- Depression, anxiety, and other mental health problems are treated like any other health issue in underwriting; if severe, they can lead to higher premiums or denial of coverage.

- Disclose any mental health issue i your applicaiton to prevent the risk of invalidating your insurance policy.

- No medical life insurance may be a coverage option for some suffering from mental illness.

- How do insurers treat depression and anxiety on life insurance applications?

- Will a mental illness increase my life insurance premiums or deny my coverage?

- How can I save on premiums while applying for life insurance with a mental health concern?

- How can I save on premiums while applying for life insurance with a mental health concern?

- What if I fail to disclose a mental illness on my life insurance application?

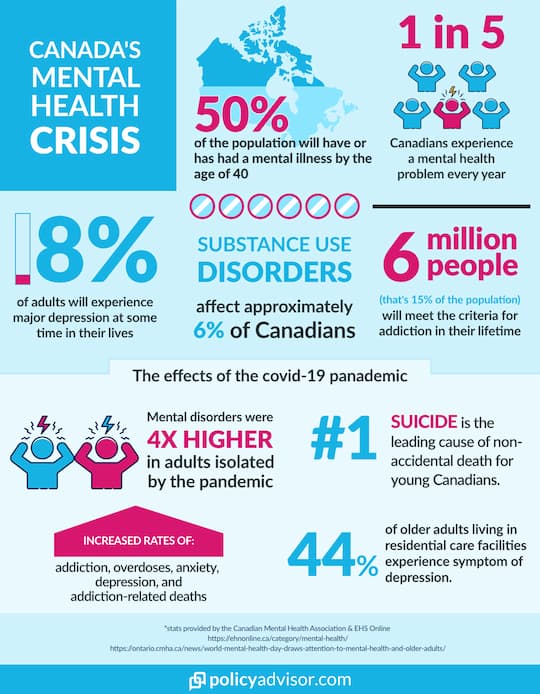

Approximately 1 in 5 Canadians experiences mental health problems or illnesses (source: Canadian Mental Health Association statistics). Fortunately, we’ve come a long way to recognizing mental health issues in this country. It’s now common for Canadians to see physicians and be prescribed medication for illnesses such as depression or anxiety.

Insurance companies also now consider mental health in their underwriting process. This has led to some with mental health conditions receiving higher premiums or coverage denial because of their illness.

This article details how insurance companies consider mental health, how mental health may affect your life insurance coverage, how you can obtain life insurance despite mental illness, and what happens if you fail to disclose a prior diagnosis.

How do insurers treat depression and anxiety on life insurance applications?

Insurers look at your personal health history, family health history, body mass index, smoking status, and other factors during the life insurance underwriting process. This determines your risk and thus the premiums that they charge you.

Depression, anxiety, and other mental health problems like bipolar disorder are like any other illness in this process — if severe enough, it can lead to higher premiums or a denial of coverage. Generally, a spout of depression a few years ago or mild anxiety won’t trigger major alarms for an underwriter.

Underwriting factors and requirements for those with mental health conditions

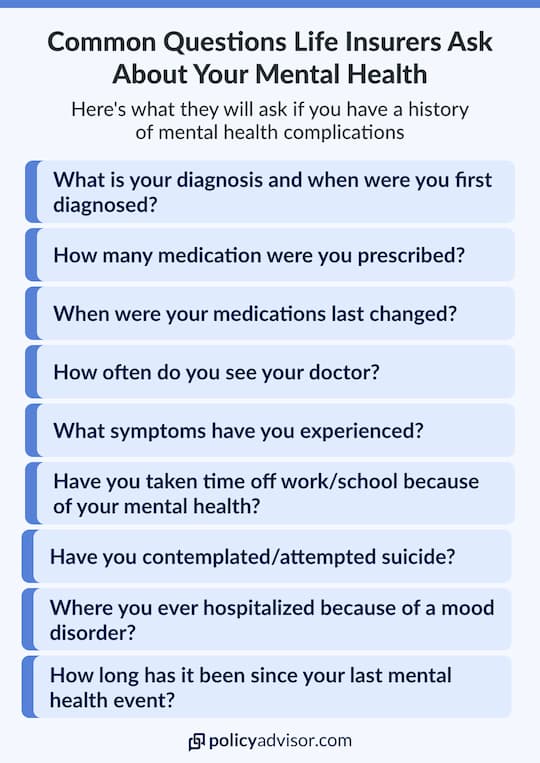

If you suffer from a mental health condition, an insurer may focus on the following to determine your risk:

- Age

- Recent improvements or worsening of symptoms

- Drug and/or alcohol consumption levels

- Whether your condition affects daily activities

- Medication and/or hospitalizations related to mental health conditions

- Severity and regularity of symptoms

- Prior suicide attempts

If a health professional diagnosed you with clinical anxiety or depression, the insurer will also want to understand your diagnosis’s contents and date. Further, the underwriter may require an Attending Physician’s Statement and ask you to fill out the “Neurological and Mental Health” section of the application or the “Nervous disorder” section of the paramedical exam or phone interview.

