- Insurance policies do not cover suicide within the first 2 years

- Many Canadian insurers consider medically-assisted death a special category on its own

- If a claim is denied because of suicide, there are other steps you can take

No one wants to talk about death, much less the topic of suicide. But when it comes to life insurance, it’s important to understand what is covered and what’s not. After all, the last thing anyone would want is for their loved ones to be left with financial hardships after they’ve passed on.

In this article, we will answer the question of whether life insurance covers suicide in Canada and what you can do if your claim is denied.

Does life insurance cover suicide?

In most cases, life insurance policies will only cover death by suicide 2 years after the policy starts. If the insured person dies by suicide before that time, the insurance company will not give a cash payout to that person’s beneficiaries.

Just about every life insurance policy in Canada includes what’s called a “suicide clause“, which states this. But there can be rare exceptions. And in the case of medically-assisted death or medical assistance in dying, it’s not always so clear cut.

What’s a suicide clause?

A “suicide clause” is a standard part of most individual life insurance policies issued by Canadian insurers. It states that if the policyholder dies by suicide within a certain time frame, the insurance company will not make the death benefit payout to surviving family.

The suicide clause usually lasts for 2 years from the start of the policy. In other words, for the insurance company to agree to pay out for someone’s life insurance plan, that person must not die by suicide for at least the first 2 years after they signed up.

A life insurance suicide clause might look like this

|

How does suicide affect life insurance payouts?

What happens with a life insurance payout when someone dies by suicide depends on:

- What kind of life insurance policy it was. Joint policies that are shared by two people would be handled differently than if there was just one person on the policy.

- When the suicide takes place. If it was during or after the suicide clause.

- The insurance company’s own rules. Your policy wording will normally state exactly how your provider would deal with a death by suicide.

In case of death during the suicide clause period

If someone dies by suicide before the two-year period of their life insurance suicide clause is up, the company will not pay the death benefit.

However, some Canadian providers will refund any premium payments that had been made towards the policy up until that time. For example, providers like Desjardins and Empire Life both state in their policies that they will return payments made or the policy’s cash value if the insured person dies by suicide before the 2-year period is up.

On the other hand, some providers might deduct surrender fees or other penalty costs. In this case, they may refund premiums paid up until that point but only after subtracting the amount of fees from it first.

In case of death after the suicide clause period

Once the two years stated in the clause are up, the life insurance policy will function as normal. The provider will pay out if the individual passes away for any of the typical covered reasons, including suicide. You can see a list of the typical reasons below.

For joint policies

Joint policies are usually bought by couples. They cover two or more lives and can either bea joint first-to-die or a joint last-to-die policy.

- Joint first-to-die: The policy pays out when the first person dies.

- Joint last-to-die: The policy pays out only after both people have died.

If someone with a joint last-to-die policy dies by suicide before the two-year suicide clause period is up, there will not be any change to the policy. The surviving policyholder will still be covered as usual.

Joint first-to-die is a bit more complex. The life insurer could simply refund any money paid toward the policy up until that time, as in other cases. Or, they could give the surviving person the choice to change the policy to joint last-to-die.

For instance, Industrial Alliance (iA) is one Canadian insurance company that provides this option. Its suicide clause is fairly extensive, and it states that it will change the type of policy to joint last-to-die PLUS recalculate premium costs based on the surviving person’s age.

This could leave the surviving partner paying much heftier costs than before, and just goes to show how complicated the impact of suicide on life insurance can be.

How does life insurance work?

Life insurance, very simply, is an agreement between you (the policyholder) and an insurance company. Under this agreement, you pay a certain fee (premium) to the insurance company every month or year. In turn, when you pass away, the insurance company will give a one-time, tax-free lump sum payout to whoever you named as your beneficiary or beneficiaries. Most people name their family members as their beneficiary — usually a spouse, child, sibling, or other close relative.

Life insurance costs depend on factors like age, sex, health, medical history, and lifestyle, among other factors. It also depends on the types of life insurance purchased — for instance, term life insurance or permanent life insurance. And, it is possible for someone to be denied life insurance if the company considers them too much of a risk.

