- Universal life insurance acts as both life insurance coverage and an investment vehicle

- It offers flexibility in how you pay premiums, a broad range of investment options, the ability to access its cash value, and added affordability depending on how you structure your coverage

- On the other hand, it is incredibly complex, gets increasingly costly (depending on your coverage), has uncertain investment returns, requires constant monitoring, and has many associated fees when accessing its cash value

- Contact an experienced broker to help you navigate the intricacies of universal life insurance, as there are many moving pieces you need to be aware of before you decide it's the right coverage for you.

Universal life insurance is a form of permanent life insurance that offers financial protection through lifelong coverage combined with flexible premium payments and multiple investment options.

The main purpose of universal life insurance is to provide guaranteed lifelong coverage while giving you options to invest and build wealth for your beneficiaries within the insurance policy.

While whole life insurance also offers cash value and investment components, universal life insurance is unique. It allows you to choose the insurance cost and investment options within your policy based on your investment goals and risk tolerance.

What is permanent life insurance?

Permanent life insurance is insurance that covers you for your entire life. Upon the insured’s death, it pays out a tax-free lump sum payment to the insured’s beneficiaries.

Sometimes, but not always, there can be an investment or cash value component to your policy. Universal life insurance and whole life insurance are the most common types of permanent life insurance.

Learn more about the different types of life insurance in Canada.

How does universal life insurance work?

Universal life insurance can be described as an “unbundled” permanent insurance plan. Your premium payments are clearly separated into one portion for lifelong insurance and the other portion for investing.

Similar to other types of life insurance, a policyholder makes periodic premium payments for universal life coverage. The insurance company deducts a portion from the premium to meet the cost of insurance and administrative expenses. The balance is then deposited into an investment account and earns tax-deferred interest. The amount left in the investment account, also known as account value, earns interest, based on the investment account options selected.

A policyholder can choose to only make the minimum premium payments to cover the cost of insurance and keep the policy active. However, this would mean not taking advantage of universal life’s unique feature: the investment account value that grows on a tax-deferred basis. You are not required to pay any tax on the investment account returns once the account value does not exceed a certain amount (a legal requirement we’ll explain further).

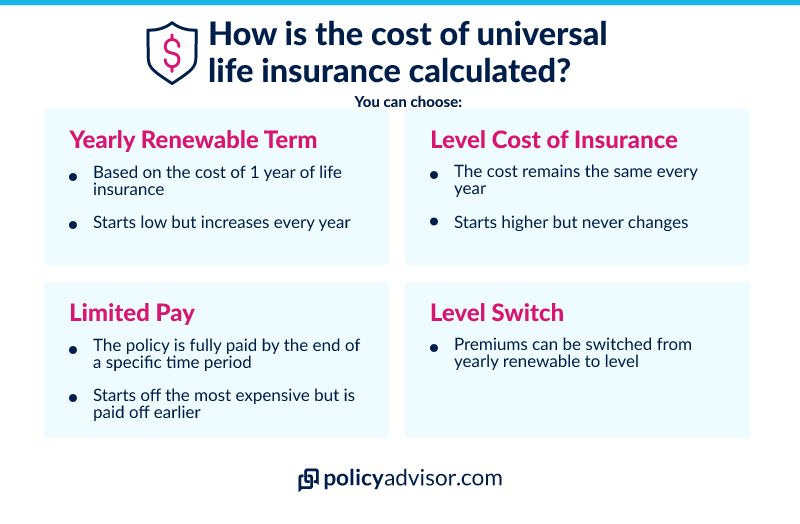

How is the cost of insurance calculated in universal life insurance?

Universal life insurance offers flexibility to choose how the cost of your life insurance should be calculated:

- Yearly Renewable Term (YRT): Policy premiums are calculated using the cost of one year of life insurance, based on the insured person’s attained age. Premium rates increase from year to year until age 100, or another age you can specify (75, 85, etc). At first, YRT-based pricing looks attractive because the price is lower and the plan can be renewed annually. However, the cost can become prohibitive with time.

- Level Cost of Insurance (LCOI): Policy premiums are fixed, guaranteed for the life of the policy, and charged to the age of 100. Level premiums are higher than in YRT insurance during the initial years, but as the insured person grows older, the premiums will stay level.

- Level Switch COI: Allows for premiums to be switched from YRT to level guaranteed rates that are charged up to the age of 100.

- Limited Pay: Limited pay is a form of LCOI, but the policy becomes fully paid up at the end of the limited pay period. This is the most expensive option in the early years as you are paying for the entire length of the policy in a shorter time.