Will a mental illness or depression increase my life insurance premiums or deny my coverage?

It’s rare to be denied coverage solely due to clinical anxiety or depression. Most insurers increase monthly premiums or restrict the policy’s scope instead.

How you treat your mental health problem may be a significant factor to how your mental health condition affects your application. If you treat your condition consistently, the drawbacks of a mental health illness on your insurability won’t be too severe.

However, circumstances such as an inability to work due to anxiety or depression, prior suicide attempts, or related hospitalizations can lead to denied coverage. The occurrence of such events, however, doesn’t guarantee rejection. (Read more about how suicide affects life insurance.)

Effects of anxiety on life insurance coverage

If you face severe anxiety and require time off work, it’s common for an insurer to postpone your application until six months after returning to work full time.

If you’re still able to work, your premiums depend on your age and your condition’s severity. If you’re under 20 years old, an insurer may postpone your application for two years and reassess you afterwards.

If you’re 20 years old or older, a mild mental health condition can result in standard rates, a moderate condition could postpone your application by six months and result in standard rates if your health is stable, and a severe condition could postpone your application by a full year and double your premiums depending on the stability and severity of your anxiety.

Applicants 70 years old or older may face additional costs and issues if anxiety is present in addition to other health concerns.

Effects of depression on life insurance coverage

The effects of depression on your life insurance coverage and premiums are similar to the effects of anxiety. Again, if your depression causes you to take time off work, your insurer may postpone your application until six months after your return to work. Additionally, those under 20 years of age commonly face a two-year postponement on their applications.

If you’re working and 20 years old or older, mild depression can increase premium costs by 50-150%. The rate may return to the standard rate if your condition improves after three years. For moderate depression, you may face a one-year postponement on your application and a 50-150% increase in premium costs. These rates may decrease after five years depending on your depression’s severity. With severe depression, there’s often a one-year postponement and premium rates that are 50-200% higher than typical rates.

Like anxiety, those over 70 may have additional costs or barriers if they suffer from other health issues in addition to depression.

Postpartum depression

Postpartum depression commonly occurs within the first three months of having a baby. It eventually dissipates. However, some insurers still treat it like clinical depression, which can mean a higher insurance premium. This is especially notable because many parents purchase life insurance immediately after the birth of their first child.

How your insurer treats postpartum depression varies from company to company. Some may not consider it at all. But getting life insurance before or during pregnancy, as opposed to after having your child, can help you avoid inflated premiums that result from postpartum depression.

Frequently Asked Questions

How do I apply for life insurance with a mental health diagnosis?

Mental health conditions don’t close the door to life insurance policies. There are policies available that don’t require a medical examination or health information.

Non-medical life insurance

Non-medical life insurance policies, such as simplified life insurance or guaranteed life insurance, allow you to obtain a policy without a medical examination, blood test, or other assessments. These policies cater to those with moderate or severe health issues that may be hard to insure otherwise.

Non-medical policies are also increasing in popularity because of the accelerated underwriting process, which can mean quicker approvals. But because non-medical life insurance generally means more risk for the insurer, you can expect premiums to be higher than policies that require a medical examination.

Although you won’t have to attend new medical examinations for non-medical life insurance, some insurers may still consider prior health conditions.

What if I fail to disclose a mental illness on my life insurance application?

Although it’s intimidating to disclose any mental health issues on a life insurance application, doing so is critical. If you don’t disclose prior diagnoses, you risk invalidating your insurance policy. Thus, your beneficiaries may lose out on your life insurance payout when they need it the most.

If you fear being denied life insurance due to your mental health condition or want to understand how to best approach purchasing life insurance while suffering from a mental illness, reach out to one of our advisors today. We can explain which insurers and policies can best accommodate your situation.

Insurance companies consider mental health in their underwriting process for life insurance, critical illness insurance, and disability insurance. Sometimes an applicant with mental health conditions can have their policy rated – resulting in higher premiums – or have their coverage outright denied because of their condition. Speak with an experienced advisor to figure out all options when it comes to applying for a policy when dealing with a mental health condition.

1-888-601-9980

1-888-601-9980