- You can still qualify for life insurance coverage in Canada even after you've had a stroke

- The type of policy and coverage amount you can qualify for will depend on the severity of the stroke and its overall impact on your health

- No-medical policies such as simplified or guaranteed may be an option for stroke survivors

- Can I get life insurance after a stroke?

- Is a stroke a pre-existing condition?

- What types of life insurance can someone get after a stroke?

- Does having a stroke affect life insurance rates?

- What affects the cost of life insurance for stroke survivors?

- How long after a stroke can I apply for life insurance?

- Does life insurance cover stroke?

- What's the best life insurance for a stroke survivor?

- How to apply for life insurance after a stroke?

- What to do if I'm denied life insurance after a stroke?

- Frequently asked questions about life insurance after stroke

Getting back to normal life after a stroke can seem like a gargantuan task, but it’s not too late to do things like buy life insurance and ensure your loved ones’ financial security.

In this article, we’ll discuss what kind of life insurance options you have after a stroke and what kind of impact it could have on an existing policy. We also go over some of the most common misconceptions about life insurance after stroke in Canada.

Can I get life insurance after a stroke?

Yes, in Canada, you can get life insurance after suffering a stroke. It’s a common misconception that having a serious health event means you can’t get insurance anymore. But, thankfully, that’s not the case.

Insurance companies do offer policies for stroke survivors, and you may have more than one option. It depends a lot on your current health status, recovery, and how much time has passed since your stroke.

What is a stroke?

A stroke is a life-threatening health issue that happens when the blood flow to a part of your brain is blocked or when a blood vessel in the brain bursts. This can cause brain cells to die because they don’t get enough oxygen.

The effects of a stroke can be serious and include paralysis, problems with thinking or speaking, and other health issues.

Different types of stroke

There are 3 main types of stroke:

- Ischemic Stroke: This is the most common type of stroke. It happens when a blood clot blocks a blood vessel in the brain. It can lead to brain damage if not treated quickly.

- Hemorrhagic Stroke: This occurs when a blood vessel in the brain bursts, causing bleeding in or around the brain. It can cause severe brain damage and is often more serious than an ischemic stroke.

- Transient Ischemic Attack (TIA): Also known as a mini-stroke, a TIA happens when the blood flow to the brain is temporarily blocked. It doesn’t cause permanent damage but is a warning sign of a possible future stroke.

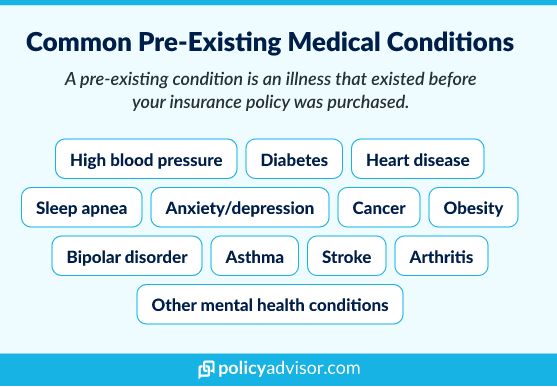

Is a stroke a pre-existing medical condition for life insurance?

Yes, a stroke is considered a pre-existing condition in life insurance. When you apply for a policy, you will have to tell the insurance company that you have had a stroke. They will take this into consideration when they are deciding whether to give you a policy, how much you will have to pay, and other details.

What types of life insurance can someone get after a stroke?

Depending on the severity of the stroke and the impact on overall health, stroke survivors in Canada may able to get the following types of coverage:

- Term life insurance

- Whole life insurance

- Final expense insurance

- Simplified issue life insurance

- Guaranteed issue life insurance

- Group life insurance

Does having a stroke affect life insurance rates?

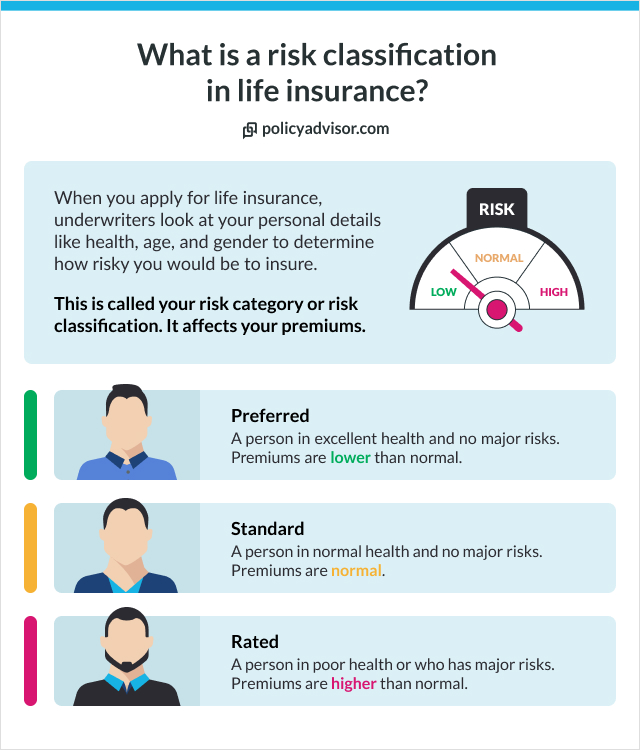

Yes, but only for new life insurance policies. If you apply for coverage after having a stroke, again depending on your individual circumstances, you may be charged higher premiums than normal. This is because life insurers see stroke survivors as higher risk since there’s a chance they may have health issues in the future.

Someone with a medical history of stroke or any other health issue may receive what’s called a rating, based on their higher perceived risk. Rated policies tend to be charged higher life insurance premiums. But, not every stroke survivor in Canada will receive a rating. It depends A LOT on the individual case.

