- Buy-sell agreements detail how a business' shares may be bought, sold, or redeemed

- Life insurance is commonly used to fund the purchase of partner shares when a partner passes away

- Setting up buy-sell agreements allows a business to avoid future conflict during a business’s transition period after a partner passes away

When a business partner dies, not only is it personally devastating, but it can leave questions about how the business will be handled going forward or how shares will be divided.

In this article, we’ll show how life insurance helps business owners ensure there’s a contuinity plan in place to avoid these challenges through buy-sell agreements.

What is a buy-sell agreement?

A buy-sell agreement is a crucial part of protecting your business and ensuring its survival no matter what.

- It’s a legal contract between shareholders or owners of a business

- It details how the business’ shares may be bought, sold, or redeemed if an owner is no longer a part of the company

- It’s usually a part of a shareholder’s agreement and a part of estate planning

Buy-sell agreements allow for smooth transition of ownership and smart financial planning that will ensure business continuity for the future.

Do businesses need buy-sell agreements?

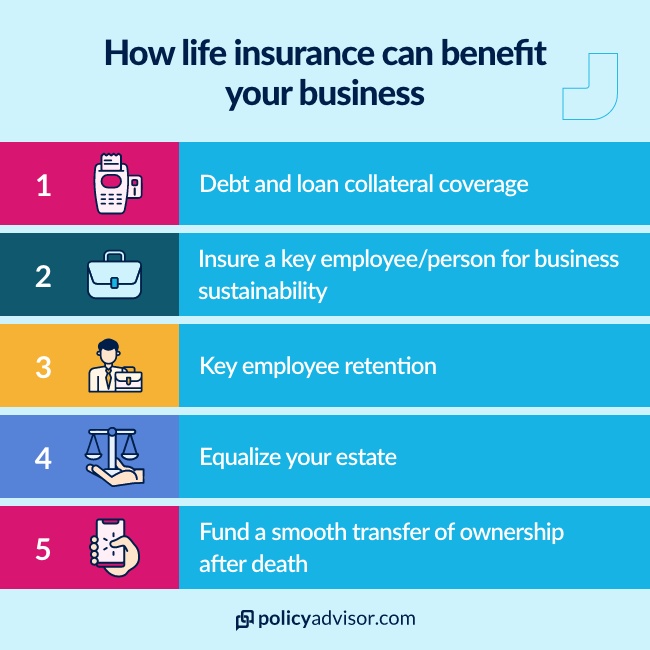

Yes. Businesses need buy-sell agreements to smoothly handle changes in ownership and prevent conflicts that could disrupt operations or even cause the business to fail. They help a business:

Do you need a life insurance policy for a buy-sell agreement?

No, you do not need life insurance to set up a buy-sell agreement. But, it is very much worth your while to do so. A life insurance payout ensures partners or the corporation:

- Keep their personal funds

- Don’t have to take out a loan

- Preserve business cash flow

How does a buy-sell agreement work in Canada?