With YRT, since the premiums are lower, the account value grows faster for the first few years, as compared to LCOI. However, as your age increases, the cost of YRT insurance increases exponentially. Thus, the account value grows relatively less in later years. You will need to pick an option that suits your needs. Although, some providers allow you to switch from YRT to LCOI or vice versa.

What are the investment options available within a universal life policy?

Most universal life products offer a wide variety of investment options. One needs to choose the option that meets their investment objectives as well as their risk tolerance.

You may have the option to hold more than one investment account within your UL insurance policy. In this case, you will also need to specify in what proportion premiums are to be allocated to your different accounts.

Here are some of the most common types of investment account options across insurers:

- Daily Interest Account (DIA): This investment option is similar to a standard savings account. Interest is calculated and credited every day. The interest rate is set by the insurer and may fluctuate.

- Guaranteed Interest Accounts (GIA): These typically have a time frame or term of 1, 5, or 10 years and will have guaranteed interest rates for that period.

- Variable Interest Options (VIO): These market-linked options may potentially provide much greater returns, but also carry higher risk. Unlike a GIA, these have no maturity date and the investment account can continue to accumulate for the life of the policy. Interest offered depends on the performance of indices, mutual funds, or other managed portfolios.

How does a universal life insurance death benefit work?

The universal life insurance death benefit also works differently than term or whole life insurance. Beneficiaries receive a tax-free lump sum death benefit (that part is the same) but there are three options for implementing it:

- Level: The death benefit is fixed at the time of purchase and remains the same throughout the life of the policy as long as the premiums are in good standing. This holds true even if the account value is low or in the negative when the policyholder passes away. Your beneficiaries will receive the fixed death benefit or the account value – whichever of the two is higher.

- Face Plus Account Value: The death benefit includes the initial insurance coverage in addition to the investment account value.

- Account Value: The beneficiary receives only the value of the investment account when the insured passes away.

There are other less-common death benefit options such as return of premium, inflation indexing, and more. If there are any leftover funds in the service account, they too will be paid out to the beneficiary.

In joint policies – such as joint-first-to-die, joint-last-to-die, or multi-life – the death benefit and account value may be paid out in parts in a prolonged process. For example, at the time of each insured’s death, a percentage of the death benefit may be paid out. The remaining death benefit amount as well as the account value of the account would then be paid out once the last insured person passes and the policy terminates.

Learn more about joint policies and the best life insurance for couples.

Finally, you may also be able to increase the death benefit by purchasing additional insurance within the UL insurance policy over the period it is active.

How do I pay my universal life insurance premiums?

Policyholders may choose to pay their premiums either monthly, annually, or over any time period they wish, as excess funds will go towards the investment component of the policy.

In universal life insurance products, a modal factor is generally not used. You pay no additional cost if you choose to pay your premiums monthly instead of on an annual basis. This is in contrast to premium payment options for term and whole life insurance. That said, most people with this type of policy do choose to pay their premiums on a monthly rather than annual basis.

However, note that if no premium is paid, an equal amount is taken from the investment account to cover the cost of life insurance and the policy will remain in force. If the investment account’s value can no longer cover the premiums, the policy will lapse.

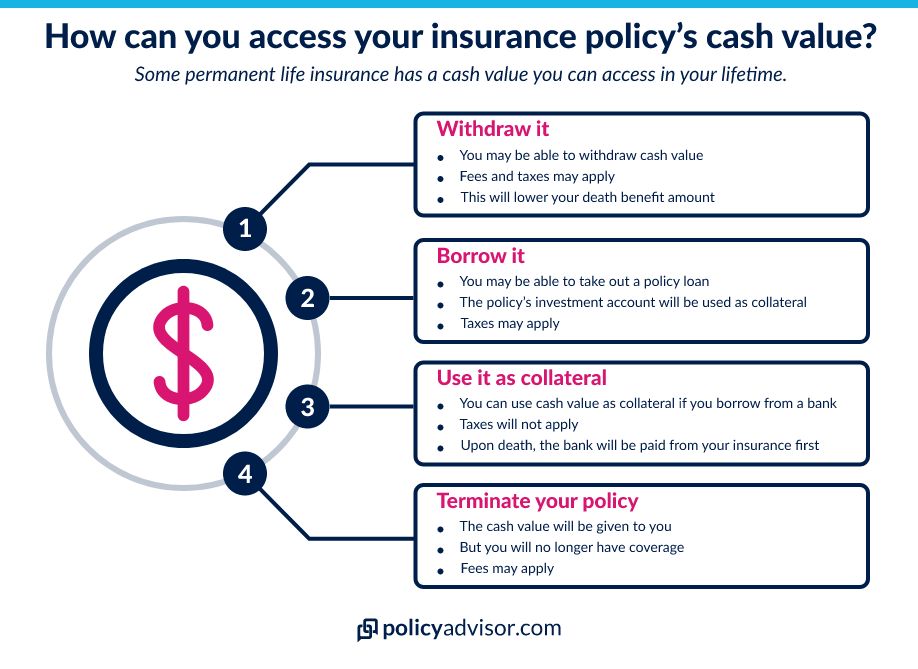

How do you access the cash value of a universal life insurance policy?

