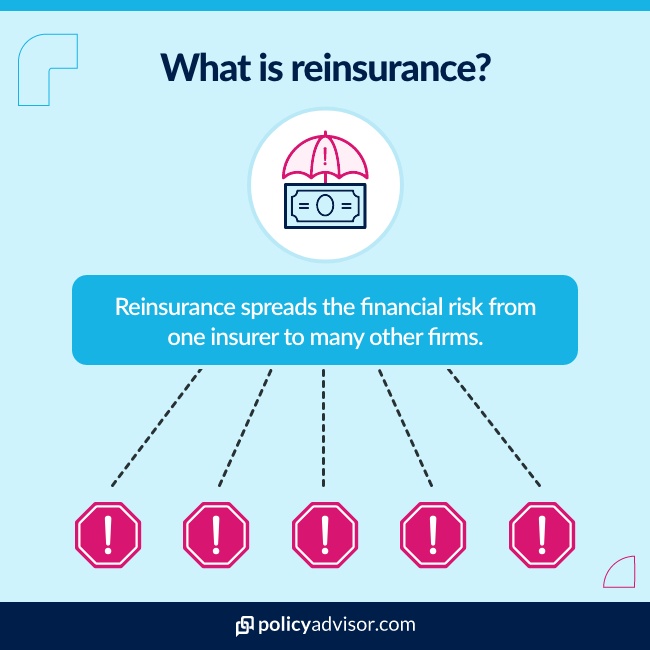

- Reinsurance is used to spread out risk across different insurance providers and minimize losses in extreme circumstances

- There are two main types of reinsurance contracts: facultative reinsurance, in which contracts are signed on a one-off basis, and treaty insurance, which covers an entire class of insurance policies.

In the same way that personal insurance protects people from financial pitfalls in difficult circumstances, reinsurance is a risk management strategy that shields insurance providers from major losses. Keep reading to understand what reinsurance is, how it works, and how it can affect your insurance application.

What is reinsurance?

In the simplest terms, reinsurance is insurance for insurance companies. It enables the insurance companies to protect themselves in the same way that car, home, and life insurance offer financial protection to individuals in times of need.

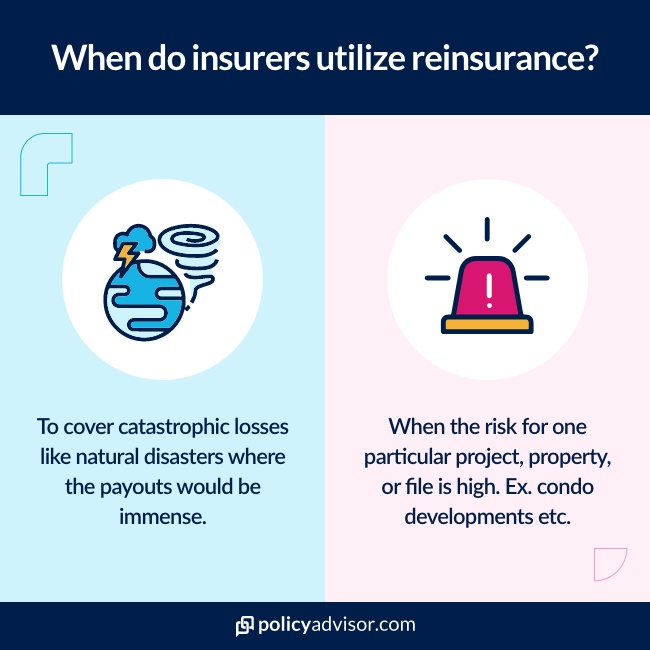

In more specific terms, reinsurance is a type of protection that insurance providers buy to minimize their risk in the event of major claims, such as a natural disaster. Be warned! Reinsurance is not a topic everyday Canadians jump into that often. It is a complicated insurance concept that is impossible to describe without a hint of jargon.

With that said, reinsurance allows insurance companies to share liability with other firms, especially in cases where the primary insurance company does not have enough cash reserves in place to pay out claims.

