TikTok is a popular social media app known for its entertaining videos of youngsters dancing. But it’s also home to hundreds of videos of self-proclaimed experts dishing out advice on topics from relationships to personal finance and everything in between.

The latest trendy “FinTok” topic is to use “infinite banking” as a way to quickly earn and save money. But the truth is there’s more to this “secret” financial strategy than many of these TikTok videos are letting on.

In this article, we’ll go over whether infinite banking is even real and give you 3 reasons why it’s not for everyone.

What is infinite banking?

Infinite banking is a concept that suggests you can use your whole life insurance policy to “be your own bank”. It was created in the 1980s by American economist R. Nelson Nash, who introduced the idea in his book, “Becoming Your Own Banker”.

How does infinite banking work?

Bear with us, because infinite banking is not a simple concept. The idea behind it is that instead of keeping your money in a traditional bank, where you do not earn much interest, you invest your money into a life insurance policy with an investment component — such as whole life insurance or universal life insurance. This type of insurance policy gives you what’s called a “cash value” from the investment portion.

Additionally, instead of borrowing money from a bank, where you would be charged high-interest rates, the infinite banking concept (IBC) has you borrow against your life insurance policy. Because you’re only borrowing from your policy, the insurance company is still investing your entire cash value component. So, your cash value still grows even though you’ve borrowed a portion of it.

From there, in theory, you could use that borrowed money to invest in something else (such as in real estate) before paying it back. Even further, again in theory, you could use the interest that you would have paid on a bank loan to reinvest.

Through this concept, you accumulate gains on the cash value you borrowed while simultaneously using those same borrowed funds to invest elsewhere and earn even more. This is called compound interest growth. And, even further, the IBC strategy is to add your new earnings or other savings to your cash value when you pay the loan back so that you’re not in debt. In theory, you could earn additional money on your cash value this way.

The idea is that you could carry out your own banking needs for potentially greater financial gains.

Can you use your life insurance for infinite banking?

Yes, you can use certain specific types of life insurance to practice “infinite banking”. Although, we’d say the terminology can be misleading. But we’ll get to that a bit further down in this article.

In fact, the infinite banking strategy doesn’t really work without you using your insurance policy as leverage.

But there are some intricacies to be aware of before you hit the ground running. To start with, infinite banking would really only work with cash value life insurance. In most cases, that means whole life insurance. Additionally, even though insurance companies charge much less interest than banks do, you still have to pay interest on your life insurance policy loans.

Let’s take a step back to show how this idea really works.

What is whole life insurance?

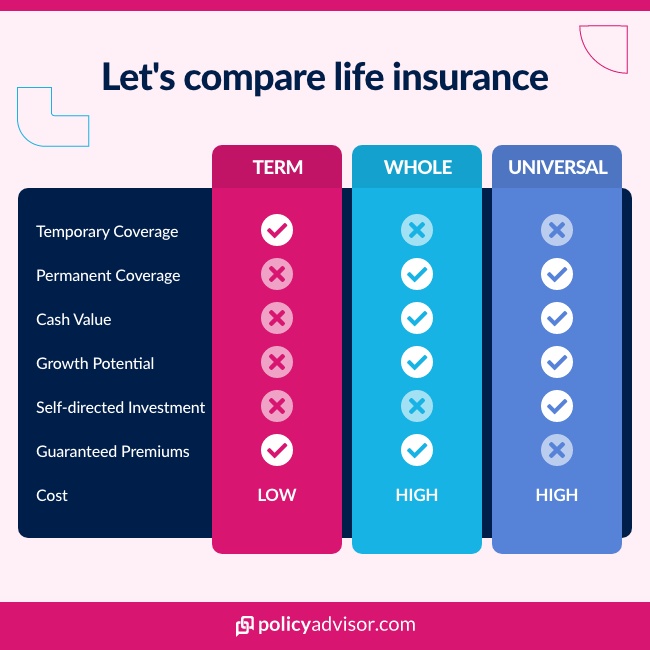

Whole life insurance is a form of permanent life insurance. It lasts for an individual’s entire lifetime, unlike term life insurance, which only covers you for a specific period of time.

(Read more about term life insurance vs. whole life insurance.)

As with all life insurance, whole life is a death benefit. When you, unfortunately, pass away, a lump sum payment is given to your beneficiary, usually the loved ones you leave behind.

But a major defining feature of permanent insurance is the investment/savings component we mentioned earlier. With this type of policy, your insurer invests the monthly/annual premiums you pay to them. Because of this, your policy has a tax-free investment or cash value.

How does infinite banking use life insurance cash value?

