- Smokers are subject to higher life insurance premiums than non-smokers

- Consumption of any form of tobacco, even a single cigarette or e-cigarette, in the last 12 months classifies you as a smoker, for life insurance purposes

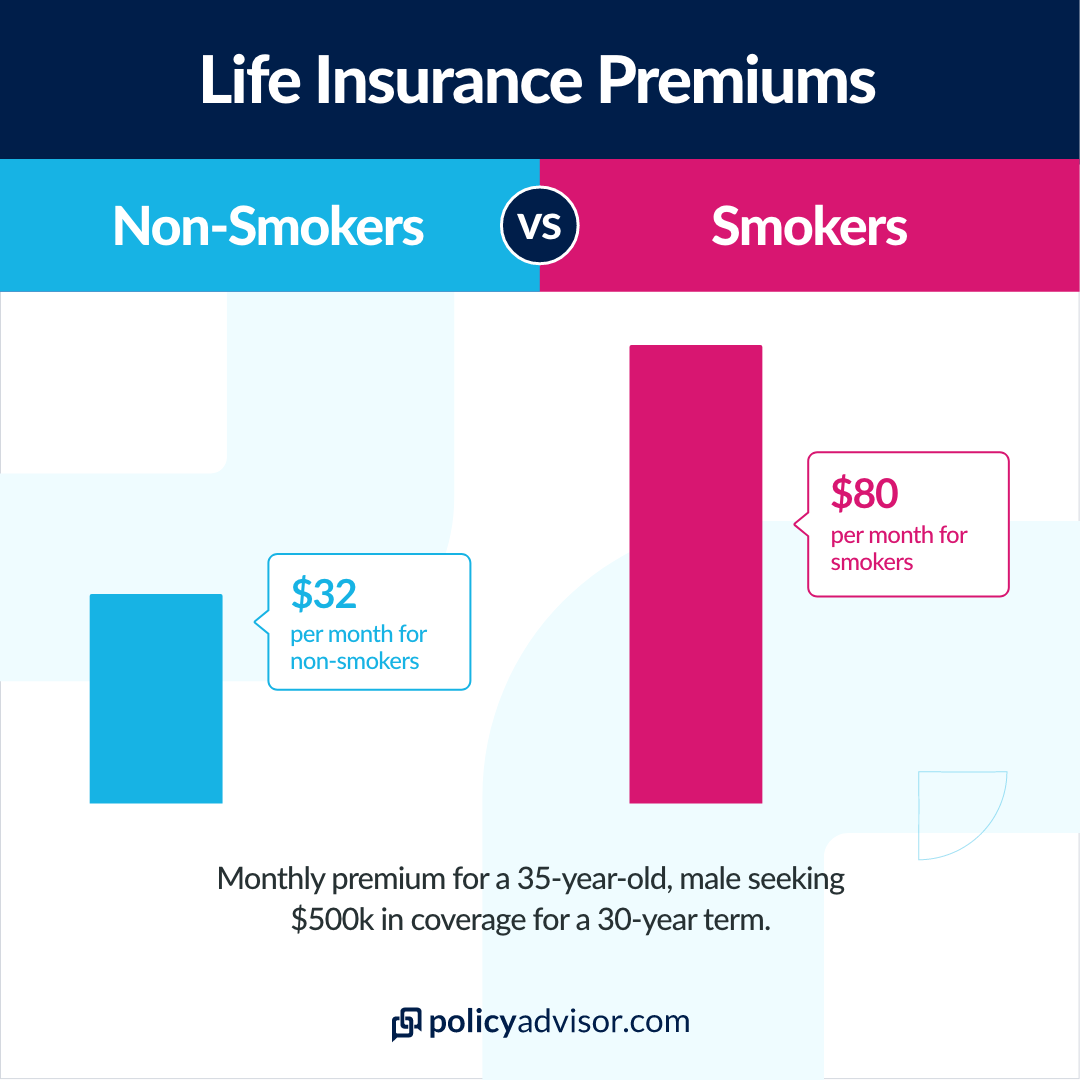

- Life insurance premiums for smokers can cost as much as 50 to 100% more than those for non-smokers

- If you have quit smoking and not used tobacco for 12 months, you can apply to have your rates reduced to non-smoker status

There are many factors that influence the monthly cost of a Canadian life insurance policy. Anything that affects your health and lifespan is taken into consideration. This includes your mental health, physical health, and other health habits.

One section on your life insurance application asks about your tobacco consumption and smoking habits. Tobacco use is linked with increased health risk for several diseases such as lung cancer, mouth cancer, and emphysema. As a result, life insurance carriers consider smokers at high risk of premature death. This means that rates for smokers are significantly higher than non-smoker rates.