This functions to keep insurance providers afloat when large or multiple claims are made and ensures that claimants will receive the benefit they are entitled to.

How does reinsurance work?

Reinsurance has been used by insurance providers for centuries and today is used in virtually all corners of the insurance industry. Its main function, as mentioned, is to spread out risk across different insurance providers and minimize losses in extreme circumstances.

For example, if a natural disaster ends up destroying or damaging thousands of homes in a region where one insurance company provides the majority of home insurance, that company would be hard-pressed to cover all the claims.

By leveraging reinsurance, however, the insurance provider can draw from other insurance companies to cover the losses while avoiding insolvency. In this respect, reinsurance not only protects insurance companies but also their clients, who are thus guaranteed coverage.

In addition to mitigating risk in extreme circumstances, reinsurance also enables insurance companies to increase their coverage capacity. Insurance companies are better equipped to take on clients with larger policy coverage because reinsurance will mitigate losses if/when the coverage is claimed. This is particularly useful because it enables insurance companies to take on more clients without increasing capital reserves accordingly.

How does reinsurance affect your life insurance application?

While reinsurance agreements between insurance companies do not often have a direct impact on individual insurance applications, they do influence the insurance market and consequently can play a role in insurance applications and outcomes.

The first major impact for insurance applicants has to do with the fact that reinsurance helps to stabilize the insurance market by mitigating risk. Because reinsurance spreads risk and enables insurance companies to take on more policies without drastically increasing capital, insurance providers are in a better position to cover higher-risk applications. In other words, reinsurance can actually improve the chances of coverage for insurance applicants.

Reinsurance also has a role to play in the rate of premiums. Global trends, from climate change to mortality data, are monitored closely by reinsurance companies, especially when they lead to claim increases. Reinsurance companies, therefore, see these trends as potential risks and adjust costs accordingly, which trickles down to the consumer and their policy rates.

Finally, if an insurance provider is working with a reinsurer on a facultative basis (see types of reinsurance below), then an insurance application may take longer to process. This is because reinsurers have their own underwriting processes for each insurance policy, which can increase processing times. And because reinsurers can decide to only take on part of the risk, the ceding insurance company must find other reinsurers, which can also tack on time.

For example, if you are applying for a life insurance policy and have some pre-existing health conditions, your primary insurance provider may need to check with their reinsurer to confirm they will take on the risk of insuring you. In turn, this could mean your application is approved, approved with a rating, or approved with exclusions due to your pre-existing condition.

What are the different types of reinsurance?

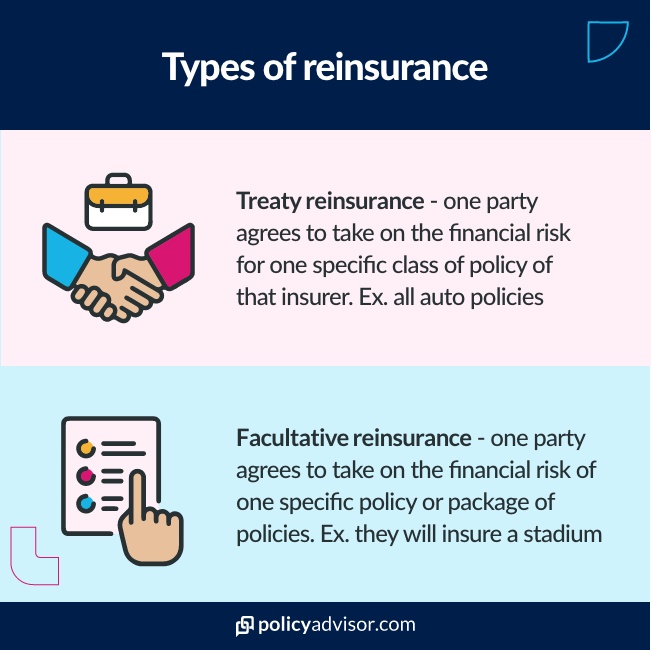

While there are many types of insurance one can buy, there are just two main types of reinsurance: treaty reinsurance and facultative reinsurance.