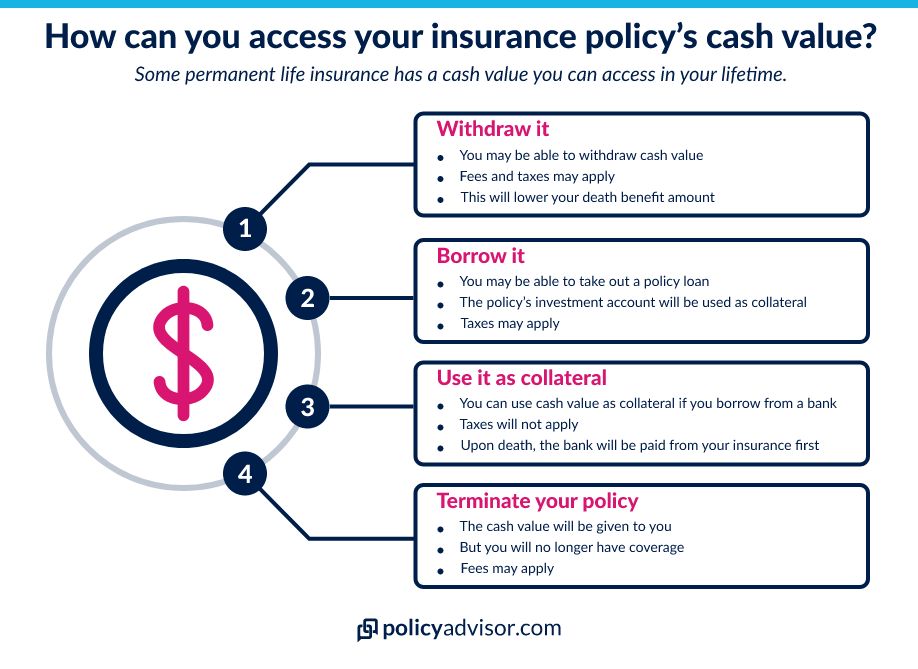

Cash value is what infinite banking wants you to go after, because there are several ways you can access it during your lifetime. Most policies allow you to borrow against it or even withdraw it.

Plus, there are different ways to grow cash value faster — especially with a universal life insurance policy. And policyholders are not obligated to pay the cash value back if they borrow against it. However, there are some caveats to this that we’ll discuss more in-depth later.

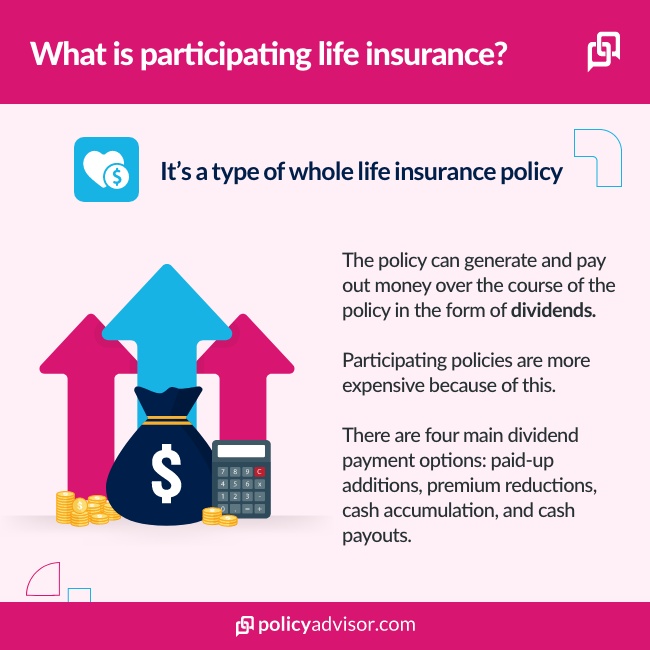

Whole life insurance can also be participating, which generates dividends that are paid out to you every year. This can be particularly useful with infinite banking because you can use life insurance dividend payments toward your insurance premiums. Or, you can use them to increase your cash value savings portion by reinvesting it into your insurance policy.

There are tons of moving parts to whole life. Check out our Learning Centre for more basics and details. Or simply give our friendly advisors a call and we’d be happy to fill you in!

How do I borrow money from my whole life insurance?

You can borrow from your life insurance cash value in two ways:

- Borrow directly from your life insurance provider

You can borrow from your life insurance cash value through your insurance provider. This is called a policy loan. Interest rates are usually lower than what a bank or lender would offer and the loan amount is generally higher. You are technically not obligated to pay it back, although it would be in your best interest to do so.

Life insurance policy loans can function somewhat like getting an advance on your death benefit. If you pay it back, your death benefit does not change. But if you don’t pay it back, the amount plus interest will be deducted from your lump sum death benefit. This would leave your loved ones with less money to support themselves when you’re no longer around, which is the main function of life insurance in the first place.