In recent years, fewer people are smoking traditional rolled cigarettes. However, this decrease in cigarette smoking has led to an increase in vaping. Many former smokers have switched to vaping or electronic cigarettes as some media portrays it as a more discrete way to consume nicotine. E-Cigarette use is also popular amongst younger demographics. This is due to accessibility, variety in flavours, and a more subtle smoking experience. However, since the rise in popularity of vaping, some studies out of the US have reported lung injury and other health concerns associated with vaping habits.

While vaping is still advertised as a healthier alternative to smoking, what do life insurance companies think? Knowing that tobacco consumption and smoking affect life insurance premiums, it’s only fair to wonder if vape use also leads to expensive insurance. This article reviews how life insurance companies view vaping when underwriting life insurance applications and what you can do to lower your premiums if you vape.

Are you considered a smoker if you vape?

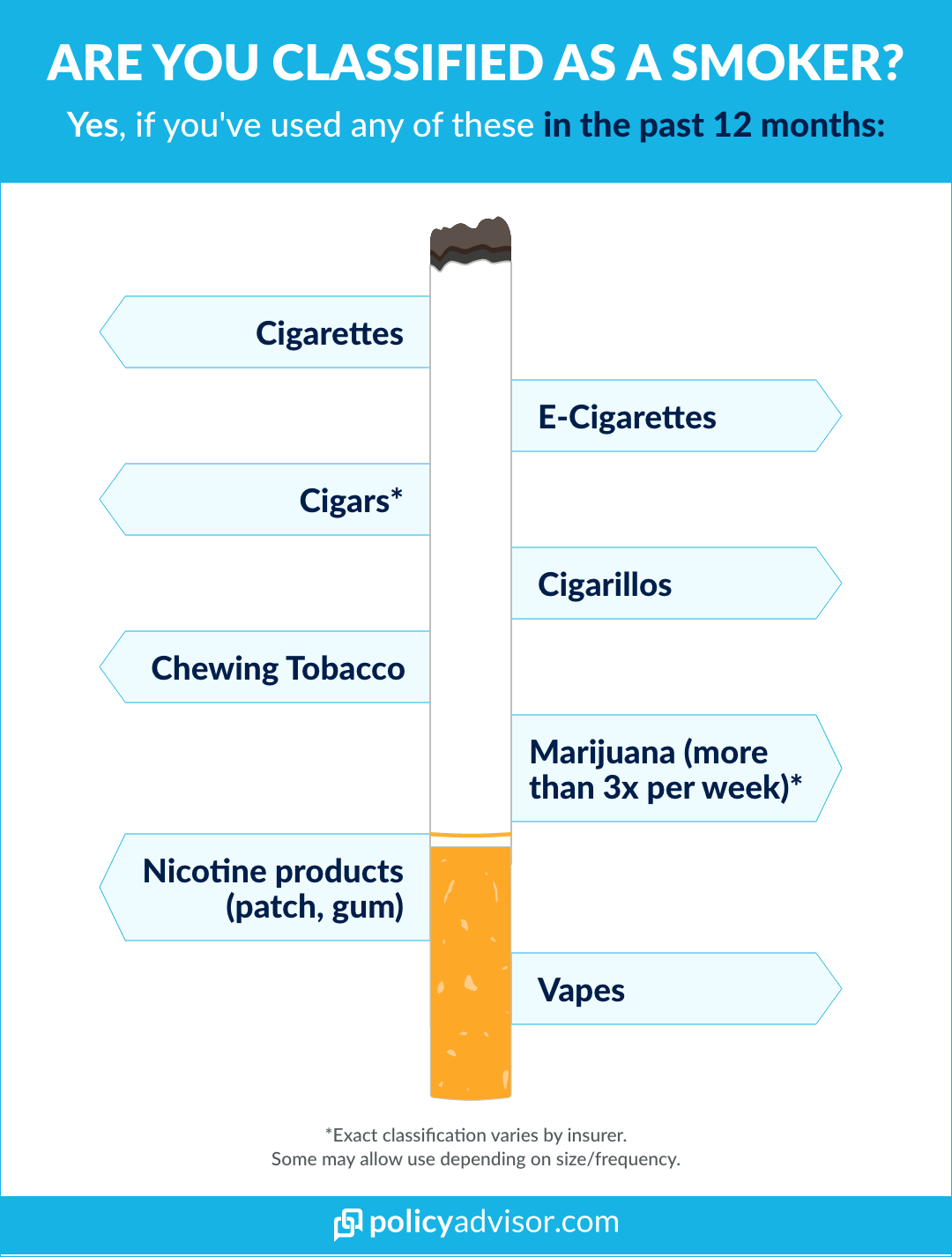

If you vape, you are considered a smoker according to most life insurance companies. In fact, you can be considered a smoker if you have consumed or used any of the following in the past 12 months:

- cigarettes

- tobacco products (chewing tobacco)

- nicotine patches

- hookahs

- nicotine gum

- e-cigarettes

- vapes

Frequent consumption of marijuana, such as edibles or cannabis products, can also classify you as a smoker. This includes adding cannabis oil to your vape. However, this will vary depending on your insurance provider.

