- Life insurance eligibility after cancer depends on the diagnosis, prognosis, and remission

- No-medical life insurance is a good option for cancer patients and people with health issues

- Cancer will not affect an existing permanent life insurance policy

- But, cancer could affect an existing term life policy if you want to renew it

Being diagnosed with cancer can affect many aspects of your life, including your finances, daily routine, and physical well-being. It can even impact your life insurance options.

Cancer is a disease classified by the growth and uncontrolled spread of mutated cells that overtake and attack healthy cells and organs. The disease is shockingly common. Throughout their lives, one in two people will receive a cancer diagnosis. And, in Canada, cancer is the leading cause of death, accounting for 1 of every 3 (source: Canadian Cancer Society).

Those who have been diagnosed with cancer often have a lot of questions about life insurance and eligibility. Are they allowed to hold a life insurance policy? Can they still be covered? Will the insurer still make a payout to their beneficiaries?

But the good news is that even though traditional life insurance might not be available for someone with cancer, there are still some other types of life insurance that can offer cancer patients and their families a bit of financial peace of mind.

Does life insurance cover death from cancer?

Yes, life insurance pays out for cancer death. This is actually quite common. But, looking for coverage after a cancer diagnosis is a bit more complicated than it is for an individual without cancer. Your cancer diagnosis and its progression determine the types of policies that will and will not be available to you.

During the underwriting process, the insurance company will look at your specific situation to determine if they can cover you. Because of this, the exact type of insurance someone with a cancer diagnosis may be able to get will vary. On top of that, policies can be different too. If you have health issues like cancer, the insurance company may lower your coverage amounts. They may also put coverage limits on your policy, like only covering certain situations.

This is why you should speak with an experienced advisor if you are considering life insurance after cancer. Insurance experts like those at PolicyAdvisor can give you advice based on your specific needs.

Additionally, if you cannot get traditional insurance because of cancer, you should think about getting guaranteed issue life insurance. This type of policy is available to almost everyone, even if they have health concerns. Although, there is a 24-month deferral period before you can submit a claim. Guaranteed issue life insurance can be the perfect policy if you’ve been turned down for regular insurance but expect to live for more than two years.

What happens to your life insurance if you are diagnosed with cancer?

If you already had life insurance before you were diagnosed with cancer, your coverage will not change. But the outcome will be different depending on whether you had a term or a permanent life policy.

Permanent life insurance policies, such as universal or whole-life, will not change even if the policy holder is diagnosed with cancer. Your insurance will still cover you fully, and you don’t have to tell the insurance company about your cancer diagnosis if you don’t want to. But you should at least tell the person in charge of your policy (the executor) about it.

If you already have an existing term policy, you will also still be covered for the rest of the time the policy is in effect. However, if you want to renew or change their coverage, you will have to tell your insurer about your current health status. At that time, you will need to share your cancer diagnosis with your provider. The insurance company might change your policy eligibility, coverage amount, and premiums accordingly.

Can you take out a new life insurance policy after a cancer diagnosis?

Even if you have cancer or have had cancer, you can still apply for life insurance. But the type of coverage available to you depends on cancer type, how it has progressed, and how long you’ve had it.

If your cancer diagnosis was:

- Less than 2 years ago

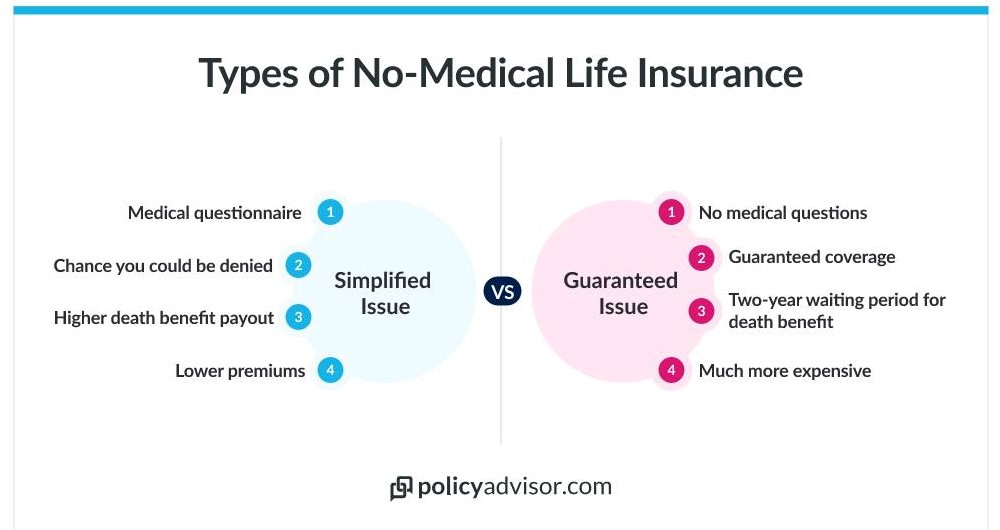

You can apply for a guaranteed or simplified life insurance policy. These policies do not require medical exams and have limited or no medical underwriting. However, you will have to wait at least 2 years before you can submit a claim, and they are much more expensive than a traditional policy. Read more about simplified issue vs guaranteed issue life insurance. - Between 2-5 years ago and you have been stable since