Similar to whole life policies, universal life allows policyholders to access the cash value savings account that earns tax-exempt interest. There are 4 ways to do so:

- Cash Withdrawals: You may withdraw the cash value partially or fully. The cash value of your policy is different from the investment account of the policy; it is adjusted for redemption or withdrawal fees. Cash withdrawals reduce the death benefit payable and may also be subject to taxation.

- Policy Loan: You may access the cash value by seeking a policy loan from the insurance company, by using the investment account’s cash value as collateral. Policy loans may be subject to taxation.

- Collateralizing the Cash Value: You may obtain a line of credit from another financial institution by using the policy as collateral. In this case, there is no taxation of the policy as you are not withdrawing from it. However, if you pass away while the loan is still outstanding, the lender is paid from the policy proceeds first and the balance is then distributed to your beneficiaries.

- Surrendering Your Policy: If you no longer need your policy’s coverage, you may choose to surrender it. The cash surrender value will be paid out to you minus any applicable surrender charges.

What affects the cash value of a universal life policy?

Since universal policies offer flexibility in making premiums payments, there are no guarantees to the amount of cash value accessible in the future. The cash value may fluctuate over time due to:

- The timing and amount of insurance premiums

- The rate of return earned on the selected investment option

- The type of cost of insurance option and the death benefit selected

- Any cash withdrawals or policy loans made from the policy

- Any changes made to the coverage

What are the advantages of universal life insurance coverage?

Universal life plans can be tailored to meet personal financial objectives.

- Flexible premiums: Universal life policies do not have a fixed premium amount. You may instead select the timing and amount of premium payments. You can choose to pay just enough to cover the insurance cost and conserve your additional cash. Alternatively, you may choose to pay the maximum possible amount once it does not trigger the anti-dump-in rule (see below).

- Broad range of investment options: Universal life products offer a range of investment options that you can choose from depending on your investment style and risk tolerance. You can be as involved as you may want in managing the investment portion of your policy.

- Affordability: Universal life is usually a more affordable choice than whole life insurance because the insured is responsible for managing the account value. Premium rates are lower as compared to whole life insurance, where the insurance company manages and guarantees the investment returns.

What are the disadvantages of universal life insurance coverage?

- Complexity: Universal life is a complex insurance product where the insured individual is responsible for managing the account value and returns. The significant amount of flexibility the product offers also creates a high degree of uncertainty about the fulfilment of insurance objectives, as neither the death benefit nor the cash values are guaranteed in this product. It’s important to speak with an experienced advisor who can help you make the right decision when selecting your universal life policy.

- Increasing costs: If you have chosen the annual renewable term, the insurance costs will increase with age. The cash value accumulation in the initial years will be utilized to pay the higher premium rates in the later years. If you’re only intending to keep the coverage for a few years, then buying term insurance will save you much more money.

- Uncertain returns: While universal life insurance policies are meant to offer you access to cash value, there is no guarantee of future returns. The cash value available to you depends on the annual rate of your coverage and returns of the invested savings in the account. The internal charges of the policy may increase every year. In addition, the interest rate or investment return that you earn may reduce or turn negative with time due to market volatility or a decline in interest rates. This can significantly erode the account value.

- Constant monitoring: Universal life policies also require ongoing monitoring to ensure that you have adequate cash value in the policy to pay for the premiums. Not only are the returns from this policy indeterminate, but the mortality expenses may also increase with age. These costs can eat away at cash value, require higher premiums, or cause a policy to lapse. For instance, if the interest rate return on the account value reduces or if the cost of insurance increases with age, you could find yourself adding additional monthly premium payments. You could then risk your policy lapsing if you can’t pay those larger premiums.

- Higher Management Expense Ratios: The investment options included in such policies carry higher expense ratios.

- Fees: Universal life policies have various fees embedded in their structure. You may be charged a fee if you decide to terminate your policy, request frequent changes to your investment options, or request a cash withdrawal or some form of loan from the policy.

What is the anti-dump-in rule?