- Treaty reinsurance is a type of contract signed between the primary insurance company—the ceding company—and the reinsurance company in which the reinsurance company takes on all risks for a specific class of insurance policy over a set period of time. Treaty reinsurance is typically a long-term agreement between the two parties, with terms being renegotiated on an annual basis. Treaty reinsurance agreements are also notable because they do not require individual underwriting.

- Facultative reinsurance contracts, by contrast, are made on a more selective basis. While treaty contracts tend to cover an insurance company’s entire portfolio or large swathes of it, in the facultative approach, the ceding company offers an individual risk or package of risks to the reinsurer, who is then in a position to approve or reject it. In the case of facultative reinsurance, the reinsurer does its own underwriting for the policies it is presented with and each is treated and approved individually.

The ad-hoc nature of facultative reinsurance means that it is conventionally used for high-risk policies (such as no medical insurance). In some cases, the primary insurance company may have to shop around with several reinsurers to cover the entire liability.

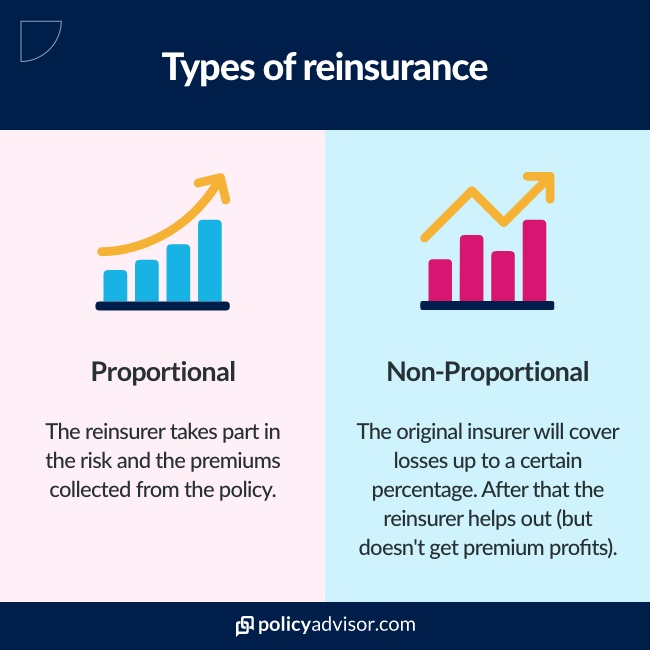

Reinsurance agreements can also be classified as proportional and non-proportional. Proportional reinsurance agreements stipulate that the insurance company and the reinsurer share losses as well as premiums. Non-proportional agreements are structured in such a way that the ceding insurer covers a set amount of risk, while the reinsurance company covers losses over a certain threshold.

Which are the biggest reinsurance companies?

The insurance market is populated with many providers, some of which specialize exclusively in reinsurance and some which offer reinsurance as part of a broader portfolio. Many of the largest reinsurance companies work globally, partnering with primary insurance providers across several continents. According to S&P Global, the top 10 biggest reinsurance companies based on net premiums written in 2019 were:

- Swiss Reinsurance Company Ltd., based in Zürich, Switzerland

- Munich Reinsurance Company, based Munich, Germany

- Hannover Rück SE, based in Hannover, Germany

- Berkshire Hathaway, based in Nebraska, United States

- SCOR SE, based in Paris, France

- China Reinsurance Corp., based in Beijing, China

- Reinsurance Group of America Inc., based in Missouri, United States

- Lloyd’s, based in the United Kingdom

- Everest Re Group Ltd., based in Bermuda

- PartnerRe Ltd, based in Bermuda

Reinsurance is insurance for insurance companies. Reinsurance is a risk management tool used by insurance providers to minimize their risk in the event of a major claim. Reinsurance allows an insurance company to share the liability with other firms. While it’s not a concept that an average insurance application needs to be concerned about, it may impact your premiums or the length of your application’s turnaround time.