You can apply for either simplified or rated insurance policy. A simplified policy doesn’t require a life insurance medical exam, but usually costs more and gives you less coverage. A rated policy is regular insurance that costs more because of greater risk. - Between 5-10 years ago and you have been stable since

You will probably be able to get normal insurance. But you will likely get a rated policy. This means your life insurance will cost more, but you will get all the benefits of a traditional policy, like more coverage and no waiting period. - More than 10 years ago and you have been stable since

You can apply for traditional life coverage and may even get the same rates as someone with no health issues.

Can cancer patients get term life insurance?

If you have cancer and you’re still getting treatment, or your cancer symptoms have only been getting better for less than 5 years, you probably won’t be able to get a term life insurance policy.

If you’ve been in remission for less than 5 years, it may be best to apply for a guaranteed issue policy or a whole-life rated policy.

How does the type of cancer impact life insurance?

Insurance companies will be more hesitant to provide coverage to someone who has been diagnosed with what they determine to be a riskier form of cancer. The more serious the cancer, the more likely it is that you can’t get regular life insurance. An insurer determines your cancer’s severity by its spread and origin. These both factor into how likely you are to recover and go into remission.

Life insurance for stage 1 and stage 2 cancer patients

Localized cancer is cancer that has not spread from its original location. It is still seen as risky, but since the cancer has not moved to the other parts of the body, insuring you is less of a risk than if it had spread. If you have stage 3 cancer, where the cancer cells have grown or possibly spread to other body parts in the same region, it may be more difficult to get traditional life insurance.

Life insurance for stage 4 cancer patients

Metastatic cancer, sometimes known as stage 4 cancer, is cancer that has spread to other parts of the body. This cancer is much more dangerous and can result in a denial of life insurance. Even if you are approved, you can expect higher life insurance premiums due to an increased risk to the insurer.

Where cancer originates in the body impacts how likely it is to spread, whether it can be treated, and whether it can lead to death. For example, pancreatic cancer only has an 8% survival rate, so it is unlikely those with that diagnosis will be approved for traditional life insurance.

However, cancers such as testicular or thyroid cancer have a survival rate of over 90%, so you’re much more likely to get coverage because the risk is lower.

Often, those who are 5 or more years in remission from less dangerous cancers can get traditional insurance, and possibly even standard rate premiums.

Is cancer a pre-existing condition?

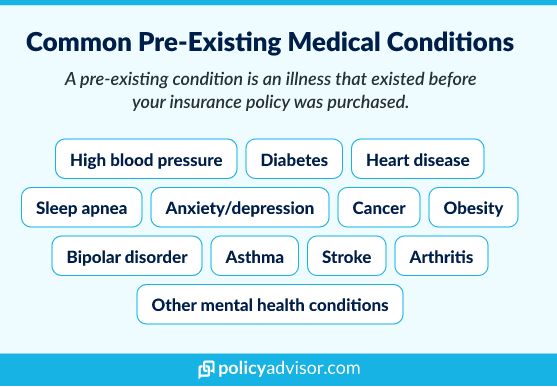

In short, yes. In insurance, a pre-existing condition is a health condition or previous diagnosis you had from before you applied for insurance, and that may impact your lifespan or overall health. This could be anything from high blood pressure to diabetes to cancer.

Do you have to tell your insurer about cancer?

In most cases, you must tell your insurance company about your health status and medical history, including pre-existing conditions and cancer. When applying for traditional life insurance, you will be asked a series of health questions, including about your cancer diagnosis, your family history of cancer, and your risk of cancer. You must tell your provider about the diagnosis during this process.

Keep in mind that if you are not honest about your medical history on your application, you can be denied coverage or your policy may be deemed void. This can be especially devastating if your beneficiary is refused your death benefit because you lied on your application.

How does cancer affect life insurance rates?

If you are approved for coverage after a cancer diagnosis, you can expect to have higher rates for life insurance than prior to being diagnosed. Since cancer is such a common cause of death, it’s a riskier disease for insurance companies to cover. This results in higher premiums and potentially less comprehensive coverage.

In most cases, people with cancer will only be eligible for guaranteed issue life insurance. And most insurers will not provide coverage above $50,000 for this kind of insurance policy. The chart below shows some of the premiums a cancer patient can expect for this kind of coverage.