A life insurance payout is referred to as a death benefit because the policyholder must pass away before the payment will be given to their beneficiary. But this payment can be used however the beneficiary sees fit. They can use it to help cover expenses like funeral costs, mortgage payments, and outstanding debts. Or, they could use it to take care of kids, pay for college tuition, maintain a certain lifestyle, or even travel the world. At the same time, a life insurance payout is not always guaranteed.

What does life insurance cover?

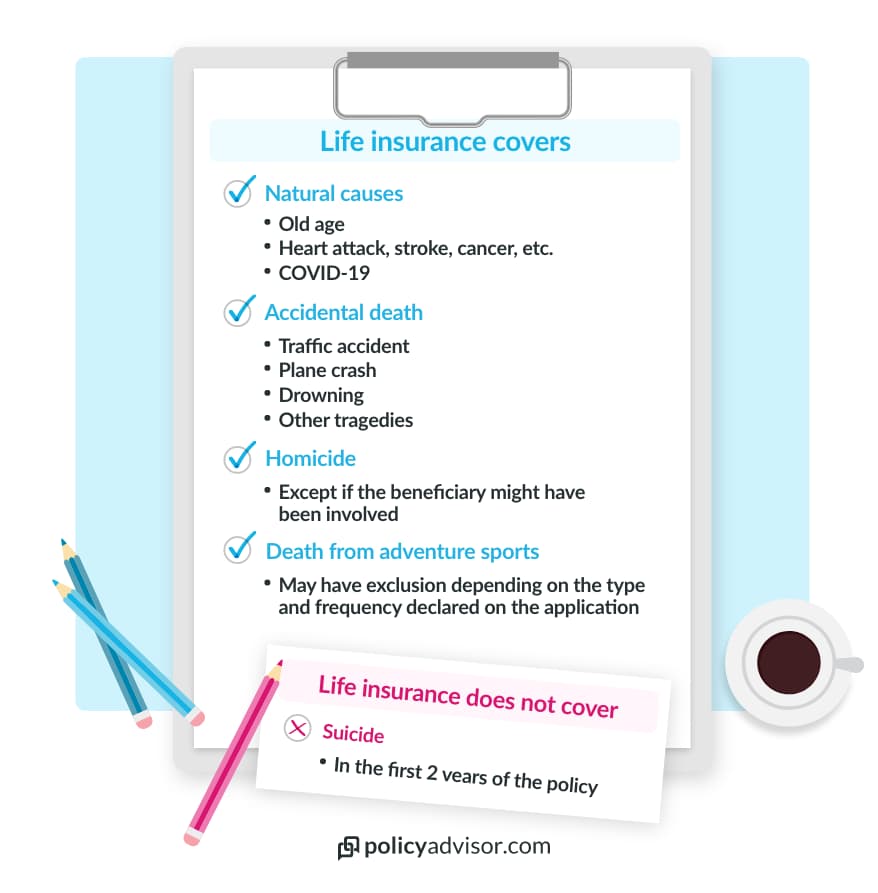

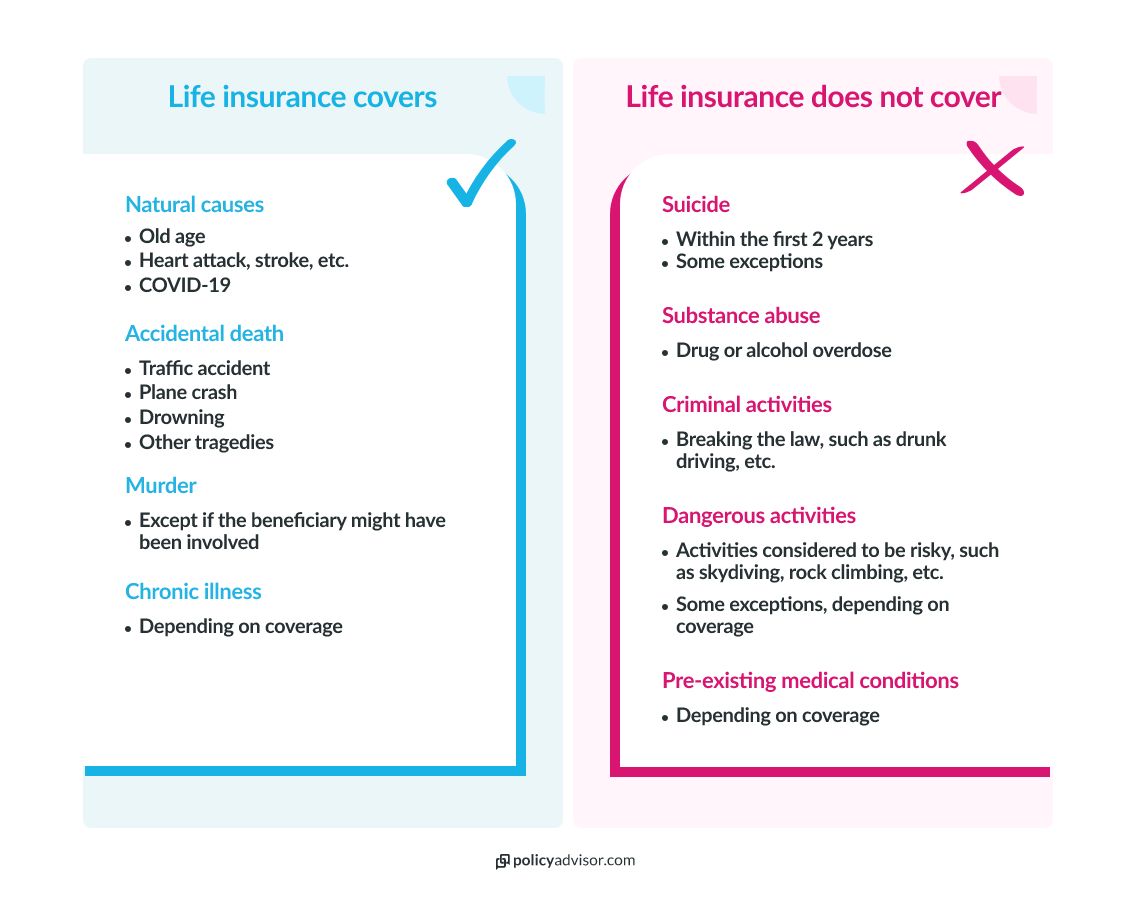

Most life insurance policies will pay a lump sum to beneficiaries if the policyholder dies from natural causes, terminal illnesses, accidents, murder, or other similar causes.

1. Natural causes

Life insurance covers deaths considered to be natural. This includes old age but also heart attack, stroke, kidney failure, cancer, and even COVID-19, among other infectious diseases.

2. Terminal or chronic illness

Life insurance plans will pay out if the policyholder dies from a terminal illness, even if it was a pre-existing health condition the person had before their policy started. Someone might have fewer (and far more expensive) coverage options with a pre-existing condition. But once the insurance company agrees to give them a policy, that policy will pay out if they happen to pass away due to their illness.

3. Accidental death

Beneficiaries still receive a payout if the insured person dies from accidental death or a tragedy such as a car accident, drowning, etc.

4. Murder

In most cases, life insurance companies will pay out if the policyholder is, unfortunately, murdered. But a big exception to this is if the policy beneficiaries or someone related is believed to be the culprit responsible or involved in the policyholder’s death.

5. Suicide

If it happens at least two or more years after the exact start date of either the contract/policy/coverage, the most recent reinstatement, or the most recent policy change that needed underwriting.

6. Illegal or criminal activities

Criminal activities can be anything that breaks the law. For instance, if someone is driving while under the influence and passes away in a car crash. Some forms of insurance can exclude covering individuals if they participate in illegal activities. But a life insurance policy doesn’t make this kind of exception — it will still pay out if the insured person happens to pass away while doing something that is against the law.

