- Limited pay life insurance is a payment plan with level premiums for a condensed amount of time, rather than paying premiums for your whole life

- Common terms are 10, 15, or 20 years or up to age 65

- Because the payments are condensed, the yearly premiums you pay in that limited period are higher than if you spread them out

- How much does life insurance cost?

- Payment options for term life insurance

- Payment options for whole life insurance

- What is a limited pay life insurance policy?

- How long does coverage last on a limited pay life policy?

- Example of a limited pay life policy

- How to reduce my life insurance premiums

- How to select a life insurance payment plan

When completing a permanent life insurance policy application, there are several payment structures available. While many opt for monthly or yearly premium payments for the duration of their policy, it is also possible to choose quarterly, annual, or limited payment options. So, which one is the best deal and will give you the most bang for your buck? We’ll explore these options in further detail, with a special focus on limited pay life insurance options.

How much does life insurance cost?

The cost of life insurance varies from person to person. Policy type and benefit amount play a big role in determining the cost of life insurance premiums, as do the age, health, smoking status, and occupation of the insured. For instance, a term life insurance policy has lower premiums than a whole life insurance policy; a 30-year-old non-smoker will have significantly lower premiums than a 30-year smoker, and a person with a history of medical conditions may have higher premiums than someone deemed healthy.

All that to say, the cost of life insurance is highly subjective to your individual circumstance and how the insurance company underwrites those circumstances. To navigate this topic in more depth head to our posts on the cost of life insurance and the cost of whole life insurance. You can also use our life insurance calculator to see how much you can expect to pay for the policy of your choice.

What are my payment options for term life insurance?

When purchasing a life insurance policy, there are a few payment structures to choose from. Term life insurance is straightforward: you either pay premiums every month or some insurance companies provide the option to pay premiums annually and offer a discount if you choose to do so.

What are my payment options for whole life insurance?