Will my insurance rates go up after I have a stroke?

No, if you already have a life insurance policy, your rates will stay the same even after suffering a stroke. Once your policy is in place, the price is locked in and won’t change due to your health.

The exception is if you renew your term life policy. At the end of your term, if you want to renew, you’ll have to go through the underwriting process again. And, your new rates may be higher because of your health history.

What affects the cost of life insurance for stroke survivors in Canada?

In addition to the usual factors that affect the cost of life insurance for everyone, such as age, gender, and type of policy, insurance providers also look at a stroke survivor’s:

How long after having a stroke can I apply for life insurance?

How long you can wait before applying for life insurance after stroke depends on what kind of coverage you are applying for, and even which life insurance company you choose.

- In general, you may be able to apply at least 6 months to a year after having a stroke

- Some companies may not even consider your application until it’s been at least 5 years since your stroke

- But, if you apply for a guaranteed policy that does not ask health questions at all, you may be able to apply right away

Does life insurance cover stroke?

Yes, life insurance covers strokes. They are seen as a natural cause of death. If someone is already covered and they, unfortunately, have a stroke and pass away, whoever they named as their beneficiary in the policy will receive the life insurance payout.

But, if your policy is new, there may be a waiting period before the death benefit payout is made. This is a period where the insurance company says they will not pay anything out if the insured person passes away due to stroke within a certain period of time (normally around 12 months).

What’s the best life insurance for a stroke survivor in Canada?

It depends on the individual circumstance and needs.

➡️ If your stroke was years ago and you’re fairly healthy now:

Standard life insurance policies (term or whole) may be best for you

➡️ If your stroke was fairly recent and you still have health concerns:

No-medical life insurance (simplified or guaranteed issue policy) may be best for you

What type of life insurance can I buy if I’m at risk of having a stroke?

Even if you have a health condition that increases your risk of stroke, like high blood pressure or diabetes, you can still qualify for any type of life insurance. An insurance company will not deny you just because you have a health issue that may make it more likely for you to have a stroke. Instead, they will assess you based on that condition.

Your best course of action is to speak with one of our licensed insurance advisors. Our experts know the Canadian insurance market, and which provider will be most likely to approve you — even for traditional coverage. Let us help you secure your family’s financial safety.

Critical illness insurance

Depending on your circumstances, critical illness coverage may also be an option for you.

- Critical illness insurance provides a one-time payout if you experience a covered medical condition, such as stroke

- It is not the same as life insurance, but it is worth mentioning as a form of insurance coverage that would provide financial support in the event of a serious health issue like this

If you have not yet suffered a stroke, but you may be at risk of it, you might qualify for a full critical illness insurance policy. Or, you could buy a critical illness insurance rider as an add-on for your life insurance policy as a more affordable option.

How to apply for life insurance after a stroke?

If you’ve survived a stroke and you’re ready to apply for life coverage, follow these steps:

What do insurance companies ask stroke survivors when they apply for life insurance in Canada?

Unless you apply for a guaranteed issue policy that does not ask any health questions at all, the insurance company will likely ask you about the following when you apply for a policy:

- When did you have the stroke? — They will want to know the date of your stroke to understand exactly how much time has passed since then.

- What type of stroke did you have? — The type of stroke and severity will help them assess your risk profile.

- What treatments did you receive? — The company will also want to know if you stayed in hospital and for how long, if you were prescribed medication, and similar details to understand how well you’re recovering.

- What is your current health status? — They will want to know about any lasting effects or other conditions related to the stroke and a picture of your general health.

- Do you have any other health conditions? — Comorbidities and other health issues that may exacerbate your health concerns will play a huge role in how the insurance company assesses you.

- What is your lifestyle? — They’ll also ask about your lifestyle to look at factors that could make your health worse and impact your longevity, such as if you smoke, diet, exercise, etc.

What to do if I’m denied life insurance after a stroke?

If you’re denied a traditional life insurance policy because of your stroke, don’t lose hope — you still have options to get covered.

Frequently asked questions about life insurance after stroke

Do I need to do a medical to buy life insurance after a stroke?

It depends on the type of coverage you buy and your individual condition — your health, recovery, medication, etc. If you apply for traditional coverage and your stroke was not very long ago, there is a chance you may be asked for medical records or to do a full physical. But, if you apply for a no medical insurance policy, you will not be asked to do a medical.

What are the downsides of no medical life insurance?

No medical insurance policies can be an option for people with severe health issues, but they come with drawbacks like:

- Lower coverage amounts — while traditional plans can give you up to $25 million in coverage or more, the highest you can usually get is $50,000

- Higher premiums — this kind of policy also typically costs a lot more than traditional policies do, because the insurance company takes on more risk to cover you

- Limited flexibility/riders — no medical policies have fewer optional features like riders and other benefits available to help you get multiple forms of coverage at a low cost

Is stroke covered by critical illness insurance?

Yes, stroke is normally one of the main types of illness covered by a critical illness insurance policy. Even basic plans normally cover at least these 3 medical conditions:

- Stroke

- Life-threatening cancer

- Heart attack

But, note that there may be some exclusions. For example, mini-strokes may not be covered.

Is stroke covered by disability insurance?

It depends on the severity of the stroke and the effects it causes. A stroke itself may not be covered under disability insurance, but if the effects leave you unable to continue working, then it could be covered. For example, in a case where a stroke results in temporary or permanent paralysis of a part of or the entire body.

Canadians who have suffered a stroke can still get life insurance coverage. It will affect the type of plan you can get, how much your premiums will cost, and how much coverage you can get. But, there are no-medical options if you cannot qualify for traditional life insurance plans. And, having a stroke will not affect an existing policy.

1-888-601-9980

1-888-601-9980