There is some flexibility regarding cigar smoking. Some providers will allow you to smoke a few cigars and still classify as a non-smoker as long as your average is less than one a month. Though, this does depend on the size and type of cigar or cigarillo.

Does vaping affect your life insurance?

Vaping will affect the cost of your life insurance. E-cigarette users, vapers, and traditional cigarette smokers are all rated the same, regardless of the frequency or severity of their nicotine addiction. Any consumption of these products in the last 12 months classifies you as a smoker.

As a smoker, you are considered at higher risk for deadly health conditions such as stroke, heart disease, and cancer than a non-smoker would be. This means that you are more likely to pass away of a pre-mature death, making you riskier to insure. If you’re considered a risk to the insurance company, they will give you a rating, and this rating raises your premiums.

Insurance providers, like BMO, take into account the health effects of vaping, as well as unknowns like how some of the carcinogens found in vaping liquid (lead, formaldehyde) have long-term effects on e-cigarette users.

While Health Canada cites vaping as healthier than smoking regular cigarettes, US studies have reported adverse health issues and respiratory issues, many of which are still unknown. As more time passes and research is done on the long-term effects of vaping, we can assume that life insurance providers will update their guidelines for the cost of life insurance for vapers.

What happens if you lie about smoking or vaping on a life insurance application?

When you apply for life insurance, you are asked many questions about your health. One of these questions will ask if you smoke or not. If you vape, you are classified as a smoker, so you must answer yes.

Depending on the type of insurance you are applying for and your age, you may also be required to take a medical exam as part of the application process. During this exam, you will provide a blood sample and/or urine test from which they can test for nicotine.

It is possible to purchase a life insurance policy without a medical exam. This type of insurance is known as no-medical life insurance. In the application process, you will still be asked if you smoke. However, because these policies require no medical exam, blood test, urine test, or assessment of your vitals, they wouldn’t have evidence of the nicotine in your system. But, it’s important to note that no-medical policies typically have a more expensive monthly premium than fully underwritten life insurance, so you won’t get a cheaper rate choosing no-medical coverage.

Moreover, even if you don’t have to take a medical exam for your life insurance policy, you still should be honest about your smoking status. An insurance policy has a contestability period that begins from the start of your policy and lasts two years. If your insurance provider finds there was any dishonesty or misrepresentation during the application process, they can rescind your policy and deny you life insurance coverage. If you die during this contestability period and are found to have been a smoker when you claimed otherwise, your beneficiaries may not receive the policy’s death benefit.

Even after the contestability period, your insurance provider has the right to deny a claim if they can prove misrepresentation or improper classification during the time of application.

What happens if you start smoking or vaping after getting life insurance?

While health professionals would not recommend one starts smoking or vaping, it may still be the case for some. If you start smoking after your contestability period and you have a guaranteed rate, you should still be insured. However, if you’re considering taking up smoking it’s best to investigate your specific policy before you buy. Simply get a life insurance quote and compare the cost of smokers rates vs. non-smoker rates. It may deter you from taking up the habit.

Is life insurance more expensive if you vape?

Yes, life insurance is more expensive if you vape. If you are a nicotine user of any kind, you are considered a smoker and are subject to higher insurance premiums. Insurance for smokers can have 50-100% higher premiums compared to non-smoker policies. For a 45-year-old, male smoker your premium could be around $205 a month while a non-smoker could pay around $75 for a term life insurance policy. That difference adds up.

However, you may still qualify for preferred life insurance rates if you are a smoker. Preferred rates are offered to those with better than average health metrics. These metrics could include cholesterol levels, blood pressure readings, and body mass index. Speak with an advisor to learn more about affordable life insurance for smokers.

How long after quitting smoking can you get life insurance?

You do not have to quit smoking to get life insurance, however, you will save a good chunk of change if you do. To be classified as a non-smoker you must have not consumed any tobacco or nicotine products in the last 12 months. After 12 months you can honestly state on your application that you are a non-smoker.

If you already have a life insurance policy but have quit smoking since the start of your policy, you can apply to have your status changed to non-smoker. With non-smoker status, you will qualify for lower premiums. You will have to sign a declaration confirming that you have quit smoking and have not consumed any nicotine or tobacco in the last 12 months. In addition, you will need confirmation of a medical exam stating that there was no trace of nicotine or cotinine in your system. Your insurance provider will also ensure there have been no other changes to your health.

Do you vape and are worried about getting life insurance?

While vaping will affect the price of your life insurance quote, our expert advisors can help you find an affordable policy that works for you! Book a call with our advisors today!

Life insurance costs are based on your health and lifestyle choices. One major price factor is your smoking status—if you’re a smoker, you’re subject to higher insurance rates. If you smoke, vape, or consume any nicotine products, you are considered a smoker. It usually takes a waiting period of one year after you quit smoking to get non-smokers rates.