- An immediate financing agreement (IFA) is an estate planning tool that helps individuals access coverage without high upfront costs

- A whole life insurance policy is used as collateral and you can borrow up to 100% of the amount you paid in premiums

- An IFA is an advanced insurance strategy that can have many benefits

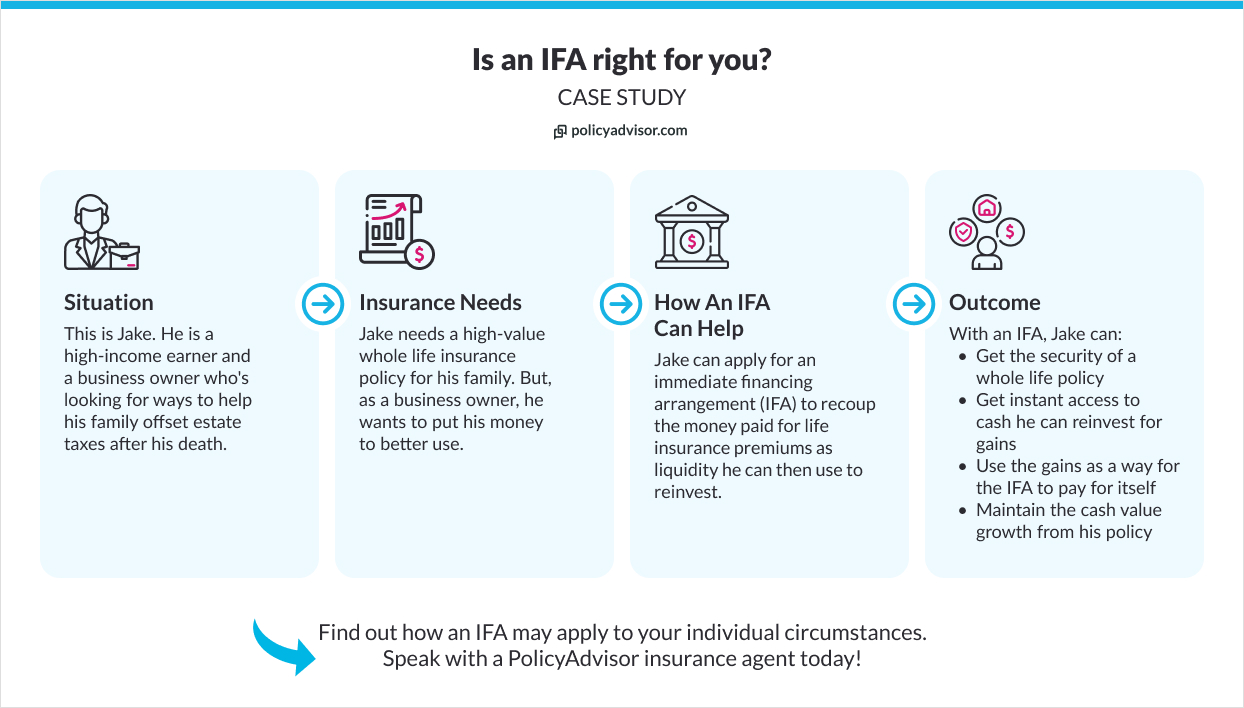

Life insurance coverage is valuable for most individuals, providing financial security and peace of mind to them and their families. For business owners and high-net-worth individuals, a life insurance policy can offer additional ways to help accomplish financial objectives.

One of those ways is through an Immediate Financing Arrangement (IFA). It’s similar to a policy loan, but offers a lot more flexibility and value, instantly. In this article, we’ll explain what an IFA is, how it works, and how it can help maximize cash flow.

What is an immediate financing arrangement (IFA)?

An Immediate Financing Arrangement or IFA is an advanced financial strategy that allows you to secure permanent life insurance coverage, while retaining access to cash to invest in your income-producing assets or businesses.

