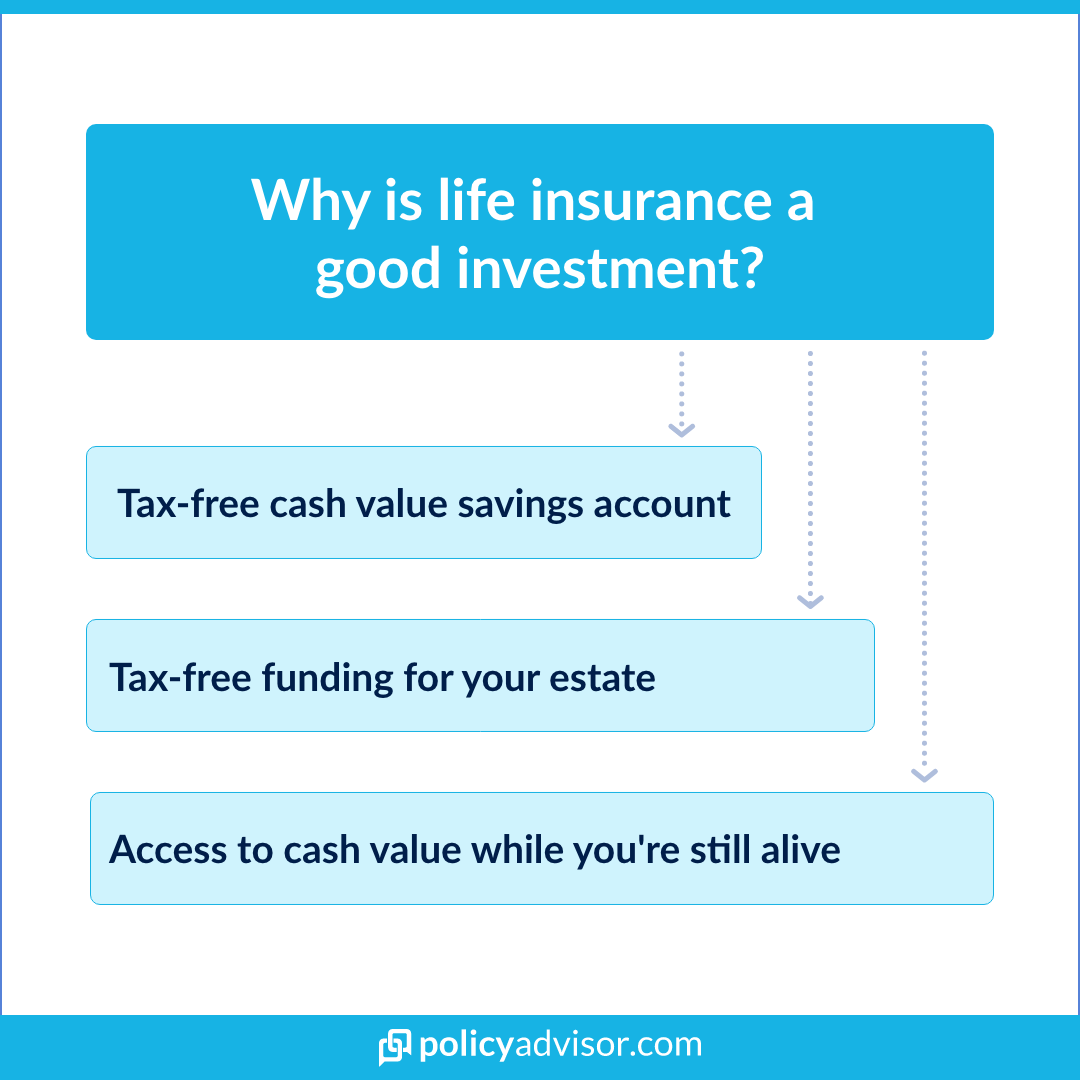

Tax-Advantaged Investing

Because death benefits are paid tax-free to your beneficiaries, your policy’s cash value grows tax-free. This is especially useful after you’ve maxed out conventional tax-free investment vehicles such as your Tax-Free Savings Account or Registered Retirement Savings Plan.

Estate Planning

The tax-free nature of your life insurance policy makes it an effective estate-planning tool, because your beneficiaries receive an amount of cash not subject to estate taxes. Further, suppose your estate comprises of many fixed or long-term assets. In this case, your beneficiaries can use the cash from your death benefit to pay any estate taxes associated with the fixed and/or long-term assets of your estate. This prevents the need to sell assets just to pay for estate tax.

Access to Funds

The ability to withdraw cash from your policy can provide a source of emergency capital. If you find yourself laid off or hit with an unexpected expense, a participating whole life insurance or universal life insurance policy can quickly provide the money you need. The ability to borrow against the policy can also provide you with access to funds with less strenuous tax liabilities.

Why should life insurance not be used as an investment?

Most Canadians may find term life insurance a better fit for their situation. Term life insurance is simpler and generally less costly. You pay premiums for a set period, and your beneficiaries only receive the death benefit if you pass away while the policy is in effect. This structure makes sense for those who plan to have little-to-no debts and substantial savings as they reach retirement age. You can also combine term life insurance with a smaller whole life policy — generally to cover your own funeral costs or other expenses and remaining debts. This practice is called insurance laddering.

Additionally, life insurance isn’t the ideal investment if you prefer managing your money independently. Even though universal life insurance provides different investment options, independent investing is still more flexible. Independent investing further has generally better returns since an insurance company isn’t taking regular deductions.

It’s common to only consider life insurance as a way to protect loved ones after your death. However, it’s also a good tax-free investment opportunity and a tool for estate planning. It’s ultimately up to your life circumstances, objectives, and risk tolerance whether you choose participating whole life insurance, universal life insurance, or term life insurance. Life insurance is overall an important emotional investment that provides peace of mind for you and your loved ones.

Need help with your insurance planning? Reach out to one of our expert advisors below and book some time to discuss your insurance needs and receive no-obligation quotes.

In addition to providing financial security for your loved ones when you no longer can, life insurance can be an excellent investment option. Used strategically, certain types of life insurance can help build wealth, including participating whole life insurance and universal life insurance. Moreover, the tax-free nature of death benefits makes life insurance an effective tool for estate planning.

1-888-601-9980

1-888-601-9980