- The cost of a $1 million term life policy depends on factors like policy type, the age of the insured, as well as their health, smoking status, and gender

- A $1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount

- A 40-year-old non-smoking female can pay under $45/month for a 20-year-term policy worth $1 million. A male in the same group can pay under $90/month

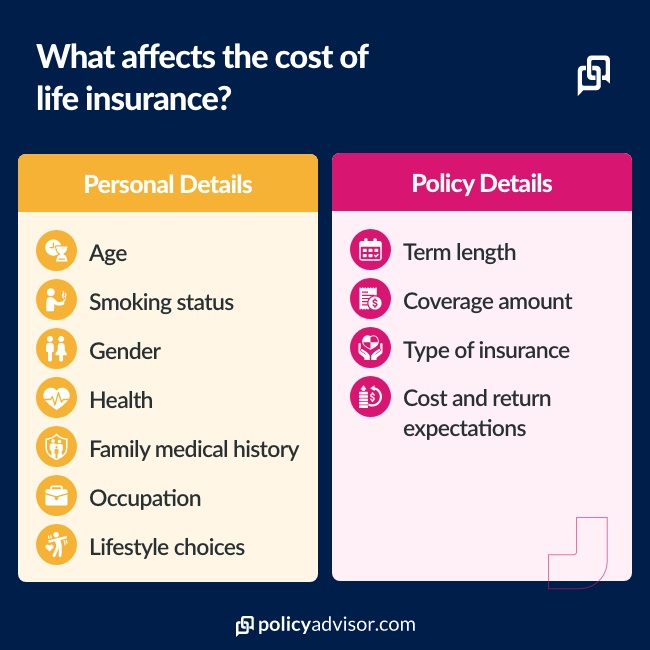

Finding out how much a million-dollar life insurance policy costs can be a daunting task. Multiple factors determine the cost of life insurance, including how old you are, your health condition, and your gender. On top of that, the type and length of term coverage you take also affect the cost. While all of that may seem complicated, $1,000,000 worth of life insurance may not cost as much as you think.

If you want to find out how much one million dollars of life insurance would cost right away, you can get a free online quote from us online in minutes. For more details on how much you can expect to pay, and how that’s determined – read on. In this article, we’ll look at term life coverage.

What is term life insurance?

Term life insurance is coverage that lasts for a specific period of time. That period of time, or term, can be a fixed number of years or until you reach a certain age. You get to choose your term length when you apply for the policy.

The most common term lengths are 10 and 20 years. Many Canadians try to purchase life coverage that will last until they are 65 years old or have reached retirement age.

With term policies, you pay yearly or monthly premiums to your insurance provider until your term ends. In return, your beneficiaries receive a tax-free death benefit (life insurance payout) if you pass away during the policy term.

Once your term ends, your coverage expires and you can then stop paying the premiums. Or, you can renew your policy or buy a new one.

What affects the cost of life insurance?

Life insurance premiums depend on several factors:

- Age

- Gender

- Current health

- Medical history

- Lifestyle

- Smoking status

- Type of coverage

Generally, the younger and healthier the person, the lower the premium. And, women tend to get lower premiums than men.

But the best way to get affordable rates is to compare quotes from multiple insurance companies. You can do that easily with our online comparison tool, or by speaking with one of our licensed advisors.

How much does $1,000,000 of term life insurance cost?

The actual cost of a million-dollar policy depends on several factors. In addition to the ones we mentioned earlier, like age and gender, term life insurance rates are also based on:

- Term length

- Coverage amount

Longer term lengths and higher coverage amounts are usually more expensive. But term life policies have more affordable premiums than most other types of life insurance.

In this article, we are looking at a death benefit of $1,000,000. The charts below show how much a million-dollar policy costs for a 10-year term and 20-year term, for healthy non-smoker men and women at different ages.

Term life insurance costs – Male, $1,000,000 Coverage

| Age | Non-Smoker | Smoker |

|---|---|---|

| 30 | $37.71 | $79.12 |

| 35 | $38.43 | $86.18 |

| 40 | $51.40 | $126.65 |

| 45 | $78.35 | $214.07 |

| 50 | $127.54 | $378.79 |

| 55 | $221.71 | $640.87 |

| 60 | $384.19 | $982.35 |

| 65 | $679.28 | $1,629.18 |

Term life insurance costs – Female, $1,000,000 Coverage

| Age | Non-Smoker | Smoker |

|---|---|---|

| 30 | $25.65 | $47.25 |

| 35 | $28.26 | $63.44 |

| 40 | $36.63 | $99.34 |

| 45 | $54.45 | $150.27 |

| 50 | $85.60 | $230.97 |

| 55 | $151.19 | $351.64 |

| 60 | $269.37 | $563.52 |

| 65 | $449.97 | $866.82 |

Do I need a million dollars of life insurance coverage?

Whether you need $1 million of insurance depends on you and your family. You should think about how much money your family or loved ones would need to keep living comfortably if something happens to you.

Some Canadians might need a million-dollar policy so that their family can:

- Pay funeral costs and other end-of-life expenses

- Keep up with mortgage payments

- Pay off outstanding debt, student loans, credit card bills, or joint lines of credit

- Afford daily living expenses and take care of children or dependents

- Afford future expenses, like a future college fund for young children

- Cover a business partner to ensure the survival of the business

Everyone’s situation is different, so you may not need as much as one million dollars. Most people would want to leave their family that much money if they pass away, but it’s not always necessary.

Frequently Asked Questions

How much life insurance do I need?

The answer to “How much life insurance do I need?” is different for everyone. As we said above, it really depends on your financial situation and how much you expect your family to need in the future.

A general rule of thumb is to get 10-12x your annual income in insurance coverage. But some families may need more than that, depending on if they have young children or other future expenses. Your age, health, lifestyle, and other factors will also impact how much coverage you should get.

If you’re not sure a million-dollar policy is right for your circumstances, there’s an easy way to check the numbers. Just check out our life insurance calculator! It only takes 5 minutes to answer a few basic questions and reveal exactly how much coverage you need.

It’s also always a good idea to speak with an insurance agent or financial advisor to find out what coverage would be best for your needs.

Who needs $1,000,000 in coverage?

Not everyone needs a million-dollar life insurance policy. It may be the best option for people with major financial obligations or dependents who rely on their income. The kinds of individuals who might need this much coverage include:

- Parents with very young children. A million-dollar policy can help put kids through school and college. It can also take care of their everyday needs, and any unexpected costs like medical emergencies.

- High-income earners. Someone who makes a lot of money would need a lot of financial cushion to provide their family with the same standard of living if they suddenly pass away.

- Business owners. Entrepreneurs can have a lot more assets and financial obligations than the average person. They could use $1 million in coverage to keep their business going even after they pass on.

- People with a lot of debt. This includes a mortgage, student loan, car loan, etc., not to mention if someone has all of these. They might need a heftier insurance policy to pay everything off if they pass away.

How do I get the best quotes for $1 million of life insurance coverage?

If you’re looking for instant life insurance quotes for a million-dollar policy, or any other coverage amount, you can find them right here on PolicyAdvisor! We help Canadians easily compare quotes from 30 of the country’s best life insurance companies.

Book some time with our licensed advisors and find out how easy it is to get the right amount of coverage – from anywhere you can access your computer or phone.

The cost of a $1 million life insurance policy is based on factors, like age, gender, health, smoking status, and type of policy. For such a large death benefit, you may be surprised at the wide range of premium costs available. Find out how much you can expect to pay for a $1 million life insurance policy.