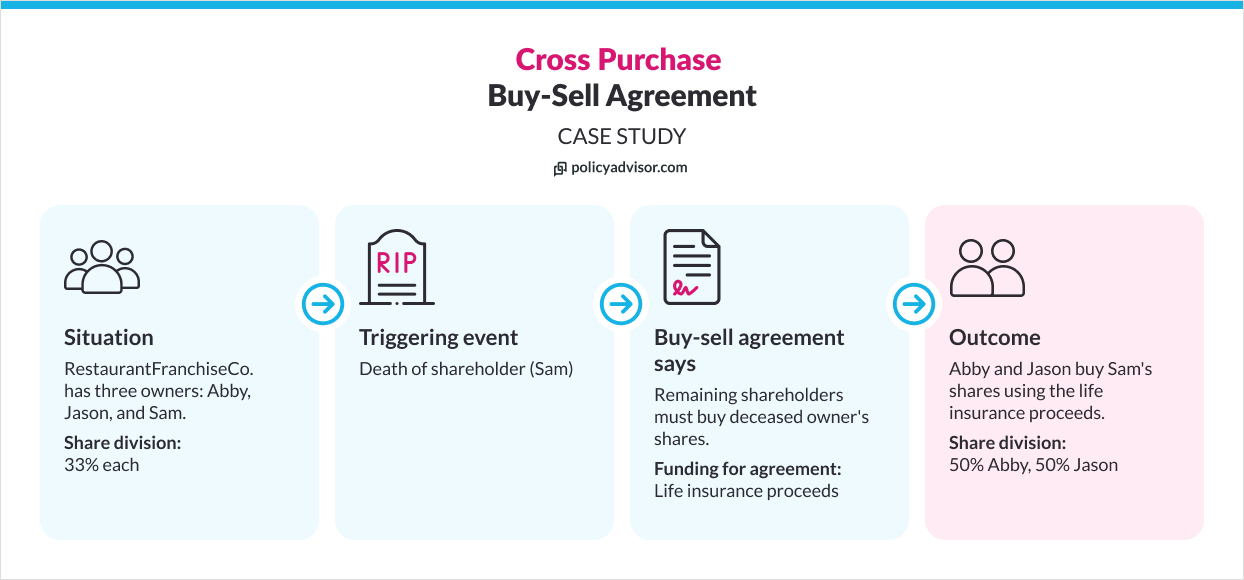

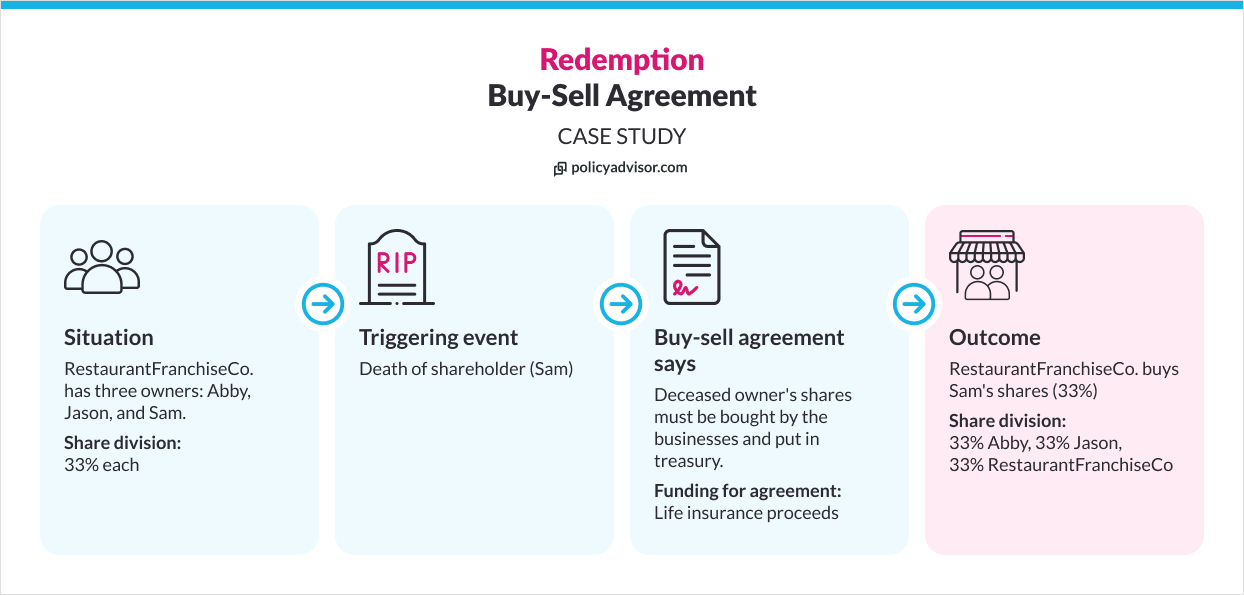

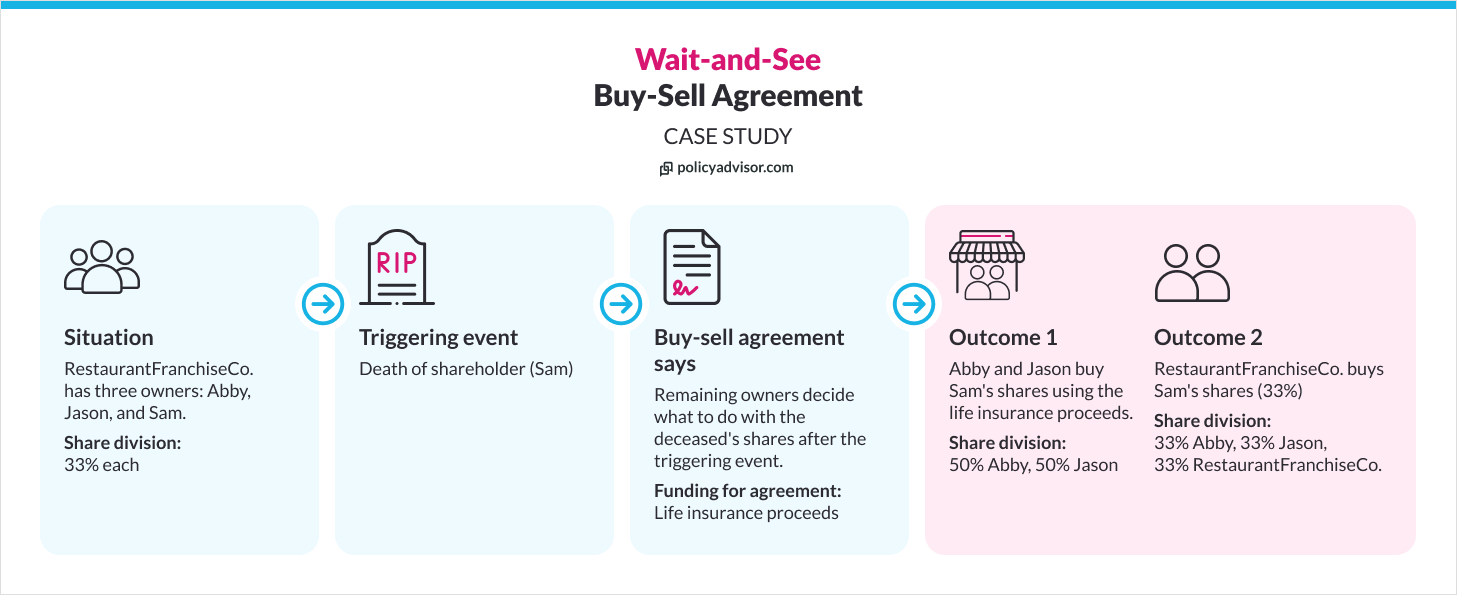

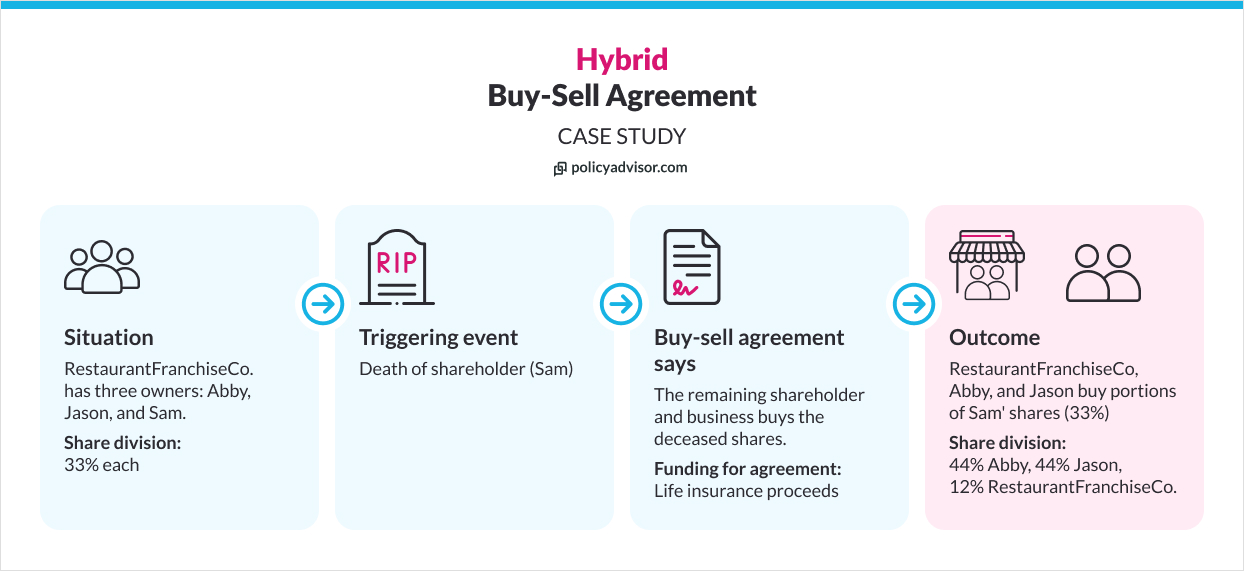

A buy-sell agreement sets rules for what will happen with a departing owner’s shares if something called a “triggering event” takes place. Here’s how it works:

- The agreement is made, providing detailed instructions about what will happen with a departing owner’s shares and other key information

- It will come into effect when a triggering event happens, such as if an owner passes away

- Shares are usually sold to the surviving owners or back to the business

- Proceeds of a life insurance policy can be used to fund the buy-back, so remaining owners aren’t financially affected by loss of the owner

What should be included in a buy-sell agreement?

Buy-sell agreements should include the following key details:

What is a triggering event?

The triggering event of a buy-sell agreement is the circumstance when the agreement will take place. A triggering event can be if the shareholder:

- Passes away

- Suffers a long-term disability (must be specified)

- Is diagnosed with a critical illness (must be specified)

- Retires

- Gets a divorce (often called “marital breakdown” in the agreement)

- Resigns or is terminated as an employee

- Declares bankruptcy

- Decides to sell their shares

What is a business’ valuation?

The business valuation is the dollar value of how much it’s worth. This will determine how much the departing owner’s shares can be sold for. That dollar amount has to be stated in the buy-sell agreement.