The anti-dump-in rule (also known as the 250% rule) is a Canadian tax law that limits the size of policy payments to prevent the policy from becoming an investment improperly growing on a tax-sheltered basis. It allows a UL insurance policy’s investment account value to accumulate on either:

- A tax-deferred basis, if accessed by the insured during their lifetime

- A tax-free basis, if accessed by the beneficiaries after the insured’s death

However, you cannot continue to make deposits of any size and let them grow on a tax-advantaged basis. The limit is the aforementioned 250% rule: the account value in any particular year must not exceed 250% of its value from 3 years prior. If it does exceed that value, the policy loses its tax-exempt status.

This check-up on the account value starts on the 10th anniversary of the policy and continues for the rest of the policy’s life.

So, why should you be concerned about the tax-exempt status of your account value? For one, it grants you the opportunity to leave a larger amount of money to your beneficiaries. Alternatively, it allows you to access and use the proceeds from your account value and defer the taxes until your death.

What is a service account?

Life insurance companies proactively seek to prevent excessive deposits by transferring excess funds (if a policyholder makes a deposit over the tax-exempt limit) to another account called the service account. This account grows separately and is fully taxable. If the financial room becomes available again within the investment account, the policyholder is able to move funds from the service account back to the original investment account.

Universal life insurance versus term life insurance

What is term life insurance?

Term life insurance is the simplest form of life insurance. Policyholders pay a flat, level premium for a fixed amount of coverage.

- Term insurance coverage is for a predetermined number of years (thus why it’s called “term”).

- The term and death benefit are determined when the insured purchases their policy.

- If you pass away while the policy is in effect, the death benefit guarantees your beneficiaries will receive a tax-free lump sum of money.

- Term insurance is the least expensive and – typically – easiest to understand of all forms of life insurance.

Learn more about term life insurance.

Similarities between term life insurance and universal life insurance

- Both whole life insurance and term life insurance offer financial security for family, loved ones, or business partners left behind if you, unfortunately, pass away.

- Both have a predetermined death benefit that pays out to a chosen beneficiary (or beneficiaries) upon the policyholder’s death.

Difference between term life insurance and universal life insurance

| Term Life Insurance | Universal Life Insurance |

|---|---|

| Lasts for a specific period of time | Is a form of permanent insurance |

| No cash value or maturity benefit | Has a cash value component |

| Modal factor is applied to non-annual premium payment | No modal factor |

| Cost-effective form of insurance | More expensive than pure term life insurance |

Universal life insurance versus whole life insurance

What is whole life insurance?

Whole life insurance provides coverage from the day a policyholder is approved for their policy until they pass away.

- Whole life insurance has a level premium throughout the insured’s life and consists of both the death benefit and a cash value component.

- Policies can be participating (where the policyholder is eligible to receive dividend payments and can even choose to pay their premiums with them) or non-participating.

Learn more about whole life insurance vs universal life insurance.

Similarities between whole life insurance and universal life insurance

- Both whole life insurance and universal life insurance are types of permanent life insurance. They both provide lifelong protection.

- Both consist of two components: an insurance component and an investment/cash value savings component.

- The customer may take a policy loan, use the policy as collateral, or choose to surrender the policy and receive the cash value.

Differences between whole life insurance and universal life insurance

| Whole Life Insurance | Universal Life Insurance |

|---|---|

| Fixed and guaranteed premiums for the life of the policy | No contractual premium payments |

| Premiums are based on a predetermined schedule | May choose the amount and frequency of payments, depending on account value |

| Additional payments over and above the contractual premium may require underwriting approval | Flexibility to make additional deposits (as long as anti-dumping rules are followed) |

| Premium is non-transparent and is guaranteed as a whole | Mortality charges, administrative expenses, and policy fees are transparent and separately guaranteed |

| Investment choices are made by the insurer | Investments are chosen by the client, from a range of options provided by the insurer |

| Not flexible: Policyholder must choose the guaranteed death benefit and premium payment term when applying for the policy | Extremely flexible: Policyholder may choose to increase or decrease their death benefit, premium payments |

| Modal factor: Monthly, quarterly, or semi-annual premium payment options are costlier than the annual option | No modal factor: Pay at the frequency you choose |

| Offers guaranteed minimum cash value and death benefit | Policyholder chooses investment options; no guarantee of returns for market-linked investments |

| Death benefit is guaranteed, as long as premium payments are made | Death benefit is not guaranteed; may reduce if mortality charges increase or if the account value reduces |

| Option to collect dividends: Participating versus non-participating | No dividend concept |

Universal life insurance versus term-to-100 life insurance

What is term-to-100 life insurance?

