Pay off debt

Whether it’s student loans, credit cards, or another form of high-interest borrowing, your tax return is a great way to put a big dent in your debt. Debt is expensive and stressful, so why not put your return towards any debt you have before you consider other, albeit more fun, alternatives.

Almost every financial advisor will recommend the same, and for good reason. You pay so much in interest for some high-interest forms of debt – especially if you’re only making minimum payments. A lump sum from your tax return may just be what you need to “swipe left” on that deadweight debt pulling you down.

Invest in your future

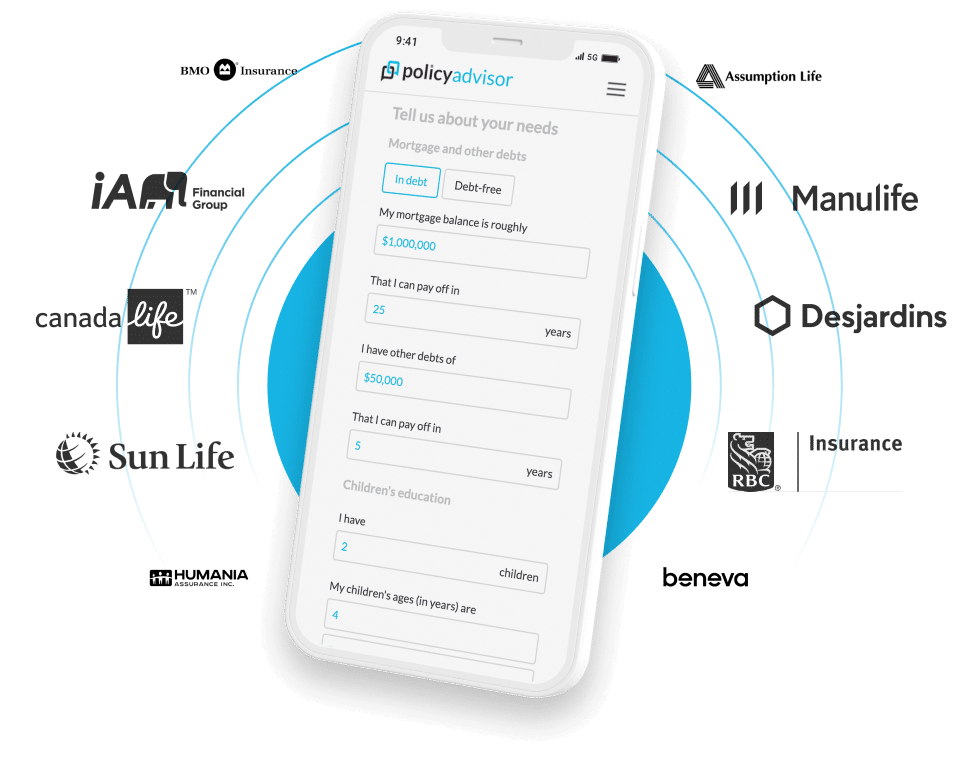

We’re going to put a little shameless plug here—you can use your tax return to pay for your life insurance premiums! Life insurance can help ensure that your family is taken care of in the event of your unexpected passing, providing them with financial stability during a difficult time. By using your tax return for your annual premiums, you avoid having to budget for your insurance bill in your monthly expenses.

You can also take the funds you’ve received from your tax return and invest them into a savings account, like a TFSA or RRSP. You won’t be able to enjoy the money now, but you will benefit in the long term by letting your funds grow in an investment account.

If you haven’t already started a Registered Retirement Savings Plan (RRSP), maybe your tax refund is the perfect inspiration to create one. Starting an RRSP will not only invest in your future retirement savings but help with next year’s tax refund as well!

If you have children, you can even consider investing in their future via an RESP or children’s insurance. Both have advantages and disadvantages, but children’s insurance offers a flexible way to leave a gift for your young ones that doubles as lifelong financial protection.

Increase your savings

If you don’t have an emergency fund, your tax return can serve as a first step in building your emergency savings. An emergency fund is crucial, especially in circumstances where you don’t already have critical illness or disability insurance and a life change significantly impairs your ability to work.

Most financial planners recommend you have between 3 and 6 months of your household income available at all times to deal with unforeseen emergencies, though 8-12 months can be a safer choice given the current economic realities with post-covid inflation. A solid emergency fund provides peace of mind knowing you can cover your expenses in the case of an emergency.

Donate to a charity

Thousands of Canadian charities rely solely on donations. Contributing to a charity is a great way to give back to your community and get a tax break; donations to registered Canadian charities are tax-deductible!

It is easy to find a charity that speaks to you. CanadaHelps.org is a great resource for finding charities that share your values. This platform is ideal because you can donate online to a variety of different Canadian charities and it provides instant tax receipts.

Upgrade your job skills

Maybe you want to pursue higher education or dream about taking career courses to increase your technical skills. Consider using your return to invest in your learning, especially if it will improve your career prospects.

Launch your own business

Getting a tax refund is not winning the lottery, but it might be the jump start you need to ignite your entrepreneurial spirit. Business owners will tell you: It’s not cheap to create a company from scratch.

Depending on your business idea, you may need to pay for an e-commerce platform, a website domain, or even initial product inventory. Putting the funds from your tax return into your own business is an excellent way to use those funds productively.

Treat yourself

How long has it been since you took a vacation? When was the last time you purchased something not because you needed it, but because you wanted it?

We’re not saying you have to Tom-and-Donna the whole thing, but your tax return can contribute to a long-needed vacation or that stand mixer you’ve been eyeing. Depending on your financial situation and needs, consider spending some of that return on something you enjoy. After the year we’ve had, this may be the most justifiable time to treat yourself!