- Estate equalization is a process where business owners fairly distribute their liquid and non-liquid assets

- Life insurance offers monetary compensation for those who don’t want to inherit the business

- Including life insurance in your estate plan will ensure that your business and family remain financially secure

Estate planning is a balancing act — sometimes, it’s more about ensuring everyone gets equal value instead of getting the same assets. Life insurance can help with that, especially for entrepreneurs who want to pass on the family business.

In this article, we’ll show how life insurance can be used for estate equalization, and give you tips on how to equitably pass your assets onto the next generation.

What is estate equalization?

Estate equalization is a strategy where an individual divides their wealth fairly between multiple heirs, especially where assets like a business are involved.

- It lets business owners use a life insurance payout as an alternative asset for heirs who do not want a share of the company

- And, it helps your family avoid fighting over inheritance

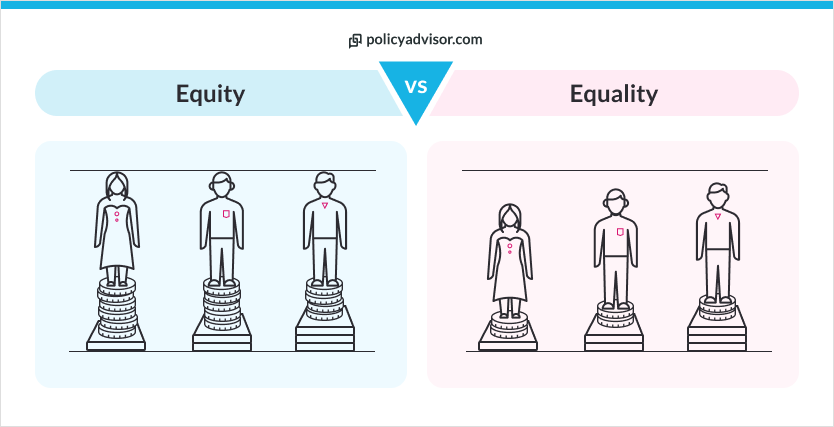

An easy way to think about it is as equality vs equity. In simple terms, equality means everyone gets the same thing. But equity means everyone gets what they need to have equal value.

For estate equalization, this means ensuring all heirs get assets of equal value and not necessarily shares of the same assets. But before we dive into how this is done, let’s briefly explain a few key terms below.

What is an estate?

An estate is everything you own at the time of your death. This can include real estate holdings, personal property, savings account, vehicles and more:

- Real estate holdings

- Personal property

- Savings accounts

- Vehicles

- Business assets (for sole proprietorship)

- A portion of business assets (if your business is a corporation)

- Life insurance policies

At your death, your estate is generally divided amongst your beneficiaries as determined in your will.

What are business assets?

Your business assets include anything that gives your business value, including liquid assets (such as stocks and bonds) and non-liquid assets (such as real estate, company vehicles, office equipment, etc). Find out more about them:

- Liquid — cash or anything that can be easily converted to cash

- Stocks

- Bonds

- Non-liquid or illiquid — cannot be easily converted into cash

- Real estate

- Company vehicles

- Office equipment

- Hedge funds

- Private business ownerships

Business shares and assets can complicate the estate planning process for business owners. In addition to usual estate planning issues, you now need to consider business partners, shareholder agreements, buy-sell agreements, and other business relationships.

What is an equitable vs. equal inheritance?

The difference between equal and equitable inheritance is that the latter considers beneficiary circumstances rather than just splitting everything exactly even. There can also be differences in terms of focus, common use cases and potential challenges. It’s a subtle difference that can go a long way in avoiding fights over estates.