In other words, an IFA is an estate planning tool that allows an individual to plan for future tax bills or other lifelong insurance coverage needs without setting aside hefty upfront premium payments for life insurance. An IFA frees up the cash flow that would otherwise be locked in life insurance premium payments, so the liquidity can be used to grow their investment portfolio or businesses instead.

To set up an IFA, an individual can use whole life insurance or universal life insurance as collateral to access a line of credit through a bank or lender immediately.

An IFA gives you a way to effectively:

- Give your beneficiaries the financial protection that comes with insurance coverage

- Continue building cash value growth that can be accessed whenever required

- Instantly recover back the money you paid for premiums

- Have liquid cash you can use for more gainful purposes

An IFA is designed such that the amount you borrow upon setting up of the life insurance policy can be repaid during your life or from the proceeds of your life insurance policy after you pass away.

Normally, you only have to pay interest on the borrowed amount. Most business owners and investors will have access to investment opportunities that can cover the cost of the interest. Further, you may also be able to offset the interest expense against your income and lower your taxes paid. More on that later.

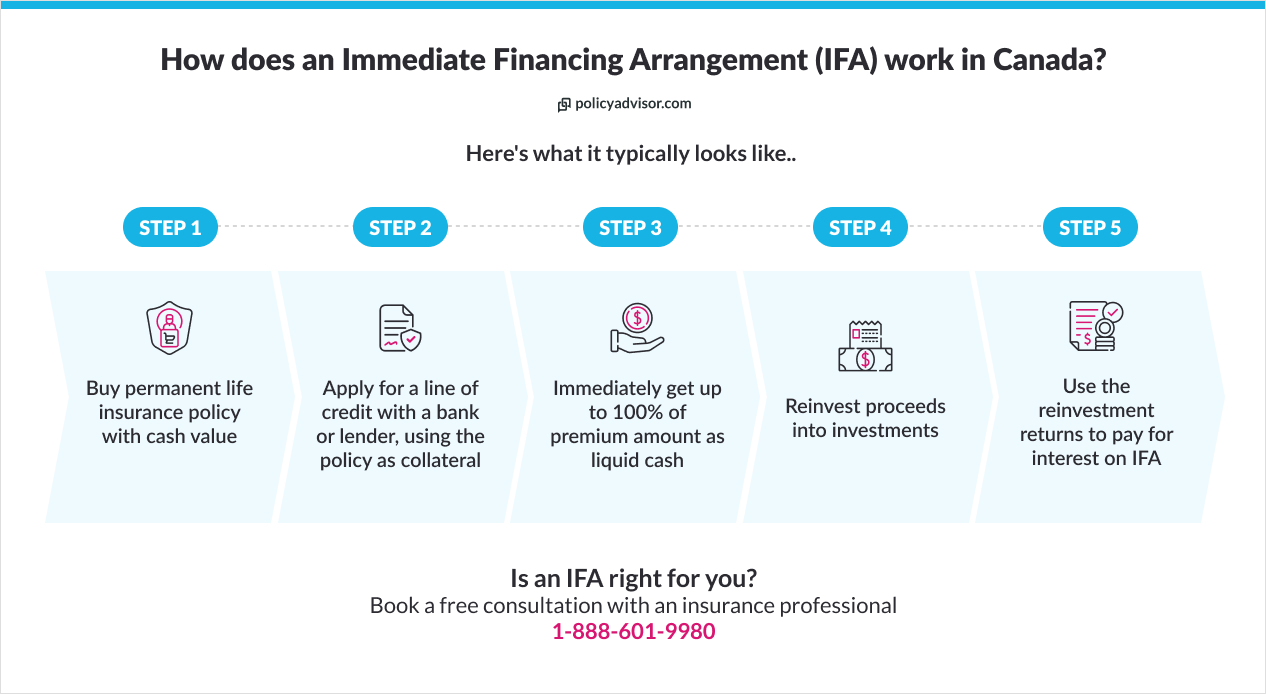

How does an immediate financing arrangement work in Canada?