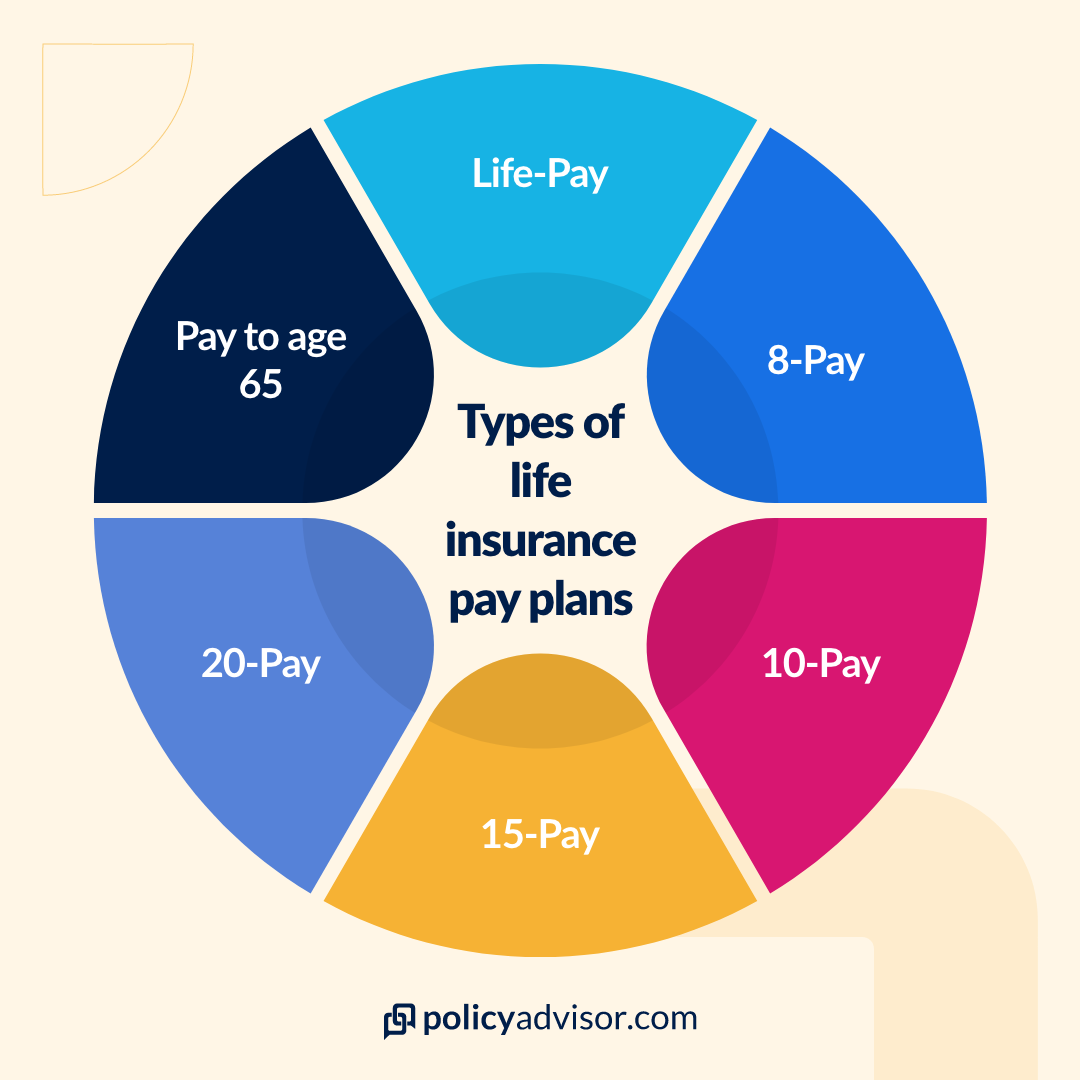

Permanent life insurance, including whole life insurance policies and universal life insurance policies, have several more options for payment because of their lifelong coverage period.

Read more about the difference between whole life insurance vs. universal life insurance.

Standard

With a standard permanent life insurance policy, the policy owner is expected to make regular premium payments over the course of their lifetime. These payments keep the policy active and ensure continued coverage as well as a death benefit paid to the beneficiary. The standard payment structure for permanent life insurance has lower individual premiums payments than other options. Most policyholders choose to pay their premiums on a monthly or annual basis using this standard payment structure, but there is another option called limited pay.

What is a limited pay life insurance policy?

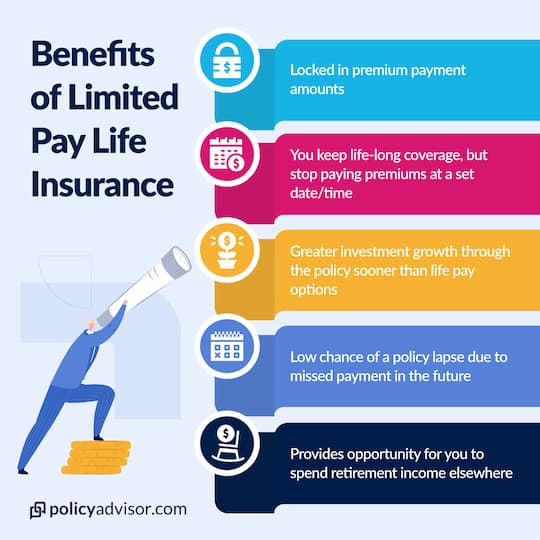

A limited pay insurance policy is a type of permanent life insurance product, sometimes called whole life, in which the policyholder pays premiums over a set period of time or until a specific age. When the agreed-upon period ends, the policyholder stops paying life insurance premiums and coverage continues. In other words, a limited life insurance policy lets you pay your entire policy’s premiums over a set period of time rather than over a lifetime.

Because premiums are paid over a set period of time, individual premium payments tend to be quite high. For example, if your total premiums owed were $15,000 for a policy, spreading them out into 8 payments might be around $1875 each, whereas if you split the payments up over 20 years, you would only pay $750 each time.

Premium rates are therefore influenced by the chosen payment structure, size of the policy, as well as the insured’s age, health, smoking status, etc. It is important to note that an existing whole life insurance policy cannot be converted into a limited pay insurance policy.

8-pay life insurance

With 8-pay whole life insurance, policyholders pay premiums for the first eight years of the policy. Because the initial policy value is accounted for in the first eight years (rather than accumulated over a lifetime of premium payments), there is greater potential for cash value growth and dividends. However, it’s important to keep in mind that because the lifetime payments are condensed, each payment will be high.

10, 15, and 20-pay life insurance

Permanent insurance policyholders have the option of customizing their own payment schedules. In other words, they can choose to pay premiums for the first 10 to 20 years of the policy. The length of the payment period is decided when the life insurance contract is signed.

Pay to age 65

This pay structure is similar to the others in that there is a point where you do not have to pay premiums anymore—but instead of a term, it cuts off at a specific age. These limited pay policies have age restrictions. For example, you wouldn’t be approved for a “to-age-65” policy if you are applying on your 64th birthday. In such a case, the policy would function more like a single-pay policy, which isn’t available on the Canadian market. This type of limited pay policy is beneficial to those who don’t want to pay insurance premiums in retirement age and want to keep premium costs lower than a 10, 15, or 20 pay structure.

