- Business-owned life insurance policies can be used to mitigate taxes that may be triggered upon the death of the insured individual (typically the individual business owner)

- When a permanent life insurance policy is bought in the business name, the cash surrender value is added to the fair market value of the company’s shares, when the insured dies

- Insurance tracking shares track the cash surrender value of the policy without any dividend entitlement

As a business owner, you have a lot to gain from a whole life insurance policy that’s owned by your business. But, business-owned life insurance can come with tax liabilities. One of the ways you can mitigate this risk is with something called insurance tracking shares.

In this article, we’ll look at what insurance tracking shares are, how they work in Canada, and some of the tax benefits of corporate-owned life insurance.

What is an insurance-tracking share or life insurance share?

Insurance-tracking shares help business owners like you mitigate the tax liability that can arise from an increase in the fair market value (FMV) of a life insurance policy when an insured shareholder passes away. They’re a key part of estate and business succession planning.

What is whole life insurance?

Insurance tracking shares in Canada typically use whole life insurance, a type of permanent insurance policy that covers you for your entire life. It provides the benefits of a life insurance policy, and also has living benefits you can use during your lifetime, such as cash value and tax-deferred dividend payments.

There are also other types of permanent insurance policies, such as universal life insurance.

What is corporate-owned life insurance?

Corporate-owned life insurance is a life insurance policy that is owned by a business or company. The company pays the premiums and is the beneficiary, so they receive the tax-free death benefit payout if/when the insured person passes away.

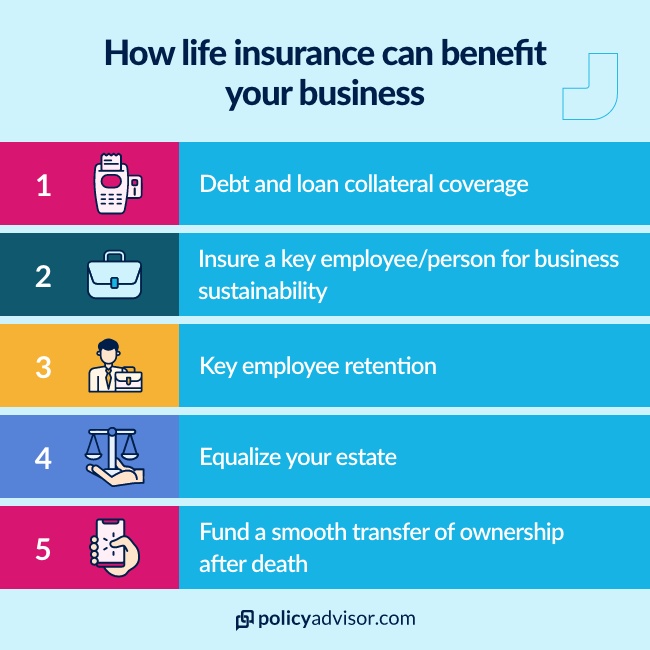

Businesses use COLI to:

Why do businesses need insurance tracking shares in Canada?

Businesses need insurance tracking shares to tax-efficiently transfer a business to the next generation. If you’re a business owner, you can use insurance tracking shares to protect your assets from taxes (such as the ones incurred when transferring assets to your children) upon death.

How do insurance-tracking shares work?

The way insurance tracking shares work in Canada is somewhat complex, and you need the help of an estate and tax lawyer to get right. Here’s a breakdown of how it works in the simplest terms:

- The business issues preferred (tracking) shares before buying a whole life insurance policy

- The preferred shares will be issued to track a life insurance policy’s cash surrender value without any dividend entitlement

- The business then buys a whole life insurance policy, being both the owner and the beneficiary of the policy

- The preferred shares increase in value alongside the cash surrender value of the policy

- When the business owner passes away, the policy’s cash surrender value is attributed to the insurance-tracking shares and not the shares of the owner

- The proceeds of the life insurance policy are paid to the business, which receives them as a tax-free credit to their capital dividend account (CDA)

- The corporation can then redeem the life insurance shares using the CDA

The overall outcome is a tax-efficient transfer of the business or proceeds to the next generation.

How else are insurance tracking shares used in Canada?

Aside from the ways listed above, insurance tracking shares can be a very effective estate planning tool in Canada. Proceeds can be used to facilitate estate equalization — a strategy to transfer assets in a fair manner to one or more beneficiaries.

This is especially useful in situations where a business owner has some beneficiaries who are involved in the family business and others who are not. The members of the family with an interest in the business can inherit it, while others receive the equivalent value from the life insurance payout.

What are the tax benefits of business-owned life insurance?

The main tax benefits of business-owned life insurance are:

How does cash value affect taxes of corporate-owned life insurance?

Cash surrender values are crucial to corporations who hold a whole life policy because the cash surrender value may become part of the corporation’s fair market value. This can have significant tax implications because:

- In Canada, transfer of assets to a spouse is tax-free; but transferring those assets to children is not

- The cash value of the policy contributes to an increase in the FMV of the business owners’ shares

- Upon the owner’s death, the shares are assumed to have been disposed of, and this creates additional tax liabilities for the beneficiary (the company)

Insurance tracking shares are useful for mitigating this. They help reduce or eliminate the taxable impact of cash surrender values upon the death of the insured.

Learn more about insurance tracking shares

Implementing insurance tracking shares into your business protection plan can be a complex process and should be done before purchasing the life insurance policy. PolicyAdvisor’s licensed insurance experts can help you better understand what insurance products may be best for your situation and business. Book some time with us below and see how you can use insurance to best plan for the future of your business.

If you’re a business owner in Canada, you can use life insurance in a variety of ways to manage your business tax-efficiently. Business-owned life insurance policies cover taxes upon the death of the insured. And, insurance-tracking shares can ensure that proceeds from a life insurance policy are passed down tax-free.