Though it has the word “term” in its name, term-to-100 life insurance (T-100) is actually a form of permanent coverage.

- The premiums are level until the age of 100.

- Once the insured crosses the 100-year threshold, the policy converts to paid-up life insurance.

- Further premium payments are not required and the policy remains in force.

- The death benefit is fixed throughout the term and determined when one applies for the policy.

Learn more about term-to-100 life insurance.

Similarities between term-to-100 life insurance and universal life insurance

- Both T-100 and universal life insurance are types of permanent life policies. They both provide lifelong protection.

- They are both generally used for effective estate planning. But T-100 may be used on a more modest scale and predominantly for funeral expenses.

Differences between term-to-100 life insurance and universal life insurance

| Term-to-100 life insurance | Universal Life Insurance |

|---|---|

| Fixed premium | No fixed premium |

| No cash value | Has a cash value component |

| Fixed death benefit | Death benefit varies |

| Least expensive form of permanent life insurance | Typically more expensive than other forms of permanent life insurance |

Should I get universal life insurance?

- If you have maxed out your tax-advantaged investment options, such as Tax-Free Savings Accounts (TFSAs) and Registered Retirement Savings Plans (RRSPs), universal life insurance is another tax-advantaged option for savings.

- Universal life insurance is an effective estate planning tool. It can be used to leave a growing tax-free sum of money to your beneficiaries and help give your family a secure financial future.

- You should consider universal life if you have the discipline to contribute regularly even without the “forced savings” that whole life insurance includes in the form of fixed and regular premiums. And also if you are also confident in your ability to choose better-performing funds for the investment account.

Please keep this last point in mind. Universal life insurance is often mis-sold to those who don’t truly need it, with the promise that the coverage can pay for itself. These calculations are based on an estimated rate of return from the investment value of the policy, which may not be realistically sustainable.

Speak with an advisor you trust (like the experts at PolicyAdvisor) before applying for a universal life insurance policy, as there may be better alternatives for your coverage needs. They can give you some life insurance quotes and help you determine what type of life insurance would be your best option.

What is the best universal life insurance in Canada?

The best universal life insurance plan for you depends on factors like your investment goals, your risk tolerance, and your budget, among others. Here are some of the most popular insurance companies offering universal life insurance:

Manulife

- Three different universal life insurance policy options

- Coverage ranges from 50,000 or $100,000

- Diverse and wide range of investment options

Read our full Manulife Life Insurance Review.

Beneva

- Maximum flexibility

- 1, 3, 5, and 10-year interest investment options

- Renewable

Read our full Beneva Life Insurance Review.

Ivari

- Coverage up to $10 million

- Joint and single plans

- Flexible enhancements

Read our full Ivari Life Insurance Review.

Equitable Life

- Two different universal life insurance policy options

- Tax-advantaged investment strategies

- Incentive bonuses (not guaranteed)

Read our full Equitable Life Insurance Review.

BMO

- Three different universal life insurance policy options

- Wide range of investment options

- Early access to cash value

Read our full BMO Life Insurance Review.

These are just a handful of the companies offering universal life insurance. There are also many others to choose from. PolicyAdvisor works with more than 30 of Canada’s largest insurance companies, so our advisors can help you find the best life insurance company for your needs.

How to pick a universal life insurance policy?

If you do decide to apply for a universal life insurance policy, you should consider a few things:

- Does the product offer a range of coverage options? For example, can you choose a joint-first-to-die or multi-life policy?

- What are the options for the investment account? The product needs to have investment alternatives that meet your risk tolerance level. For example, conservative investors would prefer fixed interest deposits, whereas those with higher risk tolerance may choose market-linked funds.

- What are the management charges for the investment options, the policy fees, and the mortality charges? With universal life insurance, all the components are separately illustrated – you can compare the components to ensure you get a cost-effective product.

- What riders and benefits do the product offer? Does it have term riders allowing you to buy additional term coverage, child protection riders, accidental death riders, or disability riders, etc.? Research or speak to an advisor to determine what riders and other optional benefits are important to you before choosing a policy.

PolicyAdvisor’s licensed experts can help you compare a wide range of universal life insurance products and make an informed choice for both your coverage and financial goals. Book some time with us to see what your options are and if universal life insurance coverage is the right product for you.

Universal life (UL) insurance is a type of permanent life insurance that combines lifelong coverage with flexible payment options and an investment component. Universal life insurance offers a way to maintain coverage while also building wealth for your beneficiaries. It has the added benefit of allowing you to tailor the cost of your insurance premiums and investment options.

1-888-601-9980

1-888-601-9980