How long does coverage last on a limited pay life policy?

As a form of permanent life insurance, limited pay life insurance is designed to provide lifelong coverage. As long as contract terms are met and premiums are fully paid over the agreed upon period, a policyholder will be entitled to utilize their policy’s cash value while they are living and beneficiaries will receive a death benefit when the named insured dies.

That being said, certain life insurance providers put limits on the length of coverage for limited pay life insurance policies. For example, limited pay life insurance contracts may provide coverage up until the age of 100 or—as is becoming more common—120 years.

What is an example of a limited pay life policy?

Limited pay life insurance policies are an especially good option for people investing in a life insurance policy later in life. It enables them to maintain life insurance coverage until they die (i.e. the guaranteed death benefit), while still benefiting from the policy’s cash value while they are alive.

Let’s look at an example of a 20-pay policy…

Jack is 35 years old and applies for a 20 pay participating whole life insurance policy for $100,000. For the sake of this example, based on his health and lifestyle, he has a predicted death age of 80.

With his 20 pay policy, he pays annual premiums of $1900 until he is 55 years old (totaling $38,000 total paid). If he had chosen a traditional life pay policy, his premiums may have worked out to $900/year, but he would have had to pay it every year until he died (totaling $40,500 over 45 years). Instead, because he chooses a 20 pay plan, after the 20 years is up, he no longer has to pay his annual premiums.

Over that 20 year period, the policy has been accumulating a cash value and paying out dividends. He has been storing these dividends away in a retirement account and he will continue to receive dividend payments from the policy even after he’s finished paying his premiums. After he turns 55 he uses the dividends payments to supplement his retirement income and rests easy knowing he still has his guaranteed death benefit of $100,000 without having to pay any more insurance premiums.

In short, by paying for a life insurance policy over a set period of time—say 10 or 20 years—policyholders can pay off life insurance in their high earning years, and set themselves up to receive cash value payouts and dividends in the later years of their retirement without having to pay policy premiums. A limited pay life insurance policy can therefore be helpful in providing income during retirement rather than costing the policyholder money in premiums.

How can I reduce my life insurance premiums?

In addition to selecting payment plan structures, those looking to strategically use life insurance to meet long-term financial goals can reduce premiums and optimize their coverage using a couple of methods.

Reduced paid-up additions

With paid-up additions, whole life insurance policyholders can purchase additional coverage using their initial policy’s dividends. This method enables you to increase the size of your life insurance policy benefit (and by consequence, its potential to increase in cash value and earn dividends) without increasing your premium payments since these are paid up using dividends.

Enhanced term insurance

Enhanced term insurance uses a combination of whole and term insurance to meet your insurance needs. The insurer sets up a base whole life policy and, using the policy dividends, purchases a term policy that tops up your coverage to your desired amount. Using this combination structure usually ends up being cheaper in premium than if you went for a single whole life policy for the same amount of coverage.

Reduced paid-up insurance

Reduced paid-up insurance, for its part, allows whole life insurance policy owners to stop paying premiums on their policy by lowering the death benefit. This is a nonforfeiture option that essentially converts the policy’s cash value into a guaranteed death benefit. However, it’s important to remember the death benefit will be reduced to whatever the cash value was at the time of forfeit—it might be much lower than you anticipated, leaving your family with a lower payout.

Changing your lifestyle

As mentioned, the cost of life insurance is heavily dictated by your personal health and lifestyle choices. By making changes such as increasing your exercise, losing weight, and quitting smoking, your rates may reduce—though insurance companies have waiting periods (i.e. you have to have quit smoking for over a year to be considered a non-smoker again) before you may see better premiums.

How to select a life insurance payment plan

Choosing a payment structure will depend on both your current financial status as well as your future goals. If you don’t want to worry about paying your life insurance premiums in your retirement when you have moved on from your high-income-earning years, you may consider a limited pay option. However, that means you will have to pay higher premiums now compared to if you stretched out the premiums over your lifetime.

At PolicyAdvisor, we have a team of insurance experts that can review each payment plan and explain how it will apply to your situation, chosen coverage, and financial goals. Book a call with us today to start exploring your options!

Some permanent life insurance policies allow you to pay your life insurance premiums on a condensed payment plan. These limited pay life insurance policies allow you to pay your premiums for a set amount of time (usually 10, 15, 20, or up to age 65), but you get continued coverage for the rest of your life. Some prefer limited pay plans as they only have to pay premiums in their best earning years and won’t have to worry about making payments while on a fixed retirement income.

1-888-601-9980

1-888-601-9980