- Use it as loan collateral for a bank loan

You can also use your life insurance policy’s cash value as collateral to borrow from a bank, lender, or other financial institution. Again, this only works for whole or universal life policies that have a cash value. With this type of loan, the bank or lender could seek repayment from your cash value if you do not pay it back. In this case, that amount would again be deducted from your death benefit, leaving your beneficiary with a lower amount. Banks also have their own rules and interest rates, which are usually higher.

Note: Policy loans can be taxed as income in certain circumstances. If the cash value is more than the Adjusted Cost Basis (ACB) of the policy, you may be taxed on the difference. For example, if your policy loan is $80,000 but the ACB of the policy is $75,000, you would be taxed on the $5,000 difference. Read more about the tax implications of policy loans.

How long do I need to have life insurance before I can borrow from it?

In many cases, there is no restriction on how long you need to have life insurance before you can borrow from it. Instead, insurance companies usually let you borrow as soon as you’ve accumulated enough cash value for your needs.

The real question is how long it takes your policy to build that cash value. And the answer is: it depends. It can take years for your cash value to grow to a substantial amount.

Even with options that can speed up cash value growth, like some universal policies, limited pay plans, enhanced life insurance, or accelerated deposit options, this process still generally takes years from when your policy begins.

Remember, permanent life insurance is meant to cover you for your entire life. It’s not designed to be a standalone investment strategy. So, it doesn’t work as a get-rich-quick deal.

Can I withdraw money from my insurance?

Yes, most life insurance contracts let policy owners withdraw from their life insurance policy’s cash value. But when it comes to infinite banking, many practitioners will suggest you avoid this route for two major reasons:

- Cash value withdrawals are not tax-free

- If you withdraw the cash value, it is no longer building growth — a critical aspect of the infinite banking theory

With a cash value withdrawal, your insurance company will deduct taxes and fees, then give you the remaining amount — also known as the cash surrender value. Withdrawing from your cash value also lowers your death benefit.

Further, keep in mind that different insurance companies have different terms and conditions when it comes to withdrawing cash value. Some may have various stipulations on how much you can withdraw, and when. Some may not allow you to withdraw at all.

You should speak with a licensed life insurance advisor like the friendly experts at PolicyAdvisor.com before deciding to borrow against or withdraw from your life insurance policy.

Is infinite banking legit?

Yes, infinite banking is a legitimate strategy practiced by some individuals. But, it is not the same as most of the quirky “FinTok” videos you may have seen.

IBC is a highly complex financial concept. There is even an official Infinite Banking Canada Group comprised of financial advisors who practice and support the theory. The individuals involved are required to sit examinations to become what they refer to as an Authorized IBC Practitioner.

Unfortunately, social media often strips the infinite banking concept down into a bogus idea that you can have “unlimited money”. This misinformation can be dangerous because it can lead viewers into buying financial products they don’t quite understand. Or products that don’t function the way they thought they would, and that aren’t beneficial for them or their families.

This is why some people believe infinite banking is a “scam” when it’s actually not.

It’s also why we can’t stress enough how important it is to speak with a licensed expert before making a financial plan.

Can I really become my own bank?

No, you cannot use your insurance policy to become your own bank. And we’ll add that if something sounds too good to be true, it usually is.

Regrettably, some people do try to sell infinite banking with the promise that you can “be your own personal bank”. But it doesn’t actually work that way in most cases.

Can you buy a whole life insurance policy? Yes, absolutely.

Can you then borrow from that policy’s cash value? Also yes.

Does this mean you are borrowing from yourself and paying yourself back with interest scot-free? Not quite.

How to use life insurance for infinite banking?

With infinite banking, you are borrowing from a cash value and death benefit that you may be entitled to through your life insurance company. As we’ve mentioned, a life insurance policy loan works like an advance on either your cash value or your death benefit, depending on how the loan plays out.

And, don’t forget, your insurer does charge interest for you to access that advance, so you’re already cutting into the original amount you would have been entitled to.

Some infinite banking agents will say that your reinvested gains will outpace that interest charge. But that’s a big “if”, and depends on how well your other investments perform — if they perform at all.

Meanwhile, if your policy is terminated, such as if you cannot keep up with minimum premium payments, you are no longer entitled to that same cash value. Instead, you would be taxed on the amount of your life insurance loan that is higher than the total amount you’d paid in premiums up to that point.

Your death benefit can be impacted in a similar way. If you, unfortunately, pass away without having paid back the loan, the amount will be deducted from your death benefit. So, you’re still cutting into that money you would have been entitled to.

In theory, you could borrow from insurance money you’re entitled to — given you meet certain conditions like maintaining your payments, and “pay yourself interest” by using investment gains to add to your cash value accumulation.

But, as we all know, life happens. Plans don’t always work out perfectly, and an investment strategy this risky can have major consequences for you and your family’s financial security.