No-Medical Life Insurance Cost Comparison

| Age | Canada Protection Plan (CPP) | Industrial Alliance (iA) | Assumption Life |

|---|---|---|---|

| 25 | $58.82 | $60.84 | $73.62 |

| 30 | $72.54 | $74.97 | $86.99 |

| 35 | $86.31 | $89.33 | $106.52 |

| 40 | $100.08 | $107.73 | $111.15 |

*Based on non-smoker rates for $50,000 in coverage with a no-medical life insurance policy. Find more rates on PolicyAdvisor.com using our free quoting tool.

Traditional life insurance premiums for an individual without cancer are much lower, but it can be difficult for someone with cancer to get that kind of policy.

Frequently Asked Questions

Can someone with terminal cancer get life insurance?

Unfortunately, it is not likely that someone will terminal cancer can get regular insurance coverage. The risk is too high for the insurance provider. In this case, the best life insurance for cancer patients is a no-medical-exam life insurance policy.

What happens if someone dies shortly after getting life insurance?

What happens depends on the type of policy you have. If your policy does not have a waiting period, your loved ones will receive the insurance money as stated in your agreement with the insurance company. But if your policy has a waiting period and you pass away before that period is over, your beneficiary won’t get the full payout.

For example, if someone has a guaranteed life insurance policy with a two-year waiting period, but dies within 6 months, a death benefit will not be paid in full. However, some policies will pay back the premiums or a percentage of the death benefit if the insured dies within the waiting period.

When can cancer survivors get life insurance?

Cancer survivors can apply for life insurance anytime, but they may have a difficult time finding a lot of coverage options if they were recently diagnosed.

The longer you’ve been getting better, the more likely you are to be approved for regular life insurance. After 10 years of remission, many survivors of cancer are able to get traditional insurance policies.

What other kinds of insurance can you apply for if you have cancer?

If you can’t get a traditional term or whole life policy, you still have other options that can give you some financial protection.

No medical life insurance

A no medical policy does not require a medical examination or comprehensive medical questionnaire. This type of policy is great for people who can’t get regular insurance, so it’s a good option for cancer patients. Simplified issue life insurance and guaranteed life insurance policies are two types of no medical options.

Simplified insurance does not ask you to do a medical exam, but it does ask you to fill out a short medical questionnaire. This means there is still a possibility that your application could be denied. Often, the death benefit for a simplified issue policy is higher than a guaranteed life cover policy, and the policy itself is often less expensive.

Guaranteed issue coverage is the most expensive life insurance option. However, you do not need to answer any medical questions, meaning you will be guaranteed to be offered coverage. It is important to note that the full death benefit is not available until after the waiting period. This is often two years.

Another plus side of no medical policies is that some do allow you to purchase life insurance riders, which are optional features that provide additional coverage. So, even someone with a previous cancer diagnosis or who is undergoing treatment for cancer still has options for life coverage.

Some of Canada’s leading insurance companies offer no-medical policies. Although, PolicyAdvisor strongly recommends Canada Protection Plan (CPP). In fact, we actually rated them as the best non-medical life insurance provider in our Best Life Insurance Companies in Canada Review.

Read our full Canada Protection Plan Life Insurance Review.

Critical illness insurance

Critical illness insurance is a type of insurance that provides a one-time, tax-free lump sum payment if you are diagnosed with a life-threatening condition or disease. Some providers let you buy a critical illness insurance policy even if you have cancer or if you’re undergoing cancer treatment.

But keep in mind that whether you can get critical illness insurance depends on your diagnosis. Your policy may also come with some restrictions or exclusions. And, some providers may rate your policy, leading to higher premiums.

Read more about critical illness insurance coverage and cancer.

Cancer insurance

Cancer insurance is similar to critical illness insurance. It covers the cost of medical and non-medical expenses that come along with a cancer diagnosis. Cancer insurance can be used to cover screenings, radiation, chemotherapy, surgical benefits, and other treatments that are not covered under your universal medical care. The difference is that critical illness insurance will often offer a lump sum payment for up to 25+ medical conditions (heart attack, stroke, etc.). Cancer insurance will only pay out after a cancer-specific diagnosis. When getting a cancer insurance quote, the premiums may be cheaper than a critical illness insurance policy, but the coverage is much more limited.

Connect with an advisor

Rest assured, getting life insurance after cancer can be much easier than you think — whether you are a survivor of cancer, still undergoing treatment, or if you, unfortunately, have an advanced stage of cancer. One of the best ways to get insurance with cancer is to speak with an experienced life insurance agent, like the ones at PolicyAdvisor. We can help you find the best coverage options based on your individual circumstances.

To get a free life insurance quote or to learn more about how a specific cancer diagnosis could impact your life insurance options, book a call with one of our friendly, licensed advisors today and get expert advice on your next best move.

A cancer diagnosis can be scary and leave you questioning whether you can still give your family financial protection after the fact. The good news is, you still have life insurance options. But the type and cost will vary based on your diagnosis, recovery, and other factors.

1-888-601-9980

1-888-601-9980