In Canada, an immediate financing arrangement works almost the same way that opening a line of credit with a bank does, except your life insurance policy is used as collateral. You:

- Buy a whole life insurance policy that creates significant cash surrender value (CSV) in the initial years

- Secure a line of credit with a bank, lender, or specialized financial institution, using your life insurance policy as collateral

- Get immediate financing for up to 100% of the cash value of your policy or even up to 100% of your paid premiums

- Make regular monthly interest payments

- Pay annual recurring insurance premiums

- Steps 3 to 5 are repeated annually

- You can either pay back the loan while you’re alive or have the remaining balance taken out from the death benefit of your insurance policy after you pass away. The remaining proceeds of the whole life insurance policy are paid out to your beneficiaries upon your passing away.

Your policy will continue to build cash value growth for the entire time it is active.

What are the benefits of an IFA strategy?

Some of the biggest pros for getting immediate financing for life insurance in Canada are:

- Convenience — instant access to cash flow without liquidating assets

- Flexibility — manage funds and financial needs based on unique needs

- Peace of mind — full benefits of life insurance

- No savings lost — cash surrender value continues to grow, potentially increasing the death benefit as well

- Time-saving — full underwriting may not be needed, helping the process be quicker than other types of loans

- Versatile — proceeds can be used for anything

- Interest-saving — rates may be lower than getting a bank loan

- Lenient — technically does not have to be paid back, and can be deducted from death benefit

- Tax-saving — potential tax deductions, depending on how proceeds are used

- Self-paying — if employed correctly, an IFA can cover the cost of your life insurance coverage and be reinvested into projects that generate enough returns to cover interest too

What are the disadvantages of an IFA?

While an IFA can be quite convenient, it also comes with some considerations:

- Capital-intensive — requires sufficient disposable income or savings to pay premiums upfront

- Ongoing interest — an IFA is a line of credit, so interest continues for the period the loan is outstanding

- Risky — interest can potentially outpace the rate of return on your investments, leaving you out of pocket

- Reduces death benefit — the amount borrowed will reduce the death benefit left for your surviving spouse, family members, or other beneficiaries

- Strict requirements — some providers may ask for additional collateral, have age or income minimums, and may only accept policies from specific insurance companies

- Complex — an IFA is an advanced insurance strategy that can be difficult to grasp and effectively use

Our licensed life insurance advisors at PolicyAdvisor can help you decide if an IFA is right for you and guide you through the process of setting it up.

Can a business get an immediate financing arrangement?

Yes, private corporations are eligible to get an IFA in Canada. Accessing the proceeds under an IFA is not limited to individuals.

A business can take out a whole life insurance policy on a key person, and then obtain an IFA under the business name also.

What can insurance immediate financing arrangements be used for?

The beauty of an IFA is you can use the loan proceeds for pretty much anything you need. Most people use it for:

In general, an IFA strategy tends to be used for long-term estate planning in conjunction with business or investor liquidity needs. One of the main reasons for this is that it’s most effective when you have some way to generate the funds that will offset interest.

Otherwise, there are more cost-effective ways to access funding if your needs aren’t as complex, such as if you just need funding to renovate the house. In that case, an insurance policy loan or even just a simple personal loan from the bank might suit you just fine.

You should get professional advice from a licensed advisor to find out whether an IFA or another option would best suit your purposes.

What are the costs associated with immediate financing for life insurance?

The main costs involved in an IFA are:

Can you pay an IFA back early?

Yes, you may be able to pay your entire loan for an IFA back early instead of it being deducted from your death benefit.

A lot of people find it more convenient to let the outstanding loan amount be deducted from their death benefit later on. But this isn’t the only option. Check with your bank or lender to find out, and ask whether there may be any penalties for early payment.

How do you get an IFA in Canada?

You can only get an IFA set up with a financial institution like a bank or lender. But you should start by speaking with an insurance advisor to look into whole life policies and find out if an IFA is a good insurance strategy for you.

After you get your policy, you can then sit down with your lender to agree on credit terms, collateral requirements, and more.

