- Key person insurance eases the financial burden of losing an employee or partner that was crucial to your business’s operations

- Key person insurance can be purchased as life, critical illness, or disability insurance

- Determining the cost of this insurance depends on the evaluation method used for the cost to replace this employee and other personal factors of the key person or business

Every business has people who are irreplaceable — it could be your CEO, a founder, a team leader, or maybe even you! Losing one of these key people can be personally and financially devastating.

But, key person insurance helps to minimize the impact on your business. Read on to find out what key person insurance is, how to set it up, and how it can ensure business continuity.

What is key person insurance?

Key person insurance is a critical part of business continuity because it covers someone who is important to your business, like an employee, team member, or shareholder. It’s insurance coverage that will make a tax-free payout to the business if that person:

- Passes away

- Is diagnosed with a covered critical illness

- Suffers from a disability

You may also see key person insurance called “key man insurance” or “key employee insurance.”

Who is a key person?

A key person is someone who is invaluable to the business. This could be because of their recognition, specific skills, connections, or other resources. A company can even have more than one key person, such as:

- The CEO

- Shareholders

- A long-time employee

- A brand representative

- Any employee whose loss would impact business revenue

The key person is essential to your business operations and profit, and would be hard to replace. For an insurance provider to recognize someone as a key person, you have to submit proof of how vital they are to your business.

What can key person insurance be used for?

Businesses can use the key person insurance benefit for:

- Covering expenses associated with searching for a new candidate (recruiting)

- Covering training for the new team member

- Supplementing lost revenue from losing the key person

- Paying for anything else the business may need to recover from the financial loss

Types of key man insurance

The three most common types of insurance that can cover key persons include:

- Life insurance (term and permanent)

- Disability insurance

- Critical illness insurance

You should speak with one of our advisors to determine which type or types of key person insurance would be best for your business.

How does key person life insurance work?

With key man insurance coverage, the insurance provider pays out a benefit to the company if the key person:

- Passes away (life insurance)

- Is diagnosed with a specific serious illness (critical illness insurance)

- Becomes disabled and cannot work (disability insurance)

Here’s a step-by-step look at how the process works.

Step One

Business sets up a key-man life insurance policy on specific employees, naming the business as the beneficiary.

Step Two

If one of the covered events happens (life, critical illness, or disability), the business receives a tax-free benefit payout.

Step Three

The business can use the insurance payout to cover any costs or needs associated with losing the key person, such as recruitment, buying out shares, covering loans, and more.

How key person insurance can help your business

Key person insurance provides financial protection for the business. It will give the business an insurance payout if a listed key person can no longer be a part of business operations. The exact coverage depends on the type of key-man insurance the business purchases.

How much key man insurance do I need?

To figure out how much insurance you should take out on your key person, you will have to calculate:

- How much this person is worth to the business

This is usually done using their income or salary and multiplying that number by 5-10x - The replacement cost

How much it would take to rehire and train a replacement - Contributions earnings

How much money this key employee brings into the company

Each key person in your company may have a different valuation depending on their position with the company.

Cost of key person insurance

The cost of key person insurance can vary depending on a few factors.

Policy pricing factors:

- The type of policy

- The type of coverage

- The benefit amount

Key person pricing factors:

- Their gender

- Their age

- Their health status

Business pricing factors:

- Company size

- Business structure

- Business industry

The cost will be different for every business, so it is best to contact one of our advisors to get accurate quotes for a policy for your business.

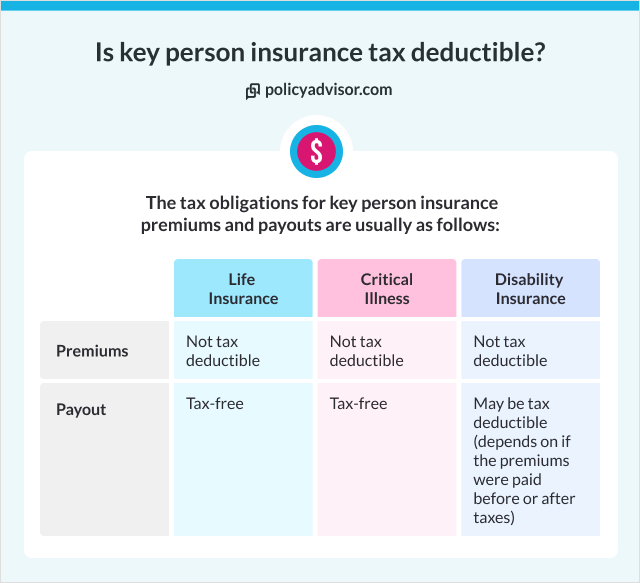

Is key man insurance tax-deductible?

It depends on the type of key person insurance and whether you’re looking at premiums or payouts. Generally, premiums are not tax-deductible but payouts are tax-free.

❌ Premiums. The premiums paid for the purpose of key person life insurance cannot be deducted as a business expense, if the business is the beneficiary who would receive the benefit payout.

✅ Payouts. Proceeds from a business-owned life insurance or critical illness insurance policy are tax-exempt. These proceeds can also be paid out as tax-free dividends once the business has recovered.

⚠️ Exceptions. Payouts may become taxable in these cases:

- Proceeds from business-owned disability insurance may be tax-deductible, but it depends on if the premiums were paid before or after taxes.

- Proceeds from business-owned critical illness or disability insurance may become taxable if given directly to an employee or shareholder, depending on the purpose of the payment.

- Proceeds from business-owned life insurance may become taxable if the business transfers ownership of the policy to the key person so their own family can benefit from the estate. This may be seen as a disposition and incur related taxes.

The tax obligations for key person insurance premiums and payouts are usually as follows:

What are the risks of key person insurance?

The main risks of key person insurance include:

- Employee departure

The key person decides to leave the company for reasons other than death, illness, or disability, you would have to cancel the insurance policy. For some policies, there may be cancellation fees involved. - Cost

Some policies can be expensive, depending on the key persons’ demographics, the business structure, or the policy type. A business may not be able to afford to keep a policy if it takes a financial hit. - Underwriting roadblocks

If the key person is in poor health or participates in high-risk activities, they may be declined by traditional underwriting. In this case, the business may have to settle for a more expensive policy with less coverage. - Underfunded coverage

Sometimes it can take months or even years to find someone who can fill the shoes of the departing key person. The insurance coverage may not be enough to make up for the loss.

Regardless of these risks, key person insurance could be the key to your continuity plan. A well-structured plan can make sure your business will thrive, no matter what!

Get key person life insurance quotes

At PolicyAdvisor, we’ll guide you through the process of setting up key person insurance for your business.

Our expert advisors will assist you in finding the right coverage tailored to your business needs. Plus, we can connect you with tax experts to ensure your business is passed down efficiently. Reach out to us today to start safeguarding yourself and your business’s future.

Key person insurance helps protect business owners against losses they may face if something happens to a vital team member. If that person passes away or becomes disabled or sick, the business can get an insurance payout that helps them replace income, pay off debts, train new employees, or anything else they need.