7. Deaths due to drug or alcohol use

Likewise, life insurance will still pay out the death benefit if someone has a history of drug or alcohol abuse and, unfortunately, dies from an overdose or a related incident.

What does life insurance not cover?

Most life insurance plans do not pay out in certain situations, such as if the death occurs within the first two years of policy purchase, death involving hazardous activities, etc.

1. Deaths from suicide within the policy’s first 2 years

As per the life insurance suicide clause, death by suicide is not usually covered by life insurance if it happens within the first two years from the exact date the policy starts, the policy is reinstated, or a policy change that needed underwriting.

2. Deaths while engaging in hazardous activities

Remember how we also mentioned that your lifestyle affects your insurance premiums? Well, it can also affect the payment of benefits. For instance, if someone suffers an accident and passes away while doing something the insurance company considers risky, like skydiving or rock climbing, they may deny the life insurance claim and not pay benefits to beneficiaries.

But beneficiaries should not find themselves caught off guard by this. The insurance company would have had to tell the insured person that they wouldn’t be covered for death from dangerous activities at the time their policy starts. So, they would already know — and hopefully let their beneficiaries know too — that they would not get a death benefit if this were to happen.

Generally, life insurance is absolute for the most part. Once someone is approved for a policy, the death benefit will be paid out except for the two scenarios we mentioned above.

If the life insurance claim is denied, the company may or may not give back the premiums that had been paid up until that point. But it depends on the individual circumstance, and the way the insurance provider handles claim denials.

Does life insurance cover medically-assisted death?

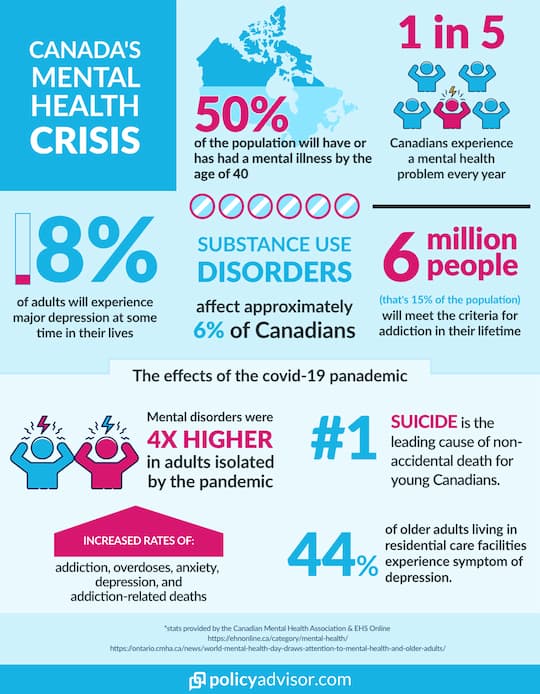

Medical assistance in dying (MAID) may be considered its own special category by Canadian life insurance providers. Research and debate are still ongoing about whether MAID is considered suicide, since it’s only available for eligible individuals who are suffering from severe mental health issues.

For providers who consider medically-assisted death its own category, they will still pay the death benefit even if it’s before the 2-year period stated in the suicide clause.

But other providers consider it the same as death to illness. For instance, Edge Benefits refers to MAID as assisted suicide, but treat it as an illness-related death. So does Industrial Alliance (iA). Both of these providers would still provide a death benefit to an insured person in this circumstance.

Foresters does not consider MAID as suicide, but instead as its own category that will be covered. However, if it takes place during the 2-year period or contestability period, the company said it will check the medical reports very closely to make sure it’s not a false report before paying a claim.

So, different companies take slightly different approaches to this.

What to do if an insurance claim is denied because of suicide?

If a life insurance claim is denied because of suicide, it can be a particularly difficult time. However, it’s important to know that you have options. Here’s what you can do:

- Review the policy. Before taking any action, it’s important to thoroughly review the deceased person’s life insurance policy and understand the terms of the policy. Check whether there was a suicide clause or other additional exclusions.