If the business can’t state a clear dollar value, they need to state a method that can be used to find out the valuation. And, it has to be able to be independently verified.

What is a funding strategy?

The funding strategy is how the corporation or other partners will get the money to buy out the departing person’s shares. It’s usually from:

- A life insurance payout

- A critical illness insurance payout

- A disability insurance payout

- A line of credit

- A sinking fund

A funding strategy should also consider what happens if the amount of money received from funding is higher or lower than the amount the shares cost.

How to set up a buy-sell agreement that uses life insurance?

To set up a buy-sell agreement that leverages life insurance, you typically have to follow these steps:

Who is the beneficiary of a buy-sell agreement?

There can be several beneficiaries when life insurance is the funding strategy of a buy-sell or shareholder agreement, such as:

- The surviving partners of the business

When the surviving partners are the beneficiaries, they receive the payout and use it to buy out the shares, meaning they’ll each own more shares. - The corporation

If the corporation receives the death benefit and makes the buyout, then the shares are settled (meaning they’re basically erased). The remaining shares are now worth more because fewer outstanding shares are left. - The deceased’s estate (surviving family)

After the partner or corporation gets the insurance payout, they buy the shares from the deceased owner’s estate. And the money paid to the estate usually ends up going to the owner’s surviving loved ones.

Frequently asked questions about buy-sell agreements

Yes. Buy-sell agreements are generally legally binding as long as the parties signed the agreement while they were of sound mind. If you properly drafted an agreement with an experienced corporate lawyer and signed it at their office, it’s most likely legally binding.

The state and future of the business may be very uncertain if you don’t have a business continuity plan in place or a buy-sell agreement.

- Remaining partners will be left to decide what to do with the shares

- This may cause tension or arguments among remaining partners

- Resulting disagreements can disrupt business, causing confusion and stress for customers, employees, and stakeholders

Buy-sell agreements ensure your business avoids these problems, and life insurance works hand-in-hand to ensure secure funding is in place.

In short, it leaves business owners like you with little to worry about if something happens to a shareholder, or to you, in the future.

A buy-sell agreement is a legal contract that outlines what will happen with a business owner’s shares if they pass away, become seriously ill or disabled, or leave the company. It’s crucial for business continuity and estate planning, preventing conflicts between personal and business interests. A life insurance death benefit is often used to fund the purchase of shares.