Difference between equitable and equal inheritance

| Aspect | Equal inheritance | Equitable inheritance |

| Definition | Assets are divided equally among all heirs, regardless of circumstances | Assets are distributed based on fairness, considering the unique needs or contributions of each heir |

| Focus | Prime focus is uniformity. Each heir receives the same amount or value | Prime focus is fairness. Distributions are adjusted to account for individual situations or contributions |

| Common use case | Families with straightforward asset divisions and similar heir circumstances | Complex scenarios, such as business ownership or varying financial needs among heirs |

| Example | Each of three children receives $500,000 from an estate worth $1.5 million | One child receives the family business (worth $1 million), and the other two receive $500,000 each in liquid assets |

| Potential challenges | May seem unfair if heirs have significantly different needs or contributions | Requires subjective judgment, which can lead to disagreements or disputes among heirs |

How can a business owner use life insurance for estate equalization?

A life insurance policy can provide the necessary cash to give each heir an equal share of inheritance. Those who want shares in the business get the shares. But, those who don’t can get the life insurance payout instead.

It works the same way for personal assets like family property. Not every family member will want all the assets in your property. You can leverage the payout from your life insurance to make sure everyone gets something.

Estate equalization example

Here’s what effective estate equalization looks like in practice. Let’s say Joe runs a sole-proprietorship family business, but then he passes away.

- Joe’s son wants to sell the business — he has his own company and can’t run both

- Joe’s daughter wants to continue the legacy — she is passionate about it and this is her only job

- This unexpected disagreement could cause legal disputes — this could negatively impact the business

Joe can choose either…

Estate equalization is the better solution in this case, because Joe’s assets were distributed equitably, not monetarily equally. This example shows how important it is to think about an equal vs an equitable divide in your estate planning — as well as the value of your business assets.

How does estate equalization with life insurance work in Canada?

To effectively use life insurance for estate equalization, you have to understand what your business assets are worth and ensure your death benefit coverage is an adequate match. You need to establish your distribution plan, determine the value of assets and get adequate coverage. Find out more:

Help with estate equalization

PolicyAdvisor’s licensed insurance experts can help you better understand what insurance products may be best for your personal and business estate plan. Book some time with us and see how our insurance products can help you smoothly pass along your business legacy.

Frequently asked questions

Is estate equilization the same thing as estate planning?

Estate equalization and estate planning are related, but not exactly the same thing. Estate planning is the broader process of organizing and arranging your assets in preparation for distribution after your death.

Estate equalization is a more specific kind of estate planning strategy that ensures all heirs receive a fair share, even if not necessarily the same in terms of monetary assets.

Are there other types of insurance a business owner can use for estate planning?

Yes. Aside from life insurance, Canadian business owners can use the following types of insurance as part of their estate planning and finance protection plan — both for business and personal.

Critical illness insurance — provides a lump sum payout if you are diagnosed with a covered critical illness. It can help pay for any business losses you may incur while you recover from this illness.

Disability insurance — replaces your income if you are disabled and can no longer work. This disability could be covered in the short term or for longer terms.

Long-term care insurance — can help pay for the cost of extended care at home or in a facility if you can no longer perform 2 or more daily living activities. It can preserve more of your business’ assets to pass on to heirs.

Remember, estate planning isn’t just about your death. It also plans for unfortunate circumstances, such as if you become incapacitated or disabled from a personal injury or illness.

What challenges might arise in estate equalization for Canadian business owners?

Challenges include accurately valuing the business, addressing potential disputes among heirs, and ensuring there are enough liquid assets to balance the estate.

Tax implications also play a significant role, as the transfer of business ownership and other assets may trigger capital gains taxes. Consulting with financial advisors and estate planning experts is crucial to navigate these complexities.

How can Canadian business owners implement estate equalization?

Business owners can use various strategies for estate equalization, such as life insurance policies, trusts, or transferring non-business assets to heirs not involved in the business.

Life insurance is particularly popular, as the death benefit can provide liquidity to balance inheritances without disrupting the ownership of the business.

Estate equalization is a strategy that lets you divide the assets of your estate fairly amongst your beneficiaries. Business owners can achieve estate equalization by offering a life insurance payout to some beneficiaries, and offering the business’ assets to others. This is helpful when some beneficiaries do not want to be involved in the business.