- Contact the insurance company. If you believe the claim was denied in error, you can contact the insurance company and ask for an explanation of their decision. In some cases, and especially if you have new information to provide, you can also ask for a review of the claim.

- Consider hiring a lawyer. The next step if you believe the claim was unjustly denied is to consider taking legal action. Many lawyers or other legal professionals specialize in life insurance claims and claim denial. They would be able to help you understand your legal rights and options, as well as guide you through the process of appealing the denial of your claim.

- File a formal complaint. You can also file a complaint with an official body in your respective province, such as the Financial Services Commission of Ontario (FSCO). The FSCO and similar organizations are responsible for regulating insurance companies in each respective province. They also serve to help resolve disputes between policyholders and insurance companies.

It’s important to remember that if your life insurance claim is denied because of suicide, it’s not a reflection of your loved one’s worth or value. Rather, it’s a result of the terms of the policy and the insurance company’s interpretation of those terms.

Frequently asked questions

How do life insurance companies determine if someone died by suicide?

Once an insurance claim is submitted, your insurance company will do its own investigation before making a payout. In the unfortunate instance of deaths by suicide, life insurers will usually look into the cause of death. This may include reviewing medical records, checking with law enforcement reports or police records, or even talking to family members or friends. After their investigation is done, they will determine whether the death benefit is payable or not.

Does life insurance ever pay out for suicide?

Deaths by suicide can be covered by life insurance companies in some cases, but it depends on several factors. As we said, suicide is a sensitive matter and there are many factors to take into consideration, even with a suicide clause in place.

Canadian life insurers may make special consideration if the life insurance policyholder was known to have suffered from mental health issues for a long time, and if the insurance company believes the individual was not of sound mind at the time of their death.

We always recommend reading the actual wording of your insurance policy to know exactly what will and will not be covered by your insurer. But we know it can be complicated to understand how things will play out if something unexpected happens.

If you have questions about your life insurance coverage, you can always speak with our insurance experts.

What other factors could affect whether insurance companies pay out for suicide?

Aside from the suicide clause, some other factors that may affect whether an insurance company pays out for suicide in Canada include:

- Age and health status at the time of death

- Mental health history

- Prior suicide attempts

- Alcohol/substance abuse history

- Recent changes in behavior or circumstances (such as job loss, divorce, etc.)

What are other reasons why life insurance wouldn’t pay out?

There are several reasons why a life insurance policy may not pay out in Canada. Some common reasons include:

1. Suicide clause:

As mentioned earlier, most life insurance policies in Canada have a suicide clause that states they will not pay out in the case of suicide within the first 2 years of the policy.

2. Misrepresentation:

If the policyholder provided false information on their life insurance application, the policy may be declared void and the insurance provider may refuse to pay out.

3. Non-payment of premiums:

If the policyholder does not keep up with their monthly or annual payments for a long period of time, the policy may lapse. This could be grounds for denial of a claim.

4. Dangerous activities:

An insurance company may not pay out if someone with extreme, dangerous hobbies like skydiving or bungee jumping unfortunately passes away while doing one of these risky activities.

5. Contestability period:

Most traditional life insurance policies have what’s called a contestability clause or contestability period, which is usually 2 years. During this period, the insurer can investigate and deny a claim if it’s found that the covered person was not honest on their original life insurance application.

These are all more reasons why it’s so important to read through your insurance policy and understand the terms and conditions before you decide to buy.

If you need any help with reviewing an insurance policy to find out exactly what’s covered and what’s not, or for help with finding the right policy for your needs, you can always speak with the friendly insurance agents at PolicyAdvisor. We’d be happy to provide tailored guidance to make sure you have the best insurance policy for you and your family.

Suicide is a sensitive topic at any point in time. But it can be even more complex when there are finances involved in the form of a life insurance policy. This article explains how suicide can affect life insurance policies in Canada.