Which Canadian Lenders offer IFA programs?

Some of Canada’s leading life insurance companies have special programs for IFAs through their banking arms. This includes:

An experienced advisor can help you assess the different products offered and see which one can best help you reach your financial goals.

Is an immediate financing arrangement right for you?

An immediate financing arrangement can be a convenient financial tool and a great strategy to help you make the most out of your whole life policy. But, it’s not suitable for everyone.

An IFA may be a good option if you:

Either way, you should speak with a licensed professional before you make a decision. An experienced team of advisors like those at PolicyAdvisor can look at your current situation and help you figure out whether an IFA is the best choice.

Is an immediate financing arrangement worth it for you?

Whether an IFA (Immediate Financing Arrangement) strategy for life insurance is worth it depends on various factors, including your financial goals, risk tolerance, and the specific terms of the arrangement. It can be beneficial in certain situations, such as providing liquidity for business needs or investment opportunities.

However, it’s essential to carefully consider the costs, risks, and potential impact on your overall financial plan before deciding if it’s the right strategy for you. Consulting with a financial advisor who understands your individual circumstances can help you make an informed decision.

Frequently asked questions

No, in general, banks or lenders will want to make sure your policy is secured or at least approved before they will agree to an IFA. Most will require that security first, and only then will they give you financing.

No, you can only use a permanent life insurance policy with a cash accumulation component for an immediate financing arrangement in Canada. This is because the financial institution will use the policy and its cash value as collateral security to recoup the advaned money if the credit arrangement falls through.

Other types of insurance policy e.g. term life policies don’t have this cash surrender value aspect, so they’re not the ideal solution for collateral.

Immediate financing arrangements let you borrow up to 100% of the amount of your yearly life insurance premium or expected cash surrender value. The specific amount will depend on your individual policy details.

The minimum amount for a line of credit varies by lender, but it’s typically set at $500,000 of minimum borrowing. Some lenders might offer a lower line of credit, like $250,000, if you’re including coverage for your spouse or business partner. Lines of credit for an IFA are usually established for a 10-year term. Consequently, it’s expected that the minimum borrowing will start at $50,000 for any given year during the 10 year period..

No, you technically cannot use an immediate financing arrangement to pay for premiums. Again, there are laws in Canada against taking out any type of loan to pay for life insurance.

So, you couldn’t go to a bank and, get a line of credit for the purpose of buying life insurance, and then contact a broker like PolicyAdvisor and use those funds to pay for premiums.

But, having said that, an IFA can act as a way for you to access the amount of insurance premiums you paid. You can borrow up to 100% of the amount of your premiums, and this effectively gives you back the money you just paid upfront when you bought the policy.

If you’ve heard about the infinite banking concept (IBC), an IFA may sound similar to you. But they’re far from the same.

An IFA is a financial strategy that helps mostly high-net-worth clients quickly access funds while still building growth and covering their insurance premium payments. In a way, it can be “self-funding” if you use the money to recoup premium costs and reinvest it in avenues that generate enough income to cover interest costs. But its purpose is not for any form of personal banking.

An IBC, on the other hand, allows individuals to leverage the cash value of their policies to finance purchases, investments, and other financial needs while maintaining control over the cash flow. With IBC, policyholders can access funds through policy loans and repay them at their discretion, ultimately creating a source of liquidity outside of traditional banking systems.

Key differences between an IFA and IBC

In summary, while both concepts involve leveraging the cash value of life insurance, an IFA focuses on immediate access to funds through borrowing against the policy, while the Infinite Banking Concept emphasizes creating a personal banking system using whole life insurance policies.

An immediate financing arrangement (IFA) helps high-income earners immediately access funds from a lender by using your whole life insurance policy as collateral. You can use proceeds as a way to get a return on the life insurance premiums you paid, which then leaves you free to use that liquidity to reinvest. An IFA is a complex strategy, but it can be useful in helping you make the most of your policy without losing growth.