Why infinite banking isn’t for everyone

The infinite banking concept is not a one-size-fits-all solution to personal finance or investing. While it can be a good strategy for an extremely adept finance expert with a large risk for appetite, the average person may be better off with a more stable investment plan.

Here are 3 reasons why infinite banking isn’t for everyone:

1. Infinite banking is costly

Ever heard the saying “you need money to make money”? That certainly applies here. To even build the structure you’d need to start doing infinite banking, you need to afford a permanent life insurance policy. And those policies are typically more expensive than term life insurance policies.

To give you an idea, for $250,000 in coverage for a 30-year-old female non-smoker in regular health, a 20-year term life policy would only cost around $15 per month. For that same amount of coverage, that same individual would be paying over $100 per month for a basic whole life policy. And that’s not even a dividend-paying whole life insurance policy (participating), which is what IBC practitioners would suggest. (You can easily compare the best life insurance quotes in Canada through our website to see exactly how term vs. whole life insurance would stack up for you.)

The question then becomes whether the potential payouts from that high cost are really worth your while.

2. Not everyone can get a whole life insurance policy

Speaking of the first steps to even start doing infinite banking, some individuals may not even qualify for whole life insurance. The underwriting process for whole life insurance may actually be more intensive than for other types of insurance because of the increased risk. As such, some individuals with pre-existing medical conditions or other health or even lifestyle concerns may be denied whole life insurance coverage entirely. Right off the bat, this means infinite banking strategy is not for them.

3. IBC is complicated and risky

Another reason why infinite banking is not for everyone is its complexity. On top of that, it’s just as risky as it is difficult to master. For most Canadians, there are easier, faster, and less risky ways to reach financial goals. Sure, infinite banking may sound appealing the first time you hear it. But think of it this way: do you really need to chance taking a possibly dangerous pro track road home when another way may work out far better for you?

Your personal finance plan should be just that — personal and tailored to your needs. Not everyone needs a complicated strategy to build wealth and provide for their loved ones. In many cases, simple is actually a far better option.

What are the risks of infinite banking?

The biggest risk to infinite banking is reducing your death benefit, or even losing your insurance policy completely.

If you borrow against the cash value of your insurance policy but cannot keep up with the cost of insurance premiums, that will decrease the death benefit left for your family.

Similarly, if you end up in a financial predicament where you cannot continue paying your life insurance premiums at all, you will lose your policy. And, you could lose all of the investments made and premiums paid towards your policy up until that point.

Most types of investments come with varying degrees of risk of losing the money you invest. The same is true with infinite banking: your investments could fall far short of your expectations, leaving you at a deficit for what you borrowed versus what you expected to gain back.

But the stakes are higher with infinite banking because it involves your family’s future financial protection. If you’re considering infinite banking, we can’t stress enough that you should speak with a financial advisor first.

Pros and cons of infinite banking

While we strongly caution anyone against jumping into infinite banking too quickly, there are certainly some pros to the practice.

| Pros | Cons |

|---|---|

| Potential to maximize investment earnings | Very complicated concept to practice |

Better loan options than banks/lenders:

|

Not a quick turnaround; it can take years to build cash value or have enough funds to get started |

| Potential to grow dividend-paying whole life insurance cash value faster | Risk minimizing the death benefit for your loved ones/beneficiaries |

| Avoid market fluctuations by letting your life insurance company invest cash value | Risk losing your life insurance policy and all of your investments |

| Quick access to liquid assets/cash flow if needed | Can be expensive to keep up |

| Tax-free investments through life insurance policy | Investments not diversified |

Who should use infinite banking?

An infinite banking strategy may be better suited to high-net-worth individuals than the average person. The tax benefits could very well be worth it for individuals on the higher end of the tax bracket.

Some business owners may also be able to leverage infinite banking in combination with the life insurance strategies designed to protect their business.

For example, business insurance, like a company-owned life insurance (COLI) policy, is already designed to offset taxes, grow cash value, and even let your company pay for premiums. Combined with an IBC strategy, this could be a very effective way for business owners to maximize gains during their lifetime.

Experienced financial professionals who are young enough to benefit from a long-term investment strategy, skilled enough to attempt IBC, and patient enough to wait for it to yield results may also be able to benefit from the infinite banking process. Of course, given they have enough financial security to take that risk.

Nelson Nash’s infinite banking strategy is extremely risky and, quite frankly, most people may fare better without it. You know what we’re about to say, but we’re going to say it anyway: we strongly advise that you speak with a licensed life insurance advisor like ours, or with a certified, legitimate financial planner before making major personal finance decisions. And/or before taking advice from FinTok without doing due diligence.

The TikTok infinite banking trend claims that you can be your own bank by using your life insurance policy. Many skeptics are surprised to find out that infinite banking is real. But there’s more to it than a 30-second video lets on, and it’s definitely not a strategy for everyone.

1-888-601-9980

1-888-601-9980